For purposes of this section, “government agency” means the state of maine, or any political subdivision of the state, or the federal government. Fuel exempt from maine excise tax becomes subject to maine sales/use tax.

_svgyhcvmgtq4m

To avoid any collection charges or action, you must pay the excise in full within 30 days of the bill’s issue date.

Maine excise tax refund. Excise tax is paid at the local town office where the owner of the vehicle resides. Mil rate is the rate used to calculate excise tax. Year 1.0240 mil rate year 2.0175 mil rate year 3.0135 mil rate year 4.0100 mil rate year 5.

Locally encouraged vehicles means buses upon which no excise tax is collected under section 1483, subsection 13. Enter refund amount as whole dollars only (don't round, just drop the cents). Maine tax alert a publication of maine revenue services for tax professionals.

Maine is one of the states where you claim personal property tax in lieu of vehicle registration fees. Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. You will receive a refund if an abatement is granted.

598, §47 (amd).] applications for refunds must be filed with the state tax assessor, on a form prescribed by the assessor, within 12 months from the date of purchase. Excise tax paid on gasoline purchased in maine and used for commercial purposes other than the operation of a registered vehicle on the highways of maine may be eligible for a refund. Please enter the primary social security number of the return.

Excise tax is calculated by multiplying the msrp by the mil rate as shown below. Where do i pay the excise tax? Excise tax is defined by state statute as a tax levied annually for the privilege of operating a motor vehicle, boat or camper trailer.

A refund cannot be issued for purchases made more than 18 months from the date the refund request is filed. The income tax rates are graduated, with rates ranging from 5.8% to 7.15% for tax years beginning after 2015. Excise tax is an annual tax that must be paid prior to registering your vehicle.

Choose your filing status and then enter the refund amount you are claiming. (3) damaged or improperly stamped. Refund information is updated tuesday and friday nights.

As of august 2014, mil rates are as follows: Any change to your refund information will show the following day. Marijuana excise tax (title 36, chapter 723 as enacted by pl 2019, c.

The amount of the refund must be the percentage of the excise tax. The rates drop back on january 1st each year. Request for a refund must be made on a cigarette tax refund application and be accompanied by a statement from the manufacturer that the packs have been returned with the maine excise stamps affixed to the pack.

Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax. A transfer fee of $3 is due to the municipality. The excise tax is based on the sticker price, or original list price of the vehicle.

(1) if a motor vehicle is sold or lost, the motor vehicle owner may be entitled to a credit for the excise tax paid on the sold or lost vehicle against the excise tax due on a subsequent vehicle. 1st year.0240 mil rate 2nd year.0175 mil rate 3rd year.0135 mil rate 4th year.0100 mil rate 5th year.0065 mil rate 6th year.0040 mil rate for example, a 3 year old car with an A refund of excise tax may be available on purchases of gasoline or diesel purchased and used by a government agency or political subdivision of this state (36 m.r.s.

Any person who fails to pay a tax assessment for which no further administrative or judicial review is available pursuant to section 151 and the maine administrative procedure act is liable for a penalty in the amount of 25% of the amount of the tax due if the payment of the tax is not made within 10 days of the person's receipt of notice of demand for payment as provided by. Insurance premiums tax, sales, use and service provider taxes, hospital tax, marijuana excise tax, and property tax. Except for a few statutory exemptions, all vehicles ( including boats) registered in the state of maine are subject to the excise tax.

An excise tax is paid and kept by falmouth. The bureau shall refund all excise tax paid by the wholesale licensee or certificate of approval holder on all malt liquor or wine caused to be destroyed by a supplier as long as the quantity and size are verified by the bureau and the destruction is witnessed by an authorized representative of. Refunds will be reduced by sales/use tax due.

Electronic request form to request individual income tax forms. Credits and refunds of excise tax are allowed as follows: Real estate withholding (rew) worksheets for tax credits.

