This form covers the death of the second spouse to die. The good news is that, while some other states still tax inheritances, louisiana abolished its state inheritance tax in 2004.

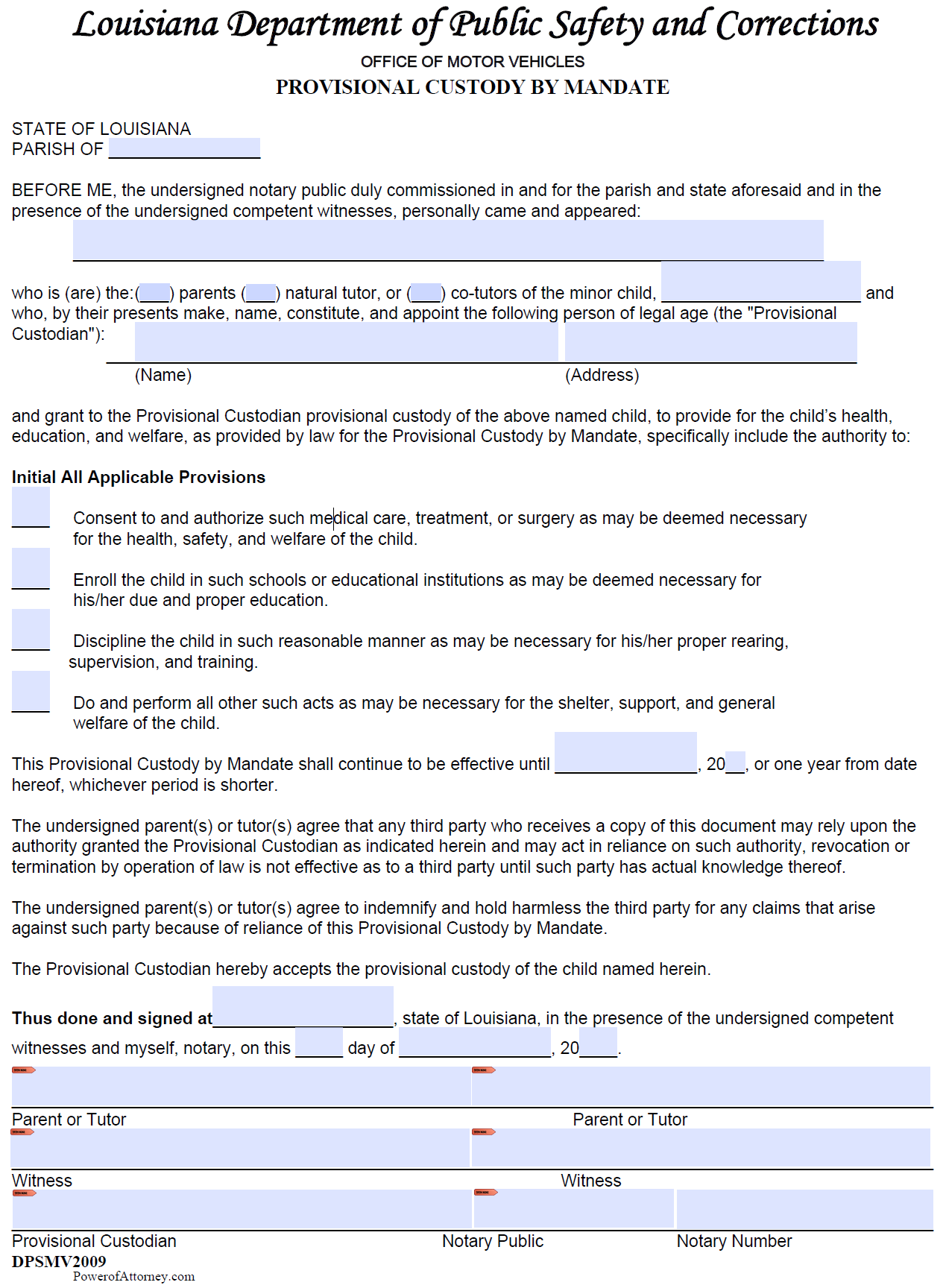

Free Minor Child Power Of Attorney Louisiana Form Pdf

If you’re looking for more guidance to navigate the complexities of louisiana inheritance laws, the smartadvisor tool can set you up with financial advisors in your.

Louisiana inheritance tax return form. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. Please check this page regularly, as we will post the updated form as soon as it is released by the kentucky department of revenue. Revised statute 47:2436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the deceased's net estate is $60,000.00 or more.

