Withholding tax is the amount of employee’s pay withheld by the employer and sent directly to the government as partial payment of state income tax. Accupay’s payroll software will be updated as soon as possible for the october 1, 2021 rate changes.

Dor Stages Of Collection

New field is labeled county subject to withholding, select the applicable county.

How to pay indiana state withholding tax. 93 rows withholding formula (indiana effective 2020) subtract the biweekly thrift savings plan. In addition, the employer should look at departmental notice #1 that details the withholding rates for each of indiana’s 92 counties. You can file online using in tax.

That includes winnings from multistate lotteries. To get started, click on the appropriate link: Indiana is registered as an employer in most states and is able to withhold taxes on your behalf in those states.

There is no standard deduction in indiana, but taxpayers may still claim itemized deductions on their indiana state income tax return. This allows you to get closer to what you need to pay on your income. Therefore, the withholding tax should be the same as the state income tax.

How you can affect your indiana paycheck. All other liabilities can be paid via intime. This will be your location id as listed on your withholding summary.

The aggregate of indian state income tax and local tax applicable in a county within the state of indiana are taken along with the allowed personal exemption and exemption for dependents.you can also check federal paycheck tax calculator. The amount of withholding tax depends on the employee’s income. You have two options for electronic payments:

While some tax obligations must be paid with eft, several thousand businesses use the program for its speed and convenience. Indiana uses the taxpayer's federal adjusted gross income to calculate the amount of state tax owed. Once registered, an employer will receive an indiana taxpayer identification number.

The state of indiana website posted a complete list of 2021 tax rates. Forms required to be filed for indiana payroll are: If i answer the in county it calculates an amount i owe to indiana;

It’s a flat tax rate of 3.23% that every employee pays. To register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Indiana has reciprocal agreements with some states, including wisconsin and kentucky, which allow people living in indiana and working in these states to pay income tax to only indiana.

To file and/or pay business sales and withholding taxes, please visit intime.dor.in.gov. You can check it out here. From the item name list, select indiana counties tax.

Generally, county income tax should be withheld based on each employee's county of residence on newyear's day of each year; The dor's intax system or electronic funds transfer (eft). Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income.

Some of the expenses and types of income that may be deducted in indiana are. Electronic funds transfer (eft) eft allows our business customers to quickly and securely pay their taxes. Register with the department of labor in each state where you have employees to obtain your state tax id number so that you can remit.

Since illinois is not a reciprocal state, however, you must file two tax returns. The indiana payroll tax calculator is based on the. Because of this, the addition of funds to an ira lowers the taxable income and the withdrawal of funds increases it.

Once in the employee record, click the payroll info tab. You may copy and paste this number directly into zenefits (hyphen included). Increased indiana county tax rates effective october 1, 2021.

Indiana state income taxes are pretty straightforward. The indiana state income tax is 3.3%. Option 2 is through payroll setup.

There is no additional penalty beyond the federal penalty for early withdrawal from an ira in the state of indiana. Employees who live and work outside indiana for 90 consecutive days within a 12 month period should update their state withholding by following the steps outlined below. Taxes should be withheld from a taxpayer’s paychecks throughout the year at a rate equal to the total of the state and county rate, but you’ll still need to file a state income tax return.

But on top of state income taxes, each county charges its own income tax. The following indiana counties increased their county income tax rates effective for wages paid on or after october 1, 2021. If all or part of your winnings came while you were outside of the hoosier state, you still must report them.

To file and/or pay business sales and withholding taxes, please visit intime.dor.in.gov.

