The tax is included in the price of every gallon sold to consumers in maine. By signing this tax excise tax report, the licensee understands that false statements made on this form are punishable by law.

Disabled Veterans Property Tax Exemptions By State

Provides a tax credit against the excise taxes imposed on alcohol manufactured and sold in maine by a brewer equal to 17.5¢ per gallon of malt liquor manufactured and exported by that brewer.

Maine excise tax credit. An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward the tax for any number of vehicles, regardless of the number of transfers that may be required of the owner or lessee in that registration year. Furthermore, the credit may not be used to reduce the taxpayer’s liability below the net tax liability of the previous year. To transfer plates and apply excise tax credit to a newly owned vehicle we will need the yellow registrationfrom the vehicle from which you are transferring the plates.

This means that you save the sales taxes you would otherwise have paid on the. Excise tax is an annual tax that must be paid prior to registering your vehicle. Cigarette & tobacco products instructional bulletin.

A transfer fee of $3 is due to the municipality. If time remains on the old registration, excise tax credit may be applied to the new registration. Ld 1415 discontinued and abandoned roads | ld 1415 testimony.

All applicable state of maine law requirements are followed in regards to excise tax credits. Other tobacco products tax declaration. The money is deposited into the highway fund and used for transportation projects in maine.

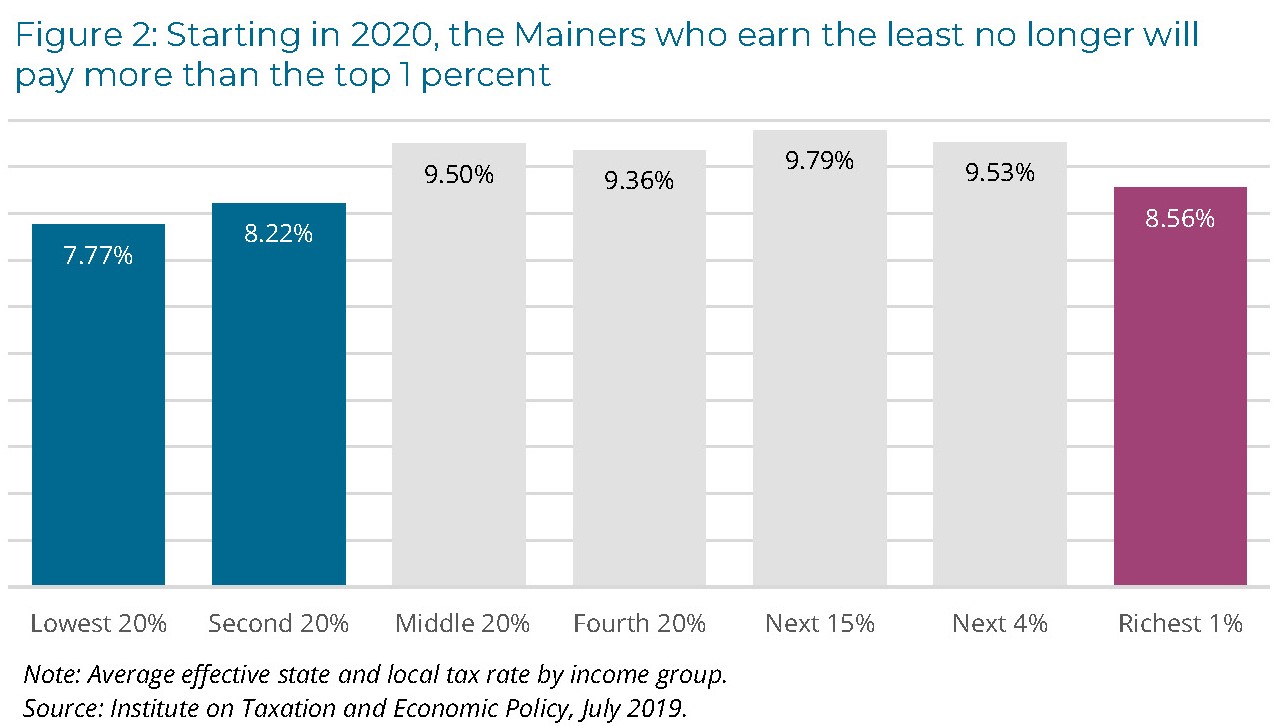

Excise tax reimbursement policy / procedures the state of maine will reimburse municipalities for the difference between the excise tax based on the sale price and the manufacturer suggested retail price (msrp) on vehicles that are 1996 or newer and registered for a gross weight of more than 26,000 lbs. In 2019, maine passed bill ld 1430, which introduces a solar tax exemption for both business and residential owners enabling renewable energy adopters to save money―while adding real value to their property and assets. According to itep’s tax inequality index, which measures the impact of each state’s tax system on income inequality, maine has the 45th most unfair state and local tax system in the country.incomes are more unequal in maine after state and local taxes are collected than before.

