Shareholder affected by the gilti hte election Shareholder already recognizes as subpart f income and gross income excluded from subpart f due to the high.

Final Regulations Clarify Potential Benefits Of The Gilti High-tax Exclusion Our Insights Plante Moran

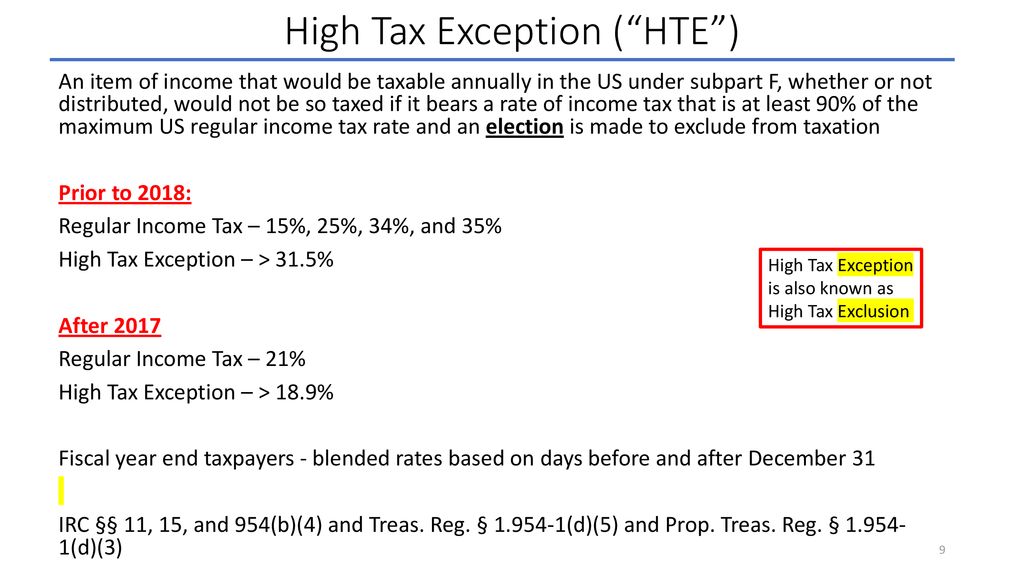

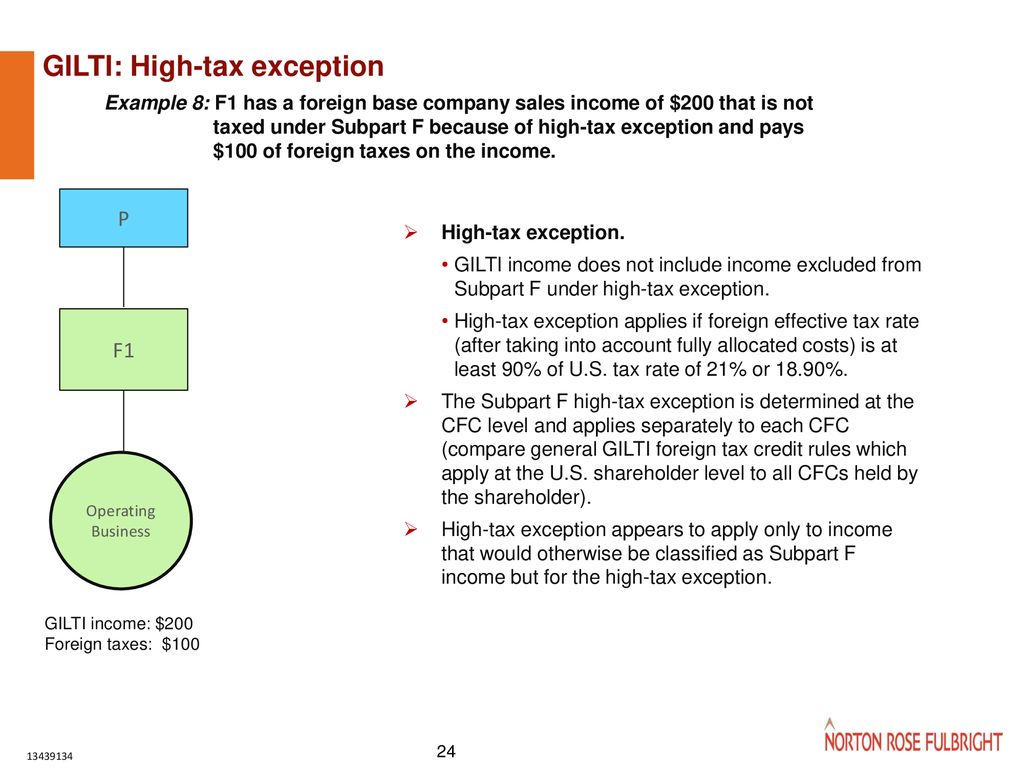

If a foreign corporation is incorporated in a country with a high tax rate rate (over 18.9%), gilti income may be exempt.

