Visit the maine revenue service page for updated mil rates. Joyce mccreight (d) has introduced a bill, h.p.

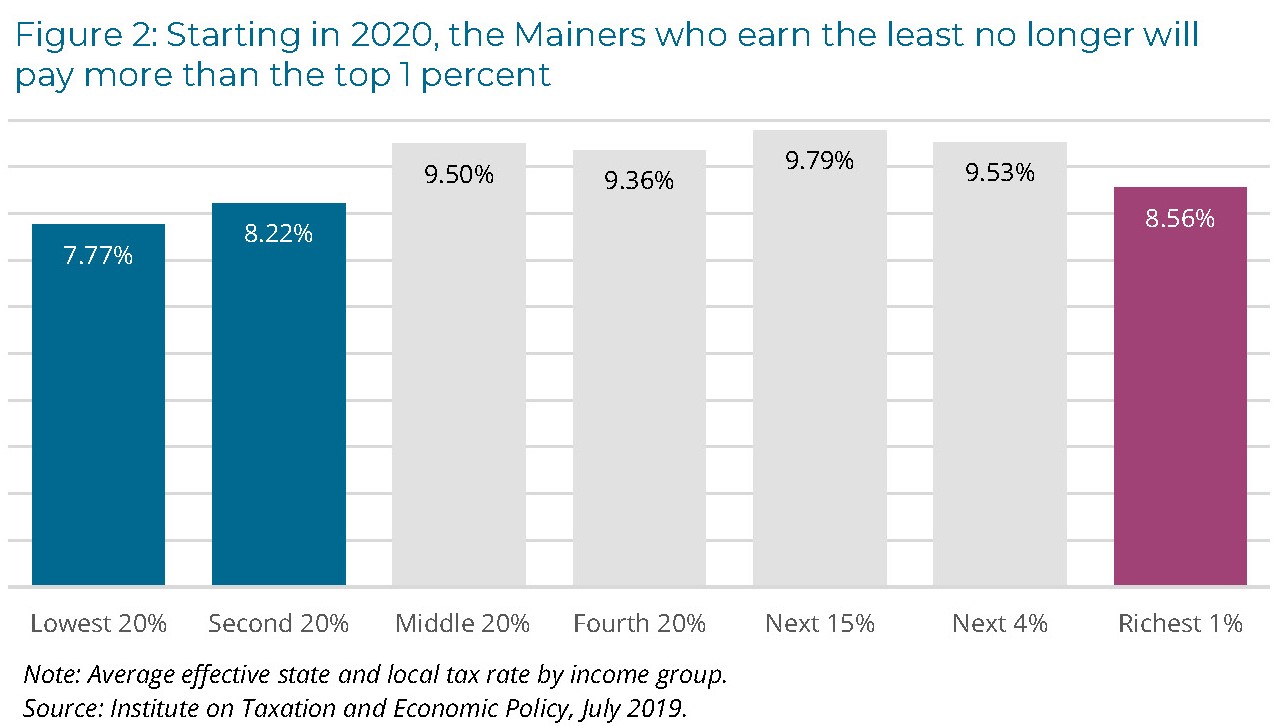

Maine Reaches Tax Fairness Milestone Itep

Msrp (manufacturers suggested retail price) newer vehicles will generally be more expensive to.

Maine excise tax rates. When a vehicle needs to be registered, an excise tax is collected during the registration. 2 nd year.0175 mil rate. 5 th year.0065 mil rate.

The amount of tax you pay depends on two things: Counties and cities are not allowed to collect local sales taxes. Other registration fees are collected, and forwarded to the state of maine.

The price of all motor fuel sold in maine also includes federal motor fuel excise taxes, which are collected from the manufacturer by the irs and are used to support the federal highway administration. How much is the excise tax? 15% excise tax (fair market value at wholesale);

The age of the vehicle 2. 16 rows effective july 1, 2009, the full gasoline excise tax rate is imposed on internal. (a) 20% excise tax (retail price) nev.

3 rd year.0135 mil rate. In maine, beer vendors are responsible for paying a state excise tax of $0.35 per gallon, plus federal excise taxes, for all beer sold. Mil rate is the rate used to calculate excise tax.

As of august 2014, mil rates are as follows: 4 th year.0100 mil rate. During the legislature’s special session in maine, rep.

An excise tax is paid and kept by falmouth. The excise tax on campers is equal to 24 mills on each dollar of the msrp for 1039, which would double the excise tax on cigarettes to $4.00 a pack.

