Taxable income (r) rates of tax; Announcing the projected budget for.

Foreign Exchange Forex Definition Forex Foreign Exchange Forex Brokers

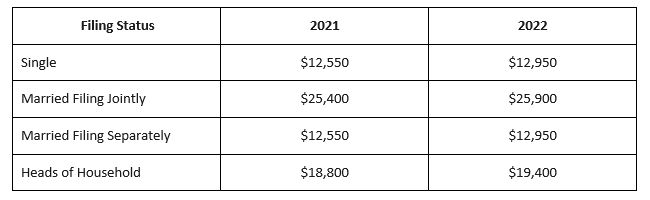

2021 and 2022 tax years:

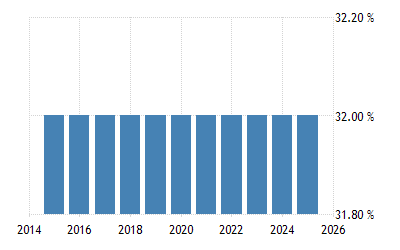

Income tax rates 2022 south africa. Calculate your income tax for 2021 / 2022. 110 739 + 36% of taxable income above 467 500. The personal income tax rate in south africa stands at 45 percent.

Individuals and special trusts taxable income. If you are 65 years of age to below 75 years, the tax threshold (i.e. 70 532 + 31% of taxable income above 337 800.

Calculate how tax changes will affect your pocket. Progressive tax rates apply for individuals. A new tax reality budget 2021 | 3 tax rates (year of assessment ending 28 february 2022) taxthresholds age threshold below age 65 r87 300 age 65 to below 75 r135 150 age 75 and older r151 100 trusts, other than special trusts, will be taxed at a flat rate of 45%.

Tax rates are proposed by the minister of finance in the annual budget speech and fixed or passed by parliament each year. Established in terms of the south african revenue service act 34 of 1997 as an autonomous agency, we are responsible for administering the south. The south africa tax calculator is designed to provide you with a salary illustration with calculations to show how much income tax you will pay in 2022 and your net pay (the amount of money you take.

Tax rates are proposed by the minister of finance in the annual budget speech and fixed or passed by parliament each year. 38 916 + 26% of taxable income above 216 200. Sars monthly tax deduction tables (pdf downloadable) 2022, 2021 and 2019:

2021 and 2022 tax years: The south africa annual income tax calculator for 2022 uses the tax tables from the south african revenue service (sars), south africa's nation's tax collecting authority for the 2022 tax year. This sars tax pocket guide provides a synopsis of the most important tax, duty and levy related information for 2021/22.

You are viewing the income tax rates, thresholds and allowances for the 2022 tax year in south africa. Personal income tax rate in south africa averaged 41.24 percent from 2004 until 2020, reaching an all time high of 45 percent in 2017 and a record low of 40 percent in 2005. According to the website of sars (www.sars.gov.za), as it describes itself as follows:

For taxpayers aged 75 years and older, this threshold is r151 100. If you are looking for an alternative tax year, please select one below. 2021 / 2022 tax year:

The amount above which income tax becomes payable) is r135 150. Sars income tax calculator for 2022 work out salary tax (paye), uif, taxable income and what tax rates you will pay “the south african revenue service (sars) is the nation’s tax collecting authority.

It’s so easy to use. Income tax for years of assessment ending during the following periods: Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year.

Rates of tax for individuals; The below table shows the personal income tax rates from 1 march 2021 to 28 february 2022 for individuals and trusts in south africa: Individuals and trusts tax rates from 1 march 2021 to 28 february 2022:

The rates for the tax year commencing on 1 march 2021 and ending on 28 february 2022 are as follows: 2022 tax rates, thresholds and allowance for individuals, companies, trusts and small business corporations (sbc) in south africa. Decoding the budget speech hours after it's been delivered.

In this section you can find a list of income tax rates for the past five years for: Companies, trusts and small business corporations (sbc) medical tax credit rates; Our online salary tax calculator is in line with changes announced in the 2021/2022 budget speech.

Irs Provides Tax Inflation Adjustments For Tax Year 2022 – Tax – United States

G20 Presidency Of Indonesia 2022

Irs Provides Tax Inflation Adjustments For Tax Year 2022 – Tax – United States

Taxavvy Budget 2022 Edition Part 1

750 Tax Pictures Download Free Images On Unsplash

Poland Personal Income Tax Rate 2021 Data 2022 Forecast 1995-2020 Historical

Budget 2022

Pin On The Economy

Honda Drops New Browser Game Evotrack To Celebrate 2022 Civic Si Debut Xl8 Translate Cars C In 2021 Honda Civic Si Honda Civic Red Bull Racing

G20 Presidency Of Indonesia 2022

Here Is The New 2022 School Calendar For South Africa

2022 Will Be The Year Of Adjusting To New Realities According To The Economists The World Ahead 2022

Sars Tax Tables 20212022 Beginners Tax Guide Sa Shares

Fifa World Cup 2022 Uefa Group Stage Qualifying Draw – As It Happened – Ascom

Angola Is Expanding And Modernising Its Diamond Sector With The Ultimate Goal Of Becoming Africas Number One Producer Of T Infographic Angola Economic Trends

Tobacco Market Size Share Trends Revenue And Future Growth Analysis 2027 Grand View Research Inc Developed Economy Segmentation Groundwater

Budget 2022 Main Points Whats In It For You

G20 Presidency Of Indonesia 2022

2022 Will Be The Year Of Adjusting To New Realities According To The Economists The World Ahead 2022