Gilti high tax exception election statement. That election is binding for all u.s. Subpart f income, but not gilti, may be reduced by certain prior year e&p deficits in accumulated. 1504(a), modified to include foreign.

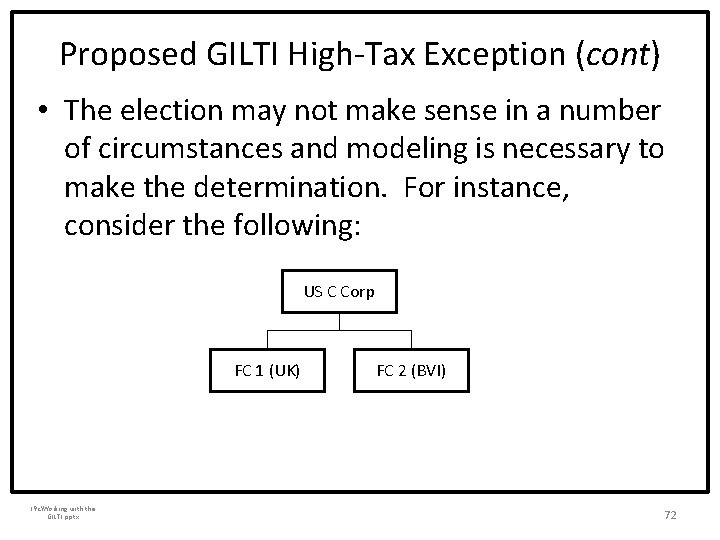

9902) were published in the federal register on july 23, 2020. Shareholders” of cfcs include gilti in income on an annual basis. 1(c)(5)) of cfcs may make a gilti hte election by filing a statement with eith er a timely filed original return or an amended tax return as long as (1) the amended return is filed within 24 months of the unextended due date of the original return, (2) each u.s.

Shareholders of the cfc file the amended return within 24 months of the due date of the original income tax return. A cfc group is an affiliated group as defined in sec. Such exclusions include—but are not limited to—income the u.s.

Enacted in the tax cuts and jobs act (tcja), §951a excludes certain types of gross income from the tested income of a cfc that a u.s. On july 20, 2020, the irs finalized the gilti high foreign tax exception election regulations. Shareholder uses to compute gilti income.

Similar to a subpart f inclusion, “u.s. The final regulations also give taxpayers the option of making a gilti high tax exclusion election with an amended income tax return as long as all u.s.

Form 8992 Gilti Calculation Pitfall – Latest To Know For 2020

5 Things To Know About The Gilti High-tax Exclusion Crowe Llp

Btcpanet

Harvard Yale Princeton Club – Ppt Download

Gilti High Tax Exception A Valuable Tax Planning Tool Warren Averett Cpas Advisors

International Aspects Of Tax Cuts And Jobs Act

Gilti High-tax Exclusion How Us Shareholders Can Avoid The Negative Impact Sch Group

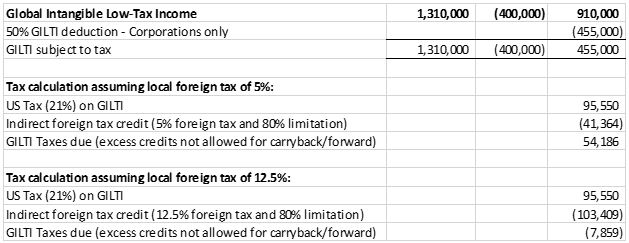

Global Intangible Low-tax Income – Working Example Executive Summary – Mksh

High-tax Exception Now Available For Gilti Income Sciarabba Walker Co Llp

Final Gilti Hte Regs Provide Flexibility Grant Thornton

Section 962 Election Of The Corporate Tax Rate By Individuals Trusts And Estates For Global Intangible Low-taxed Income Gilti Income Inclusions Thomas – Ppt Download

Lwcom

Lwcom

Harvard Yale Princeton Club – Ppt Download

Hard Hit On Global Supply Chain Structures – Ppt Download

Lwcom

Lwcom

How Foreign Subsidiary Owners Can Plan For Gilti Hte

Lwcom