Other registration fees are collected, and forwarded to the state of maine. Are there any refunds available for the motor fuel excise tax paid in maine? Visit the maine revenue service page for updated mil rates.

So, you will claim the excise taxes you paid to your city or county based on your vehicle's value. The rates ranged from 0% to 7.95% for tax years beginning after december 31, 2012 but before january 1, 2016. Mrs in preventing fraudulent tax refunds.

Pesticide container fee (reallocated from title 36, chapter 723) §4941. How is the excise tax calculated? Requests must be made within 90 days of return of the cigarettes to the manufacturer.

The state of maine has authorized falmouth to register certain automobiles, trucks and recreational vehicles. Yes, you can claim a portion of the expenses.

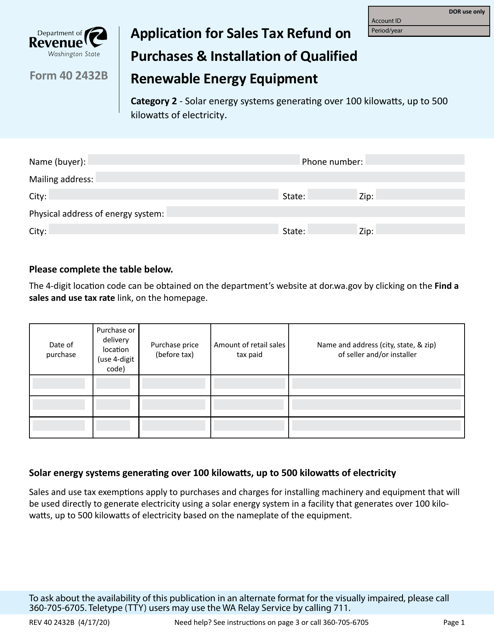

Form 40 2432b Download Fillable Pdf Or Fill Online Application For Sales Tax Refund On Purchases Installation Of Qualified Renewable Energy Equipment Washington Templateroller

2

Its Tax Times Some Funny Tax Quotes That Will Tickle You Tax Quote Funny Dating Quotes Taxes Humor

2

2

Form Off-1 Download Fillable Pdf Or Fill Online Special Fuel And Gasoline Tax Refund Application Maine Templateroller

