It would be up to the state legislature in 2019 to decide whether to. The maximum enhanced star exemption savings on our website is $1,000.

Nys Changes Are Causing Confusion With The Star School Tax Relief Program

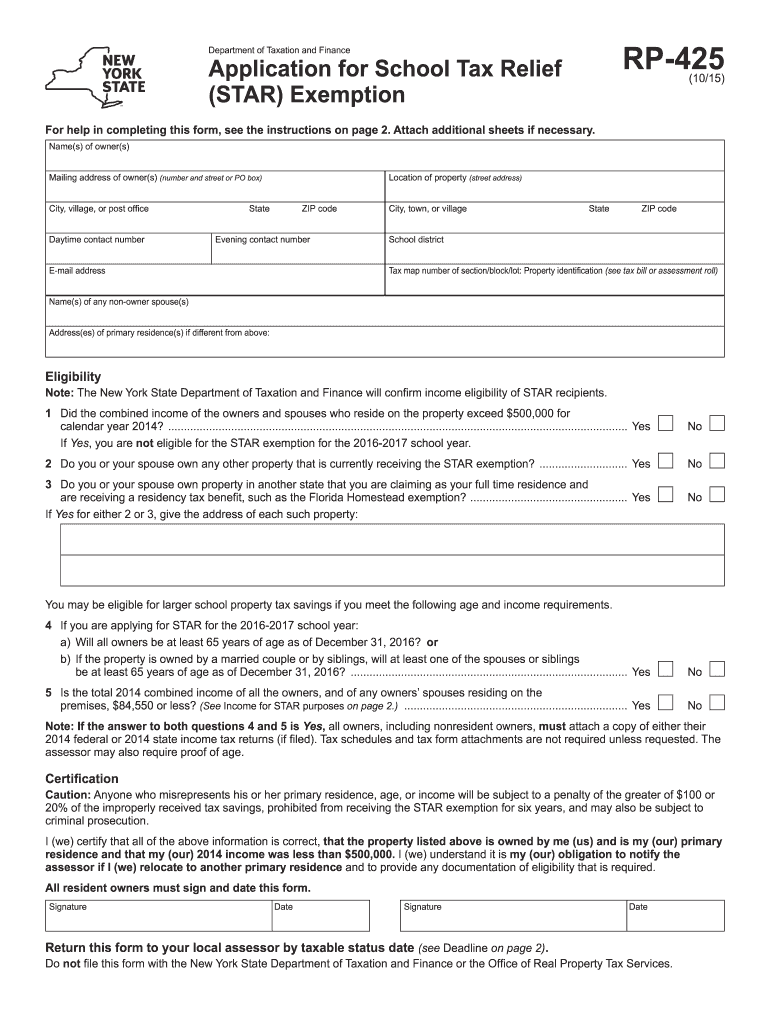

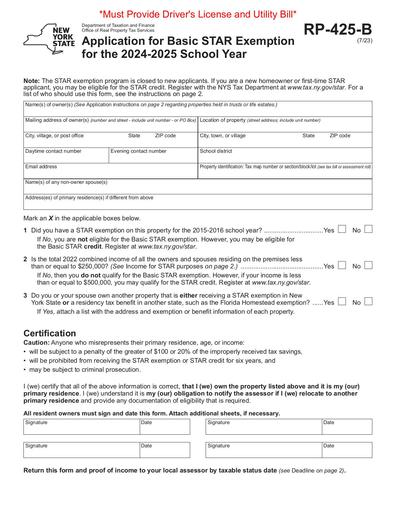

Once you are approved for basic star, you need not reapply each year unless you move to a new primary residence.

