A number will be assigned to each bidder for use when purchasing tax liens through the treasurer’s office and the online tax lien sale. Liens are sold at auctions that sometimes.

1885 Maricopa Hwy Spc 10 Ojai Ca 93023 – Realtorcom Open Floor House Plans Oak View Ojai

How does a tax lien auction work?

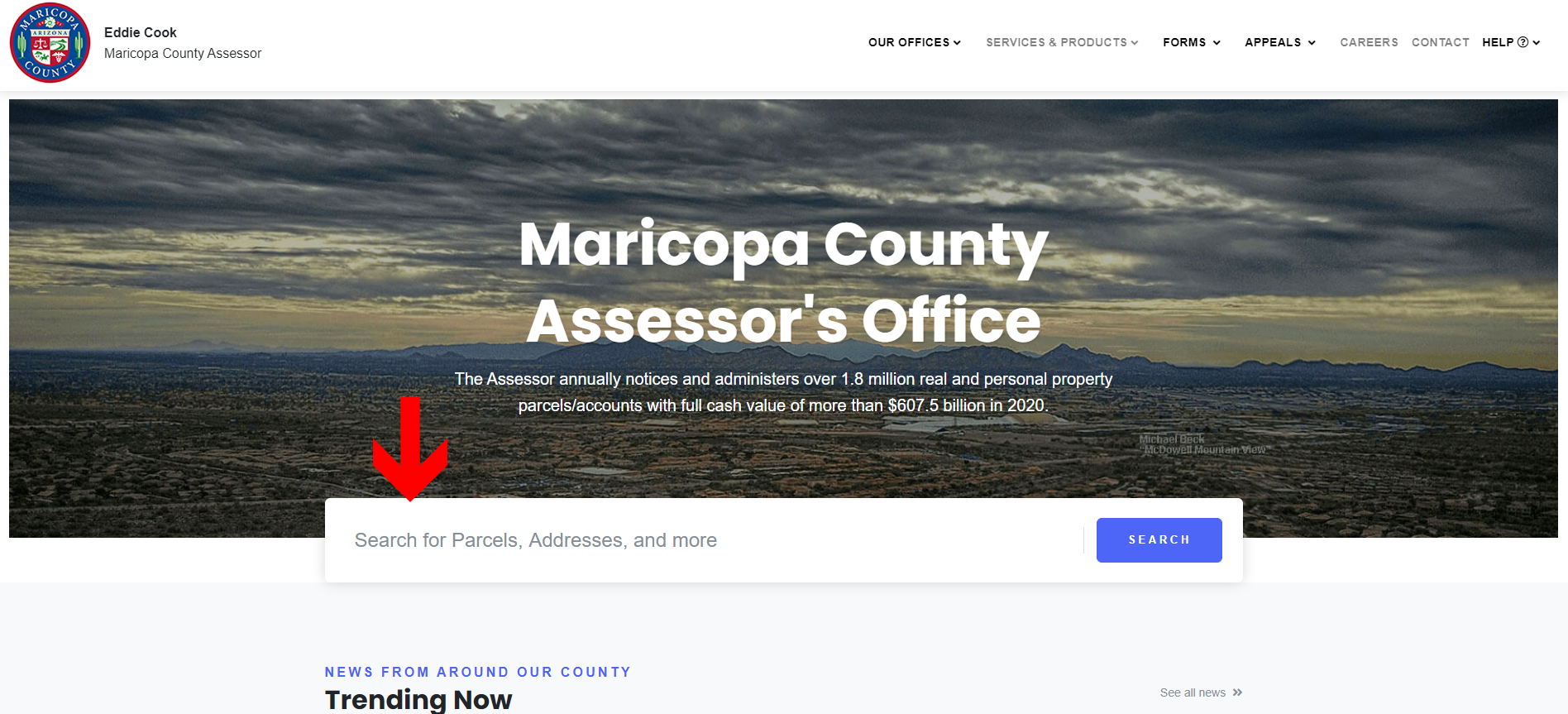

How to buy tax liens in maricopa county. Completed forms may be mailed or delivered to: Enter the assessor parcel number (apn) to search for and then click on go. Stephen richer is the 30th recorder of maricopa county.

