If you do not qualify for an educational tax credit, you may be eligible for the tuition and fees deduction. Only the person who claims the child as a dependent on their tax return is eligible for the subtraction.

Is Tuition Tax Deductible Private School Preschool Catholic College Tuition

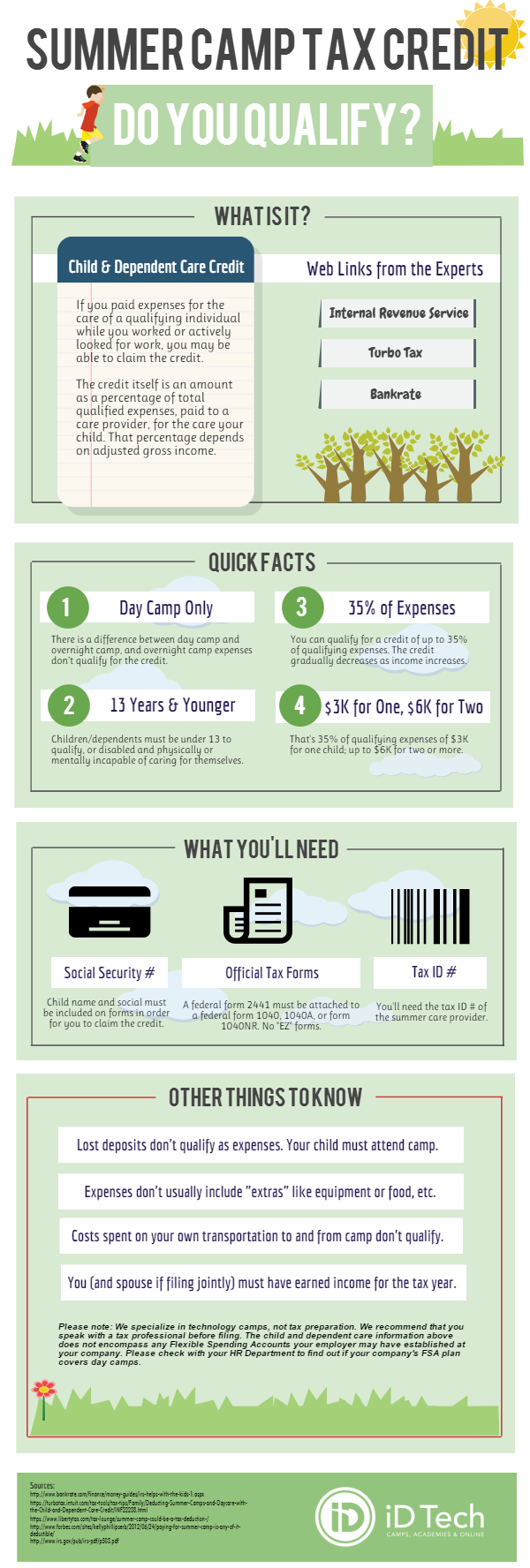

A credit called the child and dependent care credit, worth up to $1,050 for one child and up to $2,100 for two or more kids.

Is preschool tuition tax deductible 2019. While this makes tuition paid in 2019 ineligible for tuition tax credits, unused tuition and education amounts from years prior to 2019 are still available to be carried forward into subsequent tax years. The child and dependent care tax credit the child and dependent care credit can get you 20% to 35% of up to $3,000 of child care and similar costs for a child under 13, an incapacitated spouse or parent, or another dependent so that you can work (and up to $6,000 of. Can you write off catholic school tuition on taxes?

Enrollment for the next school year will not be allowed until final bill is paid. Sam and kate add the $162 from line 13 of this worksheet to their 2020 credit and enter the total on their form 2441, line 9. With a team of extremely dedicated and quality lecturers, is preschool tuition deductible will not only be a place to share knowledge but also to help students get inspired to explore and discover many.

Tuition and instructional fees are not tax deductible but qualify for the illinois educational tax credit. But the bills for private preschools and elementary schools can be scary, too. The answer is no, but parents can apply for a tax credit if they need childcare in order to work or find work.

