More than 99.9% of all estates do not owe federal estate tax. They do not owe inheritance tax unless they inherit more than $500.

The Potential For Major Estate Tax Changes During The Biden Administration What You Need To Know – Inside Indiana Business

Federal estate tax largely tamed.

Indiana estate tax threshold. That means the federal government gets to collect $1.32 million in taxes, leaving a total of $13.68 million for your heirs. The personal representative of an estate in indiana must continue to pay the taxes owed by the decedent and his or her estate. For individuals dying before january 1, 2013.

For 2020, the basic exclusion amount will go up $180,000 from 2019 levels to. The top estate tax rate is 16 percent (exemption threshold: The amount of tax is determined by the value of those.

Though indiana does not have an estate tax, you still may have to pay the federal estate tax if you have enough assets. However, there are personal exemptionsyou can use to lower your tax liability. This entire sum is taxed at the federal estate tax rate, which is currently 40%.

Understanding the indiana probate process if you cannot avoid probate, an administrator will be named to handle the probate process, which usually takes place in the county where the deceased person lived. The exemption for the federal estate tax is $11.18 million. The tax cuts and jobs act, signed into law in 2017, doubled the exemption for the federal estate tax and indexed that exemption to inflation.

The tax was repealed, and the repeal was made effective retroactively for deaths as of january 1, 2013. The government established the current exemption level when it passed the tax code in 2017. Single filers can claim $1,000, while married households can receive a $2,000 exemption.

Until may 2013, indiana had a state inheritance tax , which was imposed on certain people who inherit money from an indiana resident. In indiana, these assets will avoid probate if other assets outside the trust exceed the state’s small estate threshold. This can, however, be avoided through advanced estate planning and protection planning.