How much is the nys star exemption. According to new york state, “beginning in 2019, the value of the star credit savings may increase by as much as 2% each year, but the value of the star exemption savings cannot increase.” so, while it might be less convenient to receive a check than to have this amount deducted from your tax bill, in future years you may end up with more. How much is ny star exemption? $500,000 or less for the star credit;

Enhanced star is available for seniors with incomes of $88,050 or less and is. This amount is computed by multiplying your municipality's prior year equalization rate by 30,000 multiplied by your county's sales price differential factor or your prior year's star exemption multiplied by.89 whichever amount is greater. $250,000 or less for the star exemption;

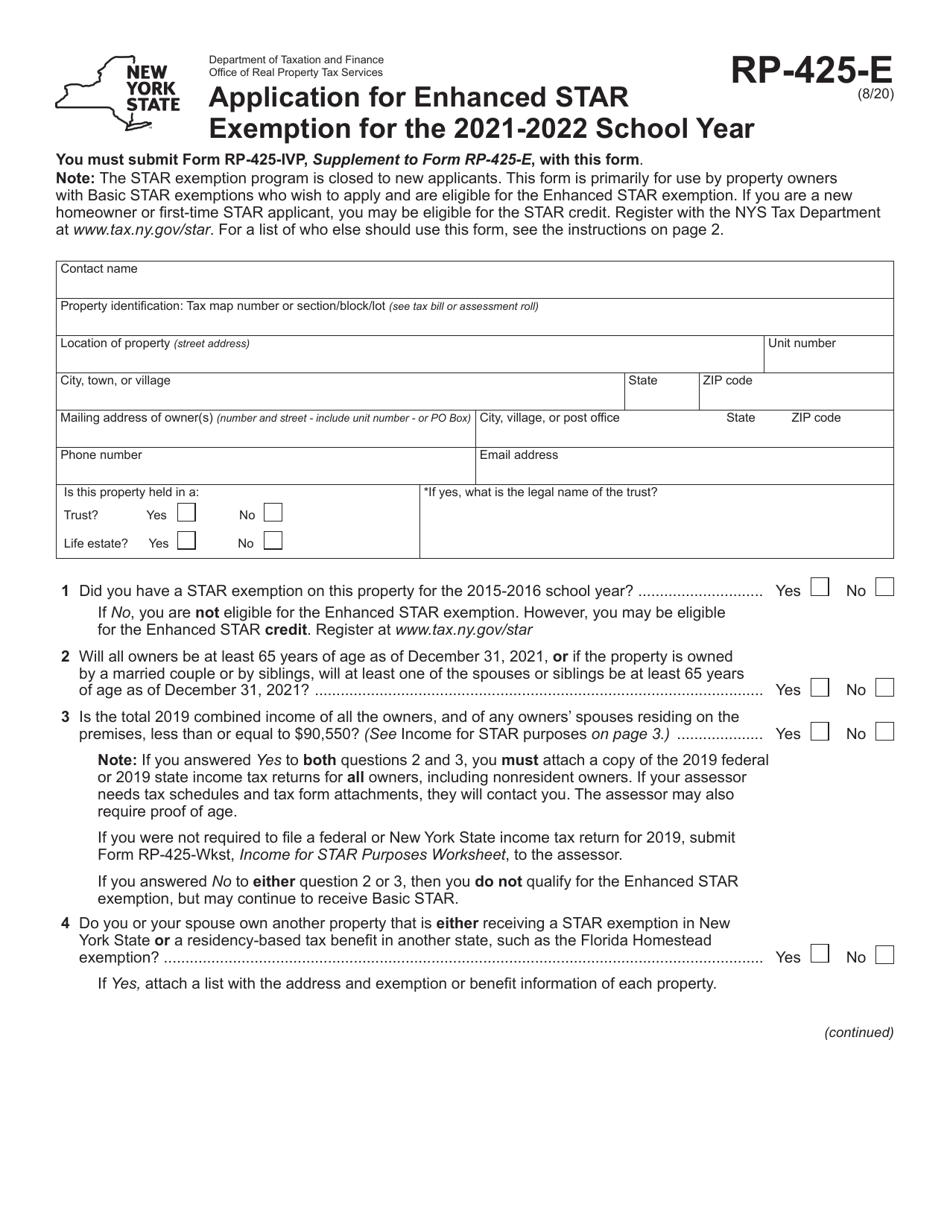

However, star credits can rise as much as 2 percent annually. If you or your spouse turn 65 at any time in 2012, you may be eligible for the enhanced star exemption. Determine the star exemption amount for which you qualify.

