It’s no secret that long island property taxes are high. This is the total of state and county sales tax rates.

Car Tax By State Usa Manual Car Sales Tax Calculator

I know the tax rate varies alot on long island but does anyone know the current percentage for a middle income town in nassau county?

Long island tax rate. The current total local sales tax rate in long island, ks is 7.000%.the december 2020 total local sales tax rate was also 7.000%. The 2018 united states supreme court decision in south dakota v. Hanson’s suffolk community has the distinction of paying the highest fire district taxes on long island.

Check out some of the states with low property tax rates: The december 2020 total local sales tax rate was also 8.875%. These figures are for the 2021 tax year.

Long island nassau glen cove 2022 budget: However, a newsday study found the rate of error is now well within the industry standard of between 5% and 15%. The suffolk county sales tax rate is %.

The average effective tax rate is approximately 2.11%, which means taxes on that same home are likely closer to $6,330 annually. Combined with the state sales tax, the highest sales tax rate in new york is 8.875% in the cities of brooklyn , new york , bronx , staten island and flushing (and 42 other cities). The minimum combined 2021 sales tax rate for long island city, new york is.

Click to read tax experts share answers and advice for. Has impacted many state nexus laws and sales tax. Why is it that long island has some of the highest property tax rates in one of the highest states for property taxes in the usa?

The 11101, long island city, new york, general sales tax rate is 8.875%. Among the many different counties of new york, suffolk and nassau counties on long island have some of the highest property tax rates (both over 2%). Click here for a larger sales tax map , or here for a sales tax table.

157 rows average real estate tax $10,100.90 returns with salt deductions 4,010 total. The long island city, new york sales tax rate of 8.875% applies to the following three zip codes: In fact, new york city suburbs pay the highest taxes in the nation.

There are approximately 21,036 people living in the long island city area. 21,145 posts, read 31,808,976 times. Find your tax rate below.

Carved out of coram, middle island, yaphank and medford, gordon heights has four zip codes for its 1.7 square miles but one fire district with an average household tax charge of $1,500, quadruple the amount of nearby areas. The new york sales tax rate is currently %. Long island city city rate (s) 8.875% is the smallest possible tax rate ( 11101, long island city, new york) the average combined rate of every zip code in long island city, new york is 8.875%.

It still has one of the lowest rates and is a nice place to live that is close to nyc with great transportation. There are a total of 987 local tax jurisdictions across the state, collecting an average local tax of 4.23%. The combined rate used in this calculator (8.875%) is the result of the new york state rate (4%), the long island city tax rate (4.5%), and in some case, special rate (0.375%).

The long island city sales tax rate is. Freedom land title agency is an authorized title agent providing title insurance and related services to the real estate and banking community throughout the united states. The minimum combined 2021 sales tax rate for suffolk county, new york is.

Long island, ks sales tax rate. Under the beautiful carolina blue. While the average effective property tax rate in manhattan is just 0.88%, and the statewide average rate is 1.69%, nassau county and suffolk county average over.

This is the total of state, county and city sales tax rates. In case none of the ways to help you pay property taxes work out, you should look at real estate in other states. It was known for one of the lowest property tax rates courtesy of long island lighting company plant (lilco) that has recently been demolished.

The new york state sales tax rate is currently %. Long island is on the expensive side, but various other options are available. The county sales tax rate is %.

What is the sales tax rate in long island city, new york? However, effective tax rates in the county are actually somewhat lower than that. The current total local sales tax rate in long island city, ny is 8.875%.

Our clients can always contact us at our roslyn long island office for help with any questions about the best filing status and tax rates. No change to property tax rate in $64.7m fiscal plan the glen cove city council approved it's $64.7 million 2022 budget at its meeting last week. In 2018, the average millage rate in the county was 26.4 mills, which would mean annual taxes of $7,920 on a $300,000 home.

Car Tax By State Usa Manual Car Sales Tax Calculator

Nyc Buyer Closing Cost Calculator Interactive Hauseit

New York Property Tax Calculator 2020 – Empire Center For Public Policy

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Calculate Capital Gains Tax Hr Block

