The latin america tax practice group invites you to attend session two of the international vat conference focusing on the latin america region that address the critical indirect tax issues businesses should analyze in a global economic downturn. Kpmg's latin america tax center links multinationals to a network of tax professionals and resources in order to provide a wealth of local and regional experience to you and your business.

Latin America Rsm Latin America

394 smith st, perth amboy nj 08861.

Latin america tax services. The biggest obstacle to improving tax collection will be weak fiscal oversight. The latam tax center is a network of tax professionals providing regional experience. Our online mobilizing resources in latin america:

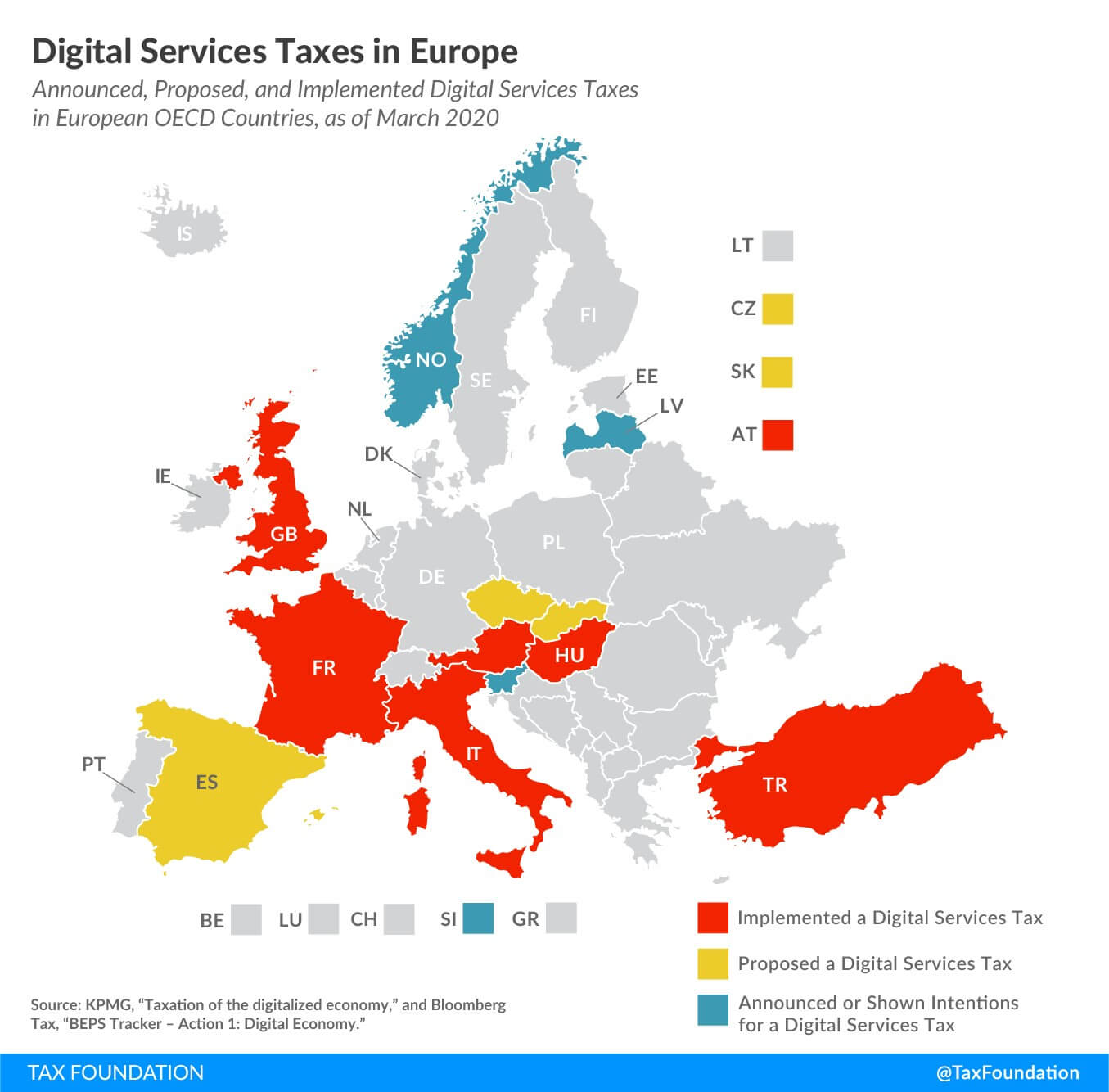

The law allowing this was published on july of 2018 and its application initiated in january of 2019. Please find below more details about those sessions and learn more about the rest of the series. The graphic below provides an overview of the status of the subject at the time of this article.

Please find below more details about those sessions and learn more about the rest of the series. Our global tax group also assists clients in structuring a wide range of. Mexico and latin america tax:

Broad range of fully integrated tax services for effective tax planning; The political economy of tax reform in chile and argentina|o essay writing service delivers master’s level writing by experts who have earned graduate degrees in your subject matter. The information a guide to help organizations align tax agendas with business agendas when enhancing sscs.

