If you purchased a nissan leaf and your tax bill was $5,000, that. Small neighborhood electric vehicles do not qualify for this credit, but they may qualify for another credit.

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Vehicle registration fees for illinois electric vehicles.

Illinois electric car tax credit income limit. The maximum credit is $500 for vehicles with a gross vehicle weight rating (gvwr) of 10,000 pounds (lbs.) or less and $1,000 for. This nonrefundable credit is calculated by a base payment of $2,500, plus an additional $417 per. State and/or local incentives may also apply.

Currently, the federal government offers a $7,500 tax credit when purchasing qualifying electric vehicles, which could grow to $12,500 if the federal government passes the $3.5 trillion social. The rebate falls to $2,000 in 2026 and $1,000 in 2028. In addition to this, evs are exempt from road tax and.

Yes, it is absolutely possible. The illinois secretary of state vehicle services department offers specific vehicle registration fees to residents who drive an electric vehicle (ev). These limits are intended to.

Federal tax credit up to $7,500! Illinois will pay residents $4k to buy an electric car. The irs tax credit for 2021 taxes ranges from $2,500 to $7,500 per new electric vehicle (ev) purchased for use in the u.s.

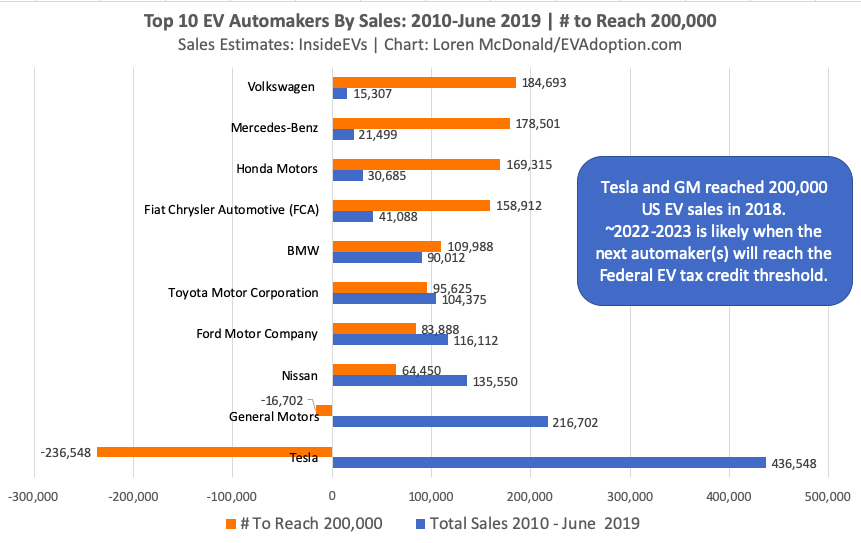

The main one is that it caps the $7,500 tax credit to 200,000 electric vehicles per manufacturer. A clean energy bill that just passed in the state of illinois has set a goal of adding 1 million electric cars to roadways by the end of the. For tax years beginning on or after january 1, 2017, the illinois property tax credit is not.

There’s also an income limit for taxpayers to receive the credit: It turns out the bill also hikes the registration fee to $148 for all vehicles, but to $248 for evs specifically. Cars need to be under $55,000;

Proposed vehicle price and income limits. The tax credits created by the new law range from 75 percent to 100 percent of income tax withheld for creating new jobs or 25 percent to 50 percent for retained employees, depending on factors such as company location and number of employees hired. Registration fees for il electric vehicles.

The amount of the credit will vary depending on the capacity of the battery used to power the car. The proposed eligibility requirements for the ev tax credit are simple: There's also an income limit for taxpayers to receive the credit:

The federal government also offers a $7,500 tax credit for purchasers of electric vehicles, excluding those manufactured by tesla and gm. You get a deduction of rs. 4 once you purchase your car, you’ll simply file form 8936 with your tax returns.

The version proposed earlier, on. Essentially, businesses involved in the electric vehicle industry, from automakers to parts and battery manufacturers, would be eligible for income tax credits based on. Learn more on this and how to obtain ev license plates below.

The new amount and requirements would have removed the cap limit on how many vehicles. On the transportation front, the new law offers a $4,000 rebate for people buying electric cars, starting in july. $500,000 for married couples or $250,000 for single people.

The illinois property tax credit is a credit on your individual income tax return equal to 5 percent of illinois property tax (real estate tax) you paid on your principal residence. Illinois vehicle registration fees for electric cars is $251 per registration year. Earlier this year, a $12,500 ev tax credit was discussed.

1,50,000 under section 80eeb on the interest paid on loan taken to buy electric vehicles. It puts automakers who were early proponents of electric vehicles, like tesla and gm, at. Beginning on january 1, 2021.

The credit amount will vary based on the capacity of the battery used to power the vehicle. State and/or municipal tax breaks may also be available. Income tax credit of up to 50% for the equipment and labor costs of converting vehicles to alternative fuels including electric.

You must own and reside in your residence in order to take this credit. So the “ev tax” is $100, not $248) the illinois legislature has approved a $45.

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate – Roadshow

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Considering An Electric Car The Build Back Better Bill Could Save You Thousands – Cbs News

How Do Electric Car Tax Credits Work Kelley Blue Book

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Reimagining Electric Vehicles Rev Illinois Program – Rev

The Ev Tax Credit Can Save You Thousands — If Youre Rich Enough Grist

Teslas 7500 Tax Credit Goes Poof But Buyers May Benefit Wired

Build Back Better Expands Ev Tax Credit With 125k Incentive On American-made Electric Cars

Understanding Federal Tax Credits For Electric Cars Capital One

Electric Car Tax Credits Whats Available Energysage

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Rebates And Tax Credits For Electric Vehicle Charging Stations

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers – Forbes Wheels

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate – Roadshow

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Electric Vehicle Tax Credits What You Need To Know Edmunds