The kansas city, missouri sales tax is 4.23%, the same as the missouri state sales tax. There is no special rate for kansas city.

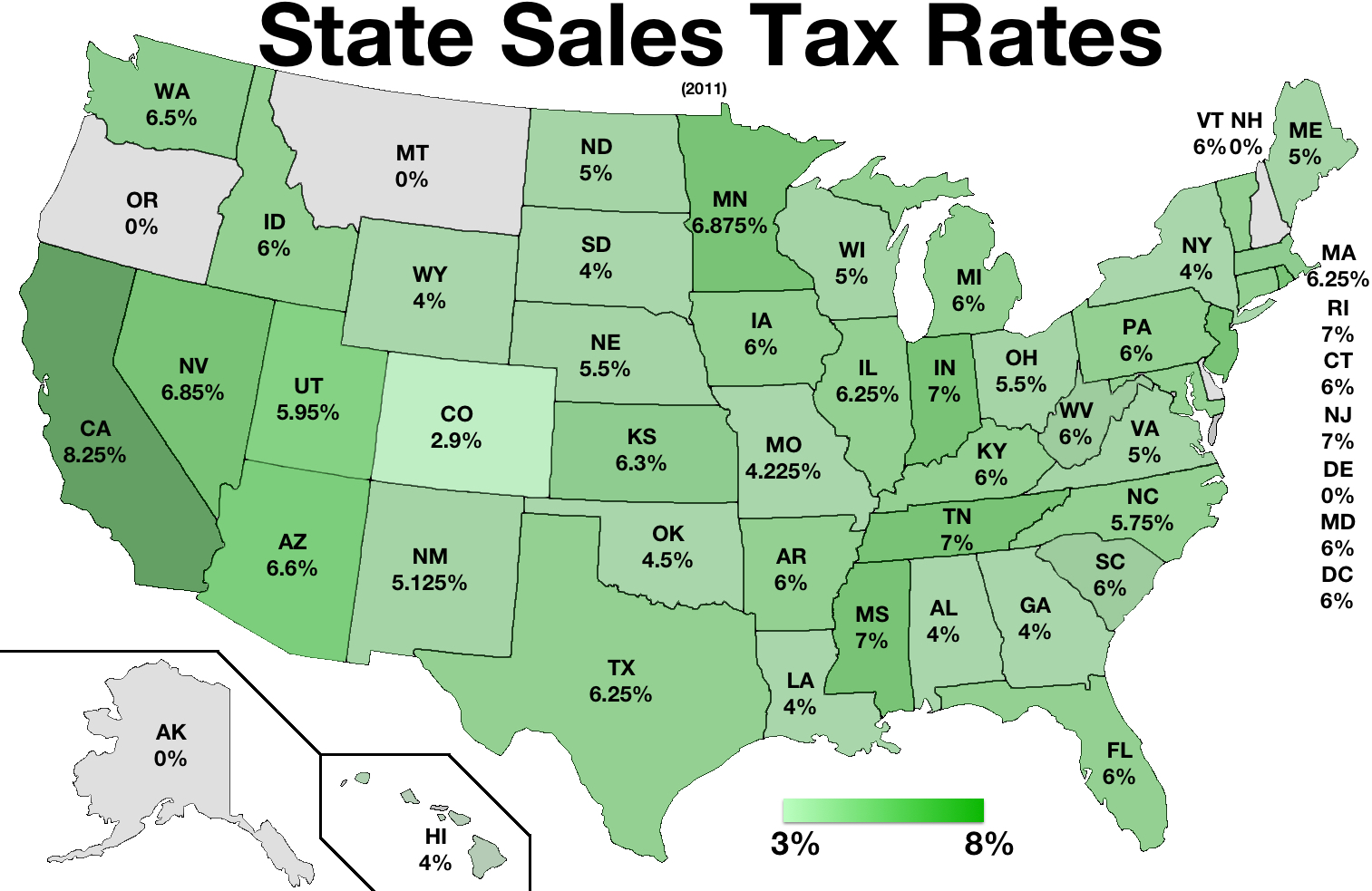

States With Highest And Lowest Sales Tax Rates

Home » motor vehicle » sales tax calculator.

Kansas city vehicle sales tax calculator. 7.75% for vehicle over $50,000. Subtract these values, if any, from the sale. How 2021 sales taxes are calculated in kansas city.

Other 2021 sales tax fact for kansas city there is 67 out of 81 zip codes in kansas city that are being charged city sales tax. 6.35% for vehicle $50k or less. The purchase of a vehicle is also subject to the same potential local taxes mentioned above.

In addition to taxes, car purchases in missouri may be subject to other fees like registration, title, and plate fees. Kansas has a 6.5% statewide sales tax rate , but also has 376 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.555% on top. 24 cents per gallon of regular gasoline, 26 cents per gallon of diesel.

Last sales taxes rates update. Kansas collects a 7.3% to 8.775% state sales tax rate on the purchase of all vehicles. There is also 249 out of 803 zip codes in kansas that are being charged city sales tax for a ratio of 31.009%.

You can find these fees further down on the page. Every 2021 combined rates mentioned above are the results of missouri state rate (4.225%), the county rate (0% to 3.125%), the missouri cities rate (0% to 5.454%. For additional information click on the links below:

For lookup by zip code only, click here. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. The kansas sales tax rate is currently %.