An opportunity for businesses with solar energy systems. As our experience in massachusetts has shown, eligible businesses. Credits and refunds of excise tax are allowed as follows:

Abandoned roads, amendments to the tree growth tax law and a commercial forestry excise tax credit are leading legislative concerns this session. Knowingly supplying false information on this form is a class d offense under maine’s criminal code, punishable by confinement of up to one year, or by monetary fine of up to $2,000 or by both. Multiply your vehicle's msrp by the appropriate mil rate.

(1) the bureau shall grant a credit for the excise tax on malt liquor or wine sold by wholesale licensees to any instrumentality of the united states or any maine national guard state training site exempted by the bureau. You can only receive excise tax credit on a transfer if you have sold or transfered ownership of the vehicle to another party. Motor fuel excise tax is a tax per gallon on motor fuel sold at retail in maine.

Legislative update, 129th maine legislature. Commonly taxed “sins” include alcohol, tobacco, gasoline, sex work, and marijuana in states where it’s legal. (1) if a motor vehicle is sold or lost, the motor vehicle owner may be entitled to a credit for the excise tax paid on the sold or lost vehicle against the excise tax due on a subsequent vehicle.

Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public. Certain excise taxes are sometimes also known as “sin taxes” because they are applied to goods or services that are considered harmful if used excessively. The bureau shall grant to the wholesale licensee a credit of all state excise tax paid in connection with that sale under the following conditions.

We cannot transfer plates or apply excise tax credit from a vehicle that has not been sold, traded, or junked. Maine levies excise taxes on alcohol, tobacco, and fuels. Excise tax amounts are based on the vehicle's msrp (manufacturer's suggested retail price) and year of manufacture.

High technology investment tax credit. This tax credit is limited to 50% of the amount of excise taxes due from a brewer. On research conducted in maine.

Department of human services (offsite) tobacco notice. When it comes down to maine's sales tax on cars, you're only taxed on the $5,000 credit not the $13,000 you bought it for. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax.

Photocopy of sellers registration (for the vehicle you purchased), will save you time.