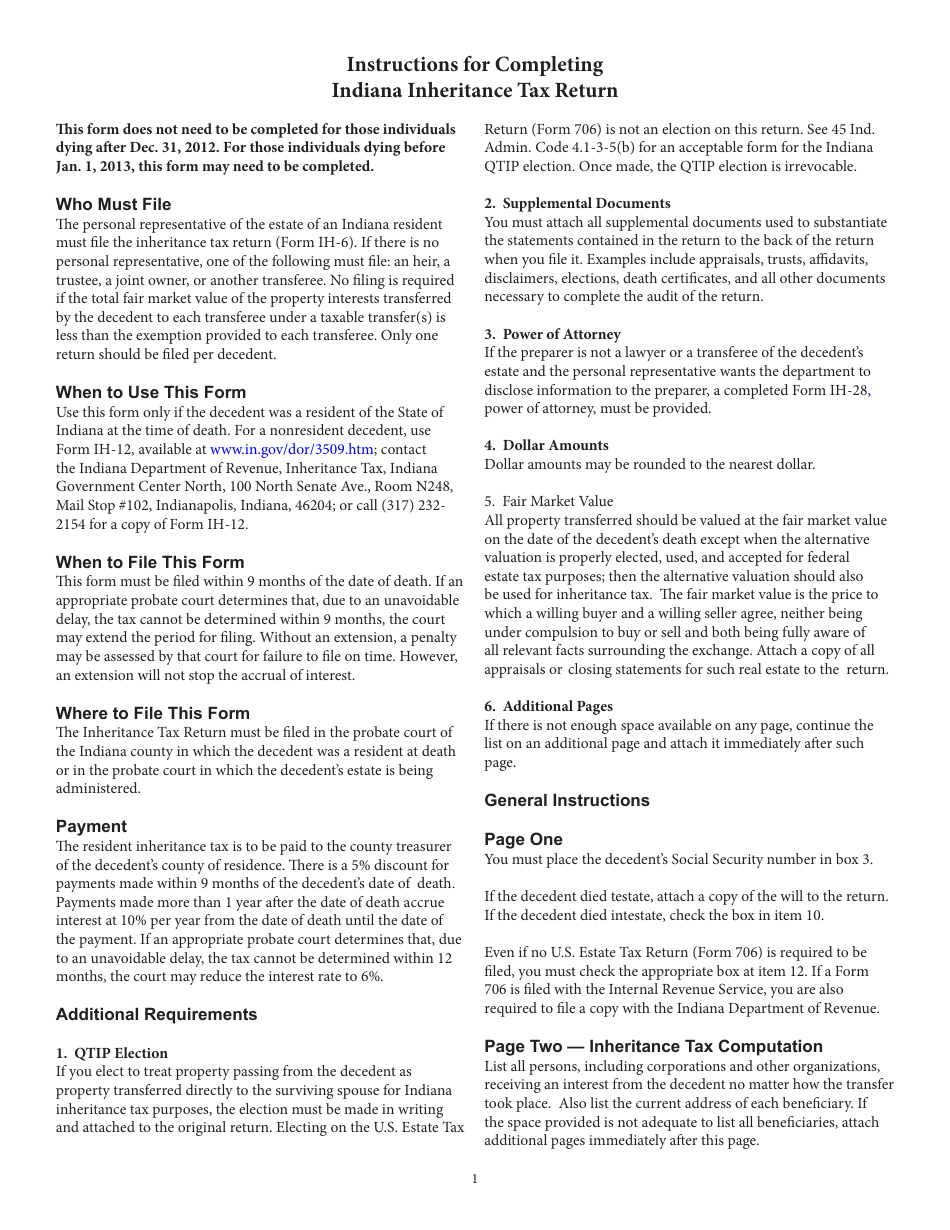

Increased the threshold for the maryland estate tax to $1.5 million in 2015, $2 million in 2016, $3 million in 2017, and $4 million in 2018. Estate are required for those dying after december 31, 2012. For 2021, the threshold for federal estate taxes is $11.7 million, which is up slightly from $11.58 million in 2020.

New jersey has the lowest, only exempting estates up to $675,000. Are required to file an inheritance tax return (form Most relatively simple estates (cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or elections, or jointly held property) do not require the filing of an estate tax return.

Property taxes owed by the decedent As of january 1, 2012, the exclusion equaled the federal estate tax applicable exclusion amount, so long as the fet exclusion was not less than $2,000,000 and not more than $3,500,000. It taxes the entire amount of the estate on estates over that $1 million threshold.

Combined with a top federal rate of 40 percent, some heirs face a tax of up to 56 percent, but the federal estate tax kicks in at just under $12 million while illinois’ estate tax applies to any inherited value above $4 million. This could include cash, real estate, retirement accounts or a range of other assets. Anyone who doesn't fit into class a or b goes here—including, for example, aunts, uncles, cousins, friends, nieces and nephews by marriage, and corporations.

Indiana’s inheritance tax still applies. That number is used to calculate the size of the credit against estate tax. No estate tax or inheritance tax.

The maximum rate of estate tax is 40 percent. In 2010, vermont increased the estate tax exemption threshold from $2,000,000 to $2,750,000 for decedents dying on or after january 1, 2011. The top estate tax rate is 16 percent (exemption threshold:

John's estate would not be liable for the federal estate tax at $3 million because this is well below the $11.7 million federal exemption threshold. This replaced indiana’s prior law enacted in 2012. Schedule, and the fiduciary for the trust or estate must continue to withhold indiana adjusted gross income tax for all nonresident beneficiaries.

