However, maryland legislators do not share this skepticism, and have introduced a bill to impose a tax on revenues derived from digital advertising. Austria taxes income from digital advertising at 5 percent.

List Of Shipping Documents That Are Required For The Import Export Process – Incodocs Import Exports Database Business Busi Trading Export Marketing Tips

House bill 732 maryland house bill 732 (“hb 732”), introduced on january 30, 2020, proposed to impose a new tax on taxpayers’ gross revenue from digital advertising services in maryland.

Maryland digital ad tax bill. Effective for tax years beginning after dec. Maryland house bill 732 (2020 session) imposed a special tax on gross revenues received from digital advertising services, and house bill 932 (2020 session) expanded the sales and use tax base to certain digital products and services. Maryland would exempt from the tax advertisement services on digital interfaces (e., websites and apps) owned or operated by or operated on behalf of a broadcast.

Hogan jr.’s veto of a monumental education reform bill, culminating years of work from policy experts, education advocates and. The companion bills have two key components: Earlier today, the maryland senate budget and taxation committee voted to pass out of committee senate bill 2, which would impose a new tax on digital advertising services.

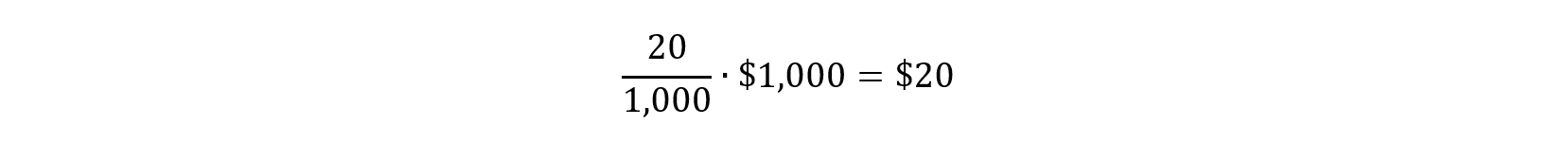

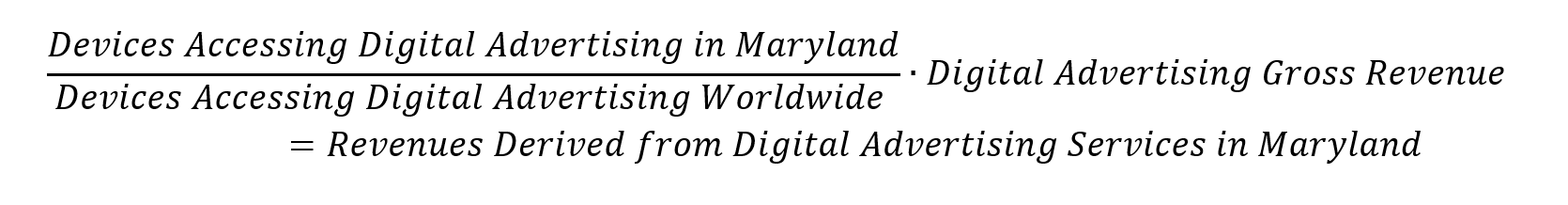

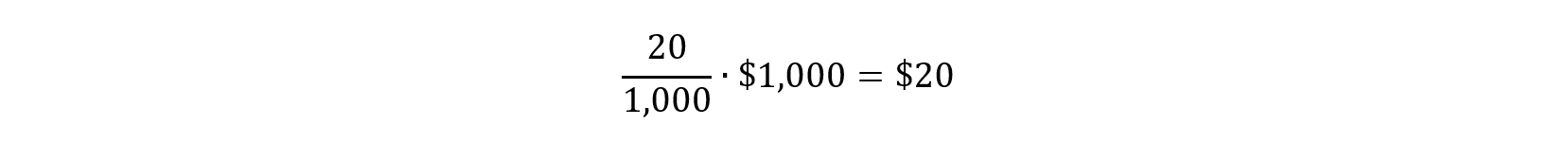

Bill ferguson, president of the maryland senate, is the primary champion of a law that will tax tech giants. The new tax had been approved by the state’s legislature in early 2020 but, rather than signing hb 732 into law, governor hogan rejected the bill, noting that it would “be unconscionable” to raise taxes and. 732 imposes a tax on a person's annual gross revenues derived from digital advertising services in maryland.

