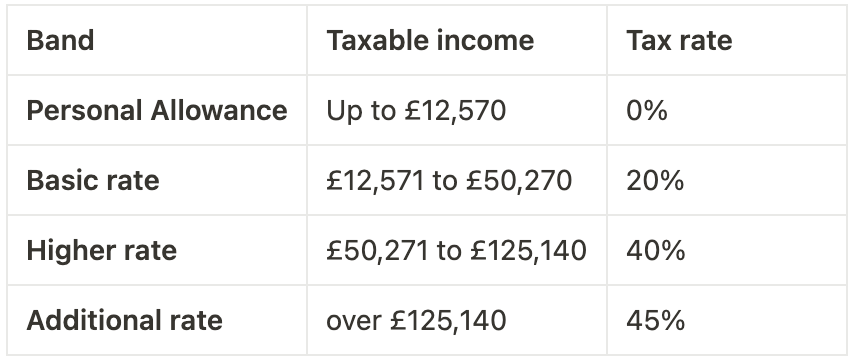

The amount of income that is not taxable is 12,570 pounds per year. Percent of income to taxes = 35%.

Income-taxcouk – Uk Tax Calculator – Home Facebook

£10,000 £20,000 £30,000 £40,000 £50,000 £60,000 £70,000.

Income tax calculator uk. The income tax calculator calculates the income tax payable after available reliefs, for one or more chargeable event gains on a life or redemption policy. Table of income tax bands by tax year. Income tax for united kingdom is tax paid based on your income during the tax year, which starts on april 6th and ends on april 5th in the following year in uk.

If your salary is £45,000 a year, you'll take home £2,853 every month. Need more advanced tax calculations? The latest budget information from april 2021 is used to show you exactly what you need to know.

Reduce tax if you wear/wore a uniform: Our income tax calculator calculates your federal, state and local taxes based on several key inputs: Your household income, location, filing status and number of.

Salary calculator our salary calculator calculates your income tax and national insurance contributions. A personal allowance is an amount of income you can earn each year before you need to pay income tax. Uk income tax calculator quickly calculate how much tax you need to pay on your income.

It takes into account income related personal. By analogy with the minimum wage, the rates are revised every year on april 1st. Salary after tax calculator quickly calculate your take home pay and know how much you pay in taxes.

Why not find your dream salary, too? Just copy and paste the below code to your webpage where you want to display this calculator. The total federal tax that you would pay is $6,155 (equal to your income tax, on top of your medicare and social security costs).

2018/19 2019/20 2020/21 2021/22 2022/23. Between £50,271 and £150,000, you'll pay at 40% (known as the higher rate) and above £150,000, you'll pay 45% (the additional rate). Free tax code calculator 2.

The uk's income tax and national insurance rates for the current year are set out in the tables below. Up to £2,000/yr free per child to help with childcare costs: £ 40,000 salary take home pay.

Note that your personal allowance decreases by. Dividend tax calculator quickly calculate the tax you need to. Transfer unused allowance to your spouse:

Estimate your earned income tax credit (eic or eitc) for 2021 tax year with our eic calculator This provision does not apply to. The united kingdom has a progressive income tax scale of 0 to 45%.

Total estimated tax burden $19,560. It is not the same for everyone, as for those who earn over £100,000, their personal. The simple uk income tax calculator.

Student loan, pension contributions, bonuses, company car, dividends, scottish tax and many more advanced features available in our tax calculator below. This calculator only provides you with an indication of the tax you may have to pay based on rates and allowances which apply to the 2021/22 tax year. With all this in mind, the total amount that you would take home is $33,845.

Note that for uk income above £100,000, the personal allowance reduces by £1 for every £2 of income above the £100,000 limit. If you earn £ 40,000 a year, then after your taxes and national insurance you will take home £ 30,840 a year, or £ 2,570 per month as a net salary. Highly accurate and reliable income tax calculator for uk based taxpayers, with detailed information about tax, national insurance and net pay.

It can’t be used where the gain is assessable on trustees, or where a company owns the investment, because life and redemption contracts owned by a company are taxed under the ‘loan. This tool is an online utility. See your income tax, pension, childcare, student loan and national insurance breakdown.

