The employee must provide proof of their esd exemption to their employer before the employer can waive. When you prepare and efile your 2021 tax return , enter the qualified long term care premium dollar amount during the tax interview and the tax app will show it on schedule a of.

Ranking The Best Long Term Care Insurance Of 2021

Long term care insurance may be deductible for state income tax purposes.

Is long term care insurance tax deductible in new york state. If the amount you pay exceeds the limit, you can't deduct more than that stated limit. Additional legislation was passed increasing the tax credit for long term care insurance. Questions answered every 9 seconds.

Ad a tax advisor will answer you now! Questions answered every 9 seconds. Ad a tax advisor will answer you now!

You may also use your health savings account to withdraw. Ad compare top expat health insurance in indonesia. Get the best quote and save 30% today!

You can get a credit for 20 percent of the premiums you paid, though the following conditions apply: See other tax deduction including medical expense deductions. Get the best quote and save 30% today!

Any qualified policy covering long term care services that was approved in new york and issued before january 1, 1997, also qualifies. The credit is not refundable; New york state tax credits.

New york state allows favorable state tax treatment of premiums paid for policies which qualify under the federal law and meet new york minimum standards. The credit may not reduce your tax liability below the minimum tax due The irs has released the 2021 deduction limits for individuals and business owners.

There are a ton of pros and cons associated with long term care insurance, but one pro i just learned about was its possible positive result on your state income tax return. Additional legislation was passed capping the tax credit for long term care insurance premiums at $1,500 and making the tax credit only applicable to tax returns wherein adjusted gross income is below $250,000 for taxable years beginning in 2020. Long term care premium tax credit legislation was passed in 2000 and took effect in taxable years beginning in 2002.

Ad compare top expat health insurance in indonesia.

The Tax Deductibility Of Long Term Care Insurance Premiums In 2021 – Long Term Care Insurance

The Tax Deductibility Of Long Term Care Insurance Premiums In 2021 – Long Term Care Insurance

North Carolina Long Term Care Insurance Quotes – All Companies

Delaware Long Term Care Insurance Quotes – All Companies

Vermont Long Term Care Insurance Quotes – All Companies

Maine Long Term Care Insurance Quotes – All Companies

Who Has The Cheapest Auto Insurance Quotes In Michigan – Valuepenguin Car Insurance Best Car Insurance Rates Car Insurance Rates

Arizona Long Term Care Insurance Quotes – All Companies 2021

Ranking The Best Long Term Care Insurance Of 2021

Shopping For Long-term Care Insurance Can Be Uniquely Frustrating Says Acsia Partners Send2press Newswire Long Term Care Insurance Health Insurance Options Long Term Care

Irs Reveals 2022 Long-term Care Tax Deduction Amounts And Hsa Contribution Limits Ltc News

What Is Long-term Care Insurance Should I Buy It – Valuepenguin

Ranking The Best Long Term Care Insurance Of 2021

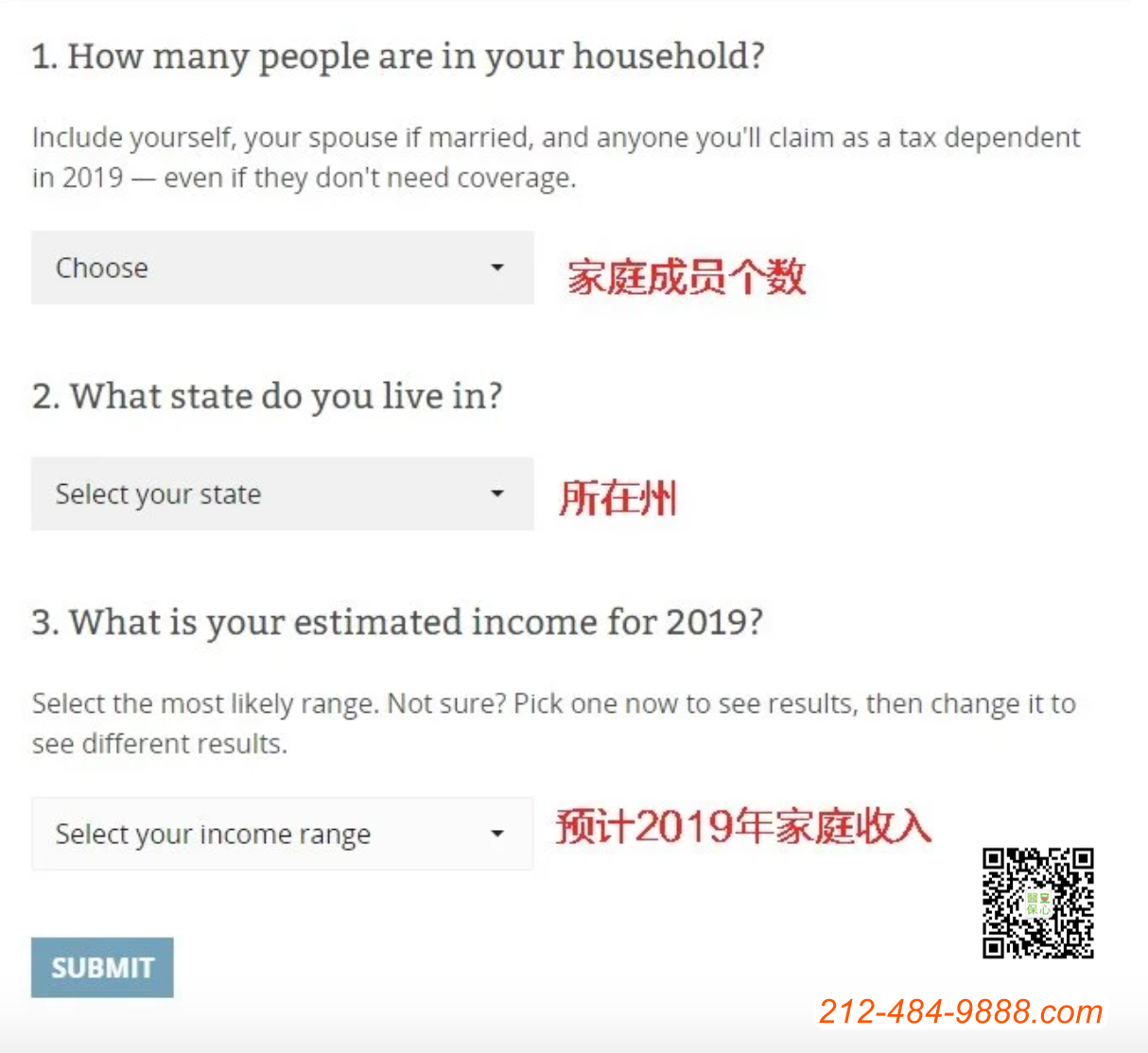

2021 New York Essential Plan Income Guideline Safe Policies Insurance

The Tax Deductibility Of Long Term Care Insurance Premiums In 2021 – Long Term Care Insurance

List Of Best Term Life Insurance Companies For 2017 Each Of Insurance Company Has Best Term Life Insurance Life Insurance Companies American Family Insurance

The Tax Deductibility Of Long Term Care Insurance Premiums In 2021 – Long Term Care Insurance

15 Percent Of Us Population Is Age 65 Up Httpsmetricmapsorg2020031415-percent-of-us-population-is-age-65-up One Bedroom One Bedroom Apartment The Unit

Your Only Chance To Opt Out Of Washingtons New Long-term Care Tax Is Fast Approaching – Puget Sound Business Journal