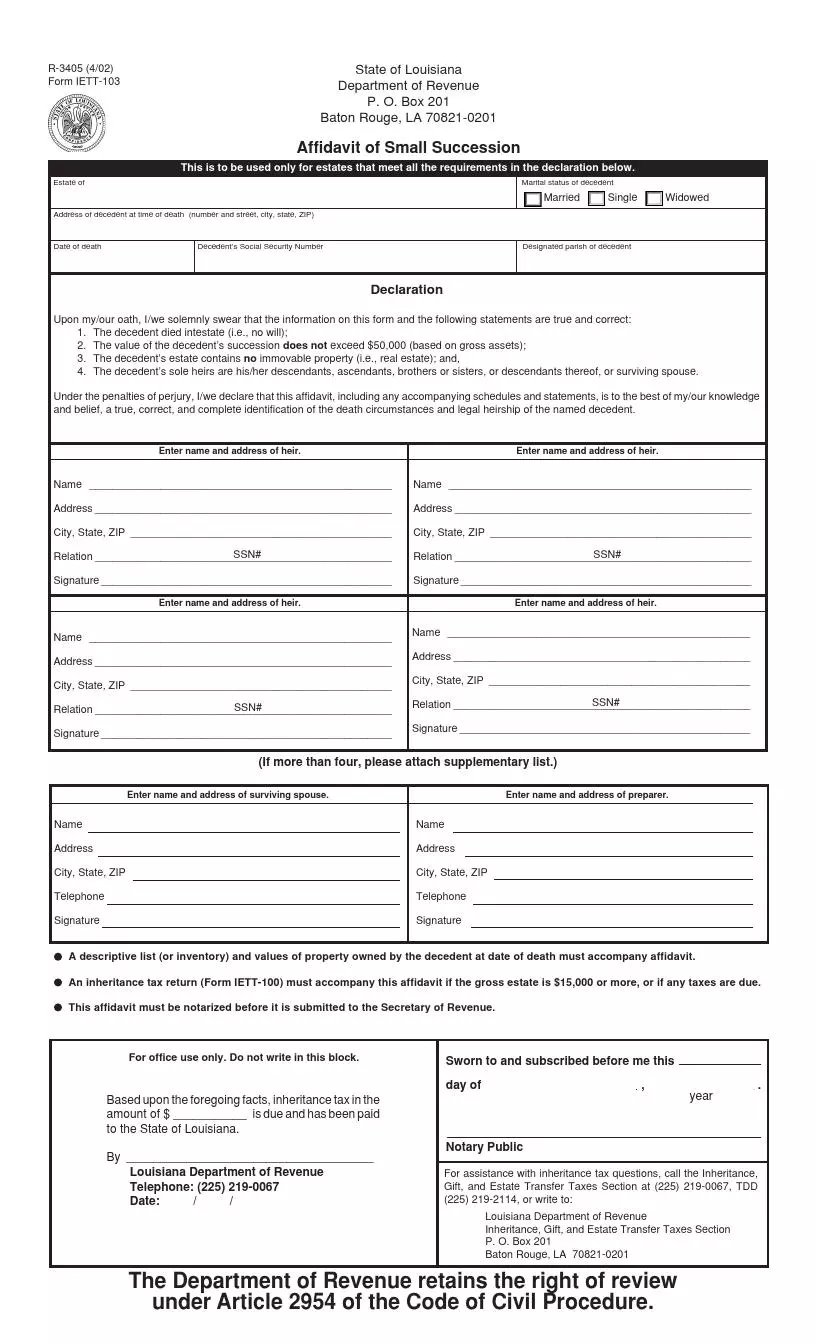

Inheritance taxes in iowa will decrease by 20% per year from 2021 through 2024. Avoid estate tax, avoid probate, bequest of property, capital gains tax, ira beneficiary, keep property in family, louisiana inheritance, louisiana probate, protect your estate, will plan i was working with an older, wealthier client yesterday and the husband asked if we could prepare a list of what their survivors would need to address after. Social security numbers of heirs are shown in the affidavit of valuation.

When tax returns are due a transfer inheritance tax return must be filed and the tax Inheritance tax resident return, instructions and payment voucher. The filing of the united states estate tax return for the same decedent may be accepted as an extension to file the louisiana inheritance tax return.