Below you will find the town of eliot boat excise tax payment form for download/completion along with the maine watercraft excise tax table for computing the boat excise tax due. Exact tax amount may vary for different items. How much is the excise tax?

Excise tax is calculated by multiplying the msrp by the mil rate as shown below. Federal excise tax rates on various motor fuel products are as follows: By virtue of maine law, all other tobacco products would also be subject to a.

1 city hall plaza ellsworth, me 04605. 10.75% excise tax (retail price) mich. For example a two year old car with a msrp of $25,000 would be charged a mil rate of.0175 totaling an excise bill of $437.50 or ($25,000 x.0175 = $437.50).

10% excise tax (retail price), $335/lb. A registration fee of $35.00 and an agent fee of $6.00 for new vehicles will also be charged for a total of $641.80 due to register your new vehicle. A mil rate of $24.00 per thousand is charged to a new vehicle.

2021 maine state sales tax. The excise tax due will be $610.80; The excise tax is based on the sticker price, or original list price of the vehicle.

Year 1.0240 mil rate year 2.0175 mil rate year 3.0135 mil rate year 4.0100 mil rate year 5. In maine, chewing tobacco/snuff are subject to a state excise tax of $2.02 / ounce as well as federal excise taxes (listed below). How is the excise tax calculated?

6 th year.0040 mil rate Groceries and prescription drugs are exempt from the maine sales tax. Watercraft excise tax rates commercial tax 3.00 3.00 tax 3.00 tax 3.50 tax 5.00 6.50 10.00 tax 5.50 7.00 10.50 tax 6.50 8.00 11.50 tax 7.50 9.00 12.50 tax 9.00 10.50 14.00 tax 10.50 12.00 15.50 tax 12.00 13.50 17.00 13.00 14.00 15.50 19.00 length to nearest foot dories & canoes 20' & under w/o motor dories & canoes over 20' w/o motor all canoes.

For more information please see the maine revenue services website or contact the division of collection and treasury. The age of the vehicle 2. 18 rows tax year assessed cfet rate per acre acres fpd actual expenditures cfet budget.

Excise tax is paid at the local town office where the owner of the vehicle resides. Maine's general sales tax of 5.5% also applies to the purchase of beer. The amount of tax you pay depends on two things:

Each year the mil rate reduces until the vehicle is 6 years old. Msrp (manufacturers suggested retail price) newer vehicles will generally be more expensive to excise than older vehicles. 10% excise tax (retail price) n.j.

$1.5 per immature plant or seedling; Excise tax is an annual tax that must be paid prior to registering your vehicle.except for a few statutory exemptions, all vehicles (including boats) registered in the state of maine are subject to the excise tax.excise tax is defined by state statute as a tax levied annually for the privilege of operating a motor vehicle, boat or camper trailer on the public ways. 10% excise tax (retail price) mont.

The maine state sales tax rate is 5.5%, and the average me sales tax after local surtaxes is 5.5%.

