Year of assessment (ya) 2015 (income generated in the basis period 1 january 2014 to 31 december 2014) income; Singapore personal income tax calculator ya2020.

Excel Investment Singapore Iras Income Tax Calculator

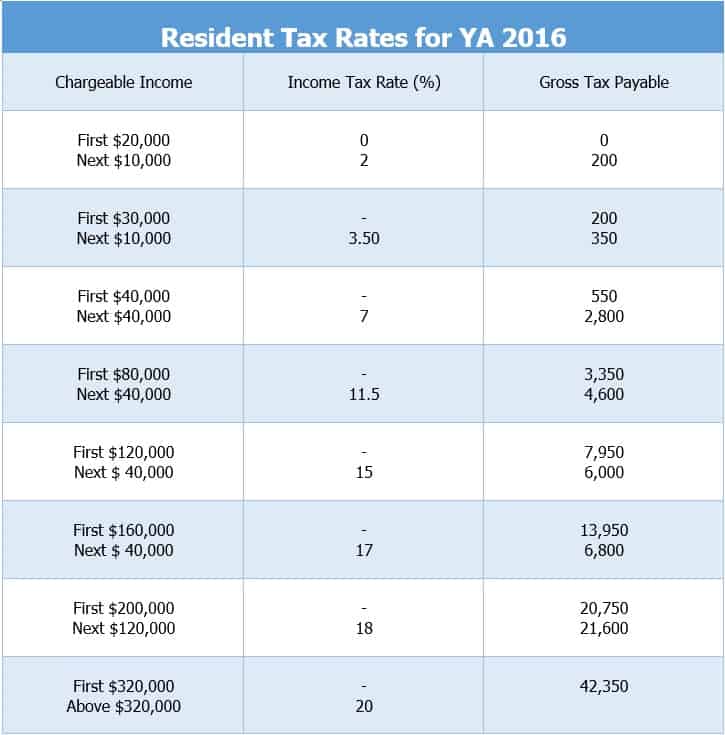

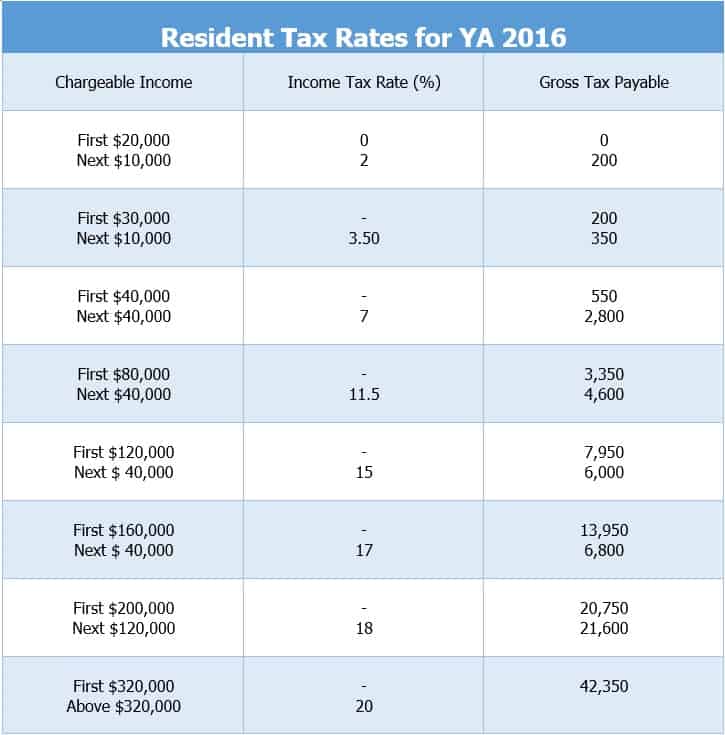

If you are a resident in singapore, the rates of tax chargeable are as follows:

Income tax calculator singapore. Other gains that are revenue in nature. Welcome to the singapore tax calculator. Below is a snapshot of a personal income tax calculator in excel format.

