The train law also implemented value added tax (vat) exemptions on certain commodities and products. The 13th month pay is included in the calculation of the income tax, assuming that the taxable amount, if any (if 13th month pay exceeds p90,000), is annualized or.

Sun Maxilink 100 Insurance Investments Retirement Fund Critical Illness

Maaring magbayad ang mga propesyunal na kumukita ng 3 milyon pababa ng 8% na buwis sa lahat ng kabayarang siningil ng propsesyunal, sa halip na magbayad ng personal income.

Income tax calculator philippines. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. There are now different online tax calculators in the philippines. (ii) those earning between p250,000 and p400,000 per year will be charged an income tax rate of 20% on the excess over p250,000.

Taxumo is the best option for digital tax filing in the philippines. If you are a contractor and want a calculation on your tax and net retention in the philippines, we can supply it to you free of charge. Inputs are the basic salary (half of monthly salary), deductions, other allowances and overtime in hours.

The national tax research center (ntrc) is an agency under the dof that conducts research in taxation to improve the tax system in the philippines. Determine the range of income. With new income tax rates comes a reform to the tax calculator in the philippines.

To help make sense, taxumo, a leading online tax compliance tool and pdax sponsored a crypto tax 101 webinar moderated. To access withholding tax calculator click here. Notes on the tax calculator:

The most popular part of the train law is the reduction of the personal income tax. The compensation income tax system in the philippines is a progressive tax system. This tax calculator will provide a simplified computation of your monthly tax obligation under the new tax reform.

Figures shown by the calculator are based on the tax reform’s tax schedule for 2017, 2018, and 2019, including deductible exemptions and contributions. You must always be sure to go with the best, efficient, updated, and legitimate online tax calculator program. It is the # 1 online tax calculator in the philippines.

Failure to meet the deadline will result in penalties such as a 25% surcharge of the tax due and a 20% interest per year from the. Tax changes you need to know on ra 10963 (train) 2017 philippine capital income and financial intermediation statistics. To estimate the impact of the train law on your compensation income, click here.

Determine the applicable row of the compensation using the revised tax table. Procedures for availment of tax subsidy of goccs. (i) those earning an annual salary of p250,000 or below will no longer pay income tax (zero income tax).

This calculator was originally developed in excel spreadsheet, if you wish to get a copy please subscribe to our youtube channel and contact us via our. Inputs are the basic salary (half of monthly salary), deductions, other allowances and overtime in hours. Highlights of the firb accomplishment report cy 2014.

Philippine public finance and related statistics 2017. Calculate your take home pay in philippines (that's your salary after tax), with the philippines salary calculator. 22 agu, 2021 how to compute income tax return philippines 2018 / tax calculator:

Tax rates range from 0% to 35%. A quick and efficient way to compare salaries in philippines, review income tax deductions for income in philippines and estimate your tax returns for your salary in philippines.the philippines tax calculator is a diverse tool and we may refer to it as the philippines wage. Review the 2020 philippines income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions, pension contributions and other salary taxes in.

This means employee a's tax is p1,875 plus 25% of the difference of his taxable income (p24,006.20) and the amount in the table (p17,917). However, in the last four months of the taxable year, he earned taxable overtime pay amounting to php 5000, php 4500, php 4000 and php 1,500 respectively, resulting in a php 15,000 increase in gross taxable income. (iii) those earning annual incomes between p400,000 and p800,000 will pay a fixed amount of p30,000 plus 25% of the excess over p400,000.

Income tax in the philippines can range from 5 to 32 percent, and you need to be sure you are placed in the correct tax brackets. Example of a standard personal income tax calculation in philippines philippine social tax contributions, if any, made by the resident alien and/or his wife to the philippine social security agencies shall be allowed as deductions from gross income in calculating their tax liabilities for the year. Income tax law provided in tax code of 19997 governs income tax procedures in philippines, resident citizens receiving income from sources within and outside philippines fall under income tax category, use this online calculator to calculate your taxable income.

Its online income tax calculator is quite similar in terms of features and functions to the dof tax calculator, except that the former provides more detailed information.

