Thus, there is no requirement to file a return with the state and no state inheritance taxes are owed. The party to whom you should address your renunciation depends upon the terms of the will in which you are a named beneficiary or, in the absence of a will, in accordance with the inheritance laws of the state of louisiana.

Louisiana Succession Taxes Scott Vicknair Law

Inheritance tax laws from other states could in theory apply to you if you inherit property or assets from someone who lived in a state that has an inheritance tax.

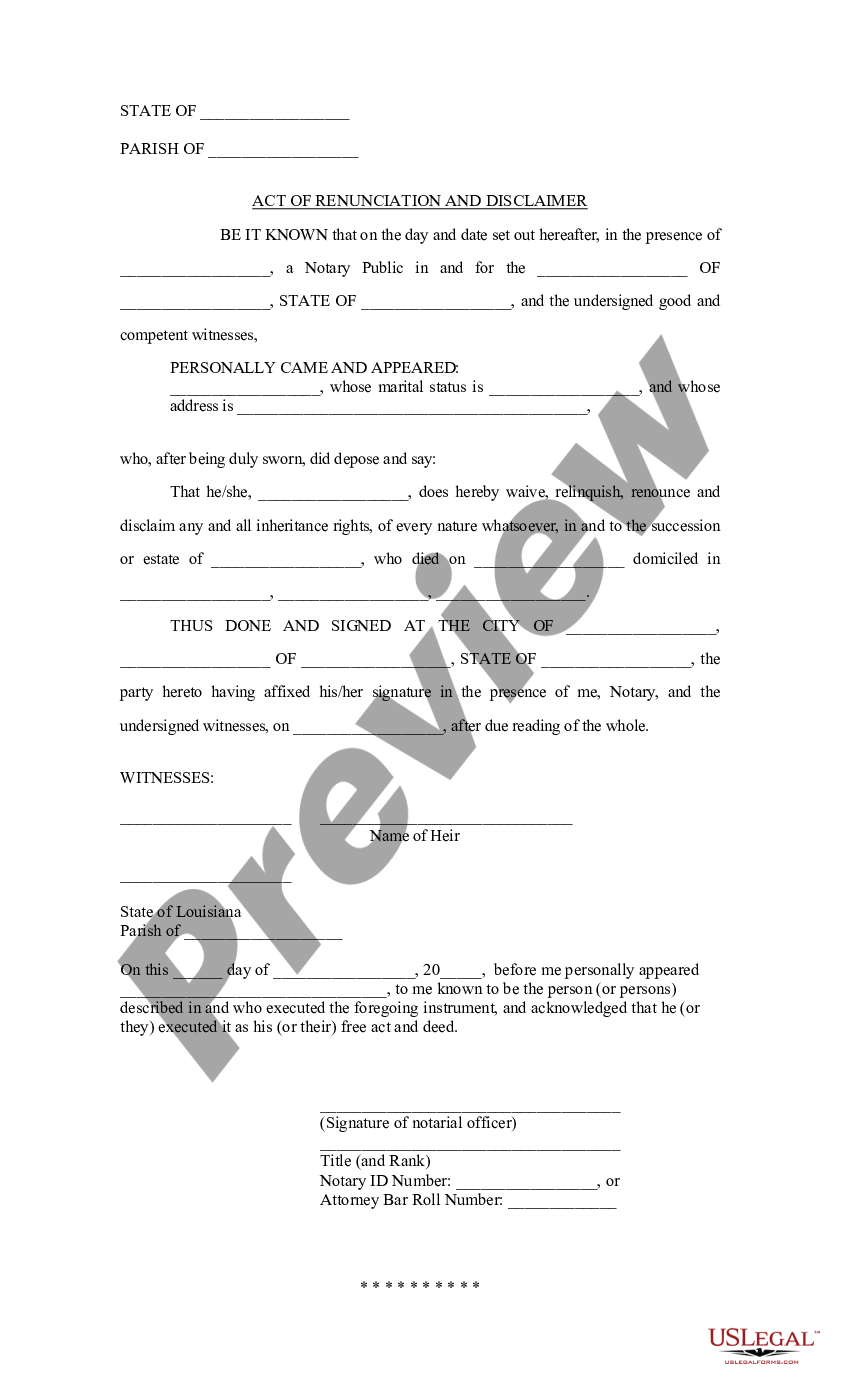

Louisiana inheritance tax waiver. Dad dies and leaves assets to mom. Sometimes, believe it or not, it makes good tax or legal sense to formally refuse (also known as disclaim or renounce) an inheritance. A legal document is drawn and signed by the heir that forgoes the legal rights of the items.