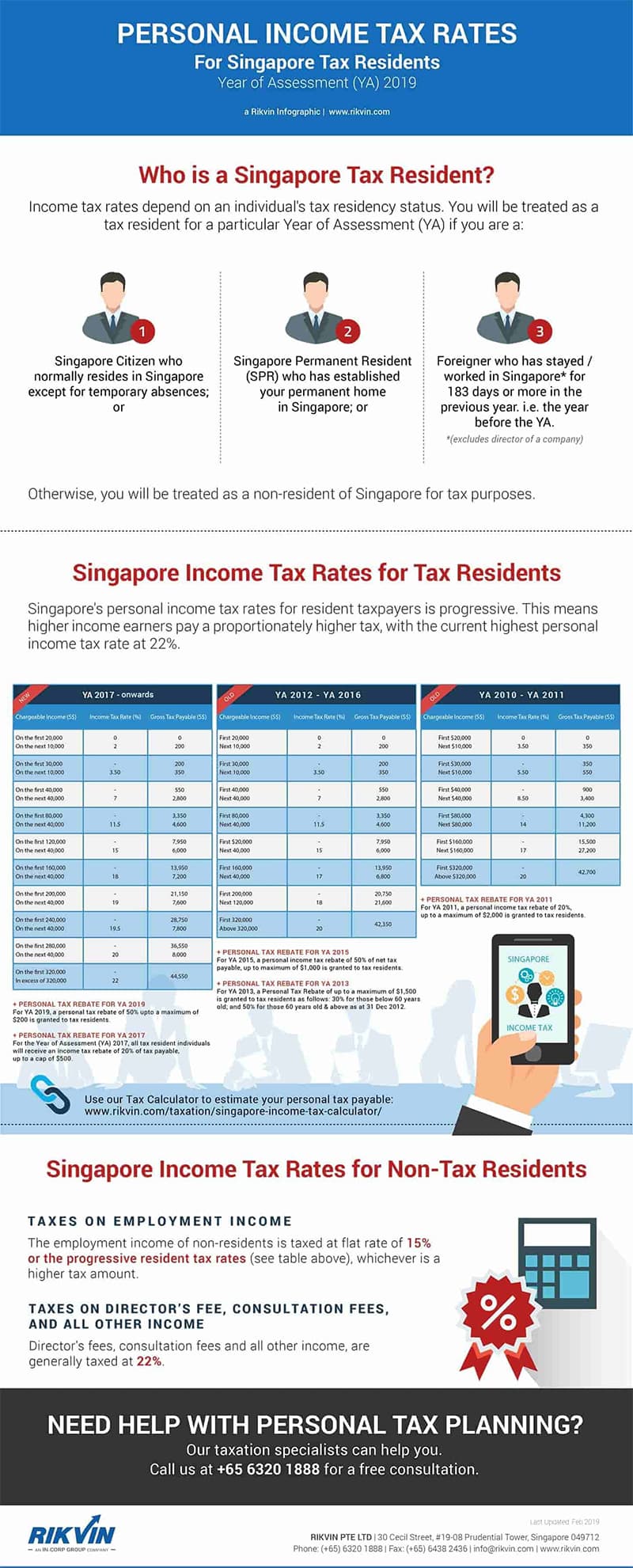

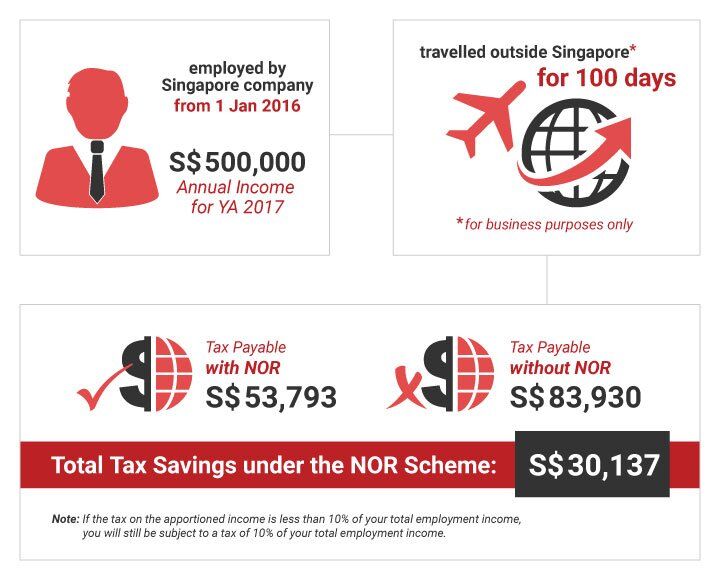

You can work out your annual salary and take home pay using the singapore salary calculator or look at typical earning by entering a figure in the quick calculator or viewing one of the salary examples further down this page. Income tax rates for singapore residents ya 2019 onwards To understand what you owe to the iras, you need to know how personal tax calculations are done under the progressive rate system.

Tax on next $4,750 @ 3.5%. Type your personal income details in the following form to calculate your tax payable. Enter your gross employment income for the previous year (including any bonuses, fixed allowances and any benefits in kind).

Generally, deductible business expenses are those ‘wholly and exclusively incurred in the production of income’. Individuals are taxed only on the income earned in singapore and the tax rates for resident taxpayers are progressive, with higher rates being applied to higher income levels. You can also visit the iras website for an updated tax calculator.

From the year of assessment 2018, the total amount of reliefs you can claim is subject to an overall relief cap of $80,000note 2. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Tax clearance calculator y tax clearance is not required for the following scenarios:

Icalculator singapore income tax salary calculator is updated for the. The personal income tax rate in singapore is one of the lowest in the world and depends on the residency status. Mr heng's tax payable on his chargeable income of $34,750 is calculated as follows:

Example of a standard personal income tax calculation in singapore this site uses cookies to collect information about your browsing activities in order to provide you with more relevant content and promotional materials, and help. Employment income employment income enter your gross employment income for the previous year (including any bonuses, fixed allowances and any benefits in kind). More details about singapore resident tax rates can be found here.

