Audits inheritance and estate tax returns; Don’t confuse estate tax with inheritance tax.

2

Sars describes the purpose of estate duty as, ‘… to tax the transfer of wealth (assets) from the deceased estate to the beneficiaries.’ essentially, estate duty, previously known as succession duty, is a form of capital transfer tax.

Louisiana inheritance and estate transfer tax return. While the estate is responsible for paying estate taxes, beneficiaries must pay inheritance tax. Federal and state income taxes. At one point, all states had an estate tax.

An estate transfer tax return shall be prepared and filed by or on behalf of the heirs and/or legatees in every case where estate transfer tax is due or where the value of the deceased's net estate amounts to the sum of sixty thousand dollars or more. Currently, the law imposes a graduated transfer inheritance tax ranging from 11% to 16% on the transfer of real and personal property with a value of $500.00 or more to certain beneficiaries. Who must file an estate transfer tax return?

Do you have to pay taxes on inheritance in louisiana. In fact, you may have to file all of the following: Revised statute 47:2436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case when an estate transfer tax is due or when the value of the deceased's net estate is $60,000.00 or more.

Like the federal estate tax laws, louisiana’s inheritance tax laws have undergone a lot of changes in the past several years. Estate/succession of decedent died testate intestate An executor or a preparer may request.

This process is called probate in other states. Estate duty is regulated according to the estate duty act (act 45 of 1955). Many states repealed their estate taxes as a result.

Louisiana inheritance and gift tax. Louisiana department of revenue taxpayer services division p. The application shall be approved by the commissioner or his duly authorized representative.

Does louisiana impose an inheritance tax? Provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax statutes, regulations, policies, and procedures. You might inherit $100,000, but you would pay an inheritance tax on just $50,000 if the state only imposes the tax on inheritances over $50,000.

To protect against the possibility of others accessing your confidential information, do not complete these forms on a public workstation. Who is required to file an estate transfer tax return? Conducts protests, appeals, and administrative reviews;

Attributable to louisiana is allowed. Dates of death on or after january 1, 2012 are considered as estate transfer tax. Revised statute 47:2436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the deceased's net estate is $60,000.00 or more.

While the estate is responsible for paying estate taxes, beneficiaries must pay inheritance tax. Inheritance tax laws from other states could. But that changed in 2001 when federal tax law amendments eliminated the credit.

The transfer inheritance tax recognizes five beneficiary The application for extension of time to file the estate tax return must be filed with the revenue district officer (rdo) where the estate is required to secure its taxpayer identification number (tin) and file the tax returns of the estate. When a compromise tax is reported on the return, a rider should be attached setting forth the computations and basis for the amount of compromise tax reported.

Some states levy an inheritance tax on money or assets after they are passed on to a person’s heirs. A compromise tax on the contingent portion of an estate may be computed by the estate representative and reported on the inheritance tax return. Louisiana does not have an inheritance tax.

How an estate tax works. A succession is the process of settling a deceased person’s estate and distributing the property to those who inherit after the debts are paid. Extension of time to file a wa state estate and transfer tax return paper application.

The term “succession” may also Original return amended return partial return date of originalaaa / / real estate (louisiana property only) stocks and bonds mortgages, notes, and cash insurance other miscellaneous property The good news is that, while some other states still tax inheritances, louisiana abolished its state inheritance tax in 2004.

You might inherit $100,000, but you would pay an inheritance tax on just $50,000 if the state only imposes the tax on inheritances over $50,000. The louisiana inheritance tax is imposed on the heirs or legatees of a. This is the process which transfers ownership of the property from the deceased person to those who inherit.

Just because louisiana doesn’t have an estate tax or inheritance tax doesn’t mean you’re in the clear as far as the irs is concerned. Develops tax forms, instructional materials, notices and publications; Estate transfer tax is imposed when assets are transferred from the estate to heirs and beneficiaries.

Does louisiana have an inheritance tax or estate tax? Louisiana has completely eliminated taxes on any inheritance, but for estates that are large enough to require a federal estate tax return, there is a louisiana estate transfer tax.

