The illinois salary calculator is a good calculator for calculating your total salary deductions each year, this includes federal income tax rates and thresholds in 2022 and illinois state income tax rates and thresholds in 2022. The calculator will automatically assume that the employer takes the maximum possible tip credit, and calculate tip and cash wage earnings accordingly.

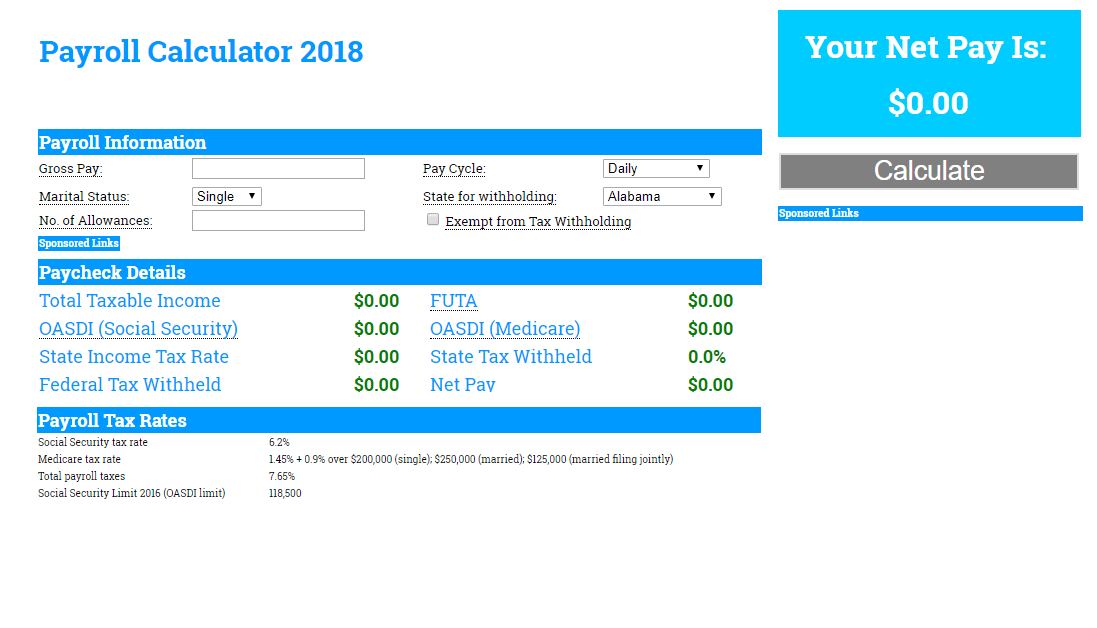

Paycheck Calculator – Take Home Pay Calculator

The telecommunications tax is a tax on services including home phone lines, cell phones, television service and internet.

Illinois employer payroll tax calculator. It is not a substitute for the advice of an accountant or other tax professional. Once you set up company and employee, ezpaycheck will calculate illinois income tax for you automatically. ← back to illinois minimum wage.

The state of illinois collects 38.7 cents for every gallon of regular gasoline. Paycheckcity delivers accurate paycheck calculations to tens of millions of individuals, small businesses, and payroll professionals every year. The free online payroll calculator is a simple, flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Computes federal and state tax withholding for paychecks; Withhold 6.2% of each employee’s taxable wages until they earn gross pay of $142,800 in a given calendar year. It simply refers to the medicare and social security taxes employees and employers have to pay:

Our illinois payroll calculator is designed to help any employer in the land of lincoln save time and get payroll done right. Paycheck manager's free payroll calculator offers online payroll tax deduction calculation, federal income tax withheld, pay stubs, and more. Flexible, hourly, monthly or annual pay rates, bonus or other earning items;

The information provided by the paycheck calculator provides general information regarding the calculation of taxes on wages for illinois residents only. Including federal and state tax rates, withholding forms, and payroll tools. The information provided by the paycheck calculator provides general information regarding the calculation of taxes on wages for illinois residents only.

But, most employers receive a futa tax credit that lowers their futa tax rate to 0.6% on the first $7,000 employees earn. Illinois payroll for employer employers covered by illinois' wage payment law must pay wages at least semimonthly and not more than 13 days following the close of a pay period. Also, these chart amounts do not increase the social security, medicare, or futa tax liability of the employer or the employee.