Residents of louisiana who earned income must file a state tax return. Louisiana has completely eliminated taxes on any inheritance, but for estates that are large enough to require a federal estate tax return, there is a louisiana estate transfer tax. In the absence of a federal extension, a louisiana extension may be granted for a period not to exceed 15 months from date of death, if.

Original return amended return partial return date of originalaaa / / real estate (louisiana property only) stocks and bonds mortgages, notes, and cash insurance other miscellaneous property Who must file an estate transfer tax return? Under the federal estate tax law, there is a credit for state death taxes that are paid, up to a certain amount.

This means that we don't yet have the updated form for the current tax year. 1 total state death tax credit allowable (per u.s. Form 92a200p is a kentucky corporate income tax form.

Louisiana has completely eliminated taxes on any inheritance, but for estates that are large enough to require a federal estate tax return, there is a louisiana estate transfer tax. You might inherit $100,000, but you would pay an inheritance tax on just $50,000 if the state only imposes the tax on inheritances over $50,000. Succession is accepted unconditionally, but see la r.s.

Iowa has an inheritance tax, but in 2021, the state decided it would repeal this tax by 2025. Federal estate tax return form 706) $ 2 ratio of assets attributable to louisiana (louisiana gross estate to federal gross estate, per federal return) 3 state death tax credit attributable to louisiana (multiply line 1 by line 2.) 4 basic inheritance tax (from schedule iii) A louisiana inheritance tax return would also be needed in most cases, and in some cases a federal estate tax return will be required.

Louisiana department of revenue inheritance, gift, and estate transfer taxes section p. We last updated the inheritance tax return in may 2021, and the latest form we have available is for tax year 2019. No inheritance tax is owed, and there’s no need to file an inheritance and estate tax return with the louisiana department of revenue.

The louisiana estate transfer tax is designed to take. This is because any income received by a deceased person prior to their death is taxed on their own final individual return, so it. Louisiana department of revenue taxpayer services division p.

(in fact, as discussed below, the louisiana department of revenue has stopped issuing receipts.) it is unclear whether people who died on or before june 30, 2004, will be subject to inheritance tax if an inheritance tax return was filed before july 1, 2008. Please check this page regularly, as we will post the updated form as soon. It’s also a community property estate, meaning it considers all the assets of a married couple jointly owned.

This means that we don't yet have the updated form for the current tax year. Even though louisiana does not collect an inheritance tax, however, you could end up paying inheritance tax to another state. The basis of property inherited from a decedent is generally one of the following:

Louisiana does not impose any state inheritance or estate taxes.

Bill Of Sale Motorcycle – Free Printable Documents Bill Of Sale Template Bill Of Sale Sale Template

Free Louisiana Revocable Living Trust Form – Word Pdf Eforms

Louisiana Succession Forms – Fill Out And Sign Printable Pdf Template Signnow

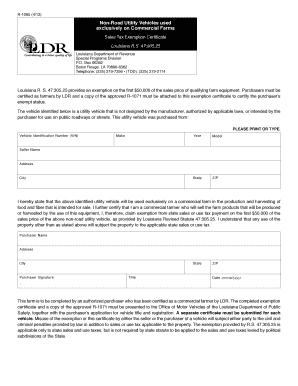

Fillable Online Revenue Louisiana Form R 1058 Louisiana State Tax Fax Email Print – Pdffiller