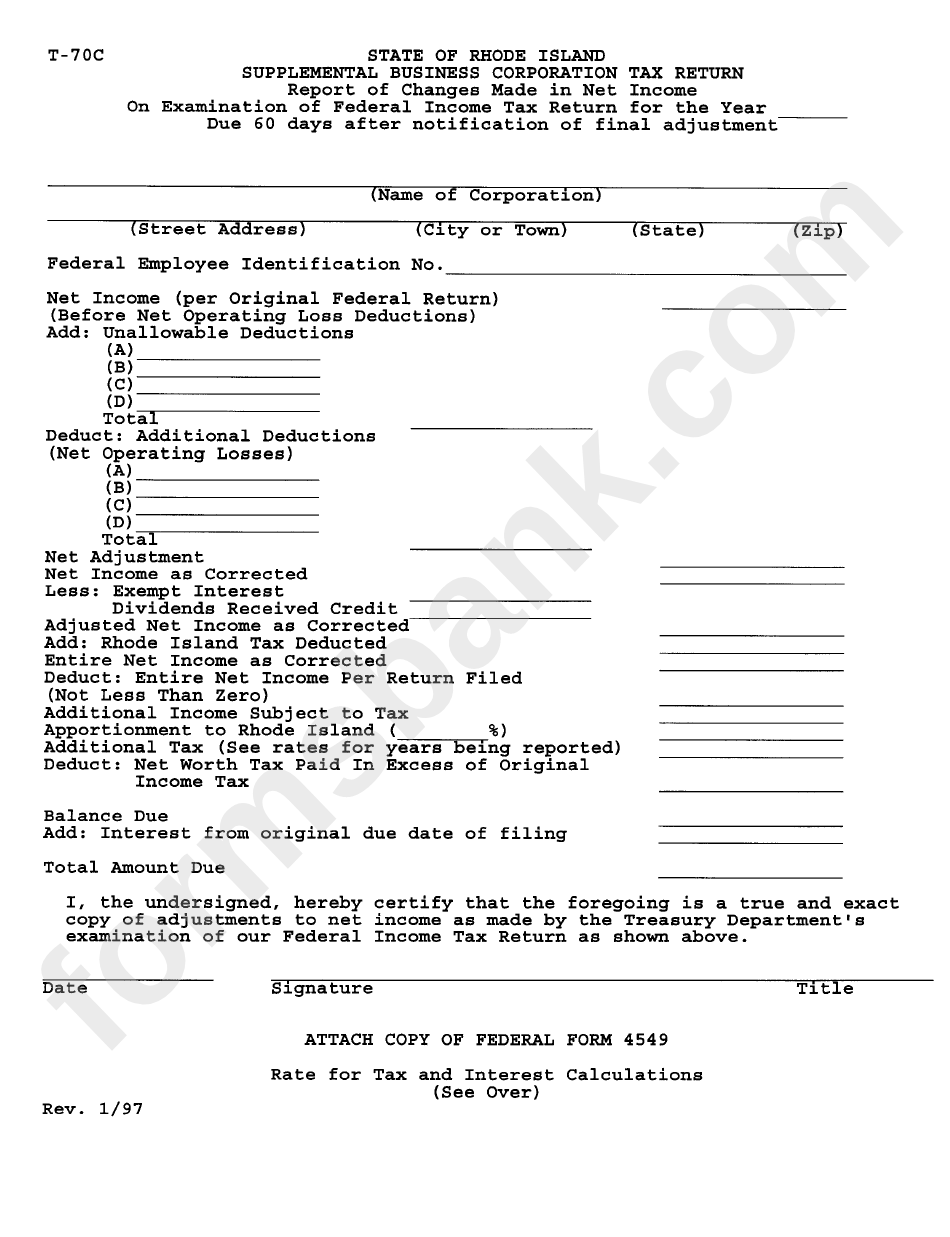

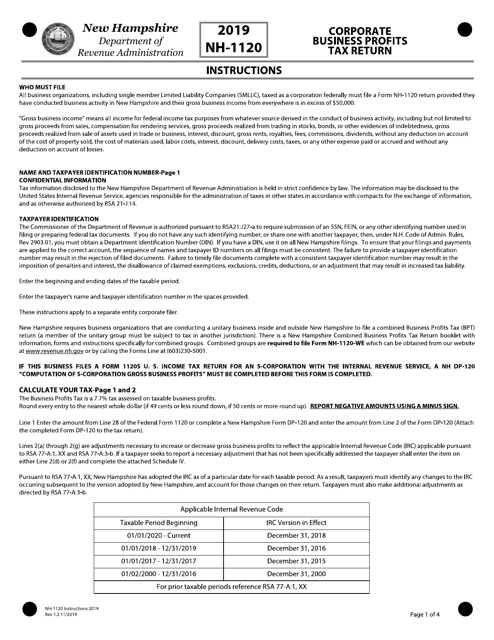

S Corp Tax Return Due Date

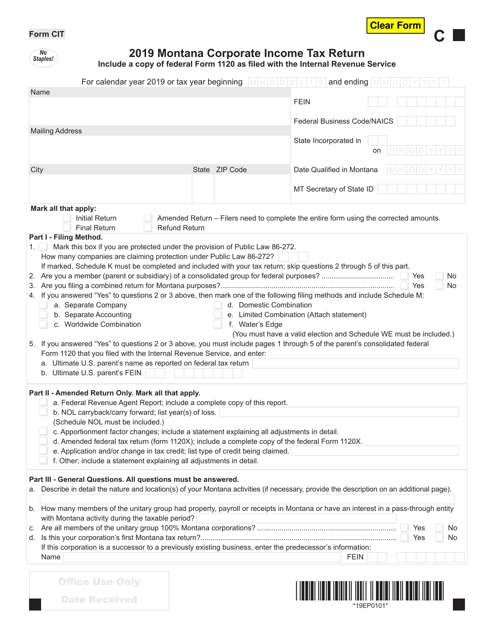

Transaction Privilege And Use Tax Return – Formsend

S Corp Tax Return Due Date

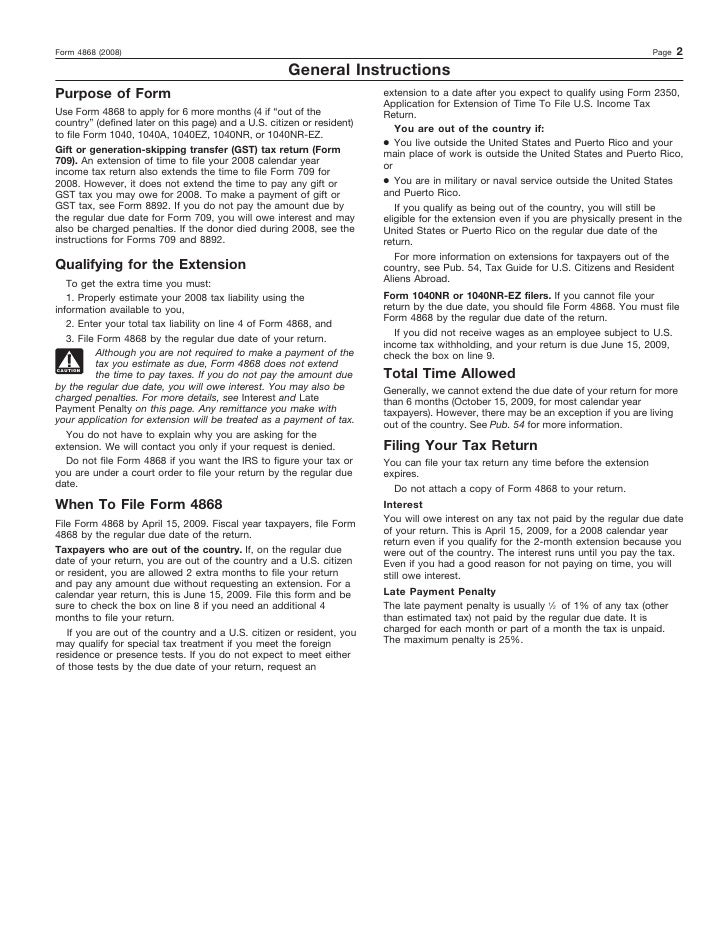

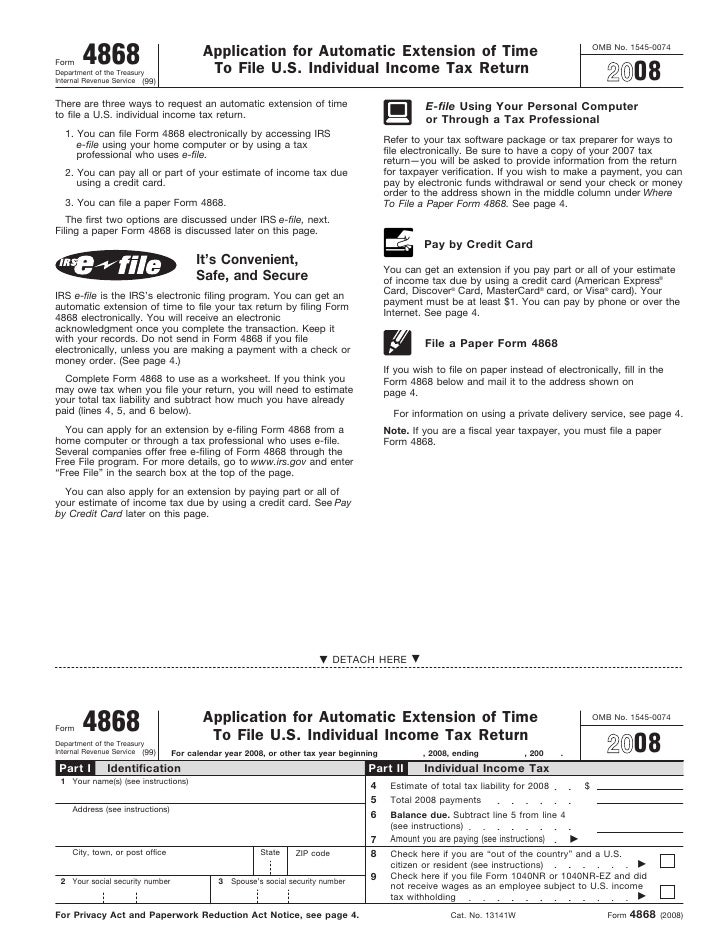

Automatic Extension Of Time To File Us Individual Income Tax Return

25soirepar Pdf Pdf Tax Deduction Income Tax In The United States

