All effective january 1, 2022. Will inheritance and gift taxes change in 2021?

Estate Planning May Become The Best Decision Youll Ever Make Trustcounsel Estateplanning Estateplan Taxlaw B In 2021 Estate Planning How To Plan Counseling

For 2021, the exemption will be $73,600 for single filers and $114,600 for married couples filing jointly.

Inheritance tax law changes 2021. The french senate recently passed a new law to ‘tighten’ the civil code around inheritance law in france. America's small family farms could be destroyed if congress passes biden's proposed tax change plan, said grover norquist, president and founder of americans for tax reform. So, your beneficiaries who may be subject to inheritance taxes may have to pay more than 40% in taxes on their bequest from your estate.

Inheritance rules changes in france 2021. French inheritance tax rates 2021 spouses and civil partners / pacs partners : This could require you to pay additional tax when you sell assets you inherit.

For deaths occurring on or after january 1, 2025, no inheritance tax will be imposed. Currently, the combined lifetime gift and fet exemption is $11.7m per person. In 2021, the amt exemption and phaseout amounts will now adjust for inflation.

And by the same token, the taxation rate for inheritance taxes may be raised in 2021. September 10, 2021, 7:14 pm edt taxing heirs on transfers of wealthy holdings hits headwinds situation is fluid as lawmakers race to draft legislation The tax proposal would remove this “step up” of income tax basis for gains over $1 million on inherited assets (or totaling over $2 million if inheriting from a married couple).

The increase in the exemption is set to lapse after 2025. Recently, the agricultural and food policy center at texas a&m university developed a study showing the impact of potential inheritance tax changes and found that if both the step act and the 99.5 percent act were simultaneously implemented, 92 of the 94 representative farms would be impacted, with additional tax liabilities incurred averaging $1.43 million per farm. The amt will begin to phase out at $523,600 for single filers and $1,047,200 for married couples filing jointly.

The proposed impact will effectively increase estate and gift tax liability significantly. People who have large estates and who want to undertake planning to reduce their federal estate tax should do so before the end of 2021 in order to take advantage of the current $11.7 million gift tax exemption amount, which will be reduced to $1 million under the new law. However, what is charged will be less if you leave behind your home to your direct descendants, such as children or grandchildren.

It still means, however, that married couples and civil partners can give away up to £1m free of inheritance tax. However, the treasury department and the irs issued “grandfather” regulations in 2019 allowing the increased exemption to apply to gifts made while it was in effect, if congress lowers the exemption after those gifts. Where you live doesn’t affect inheritance tax.

Will inheritance and gift tax exemptions change in 2021? The standard inheritance tax rate is 40%. 19 now marks significant changes to.

This means if you have less than that, there will be no estate tax if you die now. Anything above that is ta In the current tax year, 2021/22, no inheritance tax is due on the first £325,000 of an estate, with 40% normally being charged on any amount above that.

There is no federal inheritance tax and only six states collect an inheritance tax in 2020 and 2021, so it only affects you if the decedent (deceased person) lived or owned property in iowa, kentucky, maryland, nebraska, new jersey, or pennsylvania. Changes to the alternative minimum tax. This law will effectively ‘trump’ the.

The tax rates listed below have already been reduced by the applicable rate reduction for decedents dying on or after january 1, 2021 but before january 1, 2022, and should be used in the computation of shares for each beneficiary of the inheritance tax owed. 13 also caps property taxes at 1 percent of the assessed value with an increase of not more than 2 percent annually. There is also currently no california inheritance tax.

Children inheriting from each parent (or a parent inheriting from their child) to each bloodline or adopted child is taxed as follows: Then the gift and inheritance tax exemption will be reduced from $ 11.7 million to $ 6 million, with the gift and inheritance tax rate increased from 40% to 45%. However, many people are rushing to do tax planning in anticipation of the tax changes that may take effect january 1, 2022.