Pin On For Tenants

Hotel Tax Exempt Form – Fill Online Printable Fillable Blank Pdffiller

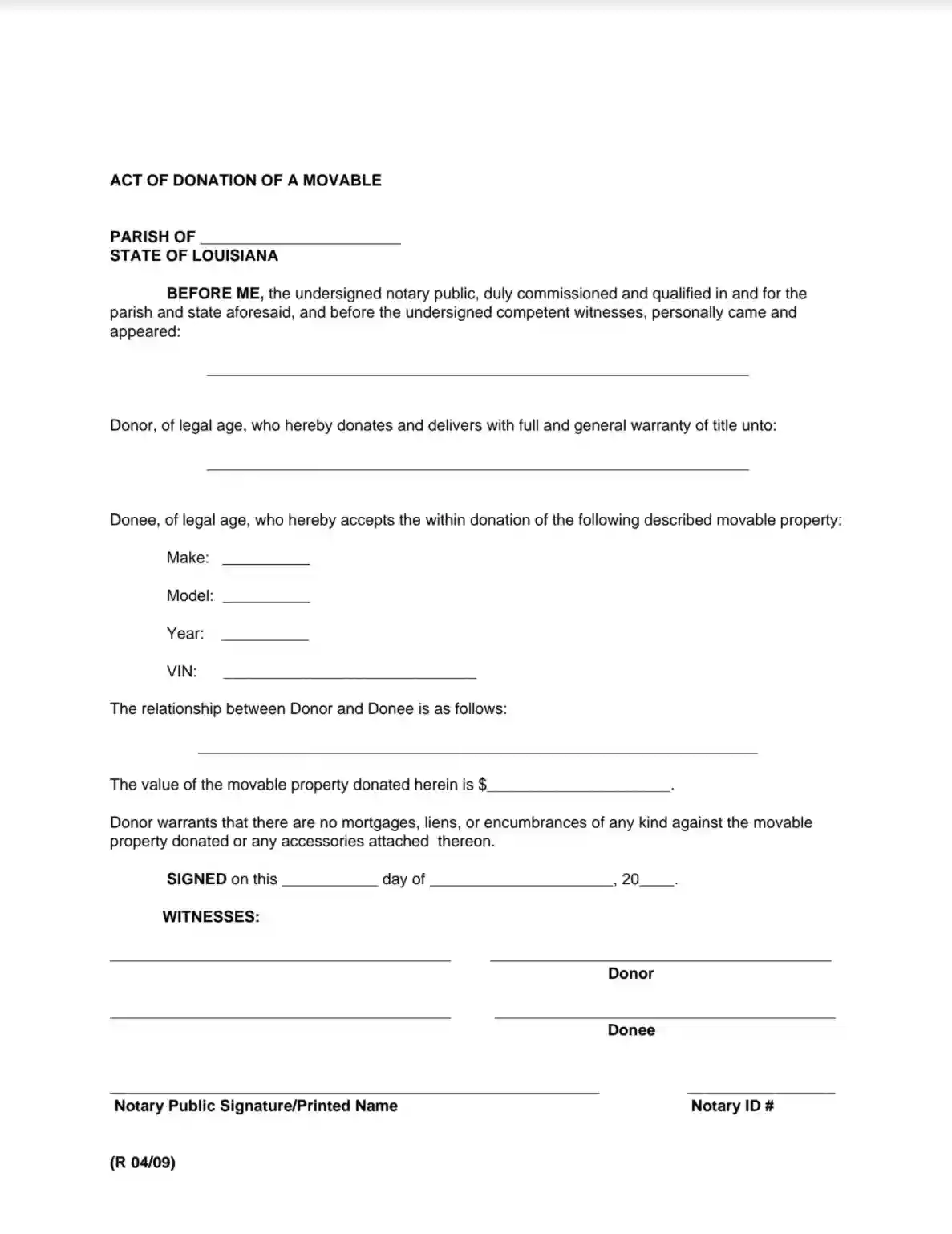

Louisiana Act Of Donation Fill Out Printable Pdf Forms Online

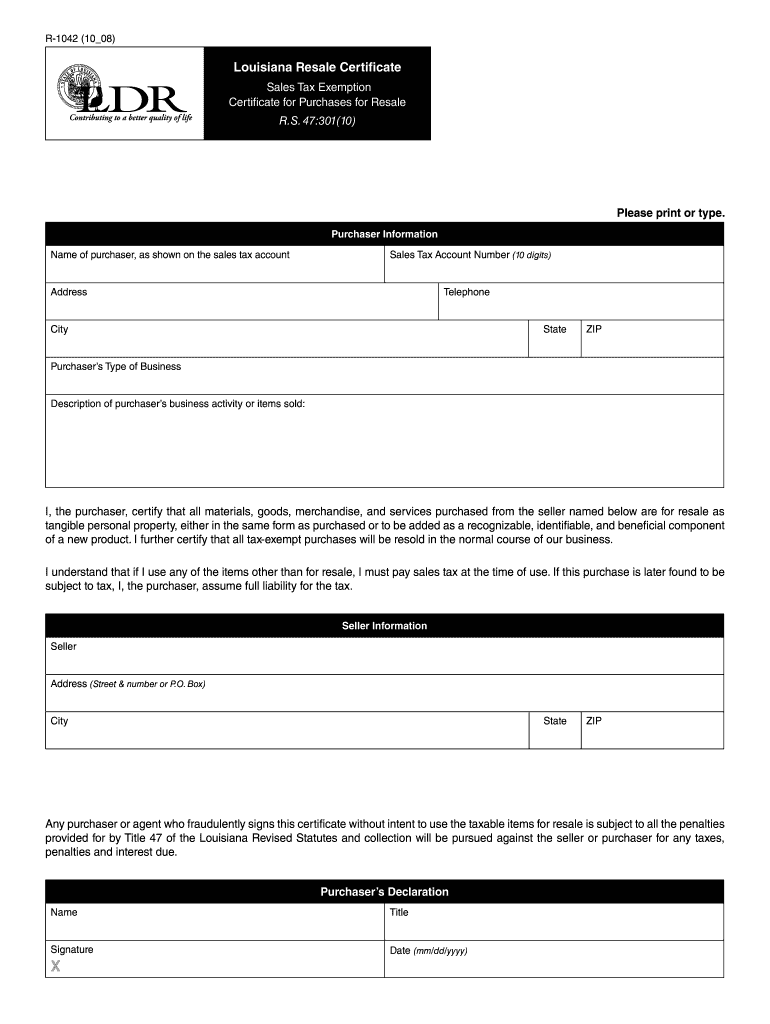

Louisiana Resale Certificate – Fill Online Printable Fillable Blank Pdffiller

Free Louisiana Last Will And Testament Template – Pdf Word Eforms Free Fillable Forms Last Will And Testament Will And Testament Louisiana

Form 1311 – Fill Online Printable Fillable Blank Pdffiller

Free Louisiana Security Deposit Demand Letter – Pdf Word Eforms Free Fillable Forms Being A Landlord Lettering Letter Form

