The personal portion of the interest will not be deductible. Question of depreciation does not arise in applicant profession is salaried and hence no business, or an expense in lieu of same can be considered.

Indusind Bank Car Loan Interest Rate 700 Eligibility Documents 07 Dec 2021

Personal auto loans are never tax deductible unless you use your car for business purposes, and even then only a portion of your car loan interest is deductible.

Is car loan interest tax deductible in india. You can’t deduct the loan interest on a personal car but you can for a business car. As per india’s income tax act, 1961, personal loans are eligible for tax exemptions or deductions depending on how you use the funds. Personal loan used for buying or construction of a residential property.

Car loan interest is tax deductible if it's a business vehicle you cannot deduct the actual car operating costs if you choose the standard mileage rate. The largest expense is usually the business car loan interest. Car loan interest that is tax deductible.

The income tax act (act) provides that interest on a loan payable outside india which is chargeable under the act shall not be deducted in computing the income chargeable under the head income. Section 24 of the income tax act, titled “deductions from income from house property” makes it possible to. As per section 24 (b) of the it act, you enjoy tax deductions if you use a personal loan to buy or construct residential property.

Interest on car loans may be deductible if you use the car to help you earn income. Here are some scenarios that help you lower your tax outgo. For purchase or construction of residential property:

Unlike home loan, you can not claim interest payments as tax deduction in car loan. Car is considered a luxury product in india and, in fact, attracts the highest goods and services tax (gst) rate of 28% currently. In this case, neither the business portion nor the personal portion of the interest will be deductible.

To determine the amount of each actual vehicle expense that may qualify for a tax deduction you will need to calculate the percent of time that the vehicle is used for business. If you're audited, you have to provide proof of not only the validity of any deductions made, but prove you're eligible to claim the deductions to begin with. Tax benefits on car loans.

1.5 lakh on the interest paid on loans taken to purchase electric vehicles. None of the interest will be deductible. Automobile loan interest vehicle maintenance insurance tolls and parking fees gasoline oil change.

The standard mileage rate already factors in costs like gas, taxes, and insurance. Section 80c allows deduction against principal repayment of up to rs.1.5 lakh every year. Of course, financing options are plentiful for vehicle purchases for p.

Unfortunately, many people fail to deduct it because of confusion about the tax law. Repayment of interest on home loan is tax deductible under section 24 of income tax act of india. Taxpayers that claim interest charges for car loans as a deduction on their income taxes are sometimes targeted as candidates for an audit.

Few significant points about car loans in india are listed below: If the vehicle is being used in part for business as an employee and the expenses are being deducted as an itemized deduction. Mahesh padmanbhan answers, notice period deduction is technically not deductible from your salary.

For example, if your income is rs 10 lakh and you have paid interest on your car loan of rs 25000, then you are liable to pay tax only on rs 975,000 besides getting a deduction on the interest you pay, you can also claim tax benefits on the depreciation of the car and other expenses such as fuel and maintenance if you use it for business purposes. Thus, you are not eligible for any deductions on your car loan if you are buying for your personal use. Accordingly, you will be liable to pay tax on all salary income received by you.

Home loan interest paid up to rs.2 lakh per year is tax deductible u/s 24. If the vehicle is entirely for personal use. You may deduct interest on a loan for a car you use in your business.

There are two different sections in terms of tax deductibility of home loan interest: Tax exemption on personal loans Also to make electric vehicle affordable to consumers, our government will provide an additional income tax deduction of rs.

Tax laws provide that expenditure incurred in relation to exempt income will not be allowed as a deduction in the hands of the tax payer. This deduction would make it easier for people who own an electric vehicle for personal use to deduct the interest they paid on the loan. This means that entire interest on the person can be tax deductible if used in business.

Read on for details on how to deduct car loan interest on your tax return. Individuals can claim a deduction of up to rs 1,50,000 for business use under section 80eeb. Car loans availed by individual customers do not offer any tax benefit;

Interest payments in excess of rs 1,50,000 are deductible as a business expenditure. Additional deductions are available u/s 80ee and 80eea. Government has already moved gst council to lower the gst rate on electric vehicles from 12% to 5%.

Section 24 falls under the domain of income from house property.