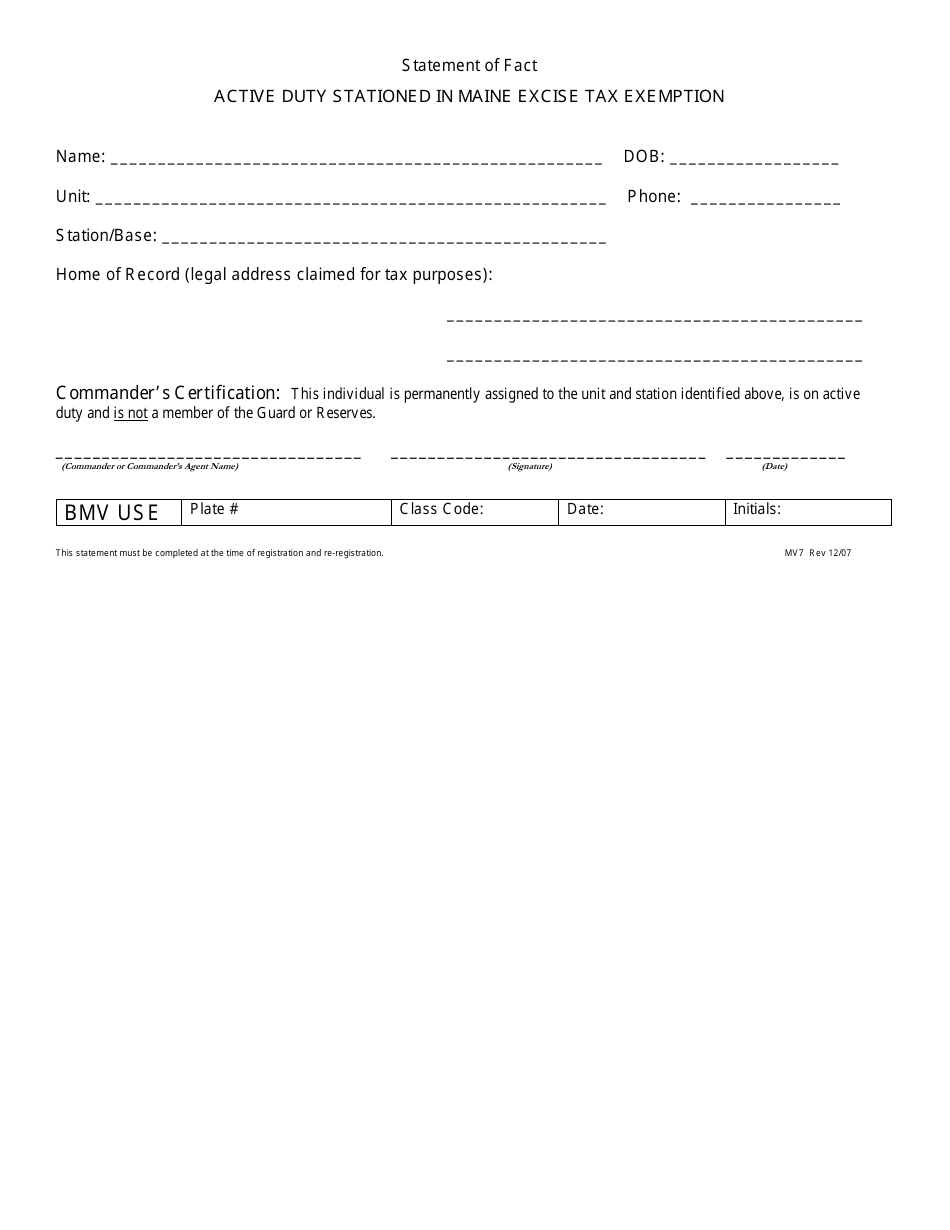

Form Mv7 Download Fillable Pdf Or Fill Online Active Duty Stationed In Maine Excise Tax Exemption Maine Templateroller

Proposals For Refundable Tax Credits Are Light Years From Tax Policies Enacted In Recent Years Itep

Whats Going On With The Child Tax Credit Debate Tax Foundation

The Main Hope Of A Nation Lies In The Proper Education Of Its Youth – Erasmus Youthday Nationalyouthday Aspireinstitute Education Youth Day National