($10,000 for example) make a deposit of exactly 10% of that amount. The way the auction works is an investor bids on the interest rate on the tax lien. Then try our free maricopa county tax lien research tutorial below:

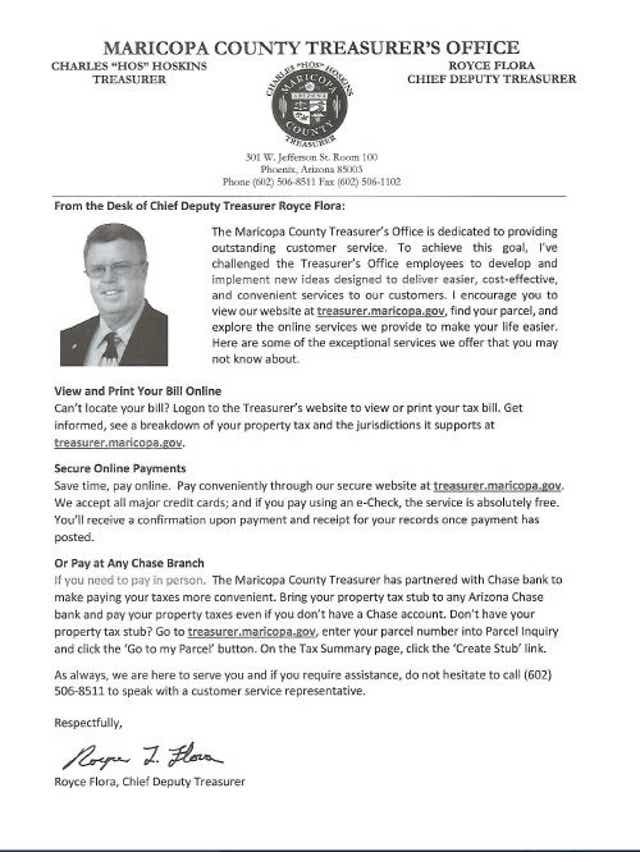

Maricopa, mohave and pima county are most popular. On a cd from the research material buying guide (available at the beginning of january). Maricopa county treasurer's office 301 west jefferson, room 100 phoenix, az 85003

Maricopa county will not be held responsible for legal or court fees when the judicial foreclosure process is stopped due to redemption payments made in an untimely manner. Download the latest maricopa county tax lien list. How to buy tax liens in maricopa county.

Interested parties must complete an unsold previously offered parcel offer form (pdf) and submit this form and payment in cash or guaranteed funds (cashier's check or money order) made payable to maricopa county treasurer. If a property owner fails to pay the delinquent taxes and fees, the treasurer offers a tax certificate for purchase at the tax certificate sale. Parcels can be foreclosed on through quiet title court action three (3) years after the date of sale.

With tax lien certificates, purchasers are investing their money with maricopa county arizona and when the maricopa county arizona tax collector collects the past due taxes, they send purchasers a check, returning what they paid to purchase the arizona tax lien. Chances are purchasers will never spend that much, it's more likely they'll need 25 to 65 tax sale lists a year. A tax lien is a claim the government makes on a property when the owner fails to pay the property taxes.

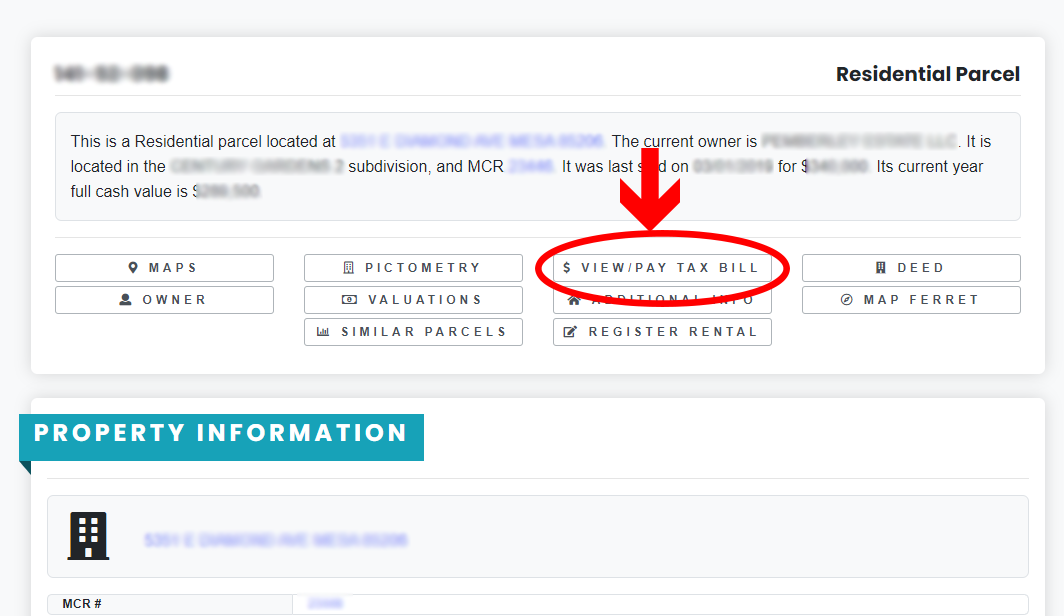

The tax sale list includes the item number, parcel number, legal owner, and legal description of the property's to be offered at. Maricopa county treasurer c/o research material purchasing Plug the parcel number from the property into the maricopa county parcel search tool.