A Year To Manage Our Money Rolling With Marbles Investing Mutuals Funds Time Management

Need A Household Employer Unified Registration Form Heres A Free Template Create Ready-to-use Forms At Formsbankcom Registration Form Employment Form

Budget 2020 Esops Taxation Get A Breathing Space Start Up Budgeting Tax Payment

Pengertian Laporan Laba Ditahan Adalah Cara Buat Contoh Pertahanan Keuangan

Sample Financial Reports Report Templates Annual For School Example Within Quarterly Report T Income Statement Personal Financial Statement Financial Statement

Pin On It

Ebook Pdf – Redfern And Hunter On International Arbitration In 2021 Law Books Good Books Ebook

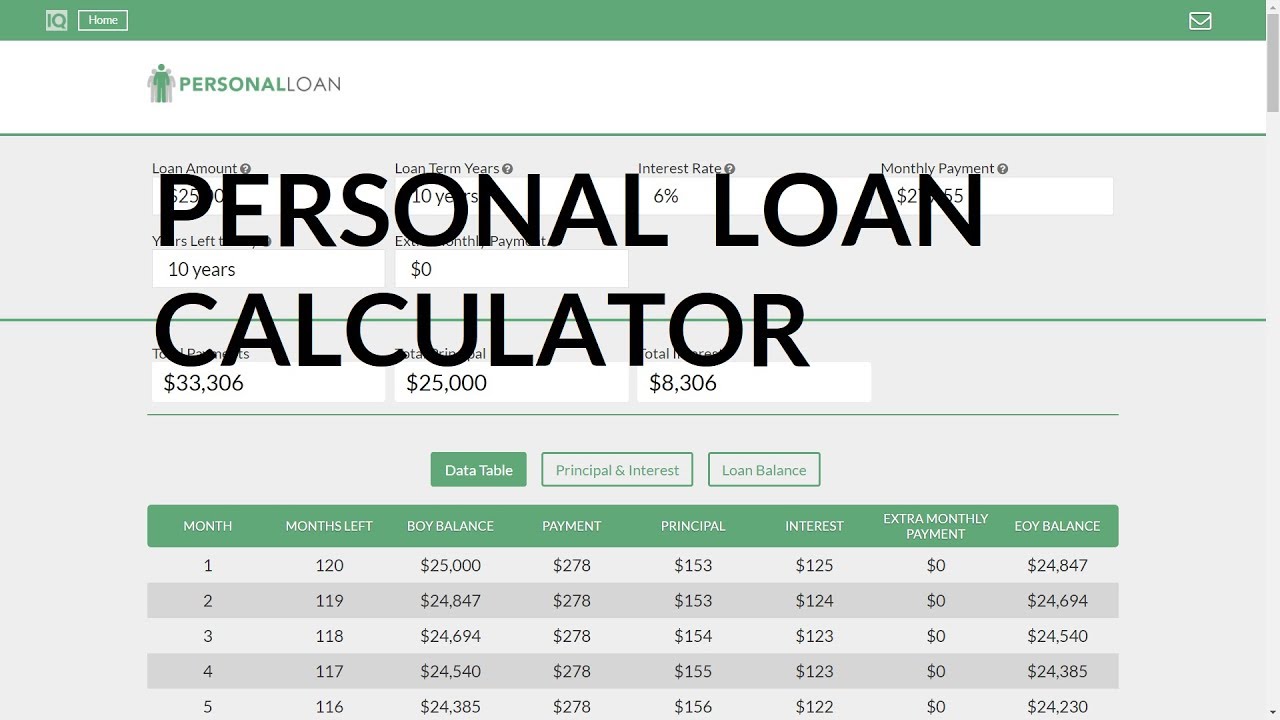

Loan Calculator For Personal Loans Personal Loan Payments Calculator Personalloans Debt Personal Loans Loan Calculator Short Term Loans

Here Are Some Pointers To Remember And The Steps You Should Take When Building An Investment Portfolio – All In One Infographic Fsmsmart Investment Portfo

Pin By Philippine Social Security Sys On Sss Faqs Pie Chart Chart

6 Budgets You Need To Master Personal Finance Budgeting Saving Money Quotes Personal Finance Budget

Rental Property Cash Flow Real Estate Investing Rental Property Rental Property Investment Real Estate Investing

57000 Income Tax Calculator Texas – Salary After Taxes Income Tax Payroll Taxes Federal Income Tax

Growth Startup Growth Business Growth Growth

Pin By Lendedu On Best Of Lendedu Tax Refund Finance Irs Taxes

Bookkeeper Vs Accountant Whats The Difference Ageras Bookkeeping Tax Tricks Accounting

Pin On Currency

The Power Of Real Estate Investing Success Business Motivation Money Management Advice Finance Investing

How To File Your Income Tax Return In The Philippines Mommy Unwired Income Tax Return Income Tax Tax Return