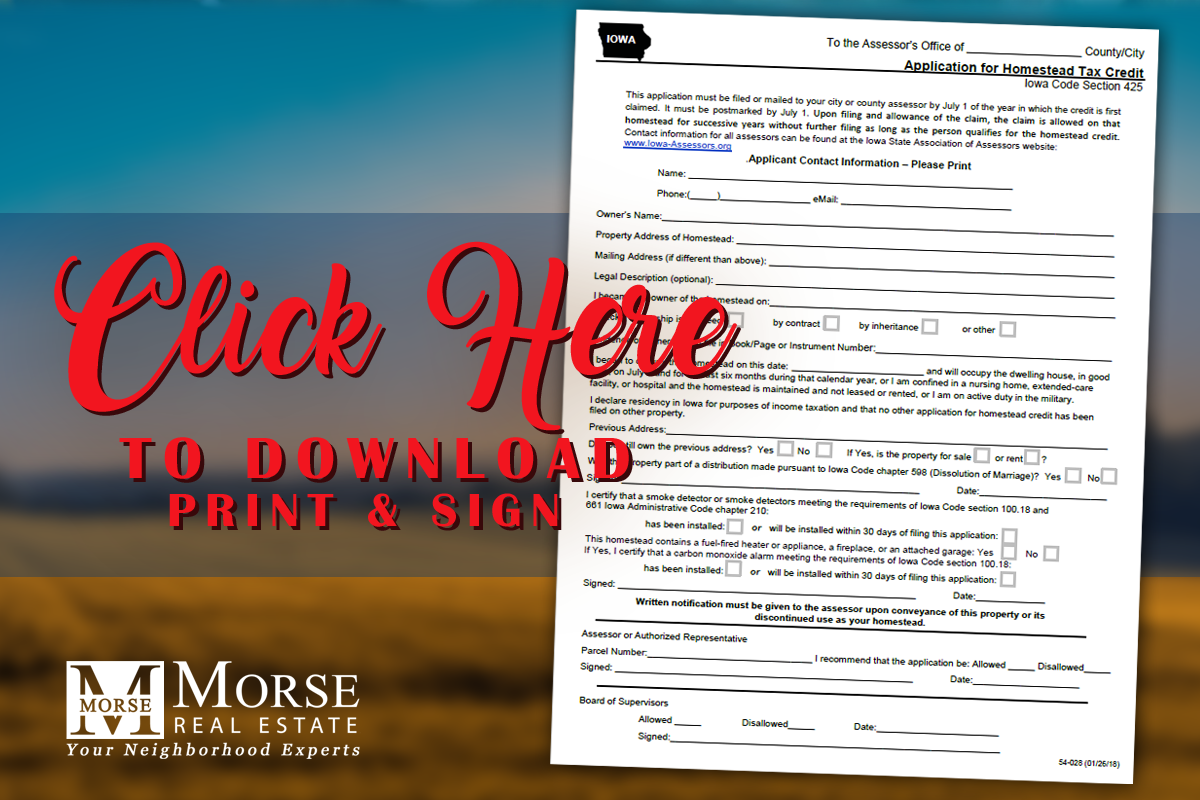

2020 iowa property tax credit claim. Submission of an application for homestead tax credit:

The Project Gutenberg Ebook Of History Of Linn County Iowa By Luther A Brewer And Barthinius L Wick

Part of the homestead tax credit in the iowa code.

Iowa homestead tax credit linn county. Upon filing and allowance of the claim, the claim is allowed on that Iowa assessors’ addresses can be found All in all, the homestead tax credit usually results in a benefit of a couple hundred dollars, but if it is available to you, apply for it!

With a population of around 172,000, scott county is one of the most populous counties in iowa. This credit is equal to the tax on the first $4,850 of actual value for each homestead. If you miss the july 1 deadline, your credit will.

The typical homeowner in linn county pays $2,754 annually in property taxes. The current credit is equal to 100 percent of the actual tax levy. Declares that you are a resident of the state of iowa for income tax purposes 2.

Iowa homestead tax credit scott county. If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of cedar rapids, and you do not currently have a homestead credit on your property you can apply from within your parcel. This exemption is a reduction of the taxable value of their property amounting to a maximum $4,850 or the.

This application must be filed or postmarked to your city or county assessor by july 1 of the year in which the credit is first claimed. The county’s average effective property tax rate of 1.79% is also higher than the state mark (1.53%). Under real estate search enter your property address.

Contact information city assessor's office city services center 500 15th avenue sw cedar rapids, iowa 52404. Upon the filing and allowance of the claim, the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead credit. Iowa disabled veteran homestead credit.

The military tax credit is an exemption intended to provide tax relief to military veterans who (1) served on active duty and were honorably discharged or (2) members of reserve forces or iowa national guard who served at least 20 years qualify for this exemption. You can apply for your homestead tax credit online! Homestead tax credit iowa code chapter 425.

Dates to remember from the treasurer's office. Occupy the residence for at least six months of the year; Find linn county tax records.

You’re located in linn county, outside the city limits of cedar rapids you do not currently have a homestead credit on your property and aren’t claiming homestead anywhere else how to apply: Claim the property as their primary residence (as opposed to a second home) apply for homestead credit by july 1; Linn county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in linn county, iowa.

It is legislated that 23 percent of annual rent payments are for covering property tax. To qualify for the credit, the property owner must be a resident of iowa & a veteran as defined in section 35.1. Homeowners qualify for a property tax credit, while renters qualify for reimbursement of the portion of rent which constitutes property taxes paid.

In the state of iowa, homestead credit is generally based on the first $4,850 of the home’s net taxable value, and to qualify for the credit, homeowners must: With a population of around 172,000, scott county is one of the most populous counties in iowa. The homestead tax credit is a small tax break for homeowners on their primary residence.if you live in the greater iowa city area in johnson county you can apply for the homestead credit with a quick visit to the johnson county assessor’s site.you’ll need to scroll down to find the link for the homestead tax credit application.

Scott county board of supervisors re: Originally adopted to encourage home ownership for disabled veterans. These records can include linn county property tax assessments and.

York county maine genealogy outdoor decor, decor, genealogy. There are additional benefits attributed to a person’s homestead, such as the statutory prohibition for some types of judgments to not “attach” to a person’s homestead (iowa code §624.23). (refer iowa code, chapter 425) disabled veteran's tax credit.

Declares that you are the current owner of the property and that evidence of that ownership is recorded in the linn county recorder’s office 3. This application must be filed with your city or county assessor by july 1 of the year for which the credit is first claimed. How do i estimate the net tax for a residential property with homestead and military tax credit?

Apply online on our website 1.

Linn County

Linn County Iowa – Wikipedia

Linncounty-iagov

Linn County Enews – Fy16 Annual Reports Property Tax Exemption Deadline

Linn County Enews – Fy16 Annual Reports Property Tax Exemption Deadline

Iowa Property Tax Calculator – Smartasset

Linn County

Iowa Property Tax Calculator – Smartasset

Linn County Iowa 1911 Map Cedar Rapids Marion Mt Vernon Central City

Some Linn County Residents Get Incorrect Tax Bills The Gazette

Assessor Linn County Ia – Official Website

Assessor Linn County Ia – Official Website

Updated Names Released In Linn County Crash That Killed Two

Linn County

Linncounty-iagov

Iowa Homestead Tax Credit – Morse Real Estate Iowa And Nebraska Real Estate

Cityofmarionorg

Tidbits Of Linn County Iowa By Russ Swart – Issuu

Tidbits Of Linn County By Russ Swart – Issuu