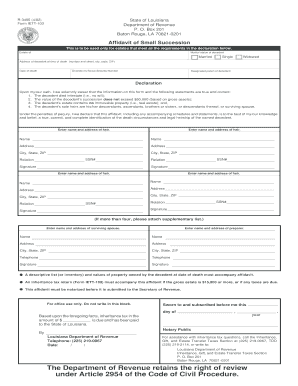

Free Louisiana Small Estate Affidavit Form Pdf Formspal

Family Law Affidavit Louisiana – Fill Online Printable Fillable Blank Pdffiller

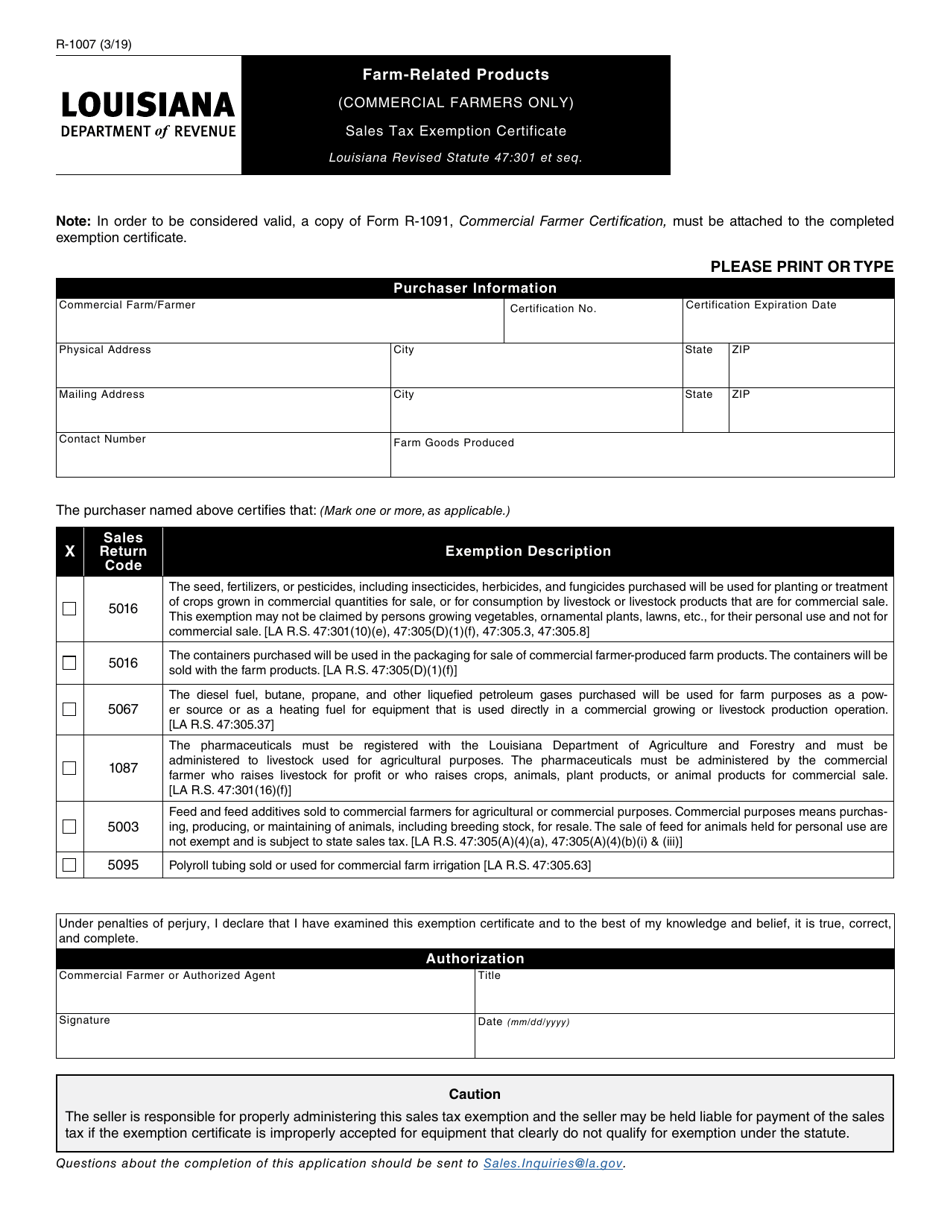

Form R-1007 Download Fillable Pdf Or Fill Online Farm-related Products Sales Tax Exemption Certificate Louisiana Templateroller

2

Free Louisiana Rental Application Form – Pdf Eforms Free Fillable Forms Rental Application Rental Application Form