Household employers should refer to publication 121, illinois income tax withholding for household employees. Your free and reliable 2019 illinois payroll and historical tax resource. Overview of illinois taxes illinois has a flat income tax of 4.95%, which means everyone’s income in illinois is taxed at the same rate by the state.

Payroll software saves il businesses time and money by calculating the taxes automatically ezpaycheck payroll software is a good choice for many small business employers. Employers withhold social security and medicare taxes and make payments on behalf of their employees. I recommend checking out our payroll tax compliance.

Futa tax is 6% of the first $7,000 you pay each employee during the year. Please refer to the table below for a list of 2021 payroll taxes (employee portion and employer portion) that are applicable to the city of chicago in the state of illinois. It varies by location, but is generally about 7% of the price of service.

Details of the personal income tax rates used in the 2022 illinois state calculator are published below the. Both the employee and the employer should be aware of the tax laws in each state. This provide the rates of your state taxes.

401k, 125 plan, county or other special deductions; Your free and reliable illinois payroll and tax resource. The flat and supplemental income tax rate continues at 4.95% for 2020 and the state annual exemption amount per allowance is $2,325.

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. As the employer, you must also match your employees. What are my state payroll tax obligations?

This procedure only applies to nonresident alien employees who have wages subject to income tax withholding. Here are the quick guide. That amount is 15.3%, with 12.4% going.

Your tax rate is 0.6% unless your business is in a credit reduction state. Doing so can help you stay updated with all the product improvements quickbooks desktop offers. The paycheck calculator may not account for every tax or fee that applies to you or your employer at any time.

If you are required to or voluntarily withhold illinois income tax for your illinois employees or payees, you must register with the illinois department of revenue and tell us the date your illinois payroll will begin. We offer stand alone payroll software that can help you It is not a substitute for the advice of an accountant or other tax professional.

But individuals who work for themselves have to pay their own illinois self employment tax. The maximum an employee will pay in 2021 is $8,853.60. The feature to calculate illinois minimum wage credit in quickbooks is not available, ds61938.

The paycheck calculator may not account for every tax or fee that applies to you or your employer at any time. Use the illinois paycheck calculators to see the taxes on your paycheck. Illinois allows employers to credit up to $3.30 in earned tips against an employee's wages per hour, which can result in a cash wage as low as $4.95 per hour.

You can also visit our newsletter page from time to time. Illinois requires employers to withhold income taxes from employee paychecks in addition to employer paid unemployment taxes.you can find illinois’ tax rates here. Monthly paydays are permitted for executive, administrative and professional employees, as well as employees on commission who are covered under the fair labor standards.

What Are Marriage Penalties And Bonuses Tax Policy Center

Ohio Sales Tax Calculator Reverse Sales Dremployee

Compliance Resources To Strengthen Your Business Life Cycles Strengthen Onboarding

S Corp Tax Calculator – Llc Vs C Corp Vs S Corp

Top 6 Free Payroll Calculators – Timecamp

Financial Services Platform Income Tax Calculator Html Code

Financial Services Platform Salary Tax Calculator 2015

Paycheck Calculator – Take Home Pay Calculator

Doordash Tax Calculator 2021 What Will I Owe How Bad Will It Hurt

How Much Should I Set Aside For Taxes 1099

Hr Block Tax Calculator Services

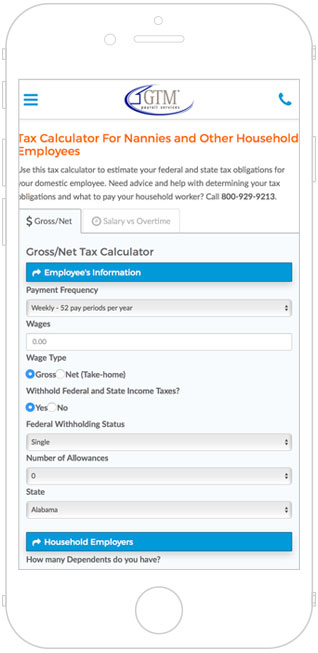

Nanny Tax Payroll Calculator Gtm Payroll Services

Need A Household Employer Unified Registration Form Heres A Free Template Create Ready-to-use Forms At Formsbankcom Registration Form Employment Form

Tip Tax Calculator Payroll For Tipped Employees Onpay

Tip Tax Calculator Primepay

Nanny Tax Payroll Calculator Gtm Payroll Services

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Self-employed Tax Calculator Small Business Bookkeeping Business Tax Self Employment

Us Tax Calculator 2022 Us Salary Calculator 2022 Icalcul