A number will be assigned to each bidder for use when purchasing tax liens through the treasurer’s office and the online tax lien sale. Disable tooltips just for this page.

Tax Bill

The successful bid (buyer) must be formally accepted and approved by the board of supervisors at a regularly scheduled published meeting.

Maricopa county tax lien auction. 24 rows tax year parcels advertised $ value not auctioned (1) liens sold $ value avg int. Some counties may have left over tax lien certificates that they sell outside of the auction. The above parcel will be sold at public auction on monday, october 4, 2021 at 11:00 am at the flood control district of maricopa county, 2801 w.

Parcels can be foreclosed on through quiet title court action three (3) years after the date of sale. Registration for the 2021 maricopa county tax lien auction is currently unavailable. 2021 tax sale information packet (pdf) 2021 tax sale list (pdf)

The certificate is then auctioned off in maricopa county, az. It is the bidder's responsibility to know the law governing these sales prior to participating in a tax certificate sale. Enter the address or street intersection to search for and then click on go.

The next tax sale is scheduled for september 9, 2021. Durango st., phoenix, arizona, 85009. If you are new to realauction tax lien auction websites, we recommend you proceed in the following fashion:

Tax liens in maricopa county, az buy tax liens and tax lien certificates in maricopa county, az, with help from foreclosure.com. The buyer of the tax lien has the. The sale of maricopa county tax lien certificates at the maricopa county tax sale auction generates the revenue maricopa county arizona needs to continue to fund essential services.

Maricopa county makes no representation that a property is usable or marketable. Select the township, range and section to search for and. Be sure to investigate thoroughly.

Do not include city or apartment/suite numbers. Bidding is online only and will begin when the list is published and close on february 5, 2019. Taxes are at least 2 years delinquent when they become available for tax lien certificate purchase.

Hope to see you there! Please check the bidding rules for availability. The next delinquent property tax lien auction for maricopa county will be on february 5, 2019 for the 2017 tax year.

Delinquent taxes, tax liens and the sale of tax certificates at public auction for unpaid taxes are administered by the county treasurer and provided for in title 42, chapter 18 of the arizona revised statutes. These parcels have been deeded to the state of arizona as a result of a property owner's failure to pay property taxes on the parcel for a number of years. If you are already familiar with our system, you may disable tooltips.