Bidding is online only and will begin when. Investors are permitted to bid on each tax lien via auction (held online for maricopa county). Maricopa county makes no representation that a property.

Even at that volume they could save $375 to $3250 a year. Enter the address or street intersection to search for and then click on go. Select the township, range and section to search for and.

Buy the latest arizona tax lien list. With a little insight tax sale list purchasers could buy another tax lien certificate where penalty profit rates of 16%, 18%, 24%, up to 36% is mandated by united states law. Are you interested in buying tax liens?

Contact the maricopa county arizona treasurer (sec. Bid on as many quality liens as you can. Research the homes, business and raw land you wish to buy the tax lien certificate for by using our free tutorials and the education section of.

The certificate is then auctioned off in maricopa county, az. Do you currently reside in maricopa county? The deposit is required and must be submitted before the deadline in order for your bids to be valid.

Tax lien certificates are sold to investors to recover the delinquent property taxes owed by the property owner. The buyer of the tax lien has the right to collect the lien, plus interest based on. Submit a deposit (online via ach) establish a budget.

Use our tax lien investing tutorials to get a basic understanding of where the property is and what it looks like. Find a delinquent property that you would like to buy the tax lien certificate for. Research the tax lien lists using the tools and due diligence taught in the intermediate and advanced education section of our website.

Every year, the counties have auctions to sell these unpaid property tax liens. In this video, learn how to buy tax liens in maricopa county and find out. Do not include city or apartment/suite numbers.

A tax lien is a claim the government makes on a property when the owner. Decide how much money you want to invest in tax certificates for this auction. As you can see, there are many advantages to buying tax lien properties in maricopa county, arizona.

Here's how to earn 16% via arizona tax liens: Taxes are at least 2 years delinquent when they become available for tax lien certificate purchase. The next delinquent property tax lien auction for maricopa county will be on february 5, 2019 for the 2017 tax year.

Purchase one of the 2011 tax lien lists below. It is highly unlikely that you will find another place to buy tax lien certificates over the internet, through the mail, through live auctions, and available for sale to persons living outside of the usa. All participants that wish to purchase property tax liens in maricopa county, arizona register by completing both of the following forms:

Some counties may have left over tax lien certificates that they sell outside of the auction. Enter the property owner to search for and then click on go. Send a completed order form with your payment of $25.00 (personal or business check, cashier's check or money order) to:

Home For Sale At 31937 N 71st St Scottsdale Az 85266 850000 Listing 6135540 See Homes For Sale Information School In 2021 Scottsdale Real Estate House Prices

Vintage Advertising For The 1959 Rambler Automobiles In The Arizona Republic Newspaper Phoenix Arizona June 27 1959 Vintage Advertisements Rambler Automobile

How Do I Pay My Taxes – Maricopa County Assessors Office

Pin By Kirkpatrick Real Estate Team On Real Estate Articles Economic News Real Estate Articles Local Real Estate Home Buying

Christmas Massage Images Russ Medical And Sport Massage Clinic Massage Therapy Christmas Gift Massage Therapy Business Massage Therapy Quotes Massage Clinic

Tax Guide

Restored 1985 Ford Crown Vic Sheriffs Car Police Cars Old Police Cars Police

Massage Quotes And Pictures Massage Is Better Than Taking A Vacation And Then Schedule Y Massage Quotes Massage Therapy Business Massage Therapy Quotes

Maricopa County Treasurers Letter Meant As Farewell Not Politics

A Student Of Mine Chose To Invest In Maricopa County Az Heres A Photo Of The Home They Eventually Owned And Resold For Maricopa County House Styles Outdoor

20 Acres In The Mesa Opportunity Zone Sell For 225m – You Have Been Hearing And Reading About The New Capital Gains Tax I Acre Capital Gain Capital Gains Tax

Nice Chandler Metro Map Zip Code Map Metro Map Map

18101 N Crestview Ln Maricopa Az 85138 – Mls 6101663 – Coldwell Banker Crestview Real Estate Services Sun Lakes

Tax Bill

How Do I Pay My Taxes – Maricopa County Assessors Office

Dallas County Release Of Lien Form Texas Deedscom County Faulkner Baltimore County

Pin On Arizona Mike Kelly

Liens And Research

7 Proven Benefits Of Purchasing Flats For Sale In Istanbul Flat For Sale In Istanbul Real Estate Investor Real Estate Investing Real Estate Development