There may be additional sales tax based on the city of purchase or residence. Missouri collects a 4.225% state sales tax rate on the purchase of all vehicles. Sales tax calculator | sales tax table the state sales tax rate in kansas is 6.500%.

2020 rates included for use while preparing your income tax deduction. The minimum combined 2021 sales tax rate for kansas city, kansas is. Other 2021 sales tax fact for kansas as of 2021, there is 165 out of 659 cities in kansas that charge city sales tax for a ratio of 25.038%.

Missouri has a 4.225% statewide sales tax rate , but also has 456 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 2.809% on. New car sales tax or used car sales tax. Kansas (ks) sales tax rates by city.

While missouri law allows municipalities to collect a local option sales tax of up to 0.895%, kansas city does not currently collect a local sales tax. The kansas city sales tax is collected by the merchant on all qualifying sales made within kansas city 9.85% is the highest possible tax rate (64105, kansas city, missouri) the average combined rate of every zip code in kansas city, missouri is 8.132%.

The last rates update has been made on july 2021. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. If purchased from a kansas dealer with the intention to register the vehicle in kansas, the sales tax rate charged is the combined state and local (city, county, and.

Wichita, ks 67213 email sedgwick county tag office; The purchase of a vehicle is also subject to the same potential local taxes mentioned above. The state sales tax for a vehicle purchase in missouri is 4.225 percent.

Use this online tool from the kansas department of revenue to help calculate the amount of property tax you will owe on your vehicle. The maximum tax that can be charged is 725 dollars on the purchase of all vehicles. The kansas city, kansas, general sales tax rate is 6.5%.the sales tax rate is always 9.125% every 2021 combined rates mentioned above are the results of kansas state rate (6.5%), the county rate (1%), the kansas cities rate (1.625%).

The rate in sedgwick county is 7.5 percent. The county sales tax rate is %. This is the total of state, county and city sales tax rates.

Other 2021 sales tax fact for kansas as of 2021, there is 165 out of 659 cities in kansas that charge city sales tax for a ratio of 25.038%. Sales tax rate by address. The kansas city sales tax rate is %.

101 rows how 2021 sales taxes are calculated for zip code 64118. There is also a local tax of up to 4.5%. The state general sales tax rate of missouri is 4.225%.

There are also local taxes up to 1%, which will vary depending on region. For the sales tax use our sales tax rate lookup. Rates include state, county and city taxes.

A $5.00 fee will be applied to each transaction handled at any of the tag offices. Cities and/or municipalities of missouri are allowed to collect their own rate that can get up to 5.454% in city sales tax. In addition to taxes, car purchases in kansas may be subject to other fees like registration, title, and plate fees.

After years of keeping income taxes to a top rate of 4.6%, kansas raised income tax rates for tax year 2017, a change that has, so far, stuck. Kansas has a 6.5% statewide sales. 4.25% motor vehicle document fee.

The most that can be charged. Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. Motor vehicle titling and registration.

(the sales tax in sedgwick county is. Official website of the kansas department of revenue.

Sales Taxes In The United States – Wikiwand

Which Cities And States Have The Highest Sales Tax Rates – Taxjar

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Tax Rates Gordon County Government

How To Calculate Sales Tax – Video Lesson Transcript Studycom

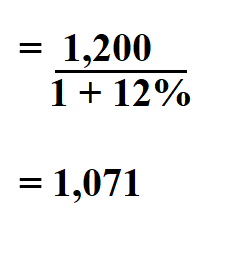

Connecticut Sales Tax Calculator Reverse Sales Dremployee

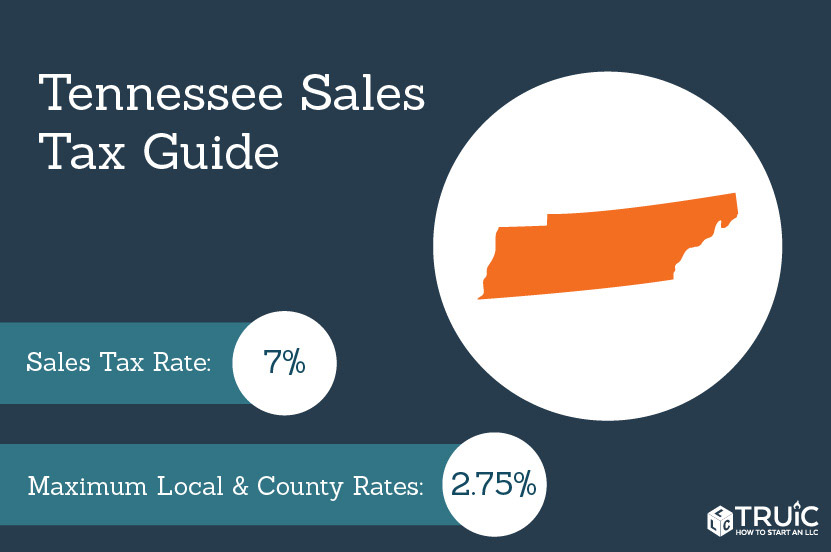

Tennessee Sales Tax – Small Business Guide Truic

Missouri Car Sales Tax Calculator

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator

Monday Map State Sales Tax Rates Tax Foundation

How To Calculate Sales Tax Backwards From Total

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Car Tax By State Usa Manual Car Sales Tax Calculator