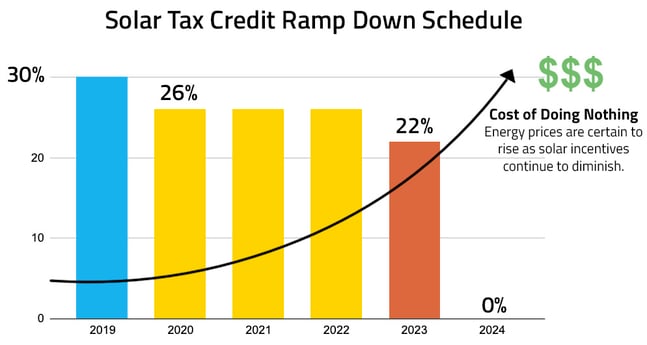

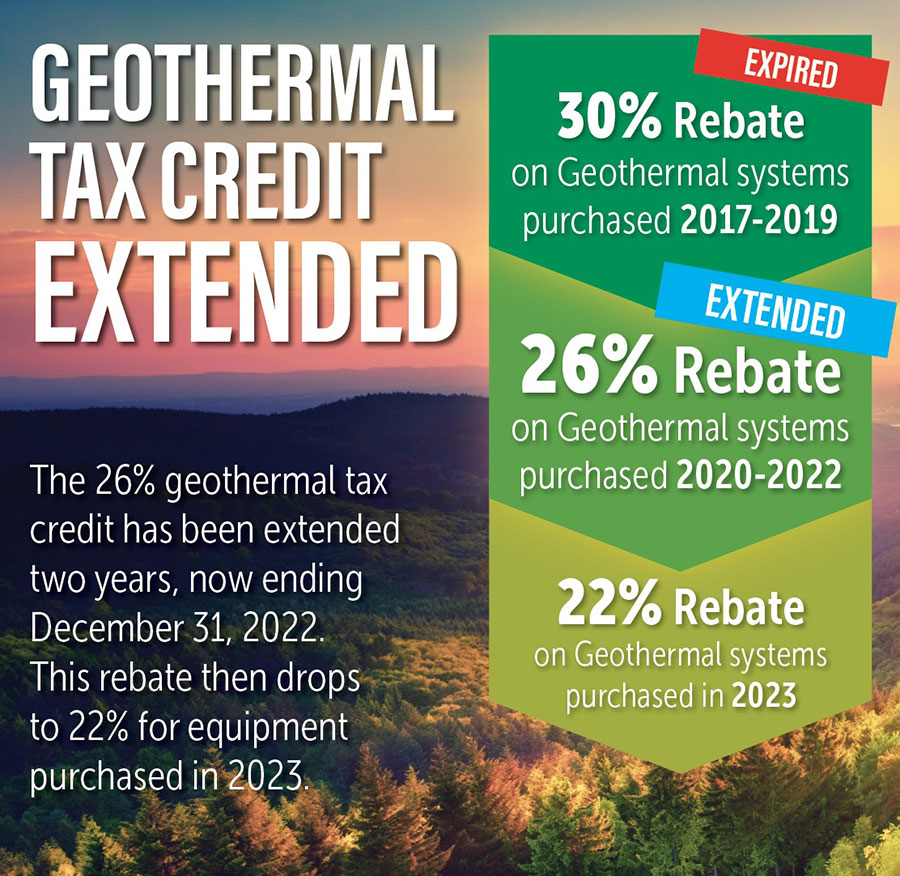

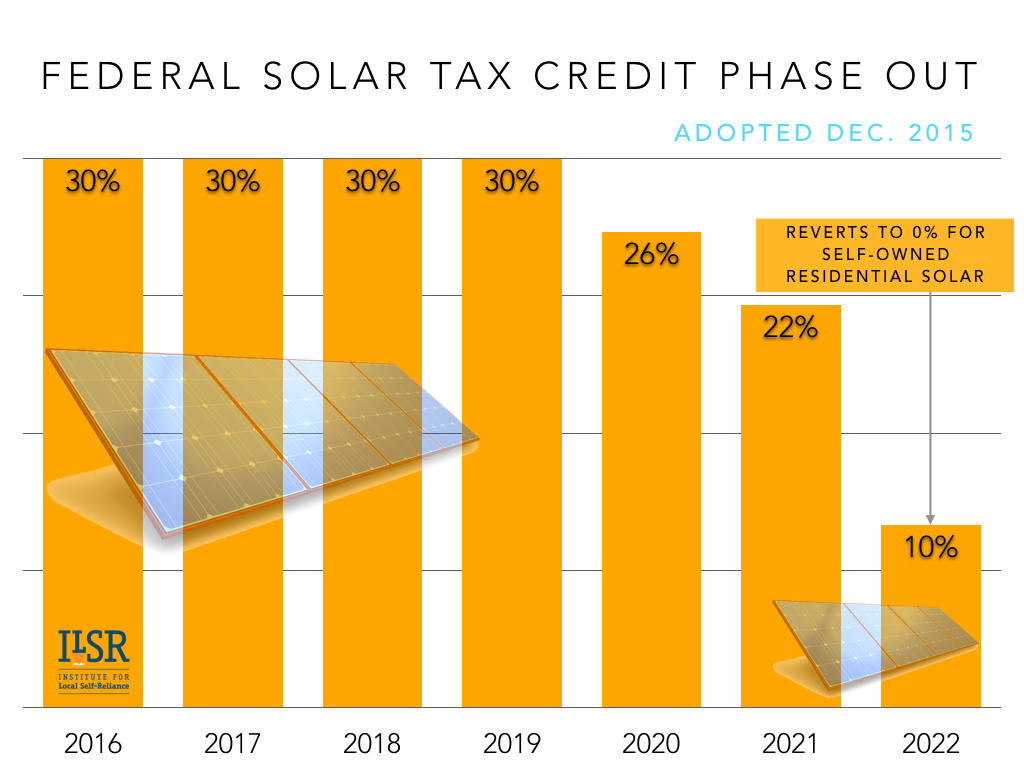

The credit then steps down to 22% in 2023 and expires january 1, 2024. in december 2020, the tax.

Understanding The Geothermal Tax Credit Extension

However, if the system is part of the construction or renovation of a house, it’s considered placed in service when the taxpayer takes residence in the house.

Geothermal tax credit extension. On december 17, 2019, the united states house of representatives passed the tax extenders package, allowing geothermal projects that begin construction before the end of. Since geothermal systems are the most efficient heating and cooling units available, the united states federal government has enacted a 26% federal geothermal tax credit with no upper limit. Help extend the geothermal 30% tax credit through 2024!

The energy efficiency property tax credit (residential credit) for ghps is extended for two years at its current level of 26% of total installation cost. This geothermal heat pump tax credit was created by the energy improvement and extension act of 2008 (h.r. From 2017 to january of 2018 there was an ongoing fight to extended this tax credit.