Use the links below to find the maximum star exemption savings amount for your school district segment. For example, if you own the property and are applying for an exemption that will begin on july 1, 2021, you or your spouse or sibling must be 65 or older by december 31, 2021. When the basic exemption is fully phased in, they will receive at least a $30,000 exemption from the full value of their property.

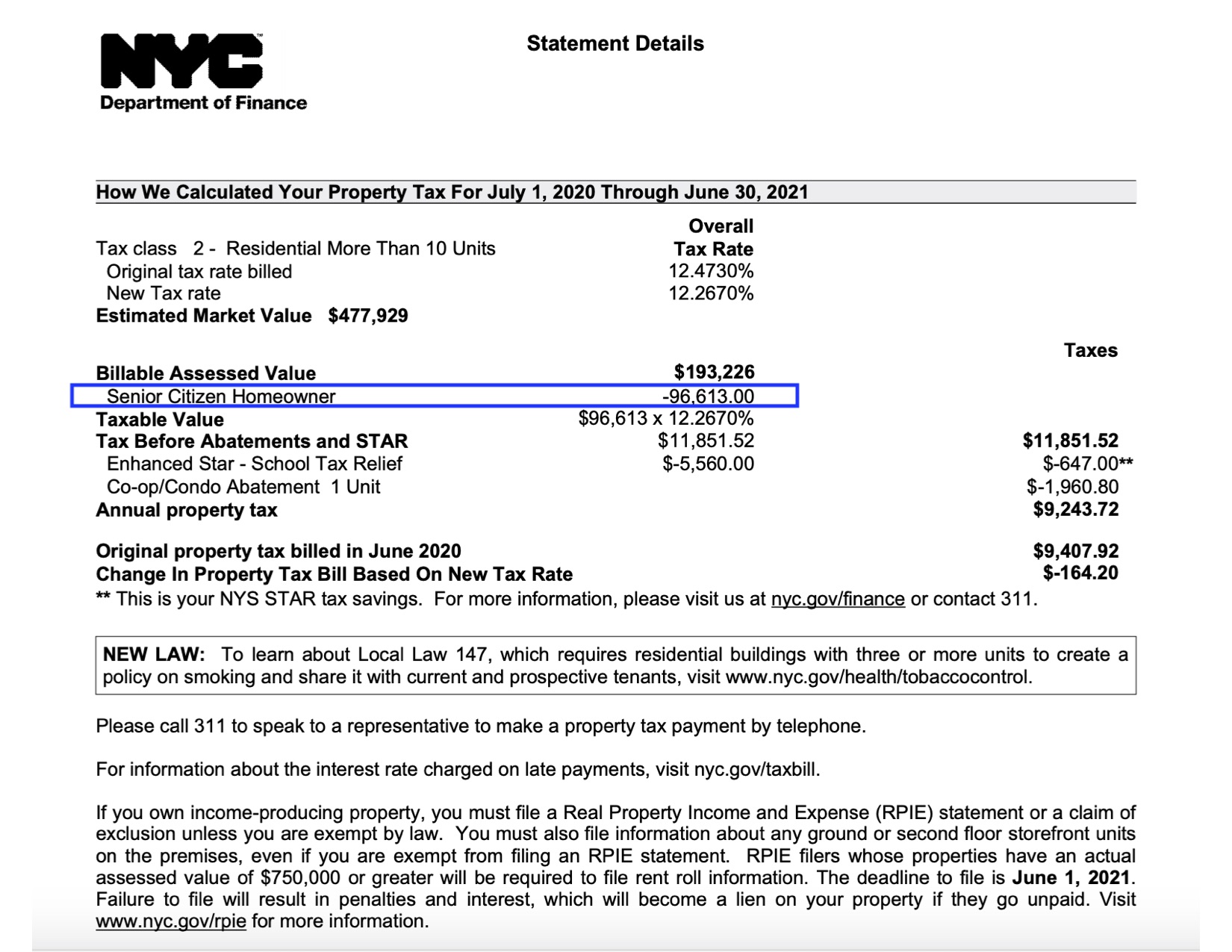

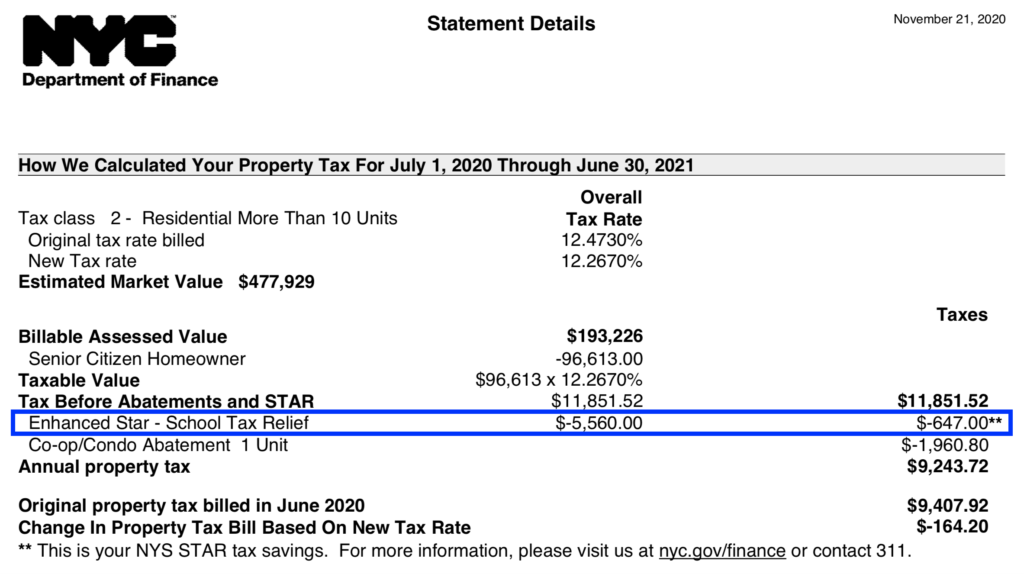

The income limit for the basic star credit is $500,000 (the income limit for the basic star exemption is $250,000); Annually for each school district segment, the amount of savings as a result of the star exemption cannot exceed the savings of the prior year. I applied last august for the senior citizen homeowners’ exemption (sche) property tax exemption.

If you’re a new homeowner or you weren’t receiving the star exemption on your current home in 2015, you can register for the star credit to receive a check directly from new york state. Provides an increased benefit for the primary residences of senior citizens (age 65 and older) with qualifying incomes: When the basic exemption is fully phased in, they will receive at least a.

Enhanced star is for homeowners 65 and older whose total household income for all owners and spouses who live with them is $92,000 or less. 59 rows the star exemption amount multiplied by the school tax rate (excluding any library levy portion) divided by 1000; Income is federal adjusted gross income minus the taxable amount of.

The total amount of school taxes owed prior to the star exemption is $4,000. Based on the first $30,000 of the full value of a home enhanced star The enhanced star exemption amount is $70,700 and the school tax rate is $21.123456 per thousand.

Married people may receive only one star benefit regardless of how many properties they own purchasers who own the property under an executory contract of sale We are also getting a maintenance increase as of april 1st. The star savings is substantial:

The benefit is estimated to be a $293 tax reduction. It lowers the tax burden on new york residents who live in school districts. The maximum enhanced star exemption savings on our website is $1,000.