(d), expect the tax to raise more than $100 million per year, which will be appropriated to maryland’s education program. The measure, sb2, would impose. Maryland’s new tax applies to annual gross revenue derived from digital advertising in the state and is imposed at scaled rates between 2.5% and 10% (beginning with.

Maryland has enacted the nation’s first tax targeting digital advertising, as the house on february 11 and the senate on february 12 overrode governor larry hogan’s (r) veto of 2020 h.b. The maryland senate on friday voted to override gov. On 12 february 2021, the maryland legislature overrode maryland governor larry hogan's veto (pdf) of legislation that imposes a new tax on digital advertising.

Maryland passes digital ad tax. Facebook, google and other online companies could face new taxes in maryland, if a bill passed this week is signed by the governor. The sponsors of the bill, bill ferguson (d) and thomas v.

This new texas bill— h.b. 732) and would impose a new “digital advertising tax” on annual gross revenues derived from. Maryland became the first state in the country on friday to impose a tax on digital advertising, as the state's senate voted to override a gubernatorial veto of.

Maryland on friday became the first state to enact a digital advertising tax targeting large tech companies like amazon, google and facebook, which could be followed by similar taxes in other states. Senate bill 787 makes several amendments and technical corrections to those laws including delaying the. The maryland general assembly recently introduced s.b.

Larry hogan’s veto of its digital advertising tax, it was clear. After overriding a veto from gov. When maryland’s legislature made the decision last month to override gov.

Legal challenges have already been filed alleging that the new tax violates the federal internet tax freedom act, p.l. With override votes, senate passes landmark education reform and digital ad tax bills into law. Larry hogan in february, the maryland legislature enacted a bill that would make maryland the first state to tax digital advertising.

1200 on february 5 th and 8 th, which propose revisions to the digital advertising tax under h.b. 4467 — would take effect in 2022.

Modern Docx Invoice Design Invoicedocxmoderntemplates Invoice Design Invoice Template Website Template

Exposed Get Your Walking Dead Reps To Take Action Empower Network Online Branding Teaching

Clean And Modern Minimal Business Invoice Template Vector Format A4 Size Paper Invoice Template Banner Ads Design Banner Advertising

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

How To Run Ads Right Now Blogging Guidelines Social Media Digital Marketing Marketing Tips

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Purchase Order Format Excel Free Download 4 Things You Didnt Know About Purchase Order Form Cover Letter Template Free School Photos Photography Order Form

Clean And Minimal Business Invoice Template Vector Format Premium Business Invoice Template Invoice Template Invoice Design Vector Format

Maryland Amends Its Digital Advertising Gross Revenues Tax Creating Additional Constitutional Infirmities – Salt Savvy

Stock Market Forex Trading Graph Graphic Concept Suitable Financial Investment Sponsored Trading Graph Fo Stock Market Forex Trading Economic Trends

Gst Day Digital Marketing Design Goods And Services Marketing Design

Httpsfastspringcom Saas Online Business Digital

Menuju Banjarmasin Smart City Finance How To Plan Commercial Property

Format Invoice Yang Benar Perbaikan Surat Kartu Nama

Clean And Modern Professional Business Invoice Template Vector Format A4 Size Construction Business Cards Invoice Template Banner Ads Design

Sv2os3nqsryeam

Free Hospital Receptionist Job Description Template Ad Ad Receptionist Hospital Free Te Job Description Template Job Description Jobs For Teachers

Pin By Heather Conley Photography Ll On Real Estate – Marketing Tips Social Marketing Tools Real Estate Marketing Real Estate Business