When you refer clients to our office!!!!! If you're based in latin america, get the software, services, and information you need to make your tax team more efficient. Colombia is one of the leading countries in terms of digital tax developments in latin america by establishing that providers of digital services must pay 19% vat over the digital services provided.

This was the second presentation in the international vat conference. Since 2011, tax morale has weakened: We represent latin american clients that have raised more than $3 billion in venture capital financing.

Mexico and latin america income tax and vat. Research local tax and trade laws or ifrs and accounting norms with tools from checkpoint. If you're in argentina, trust our powerful sistemas.

The latin america tax practice group invites you to attend session two of the international vat conference focusing on the latin america region that address the critical indirect tax issues businesses should analyze in a global economic downturn. The latest estimates by the economic commission for latin america and the caribbean (eclac) indicate that lac lost 6.3% of regional gdp in tax evasion and avoidance in 2017, and 1.5% of gdp in illicit financial flows as a result of trade misinvoicing in 2016. Alonso & garcia is a miami international tax cpa firm offering international tax planning and compliance services for latin american companies doing business in the u.s.

Ernst & young llp (united states), latin america business center, san diego • ernesto ocampo ( ernesto.ocampo@ey.com ) the information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting or tax advice or opinion provided by. In these matters, we work closely with our colleagues across the pwc network and with other professional services providers. Kpmg's latin america tax center links multinationals to a network of tax professionals to provide a wealth of local and regional experience.

Technology, ecommerce, and software as a service (saas) financial services and financial technology (fintech) health care; The replacement of cascading sales taxes by vat was one of the most significant tax reforms in latin america in the 1980s and early 1990s. Global transfer pricing services to meet u.s., mexico and other jurisdictional requirements;

Our tax professionals provide a wide array of services, including: The latin america tax guide 2019/20 provides an overview of the taxation and business regulation regime of latin america’s most significant trading countries. In compiling this publication, member firms of the pkf network have based their summaries on information current on 30 june 2019, while also noting imminent changes where necessary.

Baker mckenzie's vat/indirect tax practice presented 'digital services in latin america,' on 12 august 2020. Tax and accounting solutions for central and south america. Our professionals work with organizations across more than 30 industries, with many of our latin america practice clients operating in the following fields:

Digital tax in colombia with the dian. The center supports clients in the region by: The percentage of latin americans who would never justify evading paying taxes decreased from 54% to 48% in 20156.

Free tax preparation & or $50 cash. With more than 380 tax lawyers and economists in offices throughout europe, asia and the americas, dla piper’s global tax advisory services help tax departments of multinational companies address the complex challenges of international commerce and business operations. Figure 1.6 below shows the evolution of tax morale in latin america.

Baker mckenzie’s vat/indirect tax practice presented ‘ digital services in latin america ,’ on 12 august 2020. Compliance (corporate and personal) tax planning; Latin america’s pioneer in tax regulation of digital services.

Biz Latin Hub Accredited By Better Business Bureau

Detailed Guidelines For Improved Tax Administration In Latin America And The Caribbean Us Agency For International Development

Alianza Del Pacifico Y Mercosur Representan Mas De 80 Del Comercio Exterior Regional Economy Infographic Infographic Business Infographic

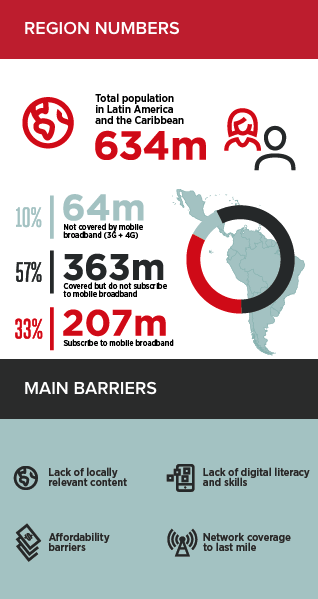

Gsma Digital Inclusion In Latin America – Gsma Latin America

Gsma Digital Inclusion In Latin America – Gsma Latin America

Gsma Digital Inclusion In Latin America – Gsma Latin America

Digital Services Tax Dst Inter-american Center Of Tax Administrations

Latin America Rsm Latin America

Pandora Papers Prompt Calls For Tax Code Reform In Latin America

2

2

Latamready 1 Latin America Erp Tax Experts Netsuite Partner Linkedin

Latin America Rsm Latin America

Moss Adams Latin America Practice

Service Company Formation And Establishment Services Biz Latin Hub

Pandora Papers Pandora Papers In Latin America Three Active Heads Of State And 11 Former Presidents Operated In Tax Havens Usa El Pais English Edition

Latin America Rsm Latin America

Latin America And The Caribbean Will Grow 59 In 2021 Reflecting A Statistical Carry-over Effect That Will Moderate To 29 In 2022 Press Release Economic Commission For Latin America And The Caribbean

Digital Services Tax Dst Inter-american Center Of Tax Administrations