If the total income of all owners and their spouses who live on the property is more than $250,000, you must register for the star credit with new york state. The maximum star exemption savings. The dates pertain to assessing units that publish.

Select your municipality and then scroll to your school district, or. Basic star is for homeowners whose total household income is $500,000 or less. Beginning in 2016 any homeowner who is applying for the first time on a property, meaning you have never had any star exemptions on your property before or you are a new homeowner of a property, is required to register with new york state department of taxation and finance.

Basic star averages about $800 a year, and enhanced star is about $1,400 a year. Eligible applicants have to own the property; The star exemption program is closed to all new applicants.

Why switch to the star credit from the star exemption. How much is nys enhanced star exemption? There is no age limit for basic star, which exempts the first $30,000 of the full value of a home from school taxes.

The total amount of school taxes owed prior to the star exemption is $4,000. In 2019, the checks will be as high as 85 percent of the star rebate for those earning $75,000 a year or less.

Lower Your School Taxes With The New York Star Program

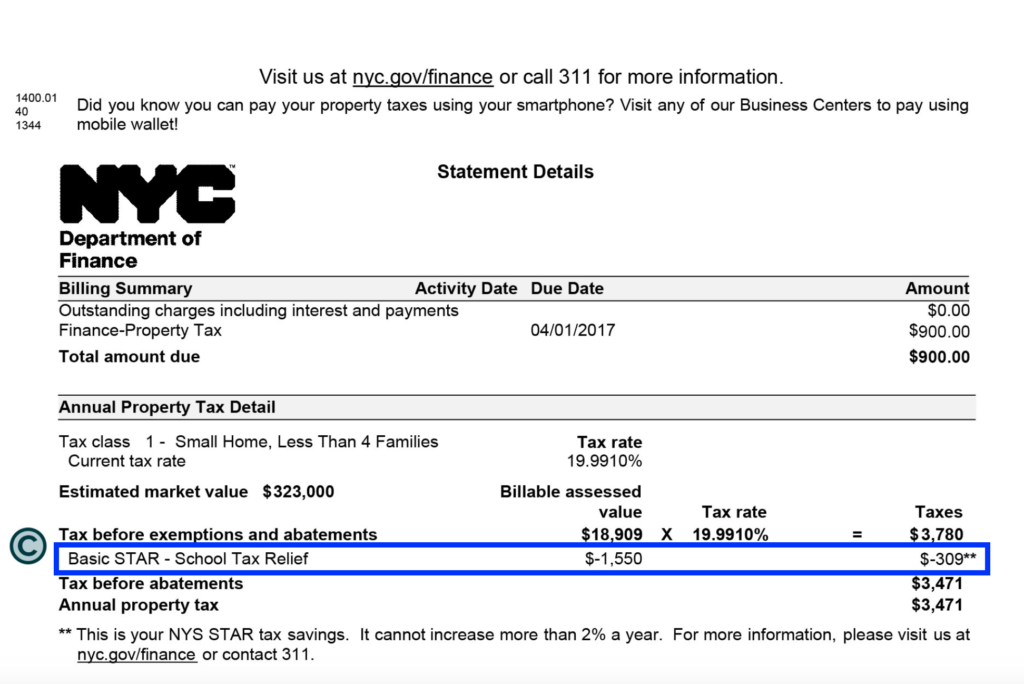

What Is The Basic Star Property Tax Credit In Nyc Hauseit

2

Ny Updates The Star Program Lumsden Mccormick

Star Conference

What Is The Nyc Senior Citizen Homeowners Exemption Sche

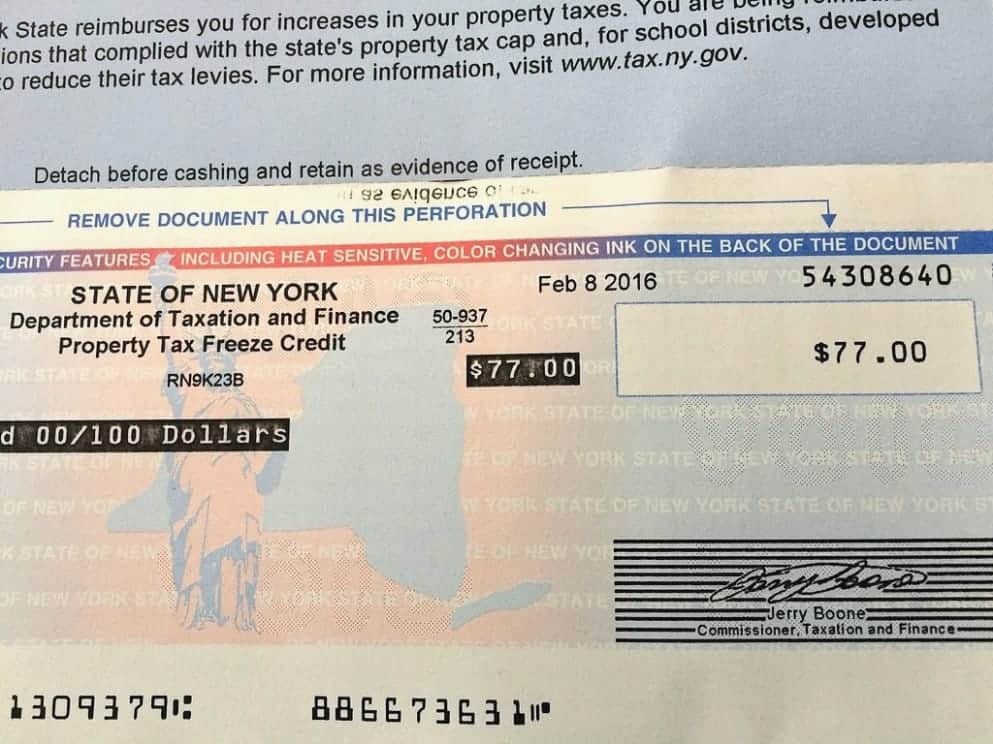

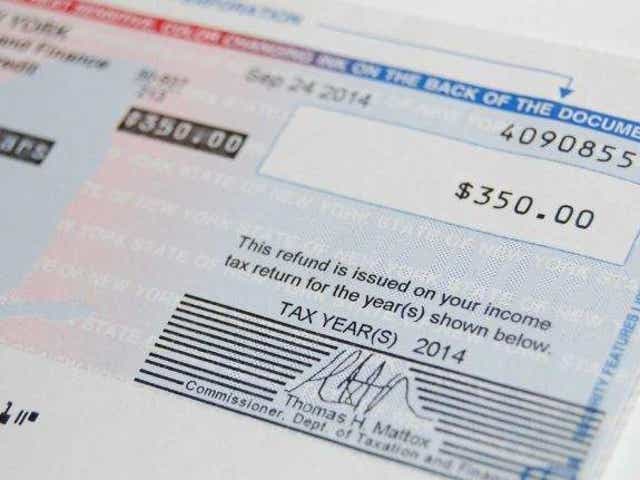

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

Form Rp-425-e Download Fillable Pdf Or Fill Online Application For Enhanced Star Exemption – 2022 New York Templateroller

2015-2021 Form Ny Dtf Rp-425 Fill Online Printable Fillable Blank – Pdffiller

Assessor

Ny Star Exemption

Star Program Town Of Coeymans

Propertytax Exemptions In Jamestown At 37 Percent Higher Than 30 Percent Upstate Ny Average

Star Conference

Understanding The School Tax Relief Star Program In Nyc – Yoreevo Yoreevo

The School Tax Relief Star Program Faq Ny State Senate

Deadline For Star Approaching – Roohan Realty