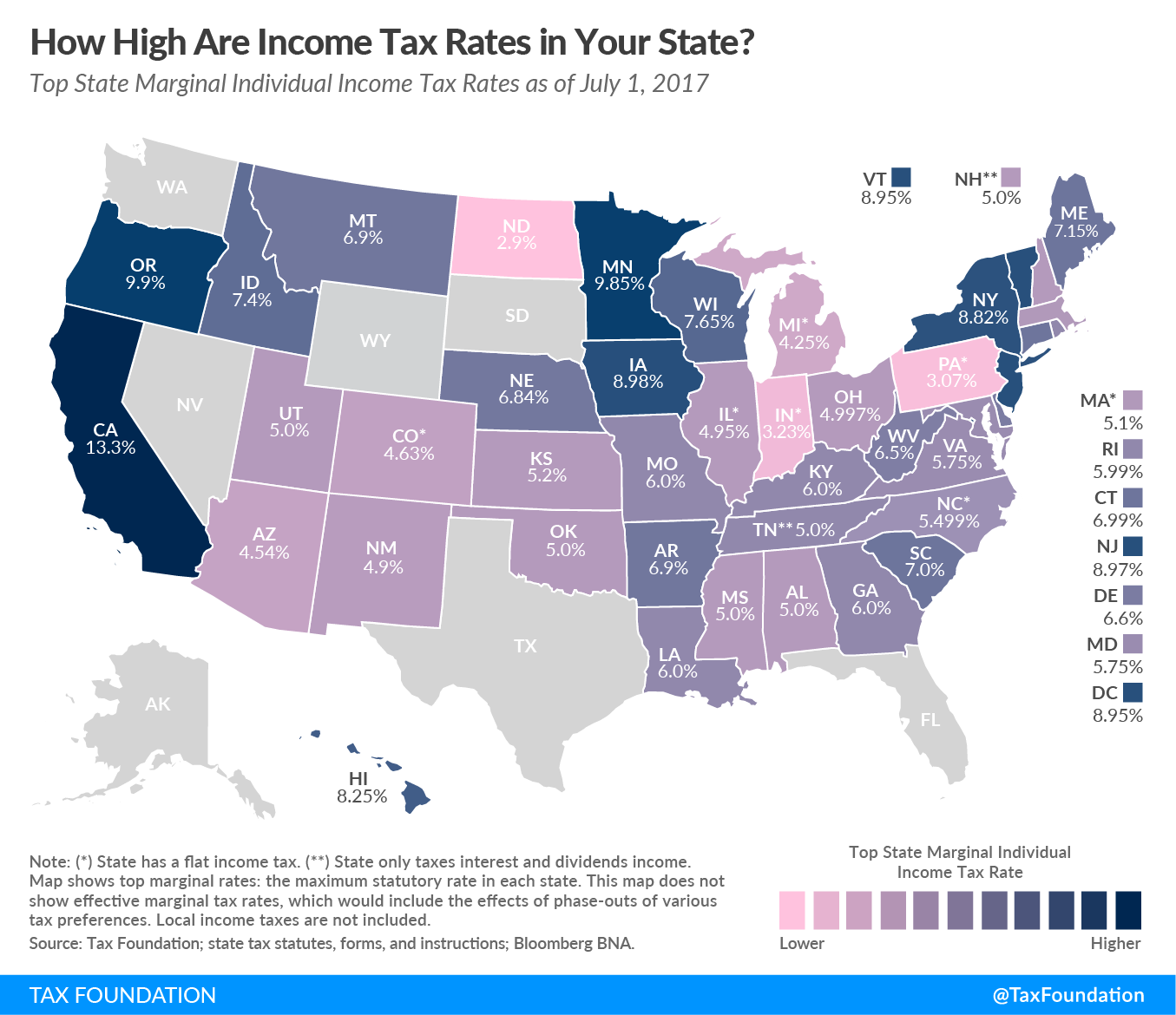

Reposting policy) the state with the highest maximum estate tax rate is washington (20 percent), followed by eleven states which have a maximum rate of 16 percent. No estate tax or inheritance tax. Hawaii and delaware have the highest exemption threshold at $5,340,000 (matching the federal exemption).

Only $100 is exempt from inheritance tax. The higher exemption will expire dec. Indiana also has a dependent.

The federal credit for state death taxes table has a tax rate of 0% for the first $40,000. but his state's exemption is only $1 million. The balance over this amount—$2 million—would therefore be subject to a.

No estate tax or inheritance tax For instance, if your taxable estate is $15 million, then after the $11.7 million credit, $3.3 million is taxable. In general, estates or beneficiaries of.

The top inheritance tax rate is 15 percent (no exemption threshold) kansas: To learn more about some of these strategies visit our asset protection services page. Estate income tax through the fiduciary income tax return, if more than $600 was made by the estate;

As of 2015, only estates with a taxable value of more than $5.43 million were subject to the tax. The maximum federal estate tax rate is 40 percent on the value of an estate above that amount. For married couples, this threshold is doubled, meaning they can protect up to $23.4 million in 2021.

If your estate is over the estate tax exemption amount, then your estate will be required to pay a flat 40% estate tax on everything over the threshold. The estate tax was first levied by the federal government in 1916. The final income tax return of the decedent;

This exemption threshold changes according to inflation; Indiana’s inheritance tax retroactively to january 1, 2013.

