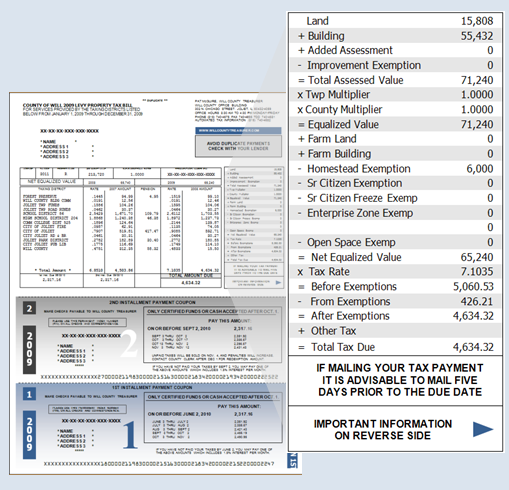

Property tax second installment due date: Federal and state payroll tax deposits due for monthly depositors:

Tax On Farm Estates And Inherited Gains Farmdoc Daily

A certificate of discharge is requested.

Illinois estate tax return due date. Illinois residents will now have until may 17 to file their individual state income taxes and to make any payments, gov. 86, § 2000.100, et seq.) may be found on the illinois general assembly's website. Tuesday, march 2, 2021 (late payment interest waived through monday, may 3, 2021)

At this time, the executor must also submit copies of appraisals and other ownership documents. The dollar amounts and limits in irs form 706 are also indexed for inflation. This extension request should be filed within 9 months of date of death.

$0.96 million x 0.12 (marginal rate) = $115,200. Estate tax section 1 east old state capitol plaza springfield, il 62701. 86, § 2000.100, et seq.) may be found on the illinois general assembly's website.

Federal and state payroll tax deposits due for monthly depositors: Linkedin with background the balance C and s corporations due for year ended july 31:

The administrator, executor, trustee, etc.,). Illinois estate tax regulations (ill. Office of the illinois treasurer attn:

Friday, october 1, 2021 tax year 2020 first installment due date: Estates valued under $4 million do not need to file estate taxes in illinois. Completed forms must be signed by the duly appointed representative of the estate (example:

There are a number of methods that illinois property owners can use to avoid paying estate taxes. If an estate exceeds that amount, the top tax rate is. The illinois estate tax exemption for 2015 is.

(b) a claim for refund of illinois estate tax or penalties arising from the effective date provisions set forth in subsection (a) of this section shall not be denied because of the expiration of the time for filing that claim, under the law that otherwise would apply, if the claim is filed not later than the date which is one year after the date this act takes effect. If the value of your estate is $6.45 million, only $1 million will be taxable on the federal level (i use the word “only” loosely). Due date extended due date ;

13 rows note that the table below is for estate income tax returns, form 1041, not estate tax. An illinois inheritance tax release may be necessary if a decedent died before january 1, 1983. Property tax first installment due date:

Tax year 2020 second installment due date: A federal estate tax return or any other form containing the same information is attached (whether or not a federal estate tax is due), and an illinois estate tax is due. Extended due date for partnerships and individuals :

This documentation is due within nine months of the decedent’s death, although extensions are granted in certain cases. Estate taxes should be paid within nine months after the death of the loved one. The federal estate tax exemption is $11.7 million in 2021.

Does illinois have an inheritance / estate tax? For 2017, the basic exclusion amount for a decedent’s estate is $5,490,000. An illinois inheritance tax release may be necessary if a decedent died before january 1, 1983.

Illinois estate tax regulations (ill. What about illinois estate tax? However, inheritance/estate tax is not administered by the illinois department of revenue.

This means that if the value of your estate is less than $5.45 million, federal estate tax will not apply to you. It is portable between spouses, meaning if the right legal steps are taken, a married couple can protect up to $23.4 million. Like federal estate tax returns, an illinois estate tax return is also due nine months after the death of the decedent.

