For green card holders and u.s. Taxed at a future date, once the income becomes distributed and taxable.

Green Card Holder Exit Tax 8-year Abandonment Rule New

In summary, when giving back your green card or renouncing your us citizenship it is important that you understand that you.

Green card exit tax rate. Exit tax, or apply for a bond (which can be very expensive). To calculate any exit tax due to the us person for surrendering a green card, an irs form 8854 is used. For example, if you got a green card on december 31, 2010.

The most important aspect of determining a potential exit tax, if the person is a covered expatriate. They remain subject to us income tax but cannot afford to surrender the card because of the exit tax they will have to pay. Expatriation tax and exit tax are the same concepts — there are not two different types of taxes for relinquishing a green card or.

Green card exit tax 8 years & tax implications at surrender: If the irs can rely on tax withholding rules to assure full collection of income tax, the covered expatriate pays tax at a 30% rate on u.s. Green card exit tax rate.

These three types of assets are exempt from the deemed sales rule, and are subject to their own special tax treatment: The exit tax varies based on many different factors. The irs green card exit tax 8 years rules involving u.s.

Us exit tax & irs requirements. Realized at the time of inheritance or gift, those deemed gains will be subject to the exit tax at the rate of 15.315% in most cases, even if the donor/decedent does not leave japan. Depending on what the total gain is, if the gain exceeds the exemption amount (currently $725,000), the expatriate may have to pay a u.s.

As a green card holder, you do not need to count years if you make a valid treaty election to be treated as a nonresident alien for that entire calendar year. In some cases, you can be taxed up to 30% of your total net worth. The expatriation tax rule applies only to u.s.

Source income as it is received. The takeaway the exit tax laws have the potential to both accelerate and increase taxes on. The “expatriation tax” consists of two components:

As such, he or she might have to pay exit tax. The general proposition is that when a u.s. Depending on the type and source of income, it may be immediately taxable vs.

Realized at the time of inheritance or gift, those deemed gains will be subject to the exit tax at the rate of 15.315% in most cases, even if the donor/decedent does not leave japan. How much is the expatriation tax? May be required to pay an exit tax on surrender of his or her green card.

Green card exit tax 8 years & tax implications at surrender: Citizens who expatriate in 2020, there may be irs exit tax consequences. With the introduction of fatca reporting, increased aggressive enforcement foreign.

As you can see, the green card tax implications are complex. The irs then takes this final gain and taxes it at the appropriate rates. Citizen renounces citizenship and relinquishes their u.s.

Us tax planning before getting a green card is essential. Lawful permanent resident in at least 8 of the prior 15 taxable years. It will be as though you had sold all of your assets and the gain generated was viewed as taxable income.

12 work ideas in 2021 this or that questions historically black colleges concept meaning The curiously titled heroes earnings assistance and relief tax act of 2008 became law 17 june 2008. The most important aspect of determining a potential exit tax, if the person is a covered expatriate.

The general rule is for us green card holders who have been in the us for 8 of the last 15 years or more with assets less than around $2 million they should escape any taxation. Exit tax is a tax paid on a percentage of the assets that someone who is renouncing their us citizenship holds at the time that they renounce them. It is always worth checking whether you.

The only way a green card holder can be exempt from paying taxes is if they have entered into an income tax treaty with the united states. Status, they are subject to the expatriation and exit tax rules. Legal permanent residents is complex.

This can mean that green card holders who have not formerly surrendered the green card are ‘stuck’!!! Realized at the time of inheritance or gift, those deemed gains will be subject to the exit tax at the rate of 15.315% in most cases, even if the donor/decedent does not leave japan. If you are covered, then you will trigger the green card exit tax when you renounce your status.

Eligible deferred compensation items, including 401 (k) plans, will only be taxed upon distribution and are generally subject to a 30 percent withholding tax. Special rules applicable to the estates of green card holders Exit tax applies to united states expatriates, a term describing people who have renounced their us citizenship and those who have renounced a green card that they have held for at least eight years out of the last 15.