In order to understand louisiana inheritance law, you need to be familiar with the legal terms usufruct and usufructuary. Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent. Ad a tax advisor will answer you now!

Sign forms and agreements with online pdf signer and share them faster than ever before The louisiana inheritance tax is imposed on the heirs or legatees of a. Ad sign documents with pdf signer without having to travel and meet your clients in person.

You might inherit $100,000, but you would pay an inheritance tax on just $50,000 if the state only imposes the tax on inheritances over $50,000. Maryland is the only state to impose both. Most relatives who inherit are exempt from maryland's inheritance tax.maryland collects an inheritance tax when certain recipients inherit property from someone who lived in maryland or owned property there.

This right is called a usufruct and the person who inherits this right is called a usufructuary. Does louisiana impose an inheritance tax? The federal estate tax exemption is.

Louisiana department of revenue taxpayer services division p. Inheritance tax waiver and consent to release form discontinued. Inheritance tax —an original inheritance tax return is to be filed in the succession record.

Ad sign documents with pdf signer without having to travel and meet your clients in person. The portion of the state death tax credit allowable to louisiana that exceeds the inheritance tax due is the state estate transfer tax. Often in louisiana, one person will inherit the right to use property and receive the fruits (income) from property.

Ad a tax advisor will answer you now! Like the federal estate tax laws, louisiana’s inheritance tax laws have undergone a lot of changes in the past several years. The economic growth and tax relief reconciliation act of 2001 phased out the state estate tax credit between 2002 and 2005 and replaced the credit with a deduction for state estate taxes for deaths that occur after december 31, 2004.

Inheritance taxes in iowa will decrease by 20% per year from 2021 through 2024. Louisiana state inheritance tax the state of louisiana has repealed all state inheritance taxes. Original return amended return partial return date of originalaaa / / real estate (louisiana property only) stocks and bonds mortgages, notes, and cash insurance other miscellaneous property

Sign forms and agreements with online pdf signer and share them faster than ever before Other inheritors pay the tax at a 10% rate. No, act 822 of the 2008 regular legislative session repealed the inheritance tax law, r.s.

Like the federal estate tax laws, louisiana’s inheritance tax laws have undergone a lot of changes in the past several years. Louisiana inheritance and gift tax. You might inherit $100,000, but you would pay an inheritance tax on just $50,000 if the state only imposes the tax on inheritances over $50,000.

Twelve states and the district of columbia impose estate taxes and six impose inheritance taxes. An inheritance or estate waiver releases an heir from the right to claim assets in the event of another person's death. Also, what states require an inheritance tax waiver form?

For instance, kentucky’s inheritance tax applies to any property in the state, even if the inheritor lives out of state. A renunciation of your inheritance waives any claim or interest you would otherwise have in the inheritance. Louisiana does not have an inheritance tax.

Louisiana succession, louisiana inheritance, keep property in family, transfer of resources. Questions answered every 9 seconds. Iowa has an inheritance tax, but in 2021, the state decided it would repeal this tax by 2025.

Close relatives and charities are exempt from the tax; Questions answered every 9 seconds. Effective january 1, 2012, no receipts will be issued for inheritance tax regardless of the date of death.

Louisiana Probate Law Practice Ex Parte Petitions For Possession – Pdf Free Download

Revenuelouisianagov

Free Form Application For Inheritance Tax Waiver – Free Legal Forms – Lawscom

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Does Your State Have An Estate Tax Or Inheritance Tax – Tax Foundation

Revenuelouisianagov

Louisiana Inheritance Tax Estate Tax And Gift Tax

Pa Inheritance Tax Waiver – Fill Online Printable Fillable Blank Pdffiller

Worldwidestocktransfercom

Does Your State Have An Estate Or Inheritance Tax

Revenuelouisianagov

Louisiana Probate Law Practice Ex Parte Petitions For Possession – Pdf Free Download

Louisiana Probate Law Practice Ex Parte Petitions For Possession – Pdf Free Download

Louisiana Probate Law Practice Ex Parte Petitions For Possession – Pdf Free Download

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Energyreportcouk

Estate Tax Waiver Notice Et-99 Pdf Fpdf Docx New York

Louisiana Act Of Renunciation And Disclaimer – Louisiana Renunciation Us Legal Forms

Louisiana Inheritance Tax Estate Tax And Gift Tax