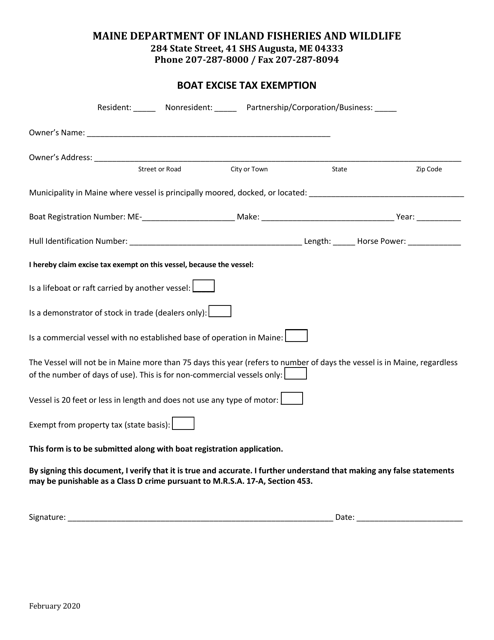

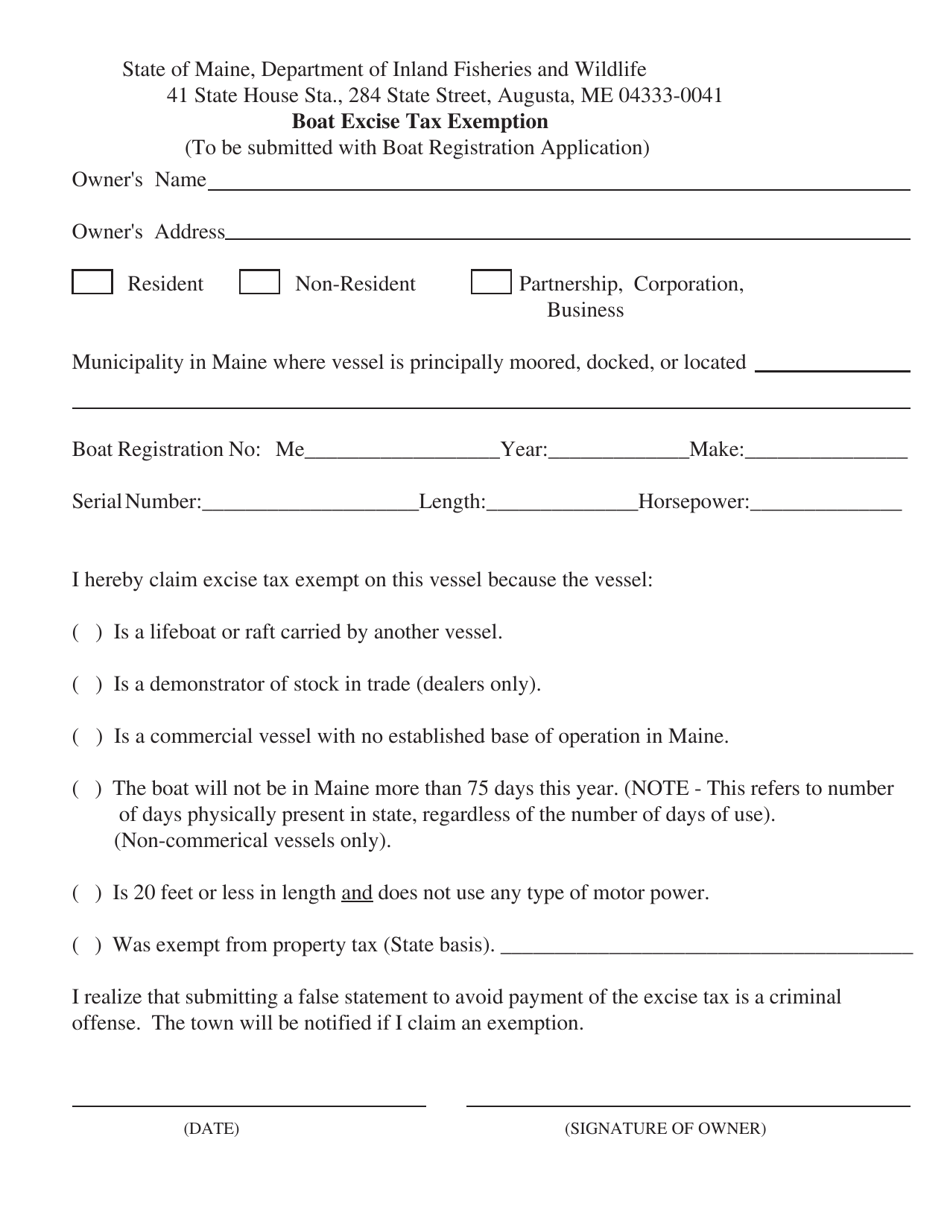

Maine Boat Excise Tax Exemption Download Fillable Pdf Templateroller

Under The Gst Regime An E-way Bill Needs To Be Generated And Carried For Movement Of All Goods Valued At Ov State Tax Goods And Service Tax Goods And Services

