Click here for a brief explanation. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property.

How To File Probate In Kern County A Peoples Choice

There are 3 assessor offices in kern county, california, serving a population of 878,744 people in an area of 8,130 square miles.there is 1 assessor office per 292,914 people, and 1 assessor office per 2,709 square miles.

Kern county property tax assessor. Claim for exemption from property taxes of aircraft of historical significance. The median property tax in kern county, california is $1,746 per year for a home worth the median value of $217,100. The assessor does not guarantee the accuracy of use codes, and is not liable for erroneous or incomplete data.

This section provides that the taxpayer need not attend the scheduled equalization hearing and testify to the property's value, if you and the assessor agree to the value and sign. Check for foreclosure notices and tax liens. Press enter or click to play code.

Purchase price (to the nearest whole dollar): The assessor’s office said major properties […] Search for recorded documents or maps.

Kern county collects, on average, 0.8% of a property's assessed fair market value as property tax. A notice of supplemental assessment relates to a new assessment resulting from a change in ownership or new construction. File an exemption or exclusion.

Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. Please type the text from the image. Not sure what supplemental taxes are?

Our mission is to collect, manage and safeguard public funds to provide community services to the constituents of kern county and we strive to do this in the most efficient and effective manner possible. Kern county property records are real estate documents that contain information related to real property in kern county, california. Property taxes for the second installment of.

The kern county tax assessor is the local official who is responsible for assessing the taxable value of all properties within kern county, and may establish the amount of tax due on that property based on the fair market value appraisal. The kern county assessor's office, located in bakersfield, california, determines the value of all taxable property in kern county, ca. Kern county has one of the highest median property taxes in the united states, and is ranked 606th of the 3143 counties in order of median property taxes.

In california, kern county is ranked 40th of 58 counties in assessor offices per capita, and 44th of 58 counties in assessor offices per square mile. Kern county assessor's office services. A written stipulation may be made and filed with the application to the kern county assessment appeals board in accordance with the revenue and taxation code § 1607.

In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property. Kern county assessor's office services. Purchase a birth, death, or marriage certificate.

The county of kern assumes no responsibility arising from the use of this information. The kern county assessor’s office is not required to supply use codes to any other agency, and takes no responsibility for their use by individuals or organizations outside of the assessor's office. How to use the assessor's parcel map search.

Maps are in the tiff image format. Our online access to kern county public records data is the most convenient way to look up tax assessor data, property characteristics, deeds, permits, fictitious business names and more. No cd's to load, no concerns about dated information.

Get information on supplemental assessments. It is an honor and a privilege to have the opportunity to serve the taxpayers of kern county. Full cash value may be interpreted as market value.

If you are not redirected click here.click here. The assessor in the county where the property is. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a.

Connect from the office, home, road or. The total assessed value of all taxable property in the county as of january 1, 2020 is valued $102.2 billion, a $2.8 billion increase over the prior year, said the assessor’s office. Use our online tool to check for foreclosure notices and tax liens on a property.

The kern county assessor, located in ridgecrest, california, determines the value of all taxable property in kern county, ca. In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property. You can enter the apn with or without dashes.

If you enter a valid apn and the map is not found, email the webmaster. Find property assessment data & maps.

Election Notebook Johnson Lays Out Goals If Elected Assessor News Bakersfieldcom

Kern County Property Taxes Due Next Week Kget 17

Tax Breaks Allow Kerns Solar Industry To Pay Far Less Property Tax Than Oil Ag And Wind Kbak

Dfbp15ptsc2-mm

Federal Spending Bill Includes 70 Million For Kern Projects News Bakersfieldcom

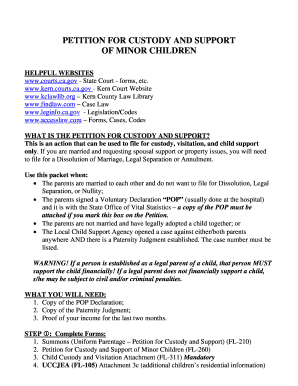

Kern County Superior Court Ca Gov Odyprod – Fill Out And Sign Printable Pdf Template Signnow

Kern County Ca Restaurants And Food Businesses For Sale – Bizbuysell

Kern County California Va Loans Info

Watch Around Kern County – Episode 6 County News Kern County Ca

Kern County Coroners Office – Fill Online Printable Fillable Blank Pdffiller

Pregnant Migrant Woman Living In California Squatter Camp Kern County November 1936 Photograph By Dorothea Lange Stock Photo – Alamy

Kern County Clerk

Kern County Says Most Offices Closed Over Holiday Lists Services That Will Be Available Kbak

California Public Records Public Records California Public

Pensions In Peril Proposed Solutions Abound But Will They Work Here News Bakersfieldcom

![]()

Health Safety Archives – Page 3 Of 13 – Fractracker Alliance

Kern County Says Most Offices Closed Over Holiday Lists Services That Will Be Available Kbak

Gavin Newsom Recall How Many Ballots Have Been Returned In Your County – Abc7 San Francisco

San Fran Looks To Wean Itself Off Kern County Oil Revenues News Bakersfieldcom