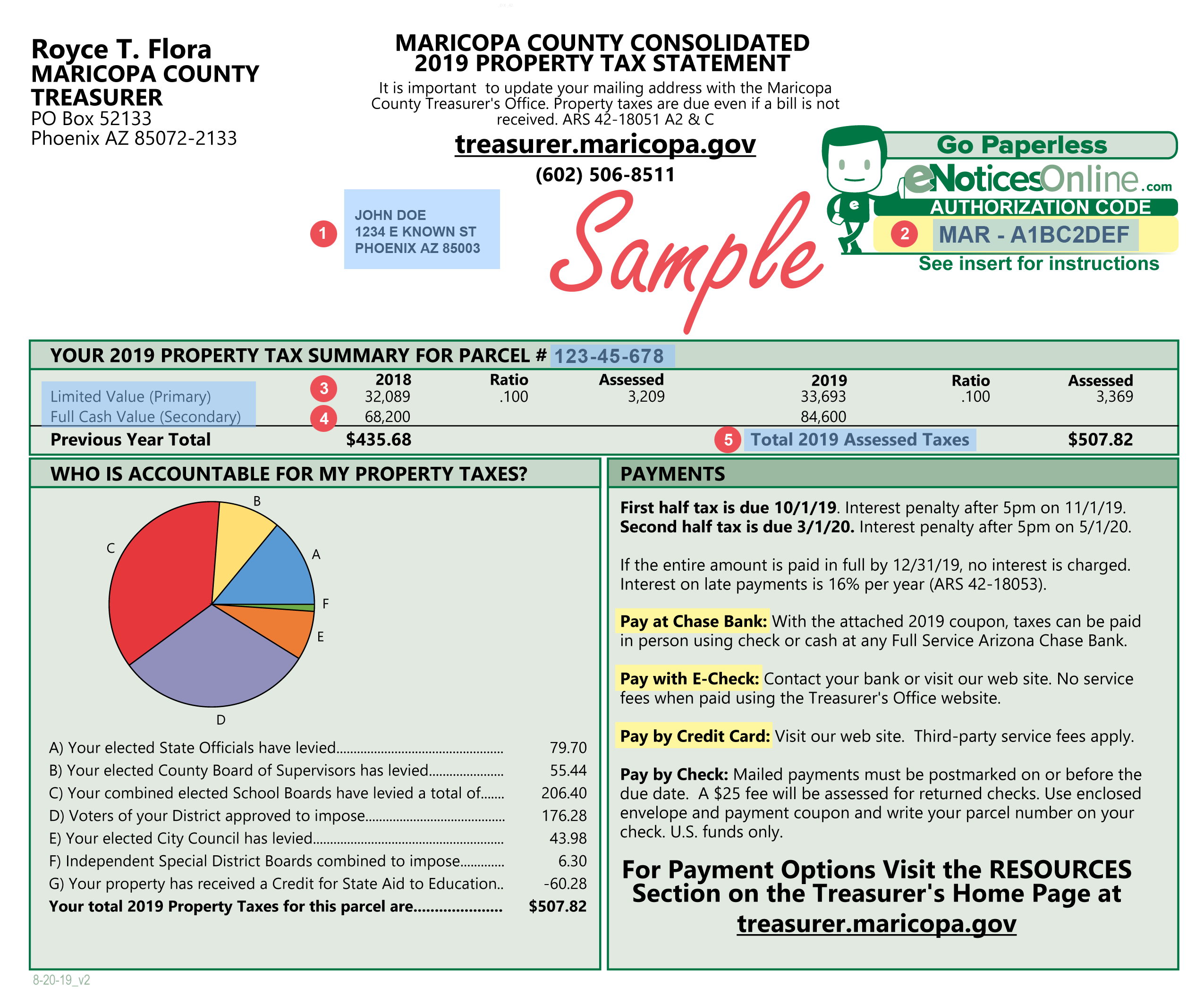

How does a tax lien sale work? Enter the property owner to search for and then click on go. In maricopa county arizona the first half of real estate property taxes is due on october 1 and are delinquent after december 31st of each year.

The way the auction works is an investor bids on the interest rate on the tax lien. Interested in a tax lien in maricopa county, az? It is a plain english.

Enter the assessor parcel number (apn) to search for and then click on go. Every year, the counties have auctions to sell these unpaid property tax liens.

How Do I Pay My Taxes – Maricopa County Assessors Office

Maricopa County Island What Is It – Life Real Estate

Maricopa County Approves 34 Billion Budget With Reduced Property Tax Rate – Ktarcom

Property Tax Rate Changes In Maricopa County Greater Phoenix Arizona

Property Taxes In Arizona – Lexology

Arizona Maricopa County Warranty Deed – Fill Online Printable Fillable Blank Pdffiller

Maricopa County Az Property Tax Bill Search – Property Walls

Maricopa County Assessors Office

Phoenix Homeowners Upset After Receiving Civil Penalty Fee 3 On Your Side Azfamilycom

Maricopa County Assessors Office Facebook

Tax Guide

Maricopa County Treasurers Letter Meant As Farewell Not Politics

Maricopa County Az Property Tax Bill Search – Property Walls

Maricopa County Assessors Office

Residential Rentals In Maricopa County Must Be Registered The Arizona Report

Property Tax Bill Maricopa County Az

Delinquent Property Tax Lien Sale Overview – Arizona School Of Real Estate And Business

Maricopa County Arizona Federal Loan Information – Fhlc

Residential Commercial Rentals City Of Tempe Az