You Are Tired Of Travelling By Bus Or Any Other Means Of Transport And You Feel That You Are Ready To Buy A C Bad Credit Car Loan Car Loans Car

What Interest Rate Do I Qualify For Autoloan – For More Visit Httpwwwautoloanbadcredittodaycominfographicshow-to- Car Loans Loans For Bad Credit Loan

Is It A Good Option To Pay Off Your Car Loan With The Mutual Fund Money You Have – Quora

Sbi Car Loan Finances The On-road Price Of The Car At Attractive Interest Rates No Pre-payment Penalty Longest Tenu Car Loans Car Loans Finance Car Finance

Documents Required For New Car Loan – New Car Loan Documentation Hdfc Bank

Car Loan Tax Benefits And How To Claim It – Icici Bank

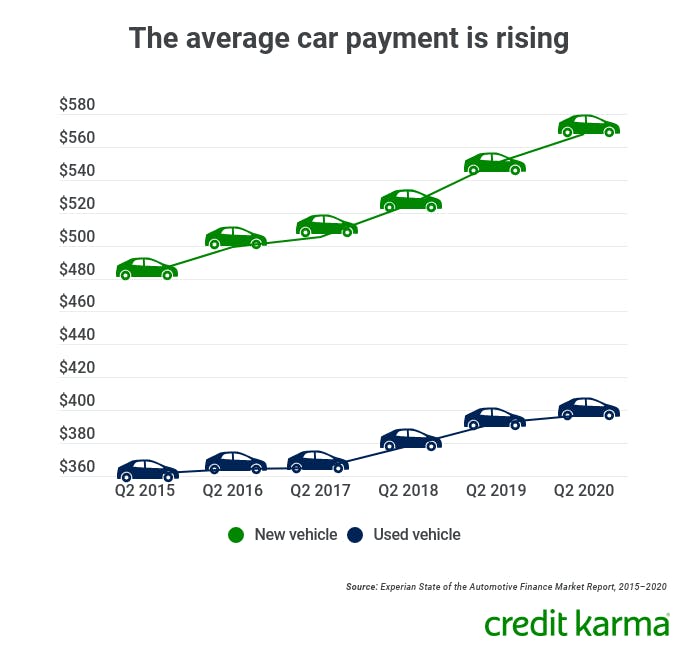

What Is The Average Car Payment Credit Karma

Is It Possible To Get A Car Loan After Bankruptcy Greedyratesca

.jpg)

How A Self-employed Can Apply For A Car Loan- Axis Bank

Auto Loan Quotes Quotesgram

Car Loan Tax Benefits On Car Loan How To Claim – Youtube

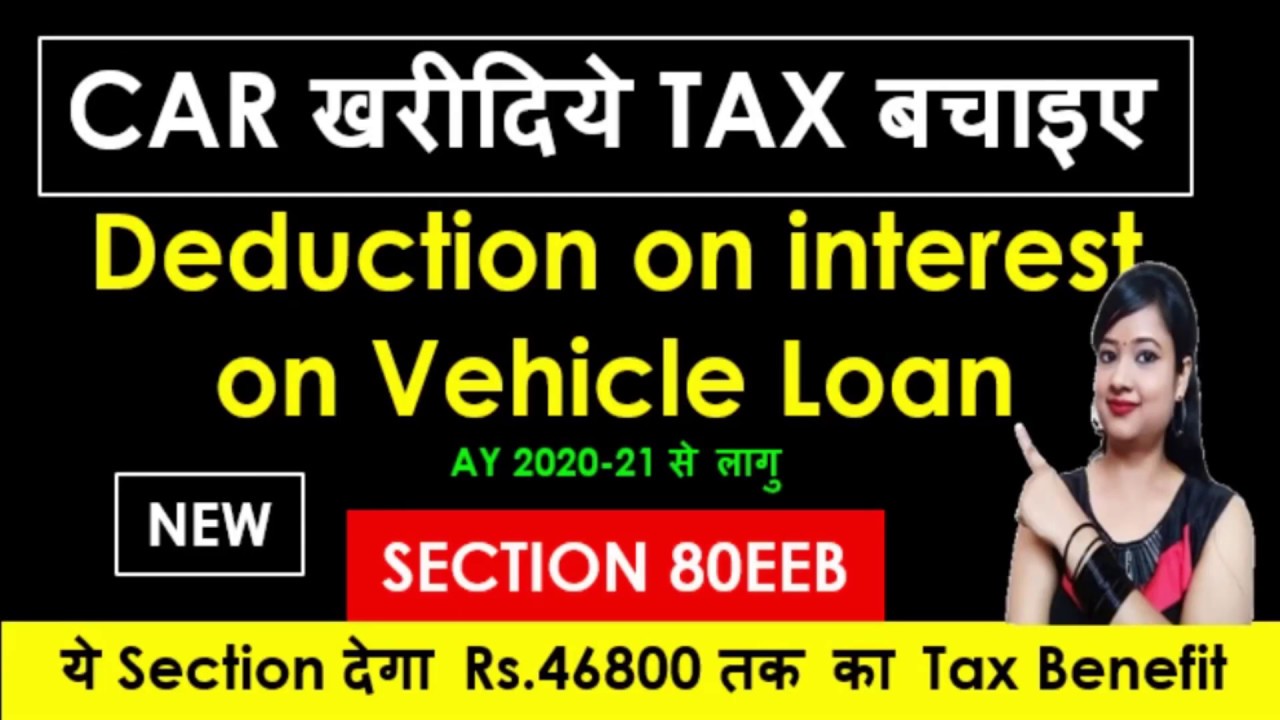

New Income Tax Deduction Us 80eeb On Car Loan Deduction On E-vehicle Loan Interest 80eeb – Youtube