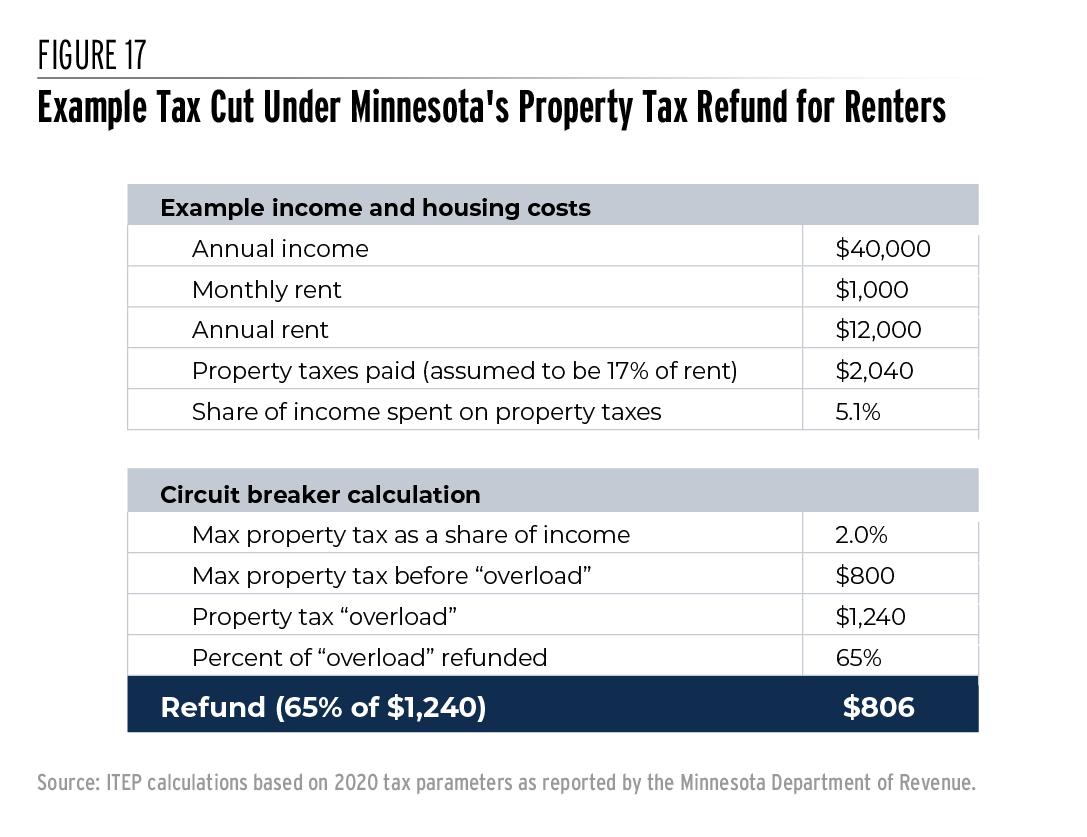

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Business Tax Refund Flyer Tax Refund Business Tax Flyer

Claim Interest On Income Tax Refund For Delay

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

2

Online Income Tax Refund To – Federal Board Of Revenue Facebook

2

Bookkeeping Help Heather

2

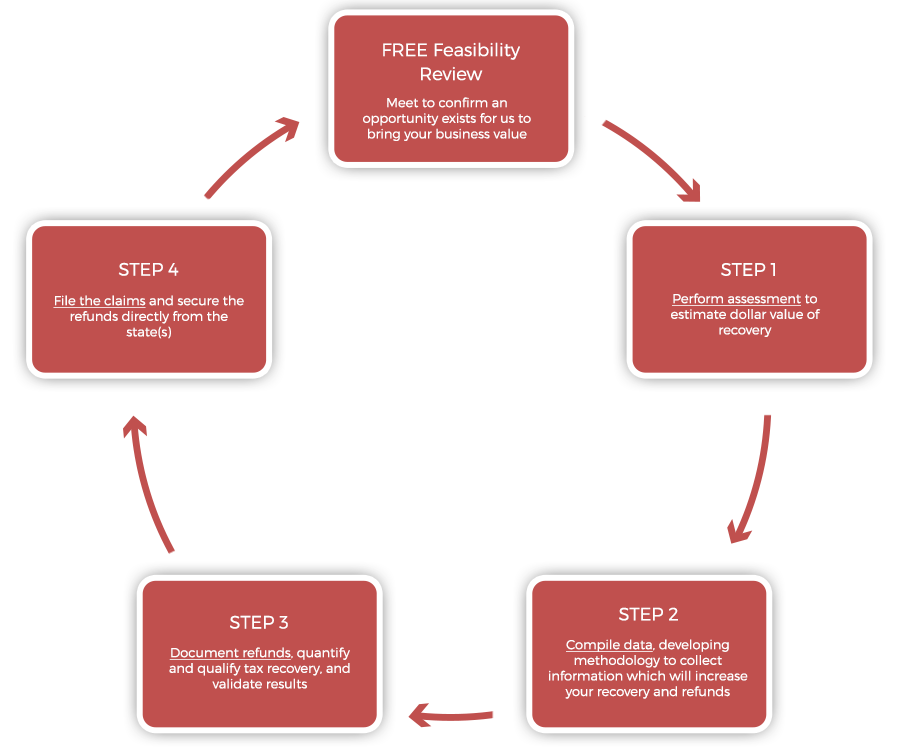

Fuel Tax Recovery And Refund Services National Fleet Services Llc

2

New Analysis A Third Of Nc Taxpayers Wont Benefit From Proposed Tax Refund Plan Itep