Automatic Extension Of Time To File Us Individual Income Tax Return

Means By Federal Estate Tax Return Filing Status Download Table

Irs Pub 523

S Corp Tax Return Due Date

Louisiana Petition For Possession And Affidavit Of Valuation And Detailed Descriptive List – Petition For Possession Louisiana Us Legal Forms

S Corp Tax Return Due Date

Form It-201 – Formsend

S Corp Tax Return Due Date

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040i1040tt By Legibus Inc – Issuu

Means By Federal Estate Tax Return Filing Status Download Table

S Corp Tax Return Due Date

25soirepar Pdf Pdf Tax Deduction Income Tax In The United States

Louisiana Succession Taxes Scott Vicknair Law

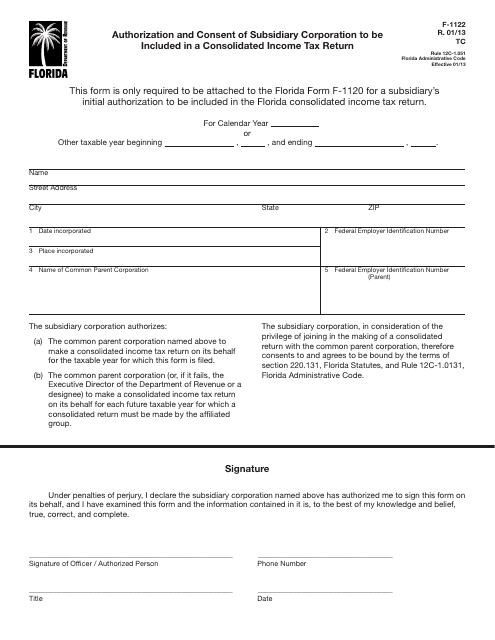

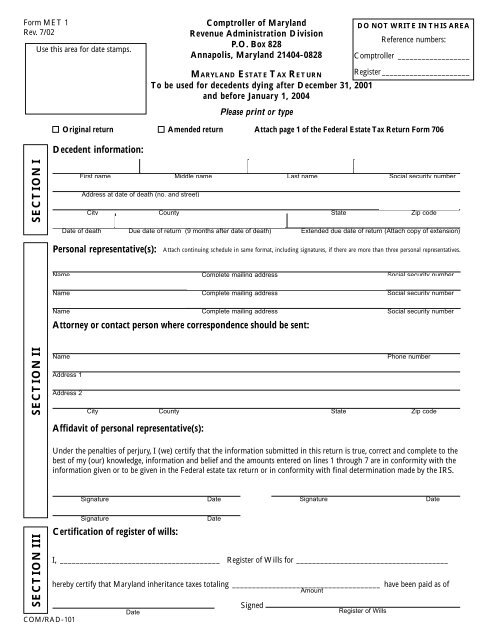

Maryland Maryland Estate Tax Return – The Comptroller Of Maryland