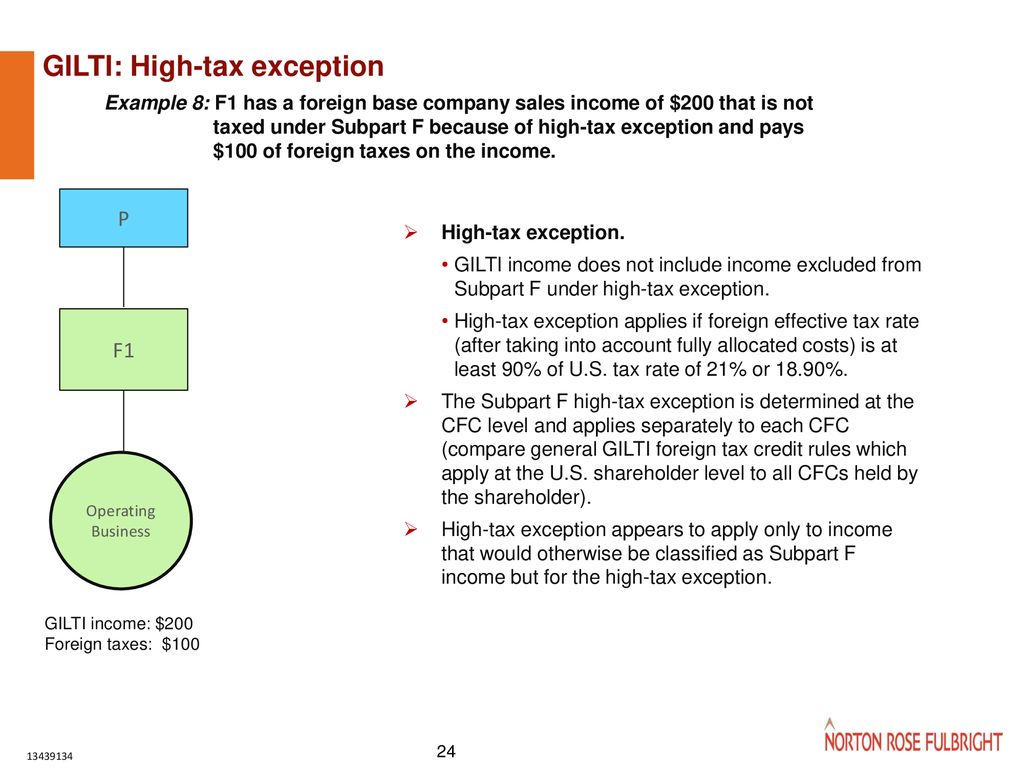

The main cost associated with the gilti high foreign tax exception is that gilti foreign tax credits would not be utilized in the gilti foreign tax credit limitation basket. 245a deduction when distributed to the u.s.

