They’ll ask if you want your 1099 send via email or mail. Every mile that you track as a contractor delivering for doordash, uber eats, grubhub, instacart, lyft etc, is saves about 14 cents on your taxes.

Adams Stax520nt White 2020 1099-int Tax Form 12 Ct Delivery Or Pickup Near Me – Instacart

Instacart shopper help you can also try heading to payable via this link and you may be able to download your form:

How to get my 1099 from instacart 2020. When you drive thousands of miles, that adds up. How to get instacart tax 1099 forms__try cash app using my code and we’ll each get $5! Instacart personal shoppers get quicker access to earnings.

You won’t send this form in with your tax return, but you will use it to figure out how much business income to report on your schedule c. On the contact us page, select chat with us to get connected right away. The only one who can give you your 1099 is the company you work for!

For 2020, the rate was 57.5 cents per mile. (i don't know if you can take a loan). You’re eligible for this form if the company doesn’t employ you, and instead, you work independently.

Last year i received my electronic 1099 from instacart (via payable) on jan 17th, but i haven't heard a. Here is the link you'll need to contact instacart: In comparison, the average time to manually complete and file a 1099.

On the desktop website, you can also select email us to send us an email. The standard irs mileage deduction: The standard irs mileage deduction:

Where can i find my 1099? I need my 1099 form. Last year i received my electronic 1099 from instacart (via payable) on jan 17th, but i haven't heard a.

You have to get a 1099r from the 403b annuity company. You can deduct a fixed rate of 57.5 cents per mile in 2020. They’ll ask if you want your 1099 send via email or mail.

If you don’t have direct deposit set up, they will mail you a check. They’ll ask if you want your 1099 send via email or mail. See part c in the 2020 general instructions for certain information returns, and form 8809, for extensions of time to file.

A 1099 form is used to report various types of income and payment transactions. This rate covers all the costs of operating your vehicle, like gas, depreciation, oil changes, and repairs. I am not seeing any pros for instacart.

When you will get each form. With an optional instacart express membership, you can get $0 delivery fee on every order over $35 and lower service fees too. They don't return calls or messages i need my 1099 for instacart said they would be out jan 31 2019 have not received i have called numerous time and i and not getting any.

When you get a copy of the 1099r you might need to amend your return to add it. How to get 1099 from postmates. Did you file your return without it?

How do i get my 1099 from instacart? How to get my 1099 from instacart. You should received an email invite from payable.

They just generally won’t be from the same source. I've called and they said they cant do anything, i've emailed 1099@instacar.com multiple times and no response. For 2019, the rate was 58 cents per mile.

For 2020, the rate was 57.5 cents per mile. All companies, including instacart, are only required to provide this form if they paid you $600 or more in a given tax year. After recently revamping its pay model for personal shoppers, instacart is now enabling them to get paid faster.

But there’s more to know about shopping and driving for instacart. I got the invite by email on jan.21 & i got my 1099 via email today. How do i get my 1099 from doordash?

How to track your miles as a delivery contractor with doordash grubhub uber eats instacart etc. Things like when shoppers get paid, how they get paid, and what happens if you don’t get any orders. All companies, including instacart, are only required to provide this form if they paid you $600 or more in a given tax year.

Or did you take a loan? See part m in the 2020 general instructions for certain information returns for extensions of time to furnish recipient statements. Last year i received my electronic 1099 from instacart (via payable) on jan 17th, but i haven't heard a specific date from instacart or payable yet for 2017 taxes.

If your earning was less than $600 you can still get your annual summary in the dashboard. Vermont and massachusetts are an exception to this rule. If you get a 1099 from a company, it's a sign that you aren't considered their employee.

There may be a pickup fee (equivalent to a delivery fee for pickup orders) on your pick up order that. It’s typically the best option for most instacart shoppers. To let us know about an issue related to a specific order, you can—.

The standard irs mileage deduction: Instacart pays shoppers weekly on wednesday via direct deposit for the previous monday through sunday week. Here is the link you'll need to request a 1099 from postmates:

Select get help at the bottom of any article in the help center. How do i get my 1099 from postmates? For example, a marketplace may issue 1099s to summarize earnings for independent contractors, while a software platform may issue 1099s to summarize their customers’ payment transaction volume.

