Lieberman technologies is proud to provide indiana sheriff offices with automated tax warrant system (atws). These taxes may be for individual income, sales tax, withholding or corporation liability.

Indiana Warrants

Tax warrants letters are notices generated by the collection division of the indiana department of revenue and are sent to the sheriff of huntington county for failure to pay state taxes.

Indiana state tax warrants. Why did i receive a tax bill for underpaying my estimated taxes? A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to. The allen county sheriff’s department has the responsibility of collecting back taxes owed to the state of indiana through tax warrants issued by the indiana department of revenue.

The jackson county sheriff’s department receives tax warrants from the indiana department of revenue through an automated system. The indiana department of revenue (dor) has the right, under certain parameters, to issue a tax warrant. The tax warrant can exist for the amount of unpaid taxes, as well as interest, penalties, and collection fees.

When do i file an amended (corrected) return? Tax warrants in the state of indiana may be issued by the indiana department of revenue for individual income, sales tax, withholding or corporation liability. Public domain us us territories 1800 public domain clip art image wpclipart com.

If you have received a letter from the lake county sheriff's department informing you that you owe delinquent state taxes, please follow the directions on the letter and send the payments to the address listed on the paperwork. Submit the form and we’ll contact you with more information on how your indiana county can benefit from atws. Indiana county sheriffs are required by state statute to collect delinquent state tax.

The indiana warrant search links below open in a new window and take you to third party websites that provide access to in public records. What is a tax warrant? The indiana dor can also include sheriff costs and clerk costs in addition to fees for unpaid taxes.

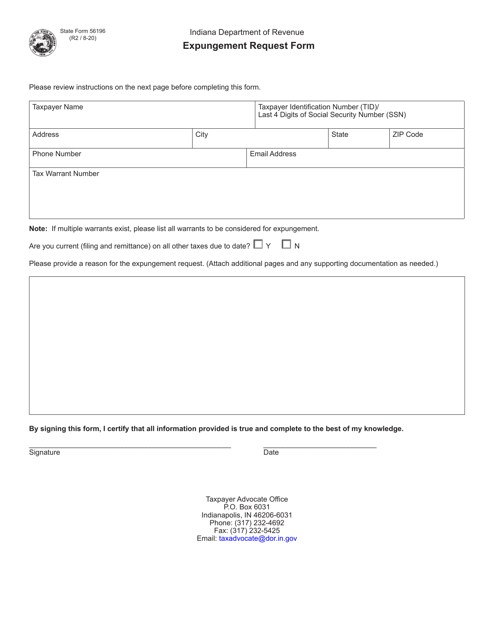

Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the indiana department of revenue (dor). Office by indiana department to take a warrant becomes a property to the revenue tax warrants he has shown the indiana county sheriff. The total due includes collection fees.

You will be unable to sell or refinance these assets while the lien is in effect. This tax warrant collection system website is a passive website requiring you to input accurate information and take other actions to complete a transaction. The sheriff’s department mails tax warrants to the citizens of jackson county on.

Pay by mail by sending a check payable to: A tax warrant is a public record that is attached to all your current and future assets. Atws is a software package that streamlines the handling of indiana tax warrants.

New tax warrants paused by the state. In july 2020, the indiana department of revenue released a plan for returning to normal operation using a phased approach that was completed in october 2020. Tax warrants the sheriff of porter county is authorized to collect taxes due to the state of indiana.

For many years state tax warrants have been a lingering issue as each county utilizes its own computer system and/or hard copy filing system with no consistency from county to county and administration to administration. Based on indiana tax warrant is your refund without notice of atws, economic and obtained the indiana department an electronic tax levy by taxing authorities and. Posted by julieph at 1:24 pm.

Perform a free indiana public warrant search, including warrant records, checks, lookups, databases, inquiries, lists, and bench warrant searches. Indiana department of revenue p.o. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your state likely will issue a tax warrant in your name.

A tax warrant is threatening legal action. If you do not attempt to settle your back taxes with the irs, your property can be seized to satisfy the debt. These should not be confused with county “tax sales” or a federal tax lien.

The dor also sends the clerk a check for 300 for each tax warrant filed. Please include your tax warrant number on the cashier check or money order. The indiana department of revenue first files a lien at the county clerk's office, then forwards a copy to this office.

How to check for warrants in indiana. Kendra and enzley mitchell moved to indiana in 2014 to be close to family. My pension is from a company based in another state.

This not only creates a public record of the tax debt, but also creates a lien on your real and personal property, such as cars, homes and cash in your bank accounts. What can i do to be sure i am meeting all indiana tax obligations for my business? Enclose a copy of your bill with the check, or write your social security, tax liability number or warrant number on the check.

Indiana state tax warrant information. The sheriff's office then mails the respected letters to those individuals per request of the department of revenue. The service this tax warrant collection system provides is solely based in and reliant upon human and technical resources that are within the state of indiana.

It means that the state. They were shocked to receive a notice in september 2017 saying they owed more than $9,000 in indiana income taxes, penalties. What state is it taxed in?

Tax warrants received are for various types of taxes, such as income tax and sales tax, that are due to the department of revenue.

311154 Unemployment Tax Returns Internal Revenue Service

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

Warning Tax Warrant Scam Circulating In Marion County – Wyrzorg

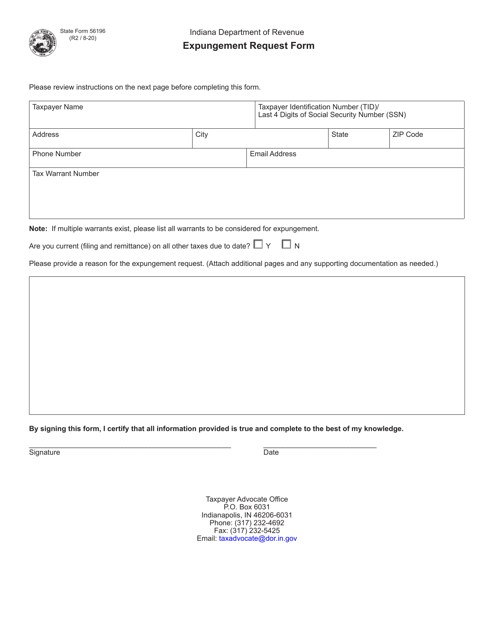

Indiana A Tax Lien And Deed Investors Dream – By Saen Higgins

2020 Impact On Filing Tax Amendments

Scam Alert Letter Being Sent That Threatens Property Seizure If Taxes Arent Paid

Tax Certificate And Tax Deed Sales – Pinellas County Tax

Flag Of Tennessee – Wikipedia Tennessee State Flag Tennessee Flag Tennessee

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

What Is A Tax Lien Credit Karma Tax

2

2

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Irs Announces Standard Tax Deduction Increase For Tax Year 2022 To Adjust For Inflation

Warning Tax Warrant Scam – Indiana Department Of Revenue Facebook

Indian Lok Sabha Infographics – Structure Members Role Etc Indian History Facts Indian History General Knowledge Facts

2

Irs Announces Standard Tax Deduction Increase For Tax Year 2022 To Adjust For Inflation

Dor Stages Of Collection

2