The singapore income tax calculator is designed for tax resident individuals who wish to calculate their salary and income tax deductions for the 2021 assessment year (the year ending 31 december 2020. Singapore’s personal income tax rate ranges from 0% to 22%. Details about income tax in singapore.

Example salary illustrations for singapore including income tax and expense deductions. Do not deduct cpf paid. Please feel free to leave the comments below at the bottom of this page.

When it comes to preparing your tax return you want to make sure you have all the bases covered. Income tax calculators for individuals, businesses, gst, property, etc are conveniently provided by the inland revenue authority of singapore (iras) on its website. Please refer to how to calculate your tax for more details.

On the first $10,000 of normal chargeable income, there is a 75% exemption; Singapore personal income tax calculator. Tax implications for foreigners at a glance (in singapore for 61 to 182 days in a year) your employment income is taxed at 15% or progressive resident rates, whichever results in a higher tax amount.

Tax rates range from 0% to 22% for residents. For singapore tax purposes, taxable income refers to: You are not entitled to tax reliefs.

This website has been made for you to quickly get an idea of the amount of taxes you might have to pay especially for the work visa holders. An extra 50% exemption on the next $190,000 of normal chargeable income. Code to add this calci to your website just copy and paste the below code to your webpage where you want to display this calculator.

Filing your returns could be daunting if you have zero knowledge about tax filing. Mytax portal is a secured, personalised portal for you to view and manage your tax. Individual income tax, corporate tax, withholding tax, property tax and goods and services tax.

The highest personal income tax rate of 22% are for individuals with an annual taxable income of more than $320,000. This application is a service of the singapore government. Refer to singapore iras to know exactly how taxation works for you.