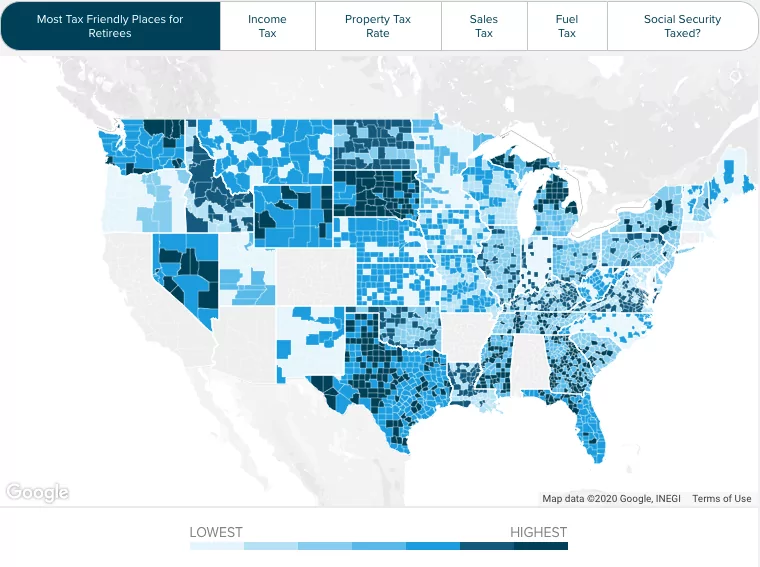

Indiana Retirement Tax Friendliness – Smartasset

2

2

Filing Final Tax Returns For The Deceased Comprehensive Retirement Solutions Crs Tax Solutions

Indiana Property Tax Calculator – Smartasset

Indiana Inheritance Tax Free Download

Download Instructions For Form Ih-6 Indiana Inheritance Tax Return Pdf Templateroller

State Estate And Inheritance Taxes

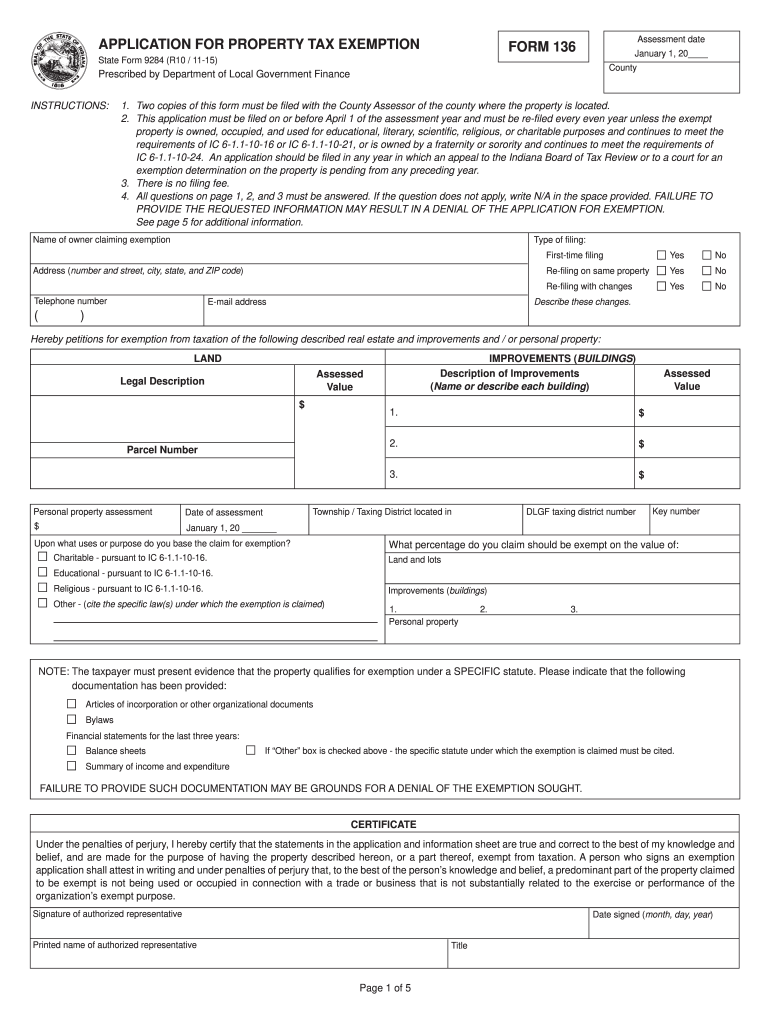

In State Form 9284 2015-2021 – Fill Out Tax Template Online Us Legal Forms

Indiana Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

How Do State Estate And Inheritance Taxes Work Tax Policy Center

All Eyes On Nevada Real Estate For 2018 Tahoe Luxury Properties

Dor Stages Of Collection

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Historical Indiana Tax Policy Information – Ballotpedia

Estate Tax Planning In Indiana – Hunter Estate Elder Law

2021 Estate Income Tax Calculator Rates

Indiana Retirement Tax Friendliness – Smartasset