Ad review the guidelines and steps to apply for the child tax relief program with our guide. To qualify for advance child tax credit payments, you — and your spouse, if you filed a joint return — must have:

Gop States And Wisconsin Get A Big Chunk Of Bidens Child Tax Credit

These changes apply to tax year 2021 only.

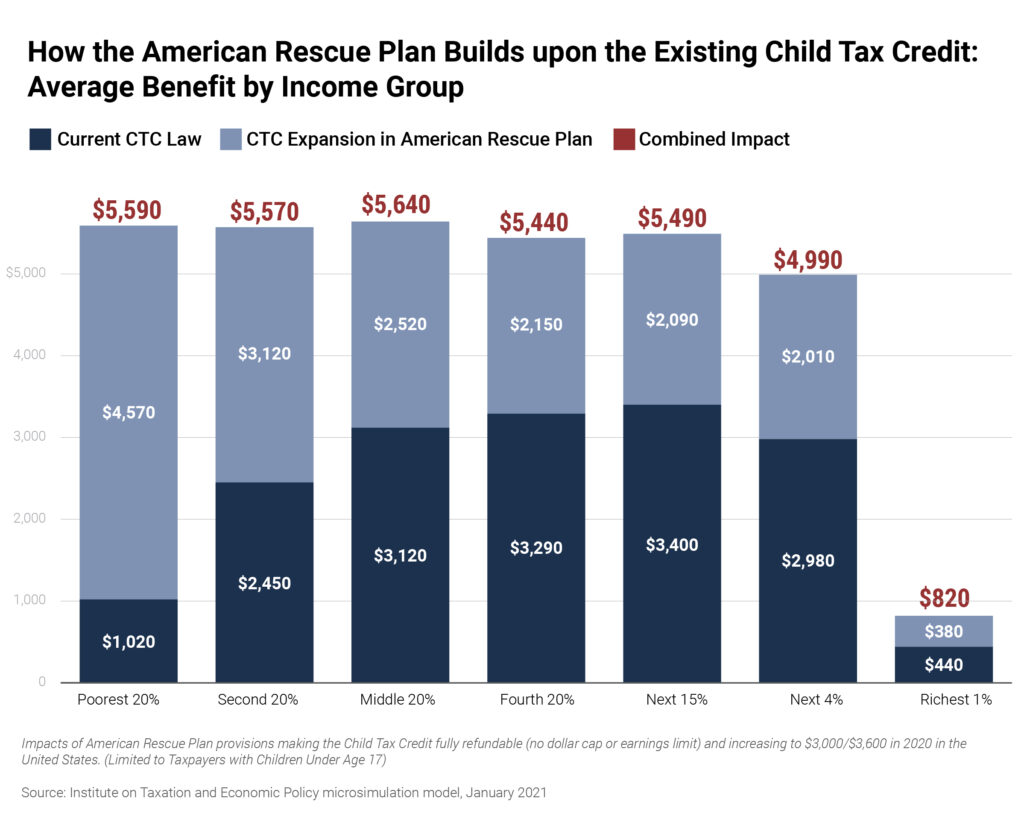

Idaho child tax credit 2021. The tax credits — included in the $1.9 trillion american rescue plan signed into law by president joe biden in march — will provide families with up to $3,600 per child over the course of a year. Child tax credit allowances are: We've updated the income tax withholding tables for 2021.

You don't need to adjust withholding back to the beginning of the year, but please use the revised tables going forward. Check how to qualify for the child tax relief program with our guide. Head to the child tax credit update portal and tap the blue button, unenroll from advance payments.

If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive, then your child is a qualifying child for purposes of the 2021 child tax credit. Those who do not opt out will receive the next payment. On the next page, tap the button marked id.me create an account.