Filing your singapore corporate tax. Simple tax calculator which is used to calculate the income tax for the singapore resident individuals. For example, individual tax residents can utilise the income tax calculator under individual income tax to compute their tax liability.

Calculating taxable income in singapore. Director's fees and other income are taxed at the prevailing rate of 22%. Understanding the concept of taxable income is very important to avoid making filing mistakes.

The personal income tax system in singapore is a progressive tax system. Here is a table with details of all the income tax slab structures. The current highest personal income tax rate is at 22%.

You can also select future and historical tax years for additional income tax calculations (where figures are held, if you would like to. You may also use the tax calculator for resident individuals (xls, 96kb) to estimate your tax payable. Your chargeable income is the amount remaining after deducting from your assessable income the personal reliefs to which you are entitled.

Your Cheat Sheet Personal Income Tax In Singapore

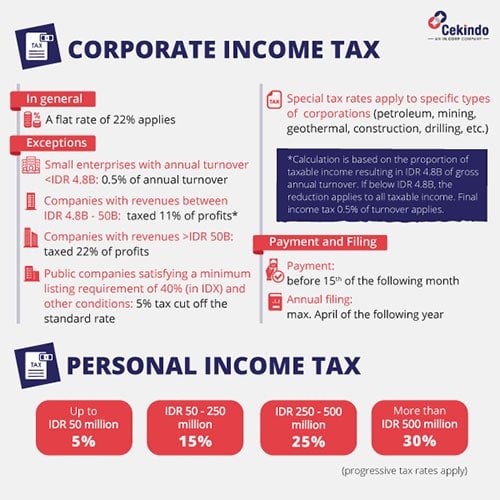

Taxation System In Indonesia Your Guide To Income Taxation

Personal Income Tax Rates For Singapore Tax Residents Ya 2010-2019

How Much Income Tax Should I Pay Calculator – Tax Walls

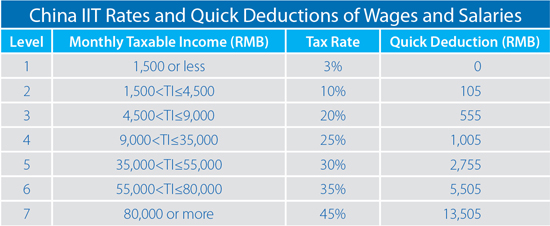

How To Calculate Your 2013 Expatriate Individual Income Tax In China – China Briefing News

Calculating Individual Income Tax On Annual Bonus In China – Updates Dezan Shira Associates

