Giving away your assets before passing is another way to avoid probate fees. Remember that the federal gift tax will apply to gifts made in excess of $15,000.

We Know The Biggest Reason Of Owing Tax Money Is Its Nonpayment But There Are Some Other Possibilities As Well Tax Debt Tax Lawyer Tax Attorney

There are several ways to accomplish this:

How to avoid estate tax in california. Keep the receipts for your home improvements. Give to charity while you’re alive. If you itemize deductions, you can take a tax deduction for any charitable donations made while you’re living.

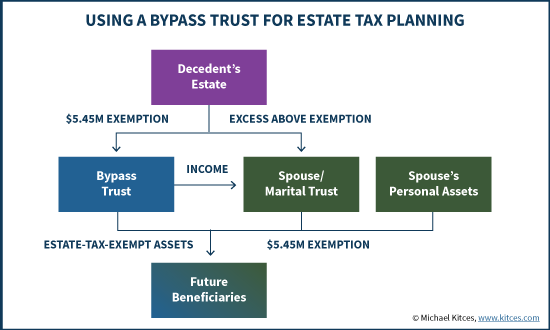

This will help you avoid owning the assets at the time of your death and subjecting them to probate. This means if a spouse dies and their federal estate tax exemption isn't entirely needed to avoid estate taxes, the unused portion can be added to the surviving spouse's exemption. The estate tax is paid out of the estate, so the beneficiaries will not be liable for paying the estate tax, technically speaking—although it would deplete the amount left in the estate for distribution.

Proposition 19 was passed in november 2020 by california voters. An irrevocable trust can be a handy way to avoid estate taxes if your estate is large enough to be potentially liable for them, at both the state and federal levels. If married, assets pass by default to your surviving spouse are not subject to estate tax regardless of value.

By designating beneficiaries, you are simply minimizing your estate’s size, which also reduces your probate fees. This tax has full portability for married couples, meaning if the right legal steps are taken a married couple can avoid paying an estate tax on up to $23.4 million after both have died. Giving a retirement account retirement accounts can be tricky inheritances for your beneficiaries.

The estate tax was once called an “inheritance” tax, but in substance it was just an estate tax. Transfer your us assets to the trust to protect them from the estate tax. Estate tax exemptions aren’t applicable, as there is no estate tax in california.

This proposition was marketed to voters as a way to protect the property tax basis of a primary residence for seniors 55+, those who are severely disabled, and victims of wildfire and natural disasters, but what they didn’t tell. Live in the house for at least two years. That is not true in every state.

What is the california capital gains tax rate for 2020? If a married couple has a $6 million estate and spouse 1 dies, everything passes tax free to spouse 2 by default. In other words, under the proposed legislation, if an estate in california met the $11.7 million federal threshold, it would not also pay the california estate tax rate, just the.

By gifting your assets, you can reduce your estate by a sizable amount. Any assets in the trust would still be subject to capital gains taxes, both in canada and in the us. Oregon also does not levy a gift tax.

There are many legal actions you can take now to transfer ownership of your assets so that they avoid probate in california. Like most states, oregon does not have an inheritance tax. See whether you qualify for an exception.

How to avoid capital gains tax on a home sale. Learn from experienced attorney, paul morison, how to avoid capital gains tax in california using proper estate planning techniques. The property tax situation in california has again been dramatically altered by the passage of the landmark california tax proposition 19 in november 2020, which went into effect feb.

Contact us to learn more. Below are six to consider: This exemption is not “portable” from one spouse to another.

That’s because with limited exceptions—and barring aggressive countermeasures —california prop 19 eliminates a parent’s ability to leave to their children or grandchildren their proposition 13 taxes and. Then, when you pass the assets to the beneficiaries, you not only avoid gift taxation limitations, but you also do not have to pay on the assets for estate tax purposes. For estates that exceed this amount, the top tax rate is 40%.

This essentially lets married couples in 2022 pass on more than $24 million. A full chart of federal estate tax rates is below. Make a gift you can give your assets to others before you die.

Inheritance tax in california while an estate tax is charged against the deceased person’s estate, regardless of who inherits what, states with an inheritance tax assess it on the beneficiary (i.e., the person who inherits money or property from the estate). Charitable contributions can also reduce the value of your estate and help you reduce or avoid estate taxes. Regardless of the size of the estate, the franchise tax board (think the irs for the state of california) will not levy any estate taxes on the inheritance.

As originally designed, new 2020 california estate taxes would have phased out once an estate hit the current federal level requirement to avoid double taxation.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Newpanda Ecard Ecards Living Trust Estate Planning

2021 Guide To Potential Tax Law Changes

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Preparing Forms For A Living Trust In California – Httpsapeopleschoicecompreparing-forms-f Living Trust Revocable Living Trust Estate Planning Checklist

Distributable Net Income Tax Rules For Bypass Trusts

Top 4 Gift And Estate Tax Avoidance Strategies Estate Tax Estate Planning Estate Planning Attorney

How To Avoid Estate Taxes With A Trust

Is Inheritance Taxable In California California Trust Estate Probate Litigation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

5 Ways The Rich Can Avoid The Estate Tax – Smartasset

The Taxlawyerlosangeles Will Make Sure That You Are Not Accused Of The Tax Lawyer Tax Attorney Business Lawyer

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Lawyer California Estate Services And Litigation Attorneys Keystone Law Group Medical Malpractice Lawyers Criminal Defense Attorney Litigation Lawyer

California Inheritance Laws What You Should Know – Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tax_attorney_sandiego Tax_lawyer_sandiego Ca Tax Attorney Tax Lawyer Irs Taxes

Fun Facts About Estate Planning Infographic Estate Planning Infographic Estate Planning How To Plan

California Estate Tax 2021 – Magnifymoney