2

Pdf Excise Tax Avoidance The Case Of State Cigarette Taxes

Excise Tax What It Is How Its Calculated

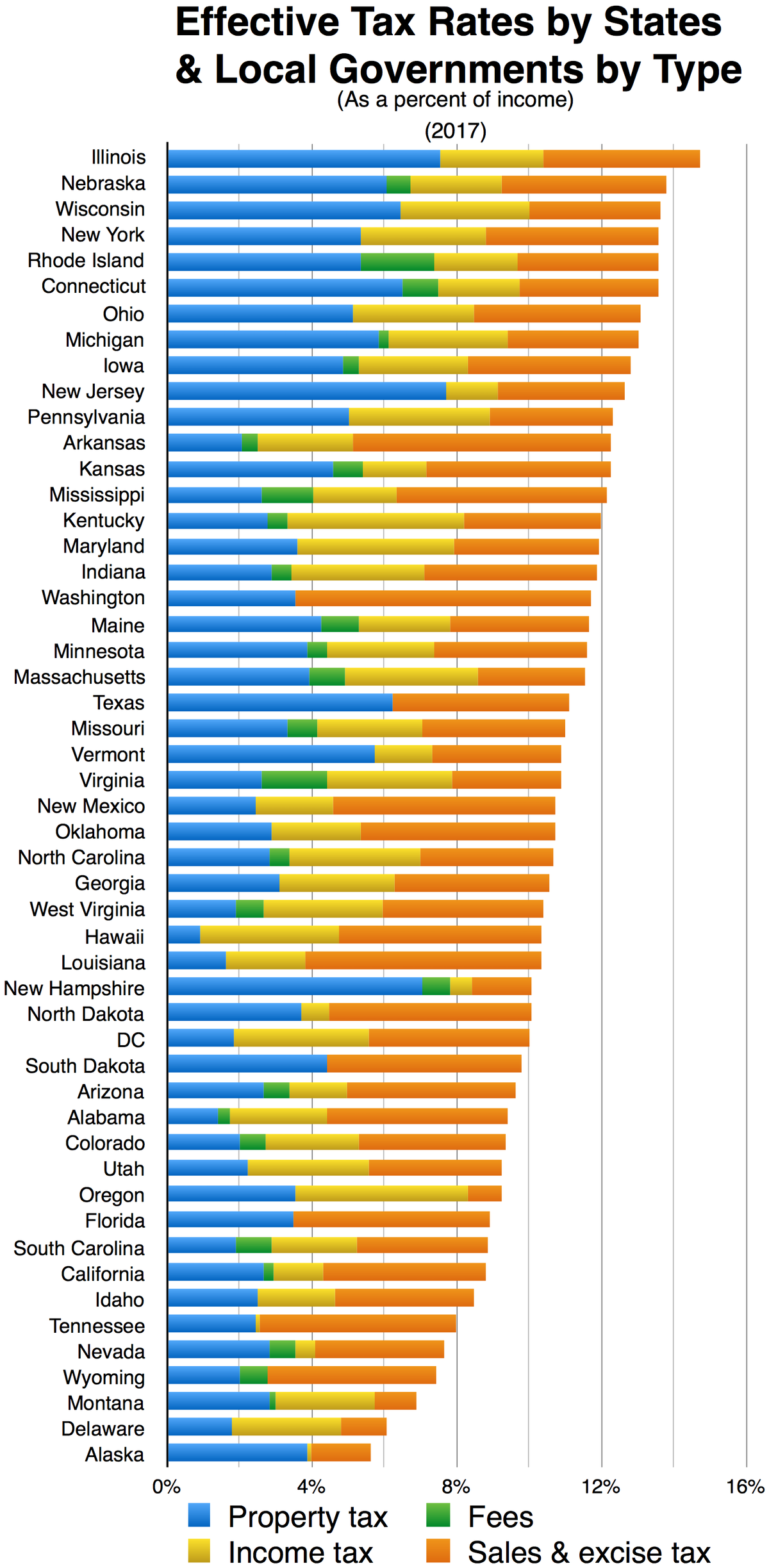

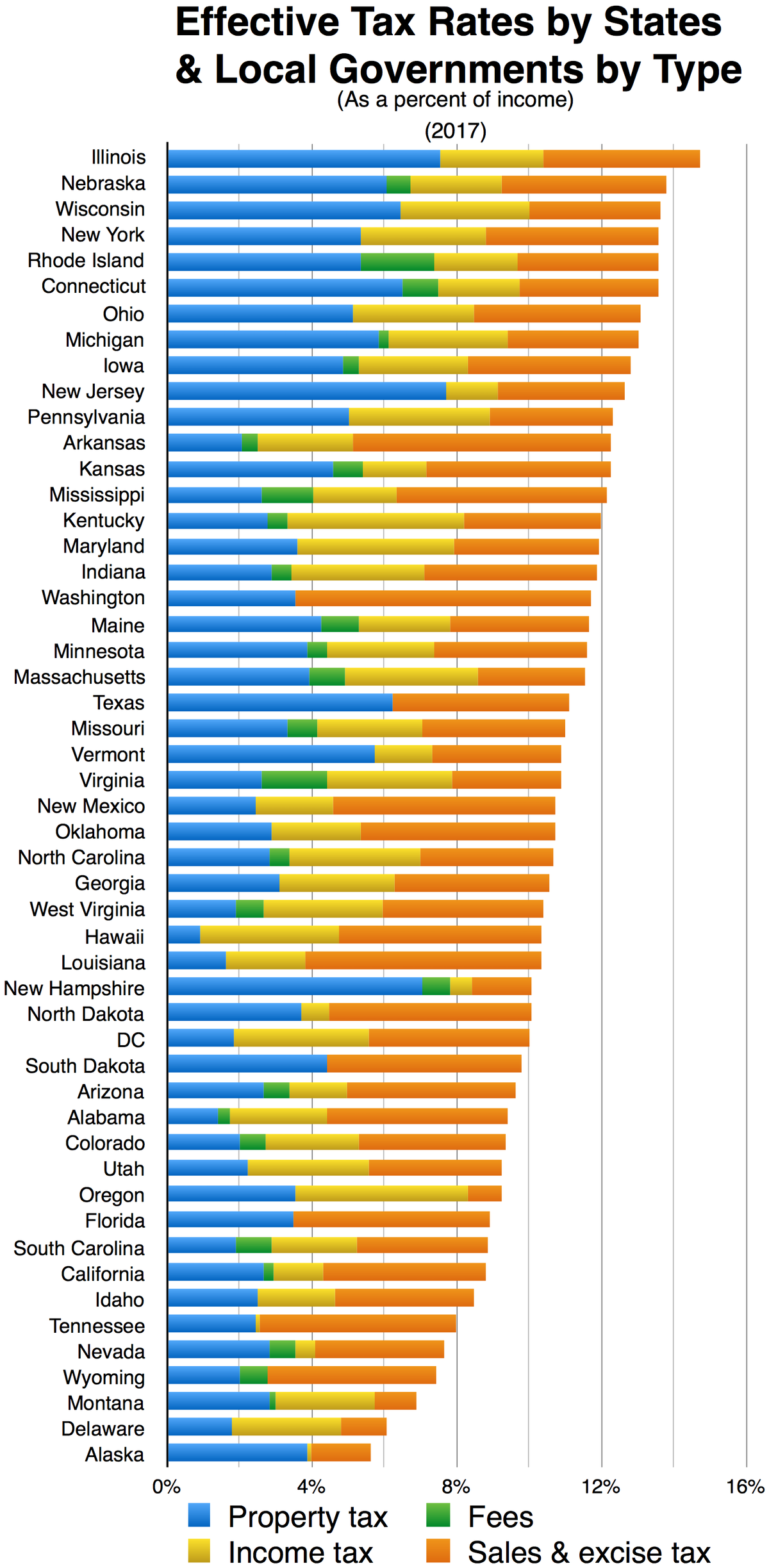

Filestate And Local Taxes Per Capita By Typepng – Wikipedia

Biddeford Man Wants To Change Maine Excise Tax With Citizen Initiative On Ballot Wgme

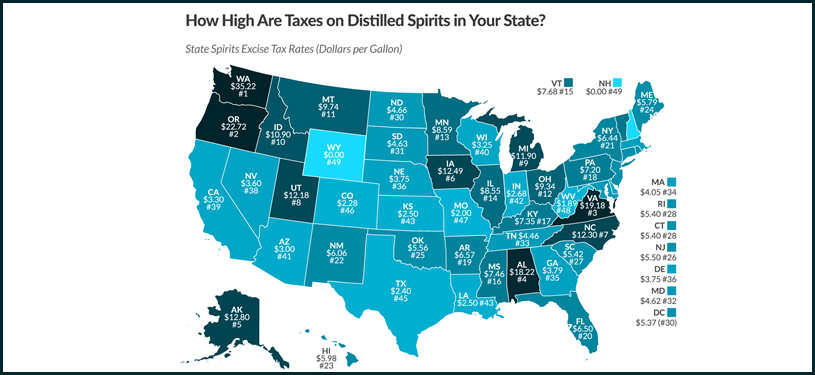

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic – Distillery Trail

Pin On Wsj Graphics

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Nadra E-sahulat Service Is Available Pi Technical Institute Now You Can Address Plot No 19 Street No 02 Col Aman Ullah Road Bha Technical Physics Info

Maps Itep

House Democrats Tax On Corporate Income Third-highest In Oecd

Maps Itep

Wine Tax By State – Easy To Read Wine Excise Tax Rates Map

Excise Tax Information Cumberland Me

Ii Taxes On Commodities A Survey In Tax Harmonization In The European Community

Maines Tax Burden Is One Of The Highest New Study Says Mainebizbiz

States With Highest And Lowest Sales Tax Rates

25 Percent Corporate Income Tax Rate Details Analysis

Md Maila Inc Attorneys Ba-emedi Reg No 201731653521 Polokwane 015 291 1109 Address 52 Landdros Mare St Labor Law Personal Injury Claims Injury Claims