Singapore Personal Income Tax Taxation Guide

Personal Income Tax Calculator Singapore

How To Calculate Foreigners Income Tax In China China Admissions

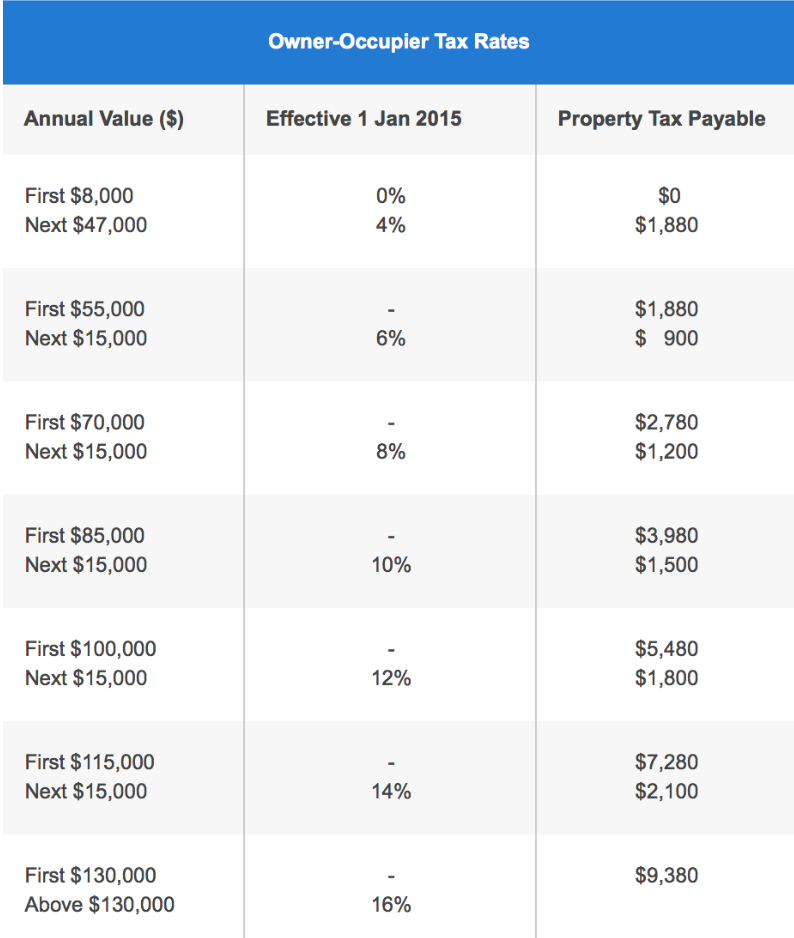

Property Tax For Homeowners How Much To Pay Rebates Deadline 2021 Update

Income Tax Singapore Vs Us

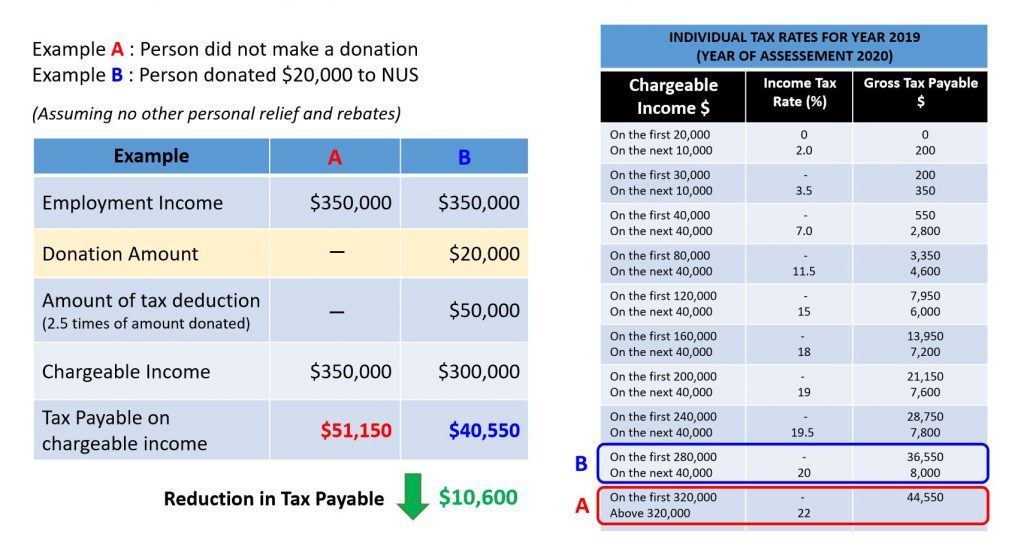

Donation Tax Calculator – Giving Nus Yong Loo Lin School Of Medicine Giving Nus Yong Loo Lin School Of Medicine

Singapore Income Tax Calculator – Corporateguide Singapore

Singapore Tax Calculator On Google Spreadsheet Just2me

Taxation System In Indonesia Your Guide To Income Taxation

Personal Income Tax Rates For Singapore Tax Residents Ya 2010-2019

How To File Income Tax In Singapore And What You Need To Know

A Guide To Singapore Personal Tax

Singapore Individual Income Tax Filing For 2016