2019, both expanded 529 plan qualified expenses. The sum of your child's entire preschool tuition is not tax deductible, but you may be able to get something better than a deduction: Deductions will not be made for days, weeks, or months that a student may be absent from school.

It is allowed for the 2020 tax year, but they must use their adjusted gross income for 2019 to figure the amount. If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty. Nonrefundable registration fee of $50 per child in preschool.

This deduction allows a deduction of up to $4,000 of tuition and books for undergraduate and graduate studies. If grandparents pay the tuition to help out the parents, but the parents claim the child as a dependent, may the parents claim the private school tuition subtraction? Generally, a course taken in 2020 at an institution in canada will qualify for a tuition tax credit if it was either:

The parents must have paid the tuition in order to claim the subtraction. Preschool tuition may be tax deductible. If you are able to deduct expenses on your federal taxes (2018 schedule 3) for child and dependent care, the irs will allow you to include expenses for “a child in preschool or similar programs for children below the level of kindergarten.” eligible expenses include preschool and ak tuition, registration and application fees.

This deduction is claimed on irs form 8917 and begins to phase out when a taxpayer's income reaches $65,000 (or. I only found out preschool tuition was deductible this year when i transferred him to an elementary school preschool program and they sent me tax forms. However, you may qualify for the child and dependent care credit if you sent your child to preschool so you could work.

The sum of your child's entire preschool tuition is not tax deductible, but you may be able to get something better than a deduction: To qualify, the larger refund or smaller tax liability must not be due to differences in data supplied by you, your choice not to claim a deduction or credit, positions taken on your return that are contrary to law, or changes in federal or state tax laws after january 1, 2019. Correspondingly, can you deduct child care expenses in 2019?

Although preschool expenses do not qualify as a tax deduction on their own right, you can claim them as part of the child and dependent care credit, assuming you qualify. As stated by the british columbia government, budget 2018 eliminated the education tax credit for 2019 and subsequent tax years. Parents of incoming montessori preschool students often ask if their childcare expenses are tax deductible.

Is preschool tuition deductible provides a comprehensive and comprehensive pathway for students to see progress after the end of each module. A credit called the child and dependent care credit, worth up to $1,050 for one child and up to $2,100 for two or more kids. It is recommended that you save all your receipts from tuition payments made to downtown doral charter elementary school.

Income limitations for the lifetime learning credit will be increased to help filers transition to the lifetime learning credit. Expenses for a child in nursery school, preschool or similar programs for children below the level of kindergarten may be deductible for federal income tax purposes as. The taxpayer certainty and disaster tax relief act of 2020 repealed the tuition and fees deduction for tax years beginning after 2020.

Tuition And Fee Schedule 2019 – 2020 – Soille San Diego Hebrew Day School

Is Kindergarten Tax Deductible Hr Block

Is Preschool Tuition Tax-deductible

Child And Dependent Care Credit Definition

Can I Claim Preschool Costs On My Taxes There Are A Few Requirements

Chile Taxing Wages 2020 Oecd Ilibrary

Is Summer Camp Tax Deductible 2019 Child Care Credit Forms Needed

Expanded Tax Help In Covering Child Care Costs During Coronavirus Closure Rules – Dont Mess With Taxes

Tax Implications And Rewards Of Grandparents Taking Care Of Grandchildren – The Cpa Journal

Are Montessori Preschool Expenses Tax Deductible – Valor Montessori Prep

Can I Deduct Preschool Tuition

Daycare Tax Statement Childcare Center Printable End Of The Etsy

Section 80c Deduction For Tuition School Education Fees

Publication 970 2020 Tax Benefits For Education Internal Revenue Service

Is Private School Tuition Tax Deductible

Is Preschool Tuition Tax Deductible In 2020 Heres What You Need To Know

Publication 503 2020 Child And Dependent Care Expenses Internal Revenue Service

Tax Strategies For Parents Of Kids With Special Needs – The Autism Community In Action Taca

Does Preschool Count As Child Care On Taxes – Tax Walls