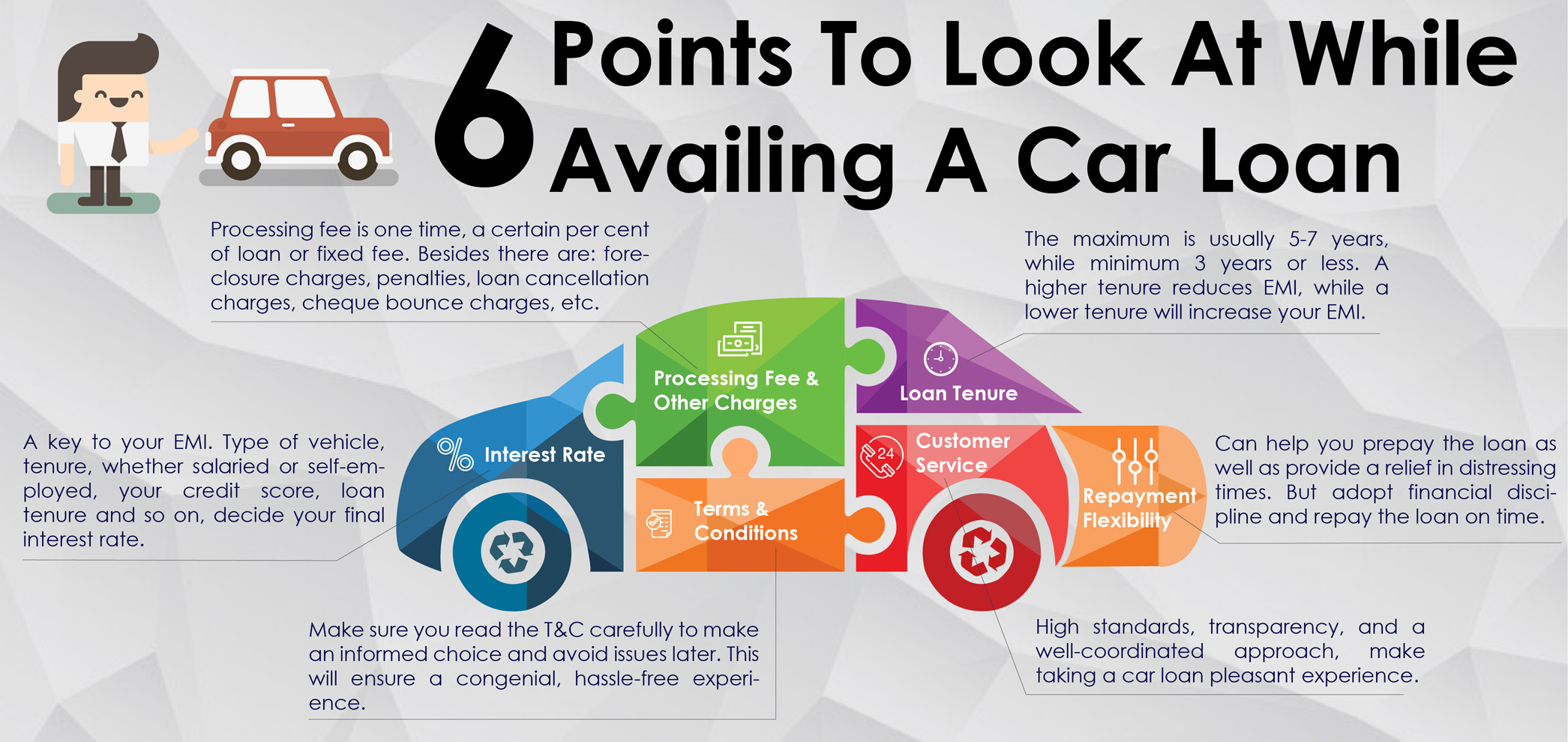

6 Points To Look At While Buying A Car For Your Family This Festive Season – Axis Bank

Is Car Loan Eligible For Tax Exemption – Paysense Blog

Car Loans In Kenya Everything You Need To Know – Bee Mashine

Icici Bank Car Loan Interest Rates Car Loans Loan Interest Rates Loan

Car Coins Images Stock Photos Vectors Shutterstock

Documents Required For New Car Loan – New Car Loan Documentation Hdfc Bank

How A Self-employed Can Apply For A Car Loan- Axis Bank