Www2deloittecom

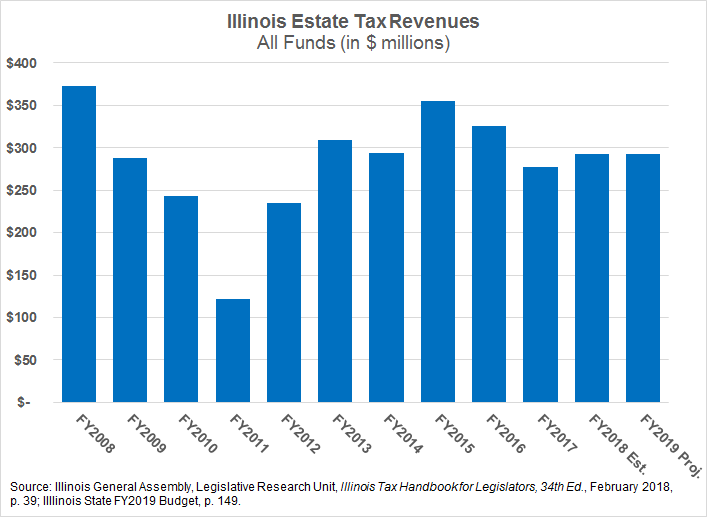

Whither The Illinois Estate Tax The Civic Federation

How Does The Illinois Estate Tax Affect You – Dhjj

Www2illinoisgov

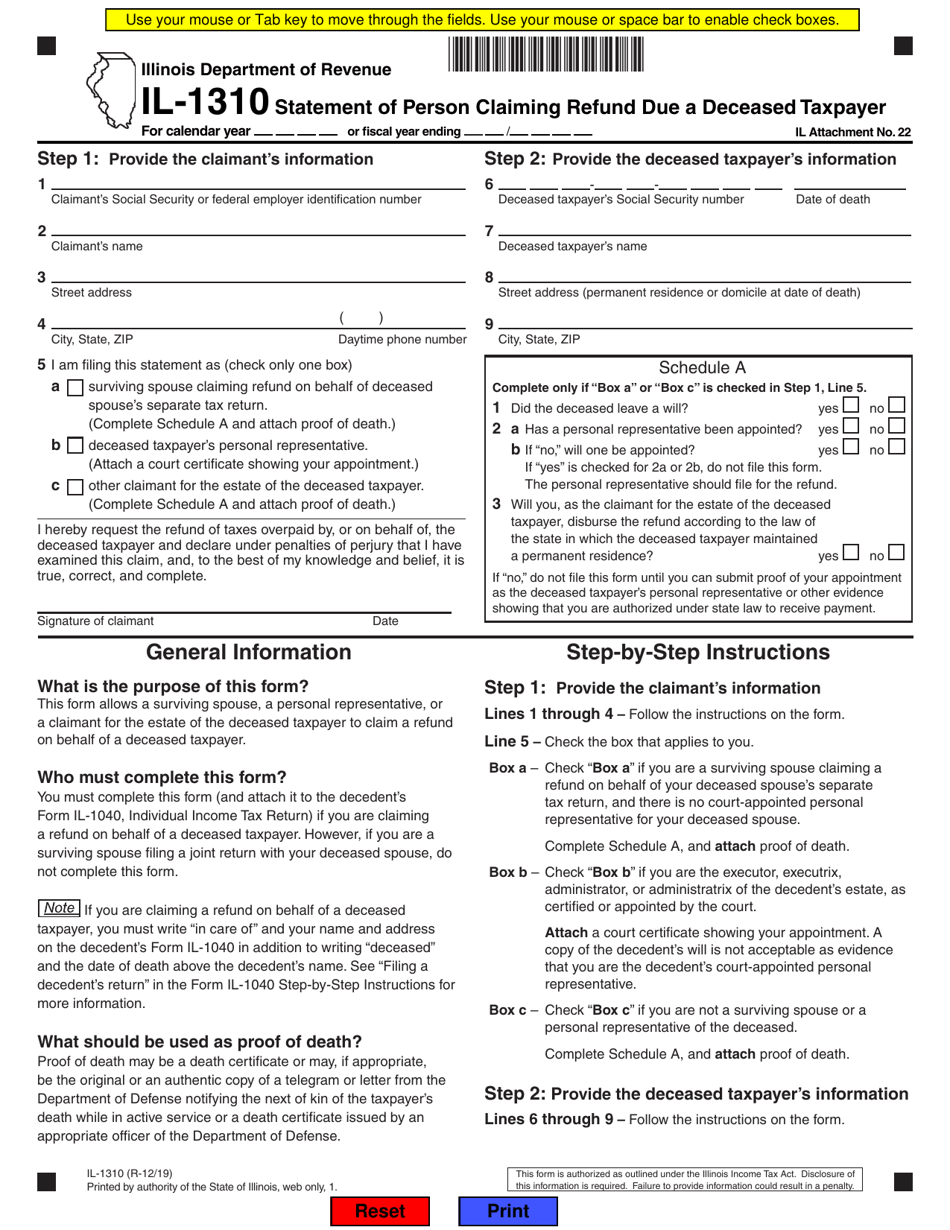

How To File Federal Income Taxes For A Deceased Taxpayer

Www2illinoisgov

Es402 Introduction To Estate Gift Tax

Illinois Estate Planning Will Drafting And Estate Administration Forms With Practice Commentary Lexisnexis Store

Illinois Taxes Deadlines Extended Due To Covid-19 Wipfli

Exemptions

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/whentofileform706-9ccbf11aa54249f3833d43622eb43afe.jpg)

When Is Form 706 Due For Estate Taxes

Zillionformscom

National Business Institute Estate Administration Procedures Why Each Step Is Important Understanding Tax Procedures To Avoid Problems Later – Pdf Free Download

17 States With Estate Taxes Or Inheritance Taxes

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

Resourcestaxschoolillinoisedu

Www2deloittecom

Www2deloittecom

Form Il-1310 Download Fillable Pdf Or Fill Online Statement Of Person Claiming Refund Due A Deceased Taxpayer Illinois Templateroller