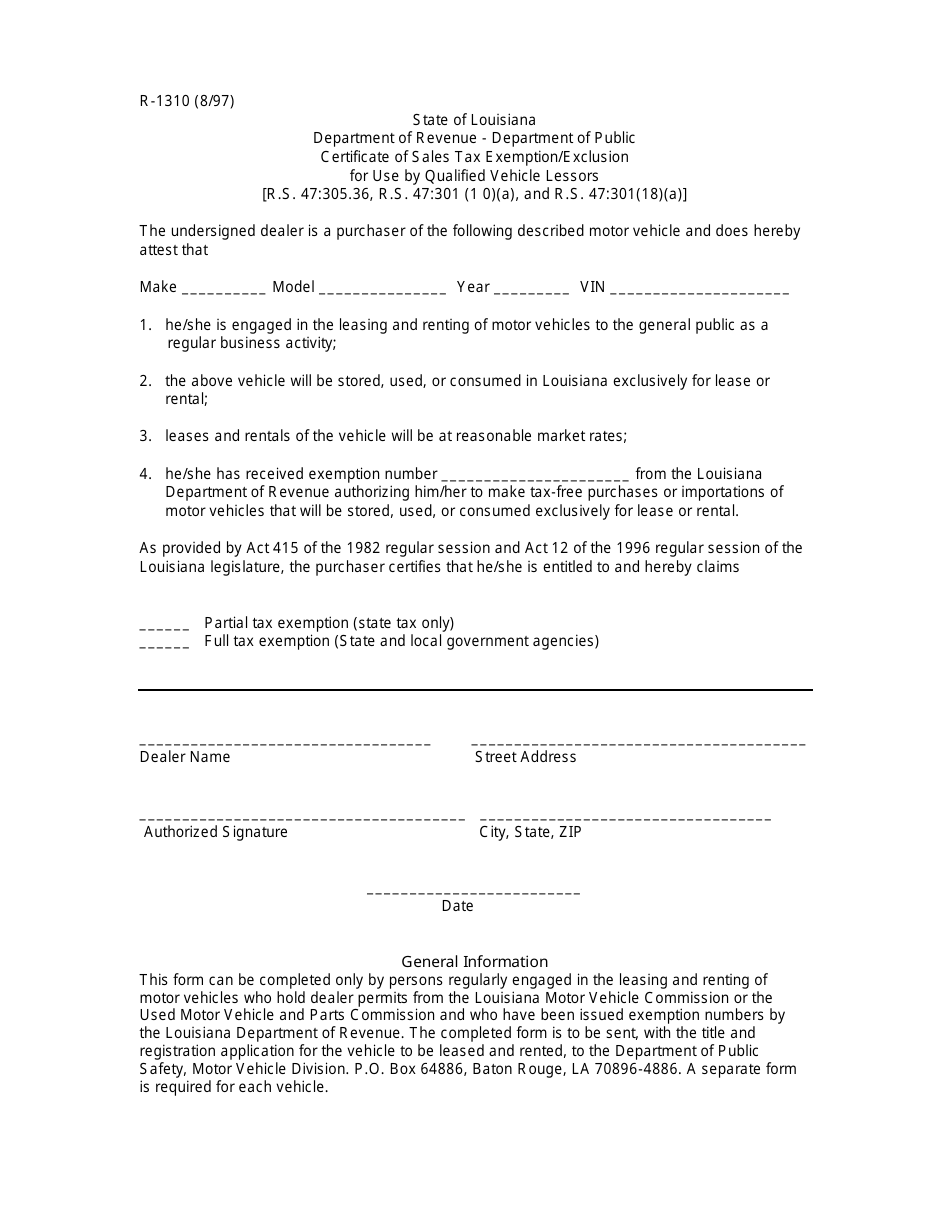

Form R-1310 Download Fillable Pdf Or Fill Online Certificate Of Sales Tax Exemption Exclusion For Use By Qualified Vehicle Lessors Louisiana Templateroller