Harvard Yale Princeton Club – Ppt Download

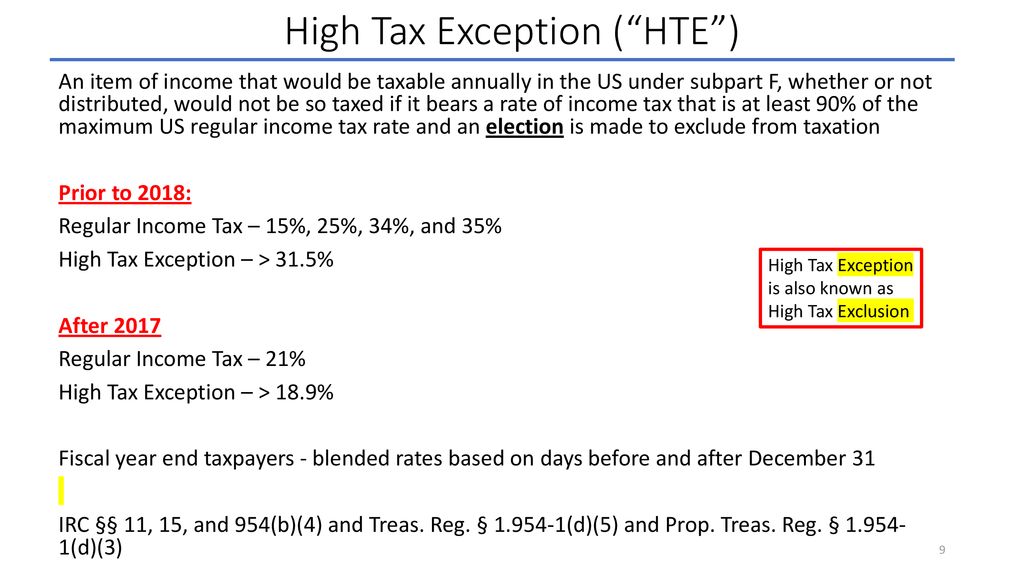

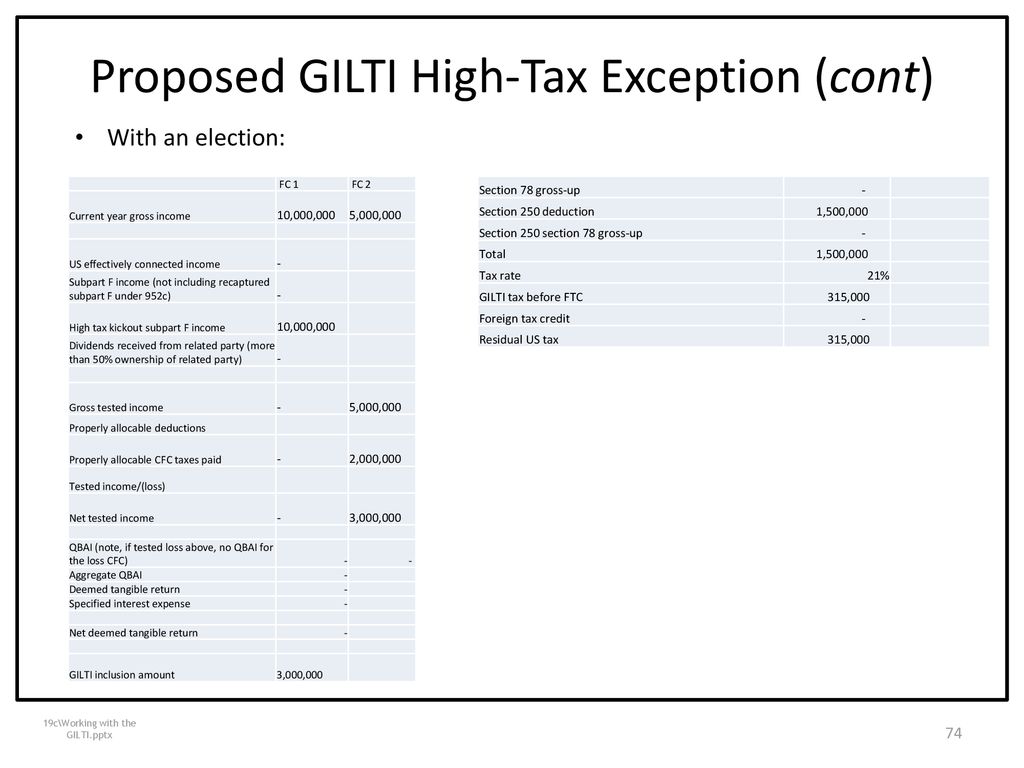

Corporate tax rate, which is 21%).

Gilti high tax exception statement. Shareholders in which or with which such taxable years of foreign corporations end. Thus, when this exception is applied, the u.s. This threshold is unchanged from the proposed regulations.

That election is binding for all u.s. Section 163(j) business interest expense limitation. Group would not be subject to current tax under either the subpart f or gilti rules, and the cfc could have untaxed earnings that may be eligible for the sec.

954(b)(4) regardless if the income would otherwise be subpart f income. Treasury department and irs this afternoon released for publication in the federal register final regulations (t.d. [15] the 2020 proposed regulations apply a more specific standard based on items of gross income attributable to the.

There is also the loss of the excluded gilti in the adjusted taxable income (ati) calculation for the i.r.c. Corporate tax rate (the gilti hte).3 as we will discuss in this article, while the Subpart f income, but not gilti, may be reduced by certain prior year e&p deficits in accumulated.

If a foreign corporation is incorporated in a country with a high tax rate rate (over 18.9%), gilti income may be.

Btcpanet

Lwcom

Lwcom

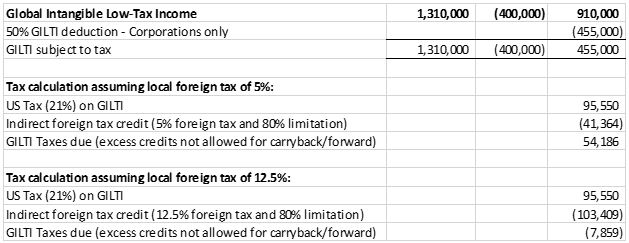

Global Intangible Low-tax Income – Working Example Executive Summary – Mksh

Gilti High-tax Exclusion How Us Shareholders Can Avoid The Negative Impact Sch Group

Lwcom

How Foreign Subsidiary Owners Can Plan For Gilti Hte

Harvard Yale Princeton Club – Ppt Download

Gilti High Tax Exception A Valuable Tax Planning Tool Warren Averett Cpas Advisors

Lwcom

Lwcom

Gilti Detailed Calculation Example

Final Gilti Hte Regs Provide Flexibility Grant Thornton

High-tax Exception Now Available For Gilti Income Sciarabba Walker Co Llp

Lwcom

Hard Hit On Global Supply Chain Structures – Ppt Download

International Aspects Of Tax Cuts And Jobs Act 2017 – Ppt Download

International Aspects Of Tax Cuts And Jobs Act

The Tax Times Final Regs Provide That Gilti High-tax Exception Is Retroactive