The rates for local taxes may vary somewhat depending on the scale of the business and the local government under whose jurisdiction it is. If the tax return is filed late, a late filing penalty is imposed at 15% to 20% of the tax balance due.

Corporate Tax Reform In The Wake Of The Pandemic Itep

A summary of the major items contained in the 2020 tax proposals is set out below.

Japan corporate tax rate 2020. The uae continues to have a 40% corporate tax rate this year. Corporate tax rate in japan averaged 40.83 percent from 1993 until 2021, reaching an all time high of 52.40 percent in 1994 and a record low of 30.62 percent in 2019. Corporate tax rate in japan remained unchanged at 30.62 percent in 2021 from 30.62 percent in 2020.

In 2019, the united arab emirates held onto its running record of being the country with the highest corporate tax rate. The tax rates for corporate tax, corporate inhabitant tax and enterprise tax on income (tax burden on corporate income) and per capita levy on corporate inhabitant tax for each taxable year are shown below. 4.2 total % of gdp 2019 japan % of gdp:

Local corporation tax applies at 4.4% on the corporation tax payable. Labour compensation per hour worked indicator: Steps have been taken, however, to ensure that the tax system does not impose unfair burdens on multinational corporations engaged in economic activities in japan on the basis of the mode of their business presence in japan.

656 2020 20 0 0 0 0 0. 4.2 total % of gdp 2019 japan % of gdp: Under the 2020 tax reform act, the interest rate applied by tax offices on delinquency tax and on refunds paid to taxpayers will be reduced from the current 1.6% per annum to 1.1% per annum.

Japan (red) net annual growth rate (%) 2020: Exempted when paid by a company of japan, holding at least 15% (direct or indirect) or 25% (direct) shares for six months; Standard enterprise tax (and local corporate special tax)

32.0 total % of gdp 2018 japan % of. The country with the lowest corporate tax rate in 2019 is actually a tie between…. Japan (red) tax on corporate profits indicator:

Beginning from 1 october 2019, corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 10.3% of their corporate tax liabilities. Corporation tax is payable at 23.4%. Before 1 october 2019, the national local corporate tax rate is 4.4%.

Combined corporate income tax rate. The average tax rate among the 223 jurisdictions is 22.57 percent.6 the united states has the 85th highest. 5% when holding at least 10% for six months;

5% for holding at least 10% (direct or indirect) shares for six months. Data is also available for: On 12 december 2019, the ruling parties in japan published their 2020 tax reform proposals (“2020 tax proposals”).

Corporate income tax rate exclusive of surtax. Corporate tax rate in japan remained unchanged at 30.62 percent in 2021 from 30.62 percent in 2020. Moreover, the annual amount of up to jpy8 million in income eligible for the reduced tax rates applicable to smes will be distributed