New Itep Estimates On Bidens Proposal To Expand The Child Tax Credit Itep

2

How To Get A Sales Tax Exemption Certificate In Iowa – Startingyourbusinesscom

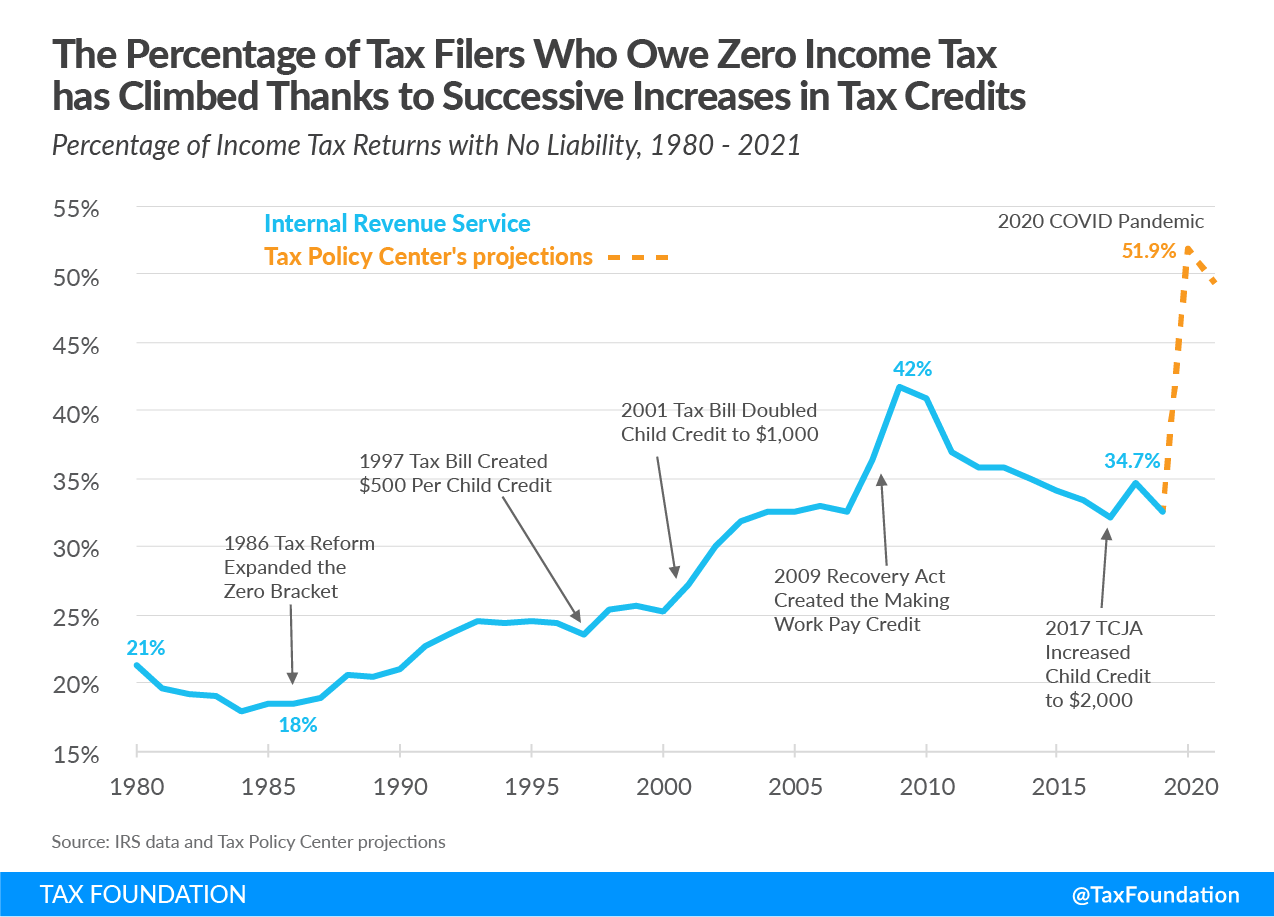

Increasing Share Of Us Households Paying No Income Tax

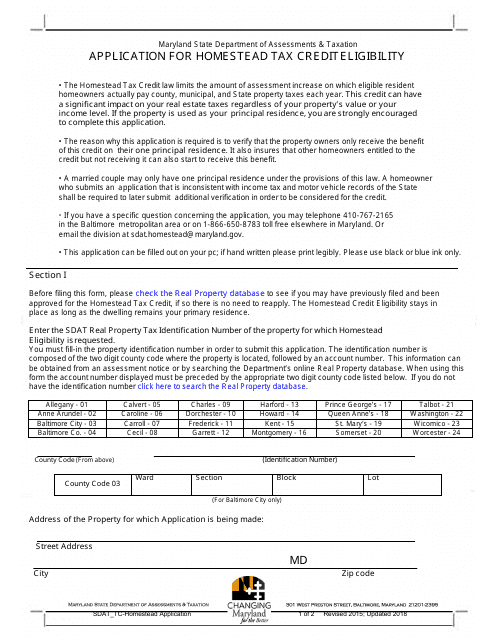

Maryland Application For Homestead Tax Credit Eligibility Download Fillable Pdf Templateroller