It’s only charged on the part of your estate that’s above the threshold. At the moment, the inheritance tax is at 40% and there are also talks about increasing the tax rates to 45% or even having a tiered structure that gets. Gifts and generation skipping transfer tax exemption amounts are indexed for inflation, increasing to $11.7 million in 2021 from $11.58 million in 2020.

Goodbye 2017 Hello 2018 Happy New Year Festive Retro Card 1501736 Happy New Year New Year Card Happy New

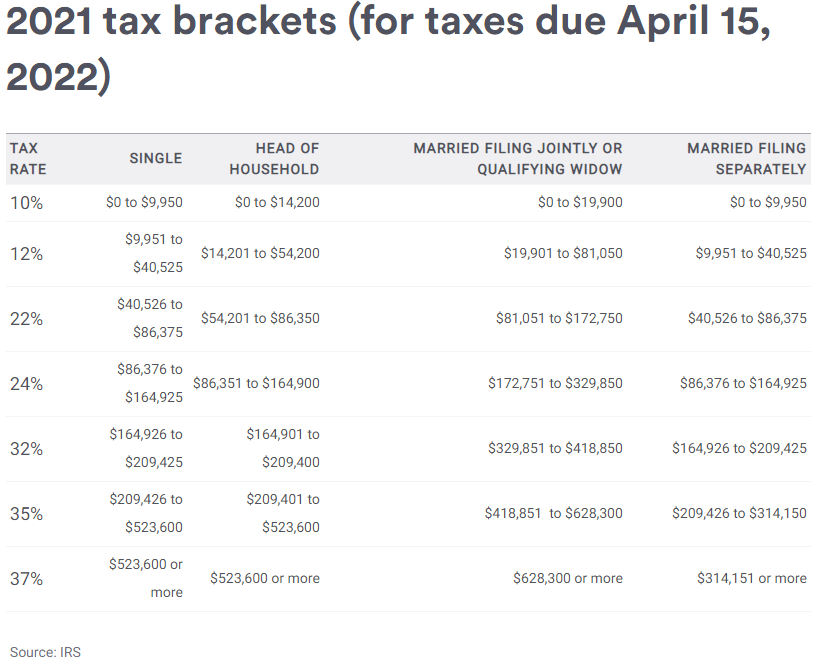

2020-2021 Federal Income Tax Brackets

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

25 Percent Corporate Income Tax Rate Details Analysis

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Filing Taxes

Jk Lassers Your Income Tax 2021 For Preparing Your 2020 Tax Return By Jk Lasser Institute In 2021 Income Tax Tax Return Tax Time

The New Death Tax In The Biden Tax Proposal Major Tax Change

-01n0wgz0jantm

Financial Documents Why To Keep A Paper Trail – Twin Cities Consumers Checkbook Financial Documents Roadmap Paper Trail

Direito_far Logo Vector In 2021 Vector Logo Logos Vector

Texas Estate Planning Statutes With Commentary 2019-2021 Edition Paperback – Walmartcom In 2021 Estate Planning Estate Administration How To Plan

Outside Lands Announces 2021 Lineup Feat The Strokes Tyler The Creator Lizzo Tame Impala – Pursuit Of Dopeness The Strokes Outside Lands Tame Impala

Papers Of The International Academy Of Estate And Trust Law – 2001 Hardcover In 2021 Academy Trust Common Law

Download Free Illustrations Of Vat Value Added Tax Document Magnifying Data Glass Calculate Audit Han Value Added Tax Indirect Tax Accounting Services

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Pay Less Tax In 2021 Schedule A Tax Assessment Today In 2021 Assessment Tax J Jones

Irs Releases Key 2021 Tax Information Standarddeduction2021 Newtaxrele Standard Deduction Irs Tax Brackets

As Of January 1 2021 The Corporate Income Tax Will Increase From 7 Percent To 799 Percentthis Will Replace T Tax Lawyer Long Term Care Insurance Income Tax