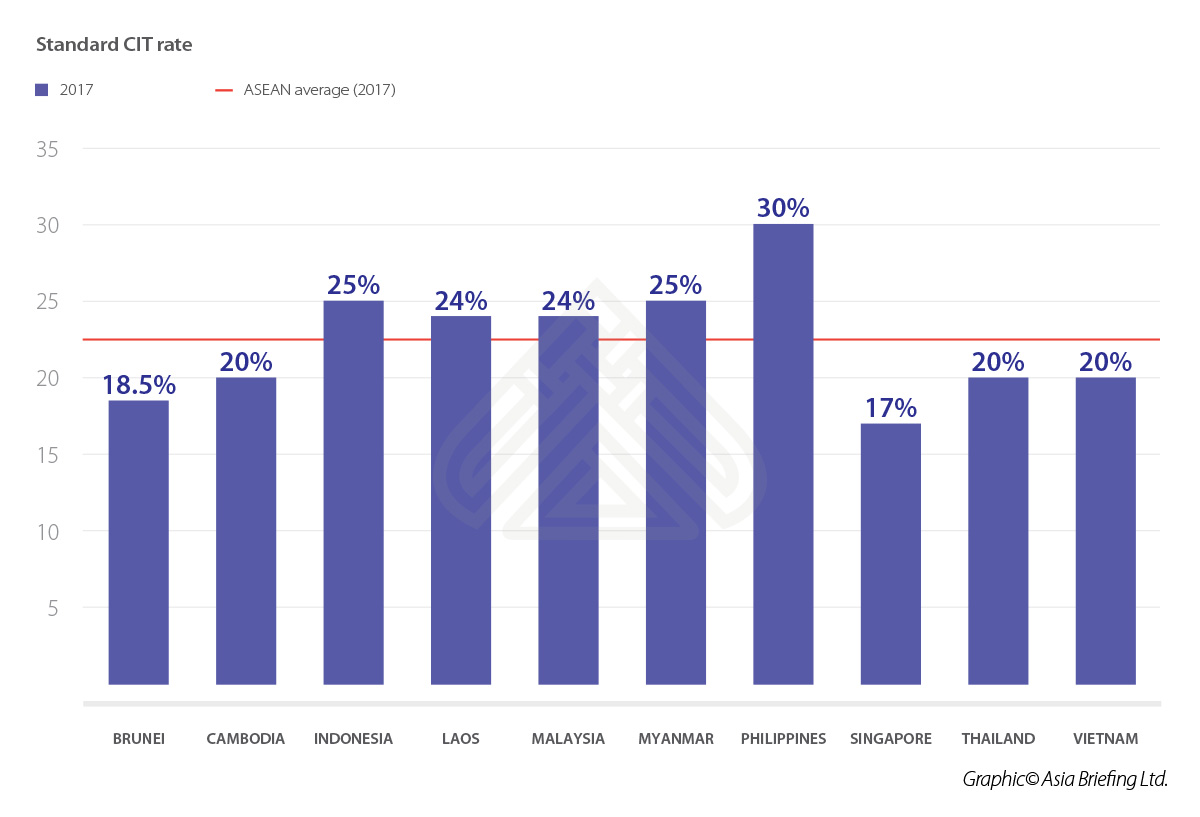

Tax rates the tax rates applied to profit and loss sharing groups will be the respective tax rates applied to each individual entity in accordance with its corporate classification. The highest and lowest corporate tax rates in the world 5 one hundred of the 223 separate jurisdictions surveyed for the year 2020 have corporate tax rates below 25 percent and 117 have tax rates above 20 and at or below 30 percent. Indirect tax rates , individual income tax rates , employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country, jurisdiction or region.

The corporation tax is imposed on taxable income of a company at the following tax rates: Exempted when holding at least 25% for 18 months; Tax rates for companies with stated capital of more than jpy 100 million are as follows:

Accredited corporations will be entitled to elect either a 30% special depreciation rate or a 15% tax credit where they invest in infrastructure to promote the introduction of 5g technology, and where the corporations put such infrastructure into use. Corporate tax rates table kpmg’s corporate tax rates table provides a view of corporate tax rates around the world. Beginning from 1 october 2019, corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 10.3% of their corporate tax liabilities.

It is expected that most of the items contained in the 2020 tax proposals will be passed into law in march 2020. Companies also must pay local inhabitants tax, which varies with the location and size of the firm.

Inequality And Taxes – Inequalityorg

Real Estate-related Taxes And Fees In Japan

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000-2020 Historical Chart

Real Estate-related Taxes And Fees In Japan

At A Glance Treasurygovau

Real Estate-related Taxes And Fees In Japan

Is The Us The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Corporate Tax Reform In The Wake Of The Pandemic Itep

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006-2020 Historical

House Democrats Tax On Corporate Income Third-highest In Oecd

Japan General Government Gross Debt To Gdp 2021 Data 2022 Forecast

Mxsfijaogoafem

Estonia Corporate Tax Rate 2021 Data 2022 Forecast 1995-2020 Historical Chart

Corporation Tax Europe 2021 Statista

Cayman Islands Corporate Tax Rate 2021 Data 2022 Forecast 2005-2020 Historical

Corporate Tax 2021 Laws And Regulations Indonesia Iclg

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Doing Business In The United States Federal Tax Issues Pwc

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021-2022 Shimada Associates