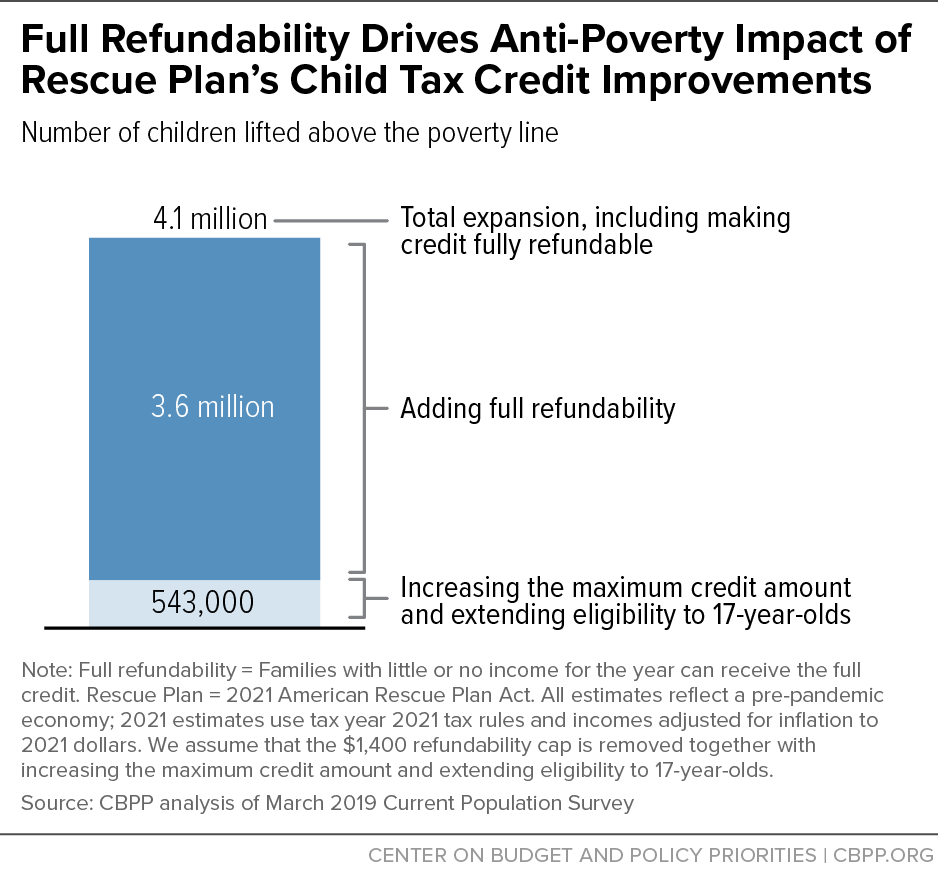

Even though child tax credit payments are scheduled to arrive on certain dates, you may not have gotten the money. The joint committee on taxation has estimated that arpa ctc enhancements cost $110 billion, while columbia university based center on poverty and social policy determined that the benefits should be about eight times. More than and less than $1 $48 $0.00 $48 $54 1.000% of the amount over $48 $54 $67 $0.06 plus 3.100% of the amount over $54 $67 $73 $0.44 plus 4.500% of the amount over $67 $73 $79 $0.71 plus 5.500% of the amount over $73 $79 $1.05 plus 6.500% of the amount over $79

As a result, you will receive advance child tax credit payments for your qualifying child. We’ve updated the income tax withholding tables for 2021 due to a law change that lowered the tax rates and decreased the tax brackets from seven to five. Ad review the guidelines and steps to apply for the child tax relief program with our guide.

2021 individual tax returns qualify for a child credit of $3,000 ($3,600 if under 6 at 12/31/2021) for children under age 18 on the last day of the year with a social security number claimed as a dependent on the return. The money available was increased, the refund was made entirely refundable and a portion of that refund is being sent out in. The amount of idaho income tax to withhold is:

This includes the idaho child tax credit allowance table. The sixth child tax credit check is set to go out dec. Check how to qualify for the child tax relief program with our guide.

Filed a 2019 or 2020 tax return and claimed the child tax credit on the return; The bill would increase the tax break to $3,000 for every child age 6 to 17 ($250 per month) and $3,600 for every child under the age of 6 ($300 per. The 2021 advance monthly child tax credit payments started automatically in july.

This includes updating the idaho child. Those who miss the deadline can still claim the credit of up to $3,600 per child if they file a 2021 tax return next year. New child tax credit payments are going out.

And unless congress steps in, it'll be the final payment in a series that has distributed $77 billion since july. You can still access the child tax credit, which for the 2021 tax year is worth up to $3,600 per. The deadline to opt out of the last child tax credit payment of 2021 is on november 29 by 11.59pm eastern time.

Fortunately, your family isn't out of luck if you missed monday's deadline.

Child Tax Credit 2021 When Will October Payments Show Up Ktvbcom

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Monday Is Last Day To Sign Up For Child Tax Credit If You Have Not Received Payments In The Last Six Months

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

How To Get The Child Tax Credit If You Have A Baby In 2021 Money

August Child Tax Credit Payments Reach Roughly 61 Million Kids – East Idaho News

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Have Questions About The New Expanded Federal Child Tax Credit Heres How It Will Work – Idaho Capital Sun

Expert Tips For Navigating The New Monthly Child Tax Credit Money

House Bill Takes Major Steps Forward For Children Low-paid Workers Center On Budget And Policy Priorities

Child Tax Credit Payments Set To Go Out To Tens Of Millions Of Families On Monday – East Idaho News

Child Tax Credit 2021 What To Do If You Didnt Get A Payment Or Got The Wrong Amount – Cbs News

July 15 Child Tax Credit You Can Opt-out Of Monthly Payment Ktvbcom

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Next Child Tax Credit Payment To Hit Bank Accounts Next Week – East Idaho News

Child Tax Credit Enhancements Under The American Rescue Plan Itep

Enhanced Subsidies Go Into Effect At Your Health Idaho April 1

House Bill Takes Major Steps Forward For Children Low-paid Workers Center On Budget And Policy Priorities