16 Printable Indiana State Tax Withholding Form Templates – Fillable Samples In Pdf Word To Download Pdffiller

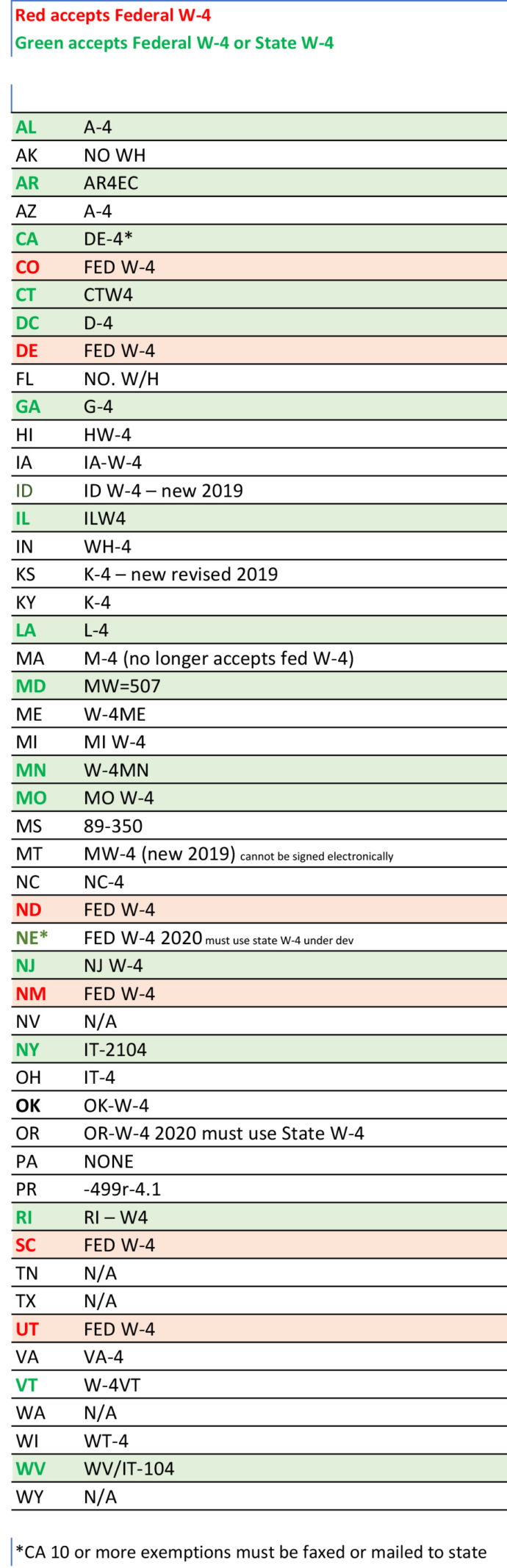

Federal And State W-4 Rules

In – Ef Message 1269

State W-4 Form Detailed Withholding Forms By State Chart

California Certified Payroll Report Requirements Payroll Payroll Template Legal Forms

16 Printable Indiana State Tax Withholding Form Templates – Fillable Samples In Pdf Word To Download Pdffiller

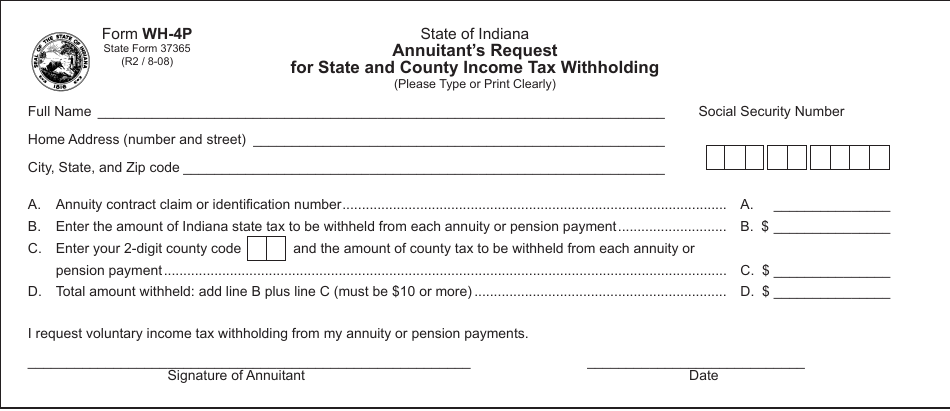

State Form 37365 Wh-4p Download Fillable Pdf Or Fill Online Annuitants Request For State And County Income Tax Withholding Indiana Templateroller

Federal And State W-4 Rules

Do I Have To File State Taxes Hr Block

Dor Your State Tax Dollars At Work

State W-4 Form Detailed Withholding Forms By State Chart

Tops W-2 Tax Forms 4-part Carbonless 8 12 X 5 12 24 W-2s 1 W-3 – Walmartcom Tax Forms Tax Irs Taxes

A Basic Overview Of Indianas Wh-4 Form For State Tax Withholding

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

State Income Tax – Wikiwand

Wheres My State Refund Track Your Refund In Every State

State Income Tax – Wikiwand

W9 Form 2021 – Futufan Futufan W-9forms Money Irs Finance Tax W9 Form 2021 Tax Forms Irs Calendar Template

Indiana Income Tax Rate And Brackets 2019