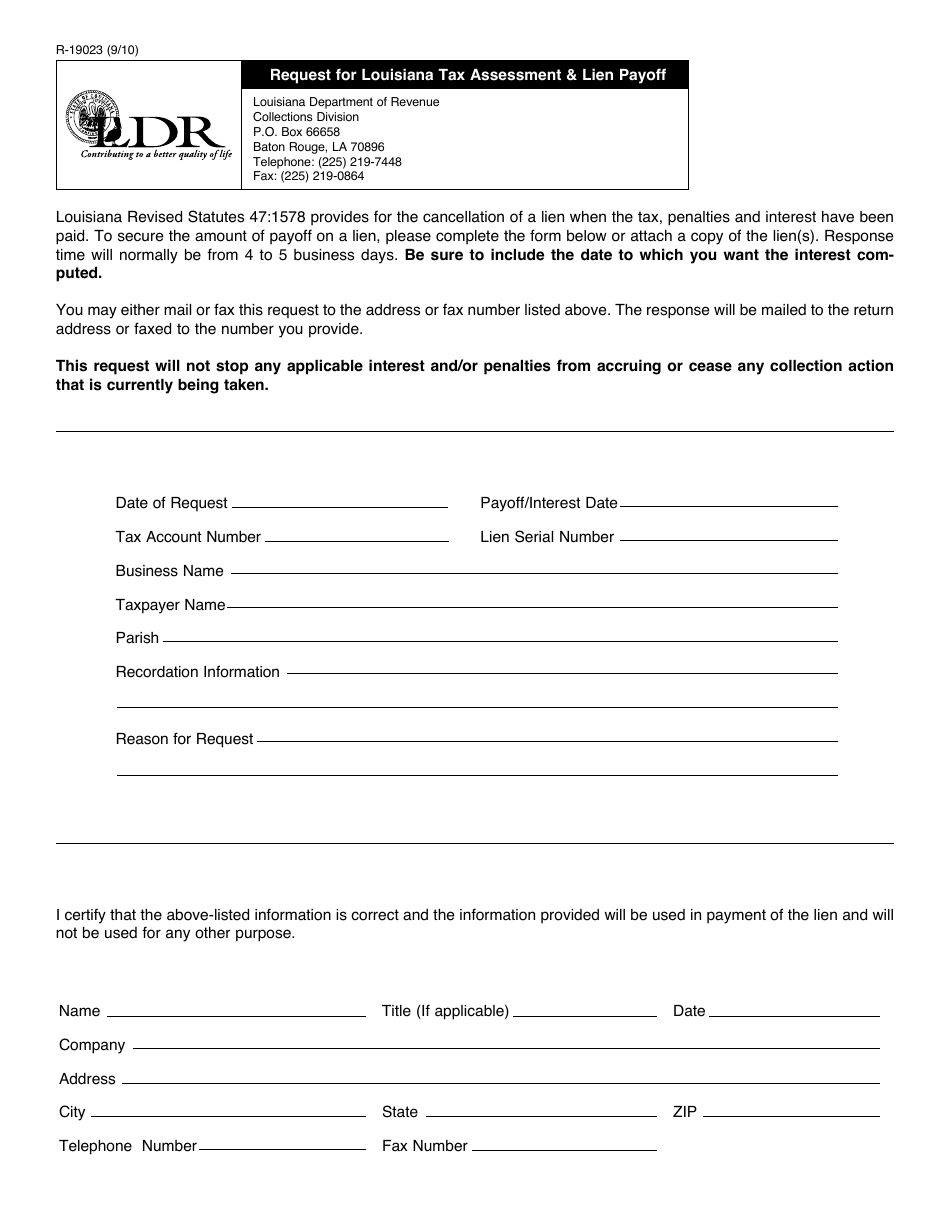

Form R-19023 Download Fillable Pdf Or Fill Online Request For Louisiana Tax Assessment Lien Payoff Louisiana Templateroller