Maine Reaches Tax Fairness Milestone Itep

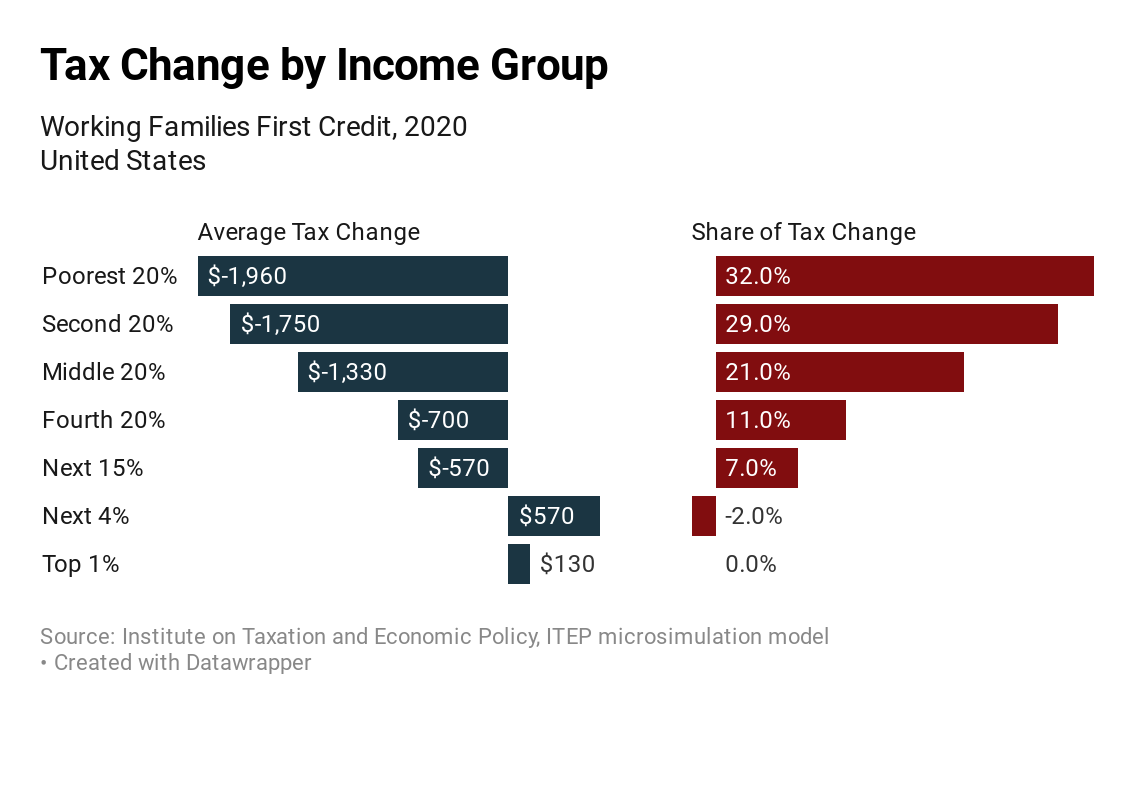

Julian Castro Provides The Latest Proposal To Expand Refundable Tax Credits Itep

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

Biodiesel Fuel Credit – Excise Tax Andretaxco Pllc

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

Child Tax Credit Enhancements Under The American Rescue Plan Itep