Dealerships may also charge a documentation fee or doc fee, which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. Check the history of a vehicle;

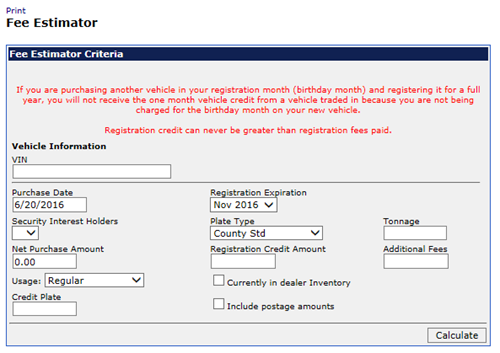

Calculate Your Transfer Fee Credit Iowa Tax And Tags

After a few seconds, you will be provided with a full breakdown of the tax you are paying.

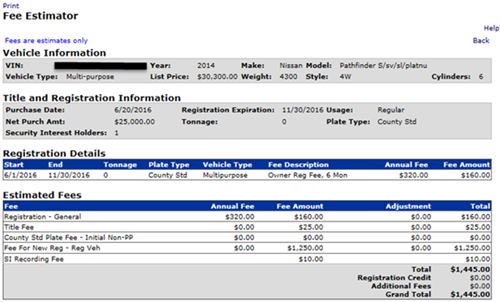

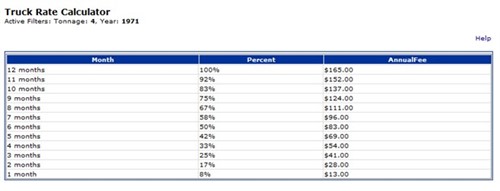

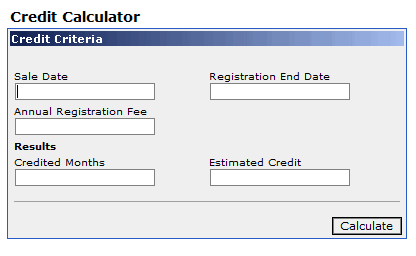

Iowa vehicle tax calculator. This deduction is for annual registration fees paid based on the value of qualifying automobiles and multipurpose vehicles. Click the following link to determine registration fees, registration fees remaining on a vehicle that has been sold, traded or junked, estimate fees due on a newly acquired vehicle, and calculate truck fees by tonnage: This property tax calculator is for informational use only and may not properly indicate actual taxes owed.

I have moved and registered my vehicle in a different state. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. For more information on vehicle use tax, and/or how to use the calculator, click on the links below.

How 2021 sales taxes are calculated in iowa. The federal adjusted gross income used to determine contribution limitations for iowa tax purposes is the amount from federal form 1040, line 8a, as modified by any iowa net income nonconformity adjustments from line 14 of the ia 1040 including any depreciation/section 179 adjustments, and the domestic production activities deduction on line 24. You can use the fee calculator to estimate your fee (s):

To calculate the sales tax on a vehicle purchased from a dealership, multiply the vehicle purchase price by 6.25 percent (0.0625). The state general sales tax rate of iowa is 6%. The refund is calculated from the date the vehicle is sold to the expiration of the registration.

Earlier this decade, iowa enacted one of the largest tax cuts in the state’s history. Cities and/or municipalities of iowa are allowed to collect their own rate that can get up to 1% in city sales tax. To calculate the sales tax on a vehicle purchased from a dealership, multiply the vehicle purchase price by 6.25 percent (0.0625).

The highest property tax rates in the county can be found in des moines. Find your state below to determine the total cost of your new car, including the car tax. You can use our iowa sales tax calculator to look up sales tax rates in iowa by address / zip code.

If you itemize deductions, a portion of the automobile or multipurpose vehicle annual registration fee you paid in 2014 may be deducted as personal property tax on your iowa schedule a, line 6, and federal schedule a, line 8. 30.5 cents per gallon of regular gasoline, 32.5 cents per gallon of diesel. Online calculators > financial calculators > iowa car loan calculator iowa auto loan calculator.

The iowa dot fee calculator is not compatible with mobile devices (smart phones). Unsurprisingly, the state's $3,384 median annual tax payment falls in the top three of iowa counties. The county’s average effective property tax rate is 1.97%, which is the highest rate in the state.