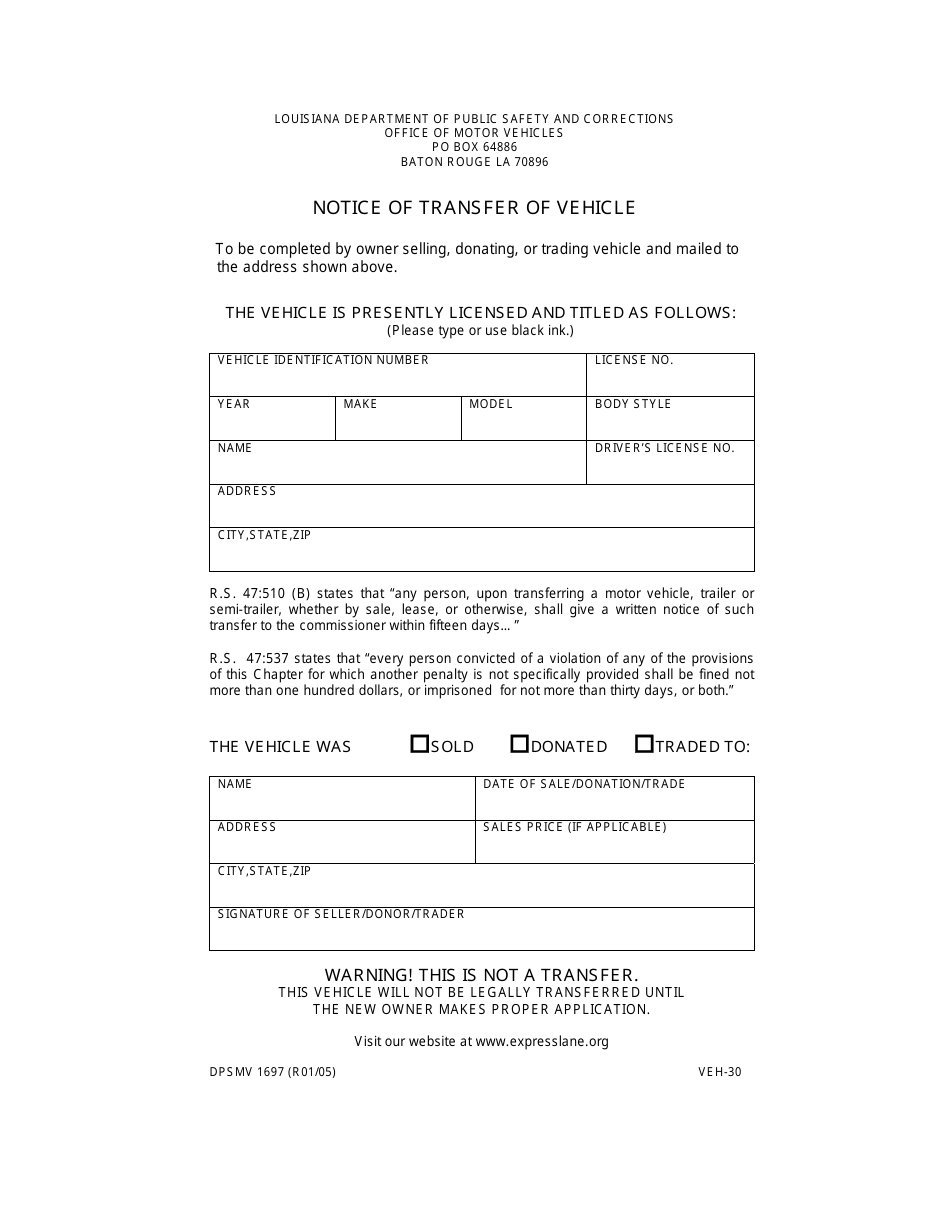

Form Dpsmv1697 Veh-30 Download Printable Pdf Or Fill Online Notice Of Transfer Of Vehicle Louisiana Templateroller