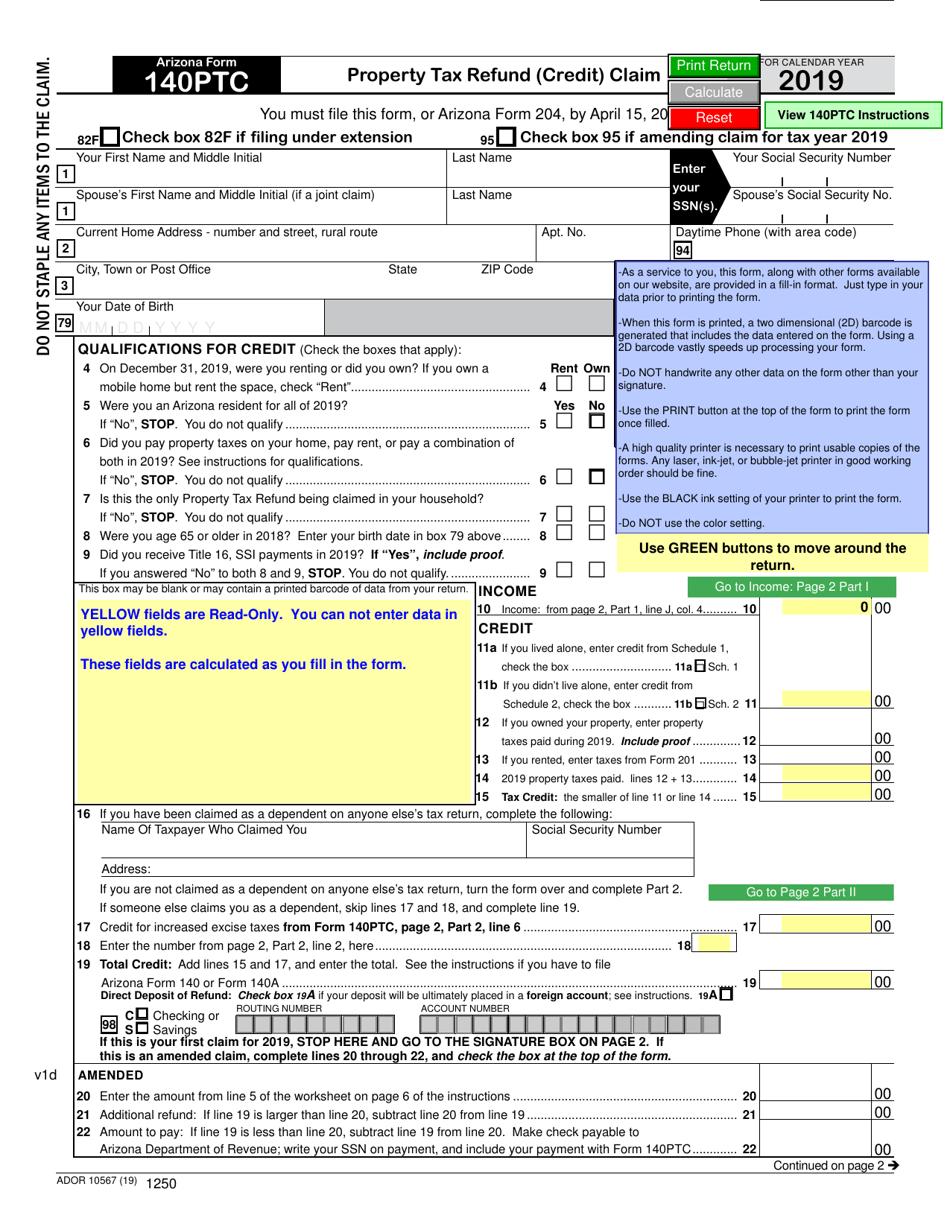

Arizona Form 140ptc Ador10567 Download Fillable Pdf Or Fill Online Property Tax Refund Credit Claim – 2019 Arizona Templateroller