Green card exit tax 8 years & tax implications at surrender:

What Is Expatriation Definition Tax Implications Of Expatriation

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Pre-immigration Tax Planning Green Card Tax Implications – Online Taxman

Renouncing Us Citizenship – Expat Tax Professionals

Bill To Remove Per Country Cap On Green Card Introduced In Us Congress Business Standard News

Renounce Us Heres How Irs Computes Exit Tax

![]()

Japans Exit Tax – Sme Japan Business In Japan

Do Green Card Holders Living In The Uk Have To File Us Taxes

2

Green Card Holder Exit Tax 8-year Abandonment Rule New

Green Card Holder Exit Tax 8-year Abandonment Rule New

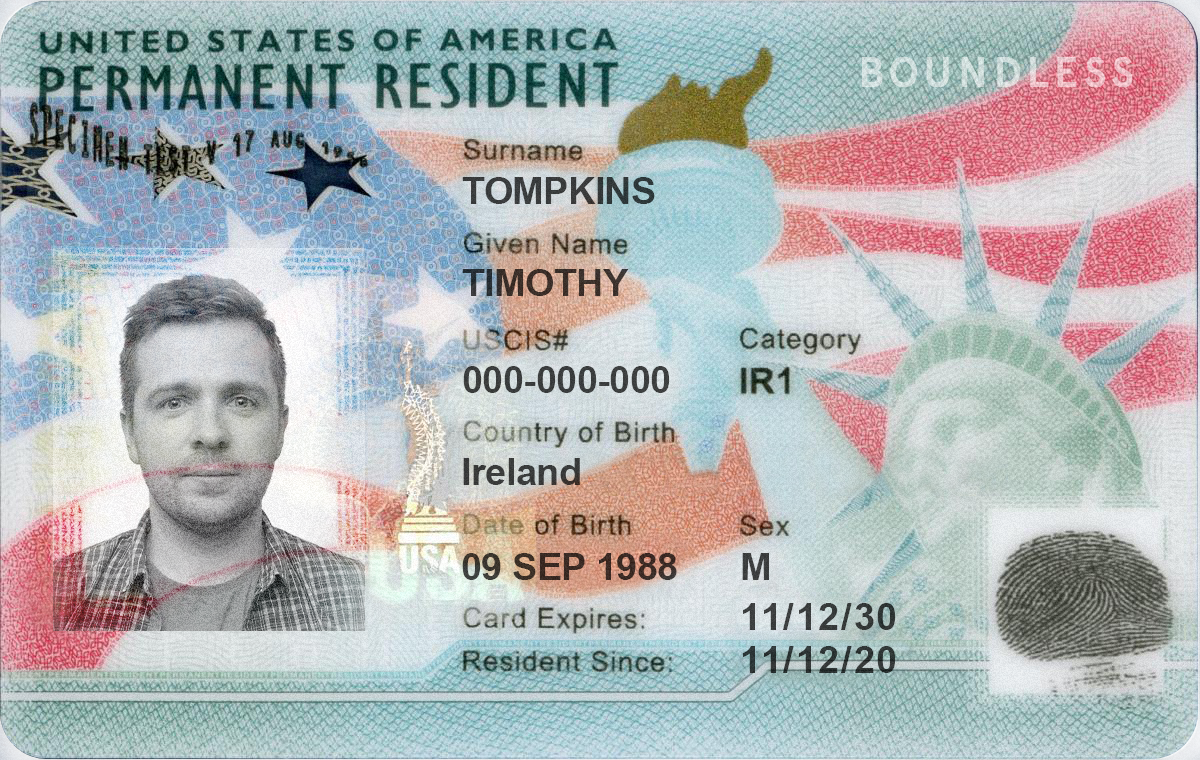

The Benefits Of A Green Card – Boundless

The Exit Tax When Moving From The Us To Canada –

Exit Tax For Renouncing Us Citizenship Or Green Card Hr Block

Will I Have To Pay Tax On My Savings When Leaving The Us

Green Card Holder Exit Tax 8-year Abandonment Rule New

The Green Card Is The Holy Grail Of Chinese Visas Heres How It Works Smartshanghai

Green Card Exit Tax Abandonment After 8 Years

Everything You Need And Want To Know About Chinese Green Cards – Ptl Group