Betterment On Twitter Investing Capital Gain Dividend

Nycs High-income Tax Habit – Empire Center For Public Policy

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

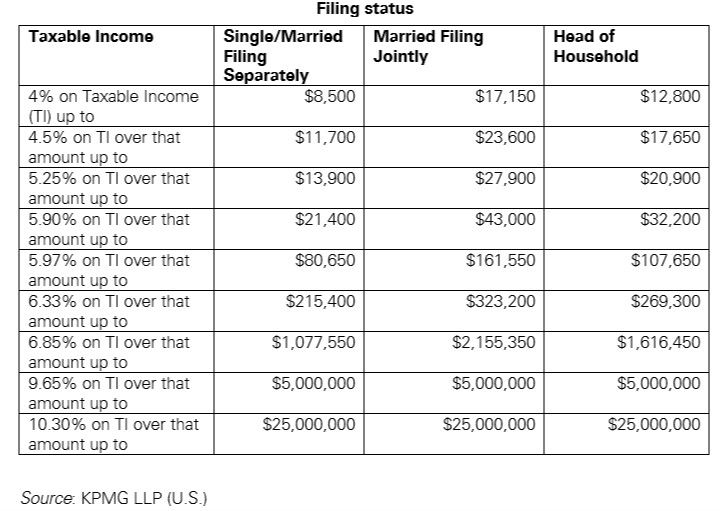

Us New York Implements New Tax Rates – Kpmg Global

What Is The Llc Tax Rate In New York Gouchev Law

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

County Surcharge On General Excise And Use Tax Department Of Taxation

2

New York Property Tax Calculator – Smartasset

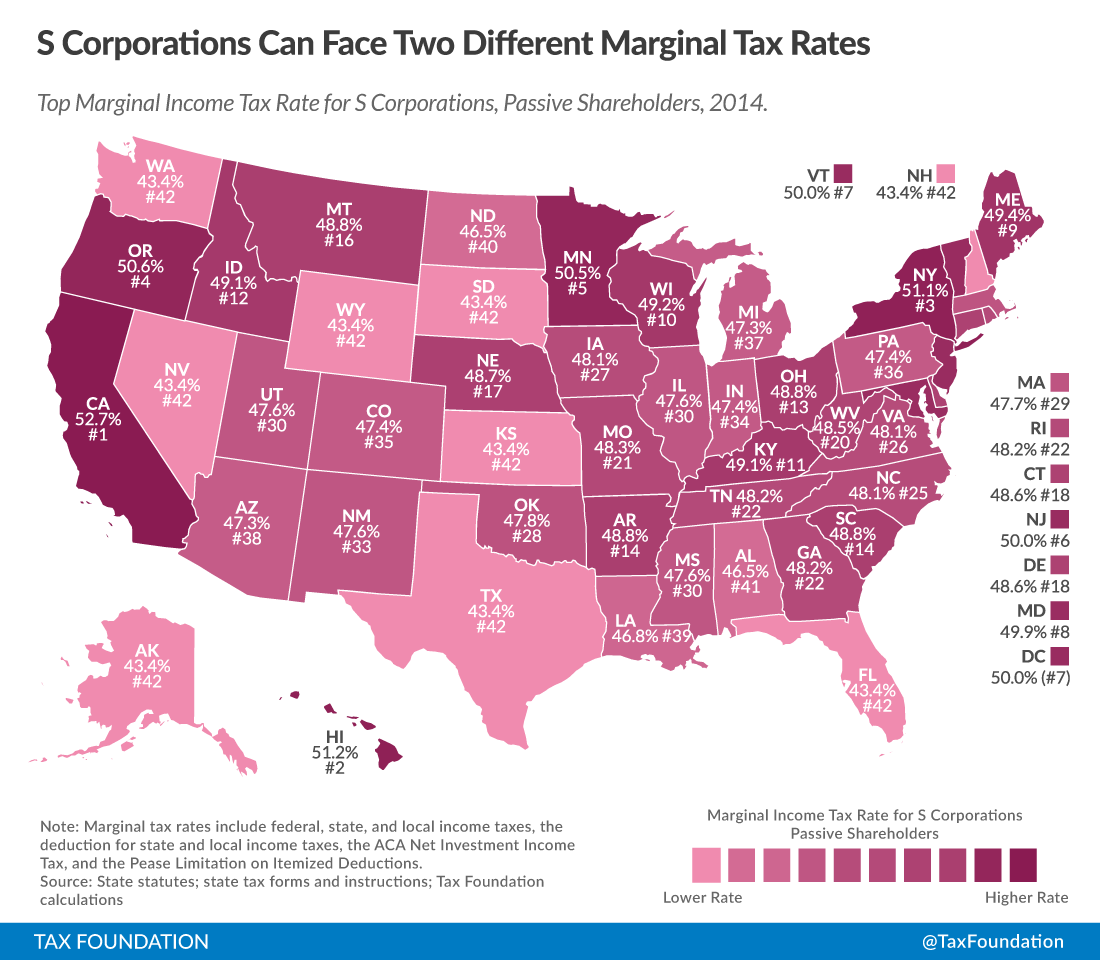

The Dual Tax Burden Of S Corporations Tax Foundation

What To Know Before Moving To Long Island

Florida Property Tax Hr Block

New York Property Tax Calculator – Smartasset