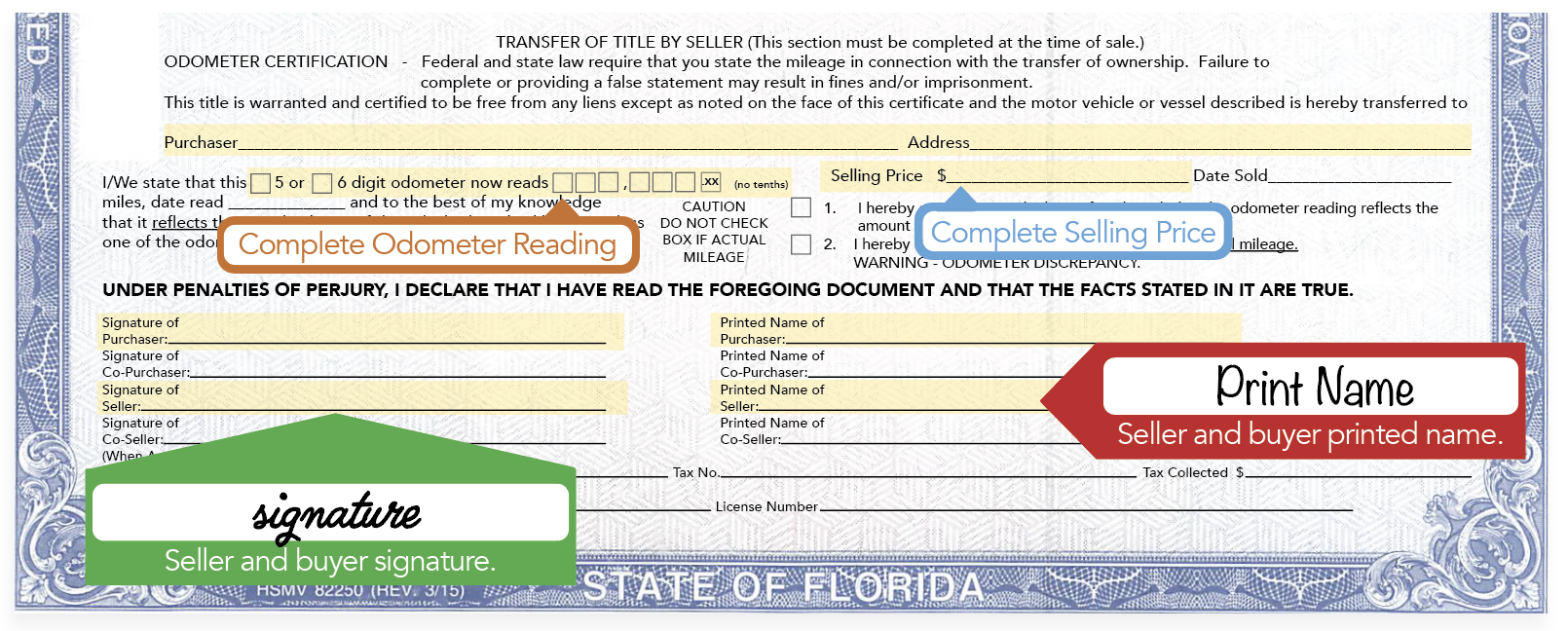

Buying & selling a vehicle. All vehicles must be registered to legally be driven in iowa. Uh oh, please fix a few things before moving on:

These fees are separate from the taxes and dmv fees. The motor vehicle division serves as an agent of the iowa department of transportation and department of revenue and. In addition to taxes , car purchases in iowa may be subject to other fees like registration , title , and plate fees.

To use our iowa salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. Security interests are notated and released and refunds of credits are processed.

How do you figure tax title and license on a vehicle? Credits and exemptions are applied only to annual gross net taxes total. Please select a county to continue.

Iowa has a 6% statewide sales tax rate ,. How do you figure tax title and license on a vehicle? For tax years on or after january 1, 1988, the tax is imposed on the unrelated business income of nonprofit corporations.

Iowa state tax quick facts. The motor vehicle division issues vehicle titles, registration renewals, personalized and other special license plates, and junking certificates. (link is external) download user guide.

How can i apply for a refund for the unused registration in iowa? Every 2021 combined rates mentioned above are the results of iowa state rate (6%), the county rate (0% to 1%), the iowa cities rate (0%. Iowa auto loan calculator is a car payment calculator with trade in, taxes, extra payment and down payment to calculate your monthly car payments.iowa car payment calculator with amortization to give a monthly breakdown of the principal and interest that you will be paying each month.

Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. The tax is imposed on the iowa net income of corporations doing business within this state or receiving income from property in the state.for tax years on or after january 1, 1987, iowa imposes an alternative minimum tax equal to 7.2% of iowa tax preferences. In addition to taxes , car purchases in iowa may be subject to other fees like registration , title , and plate fees.

The annual registration fees are determined by iowa code sections 321.109 and 321.115 through 321.124 and are to be paid to the county treasurer’s office in the county of residence. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Motor Vehicles – Lake County Tax Collector

Which Us States Charge Property Taxes For Cars – Mansion Global

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

States With Highest And Lowest Sales Tax Rates

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Crypto Tax In Australia – The Definitive 2021 Guide

Car Tax By State Usa Manual Car Sales Tax Calculator

Premiere Suite – Bali Nusa Dua Hotel

Car Tax By State Usa Manual Car Sales Tax Calculator

Registration Fees Penalties And Tax Rates Texas

Cell Phone Taxes And Fees 2021 Tax Foundation

Woocommerce Sales Tax In The Us How To Automate Calculations

Sales Tax On Cars And Vehicles In Iowa

Section 194q Tax Deduction On The Purchase Of Goods

Tax Calculators And Forms Current And Previous Tax Years