These include income tax as well as national insurance payments. You can dynamically calculate the income tax for united. Your gross hourly rate will be £21.63 if you're working 40 hours per week.

Calculate your net salary and find out exactly how much tax and national insurance you should pay to hmrc based on your income. Hourly rates, weekly pay and bonuses are also catered for. Tax calculators and tax tools to check your income and salary after deductions such as uk tax, national insurance, pensions and student loans.

Tax Calculator Take Home Pay Calculator – Reedcouk

Tax Refund Calculator – Are You Due A Tax Repayment – Quickrebates Tax Refund Tax Calculator

Income-taxcouk – Uk Tax Calculator – Home Facebook

Self-employed Tax Calculator Small Business Bookkeeping Business Tax Self Employment

How Is Corporation Tax Calculated – Jf Financial

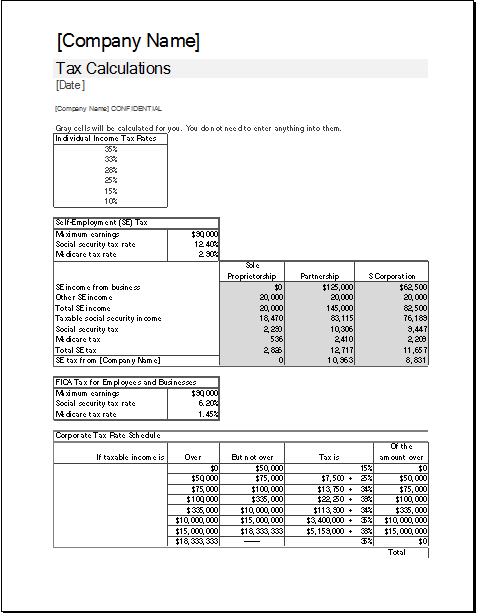

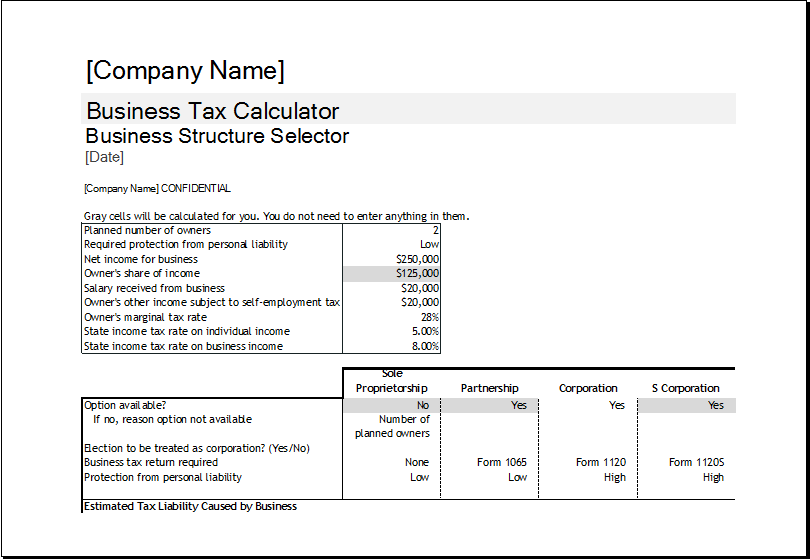

Corporate Tax Calculator Template For Excel Excel Templates

Income Tax Calculator App – Concept Calculator App Tax App Discount Calculator

Corporate Tax Calculator Template For Excel Excel Templates

Hmrc Tax Refund Calculator Will Guide You To Understand Whether You Are Eligible For A Refund From Hmrc Or Not Sinc Income Tax Return Income Tax Tax Return

How Is Tax Calculated Explained Example Rates Simplified 2018 Calculator

Uk Income Tax Calculator – December 2021 – Incomeaftertaxcom

60000 After Tax 2021 – Income Tax Uk

Computation Of Salary Income Tax Jobs Ecityworks

The Salary Calculator – Hourly Wage Tax Calculator Salary Calculator Salary Federal Income Tax

How To Calculate Income Tax In Excel

Tax And National Insurance Calculator – Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware

Tax And National Insurance Calculator – Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax Calculator Take Home Pay Calculator Wage Calculator Tax Refund Revenue Security Companies