Uber and lyft send out 1099 forms every year by january 31.

Instacart Qa 2020 Taxes Tips And More – Youtube

Mileage Verification Form Cheaper Than Retail Price Buy Clothing Accessories And Lifestyle Products For Women Men –

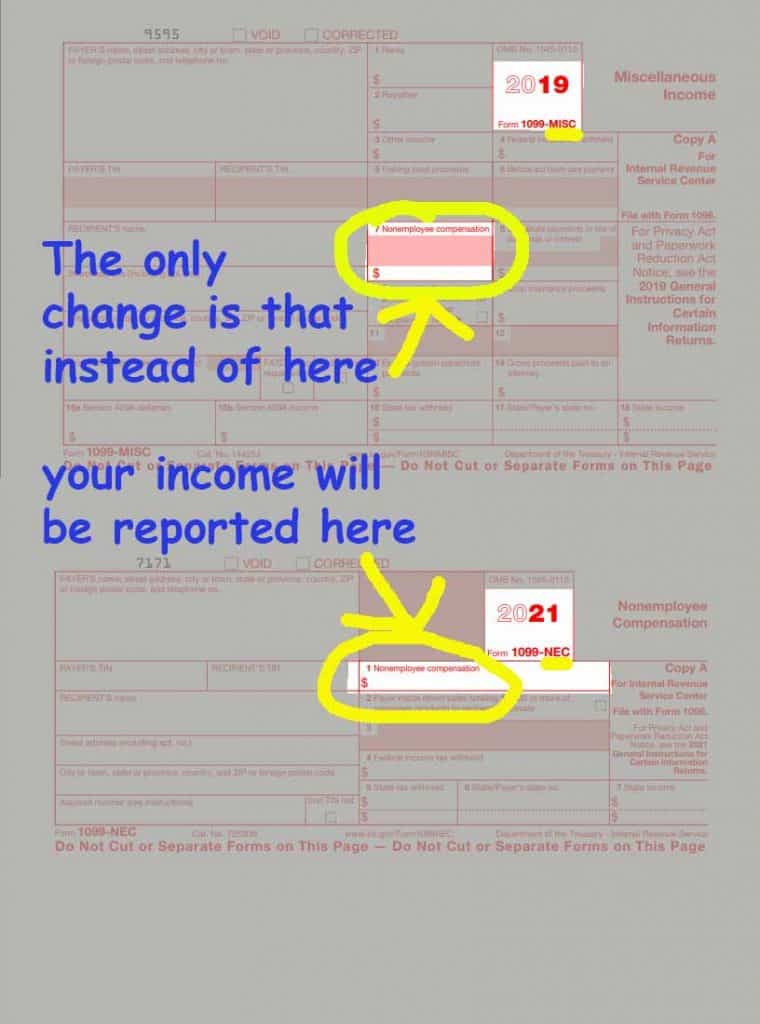

Why Is Grubhub Changing To 1099-nec – Entrecourier

Adams 2020 White 1099-nec Tax Forms 24 Ct – Instacart

Why Is Grubhub Changing To 1099-nec – Entrecourier

Adams 1099 Misc Forms Kit With Tax Forms Helper Online 2017 Each – Instacart

Why Is Grubhub Changing To 1099-nec – Entrecourier

What You Need To Know About Instacart 1099 Taxes

Understanding Your Instacart 1099 In 2021 Tax Guide Understanding Yourself Federal Income Tax

How To Handle Your Instacart 1099 Taxes Like A Pro

Got My 1099 Via Email Yikes Rinstacartshoppers

How To File The New Form 1099-nec For Independent Contractors Using Turbotax Formerly 1099-misc – Youtube

Where Amazon Flex Drivers And Instacart Shoppers Find 2018 1099 Tax Forms – Rideshare Dashboard

How Do I Get My 1099 From Instacart Stride Health

How To Get Instacart Tax 1099 Forms – Youtube

How To Handle Your Taxes If Youre A Personal Shopper Or Delivery Driver

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier

If I Could Get My 1099 That Would Be Greeeeaat Rinstacartshoppers

Where Is My 1099 Rinstacartshoppers