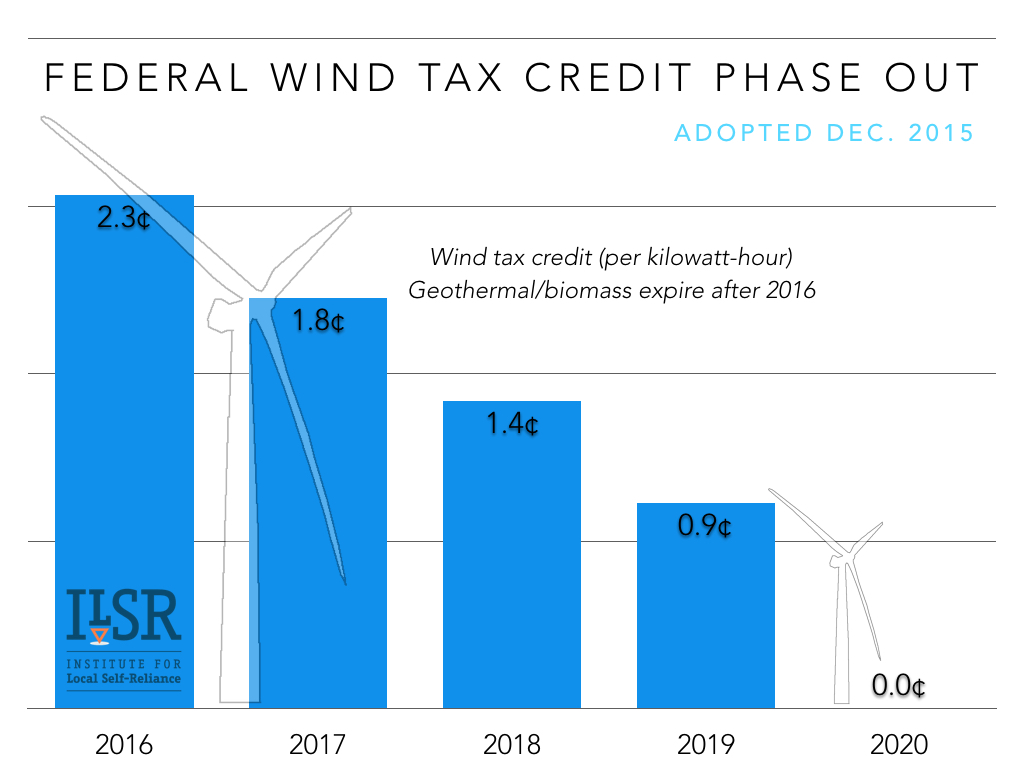

Unless amended, the tax credit will extend until 31 december 2016. The recently signed federal budget and stimulus bill includes an extension of the federal geothermal heat pump (ghp) tax credits through 2023. Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets energy star requirements at the time of installation is eligible for the tax credit.

Property is usually considered to be placed in service when installation is. The tax credits for solar and geothermal, as did the tax extension act of 1991 (p.l. Existing tax credits were set at 26% throughout 2020, 22% throughout 2021, and falling to zero at the end of 2021.

Congress recently approved an extension of federal tax credits for both residential and commercial installations of geothermal heat pumps (ghps) and several other alternative energy based solutions. “we heard from leaders afterward that it was a mistake and that there would be a willingness to bring geothermal technologies in line, in parity, with what solar and wind got,” dougherty said. This legislative package contains an.

This tax credit was available through the end of 2016. See our announcement from last week here. Tax credits for geothermal extended to 2023!

The credits have been extended through 2023. A 30% tax credit for the installation of a ground source heat pump (geothermal system) with no cap was enacted in 2009. The energy policy act of 1992 (p.l.

On december 17, 2019, the united states house of representatives passed the tax extenders package, allowing geothermal projects that begin construction before the end of 2020 to claim ptcs when the project is later placed in service, or to elect to. The 26% federal tax credit was extended through 2022 and will drop to 22% in 2023 before expiring altogether, so act now for the most savings! This would mean a 30% tax credit through 2024 , a 26% tax credit in 2025, and a 22% tax credit in 2026.

The federal tax credit for geothermal installations was extended for two more years at the end of 2020. Geothermal tax credit explanation property is usually considered to be placed in service when installation is complete and equipment is ready for use. These tax credits were initially introduced as part of the energy improvement and extension act of 2008, but with the exception of solar and wind energy credits the tax benefits ended at the close of 2016.

The energy efficiency property tax credit (residential credit) for ghps is extended for two years at its current level of 26% of total installation cost. As we mentioned last week, this legislative package includes an extension for commercial and residential geothermal heat pump (ghp) tax credits. The new legislation lengthens the deadline for the credits for ghp installations.

In december 2020, the tax credit for geothermal heat pump installations was extended through 2023. Extension for commercial and residential geothermal heat pump (ghp) tax credits. Residential credits are 26% through 2022, step down to 22% in 2023, and expire january 1, 2024.

The extension keeps the tax credit at 26% for residential geothermal for 2021 and 2022. In december 2020, the tax credit for geothermal heat pump installations was extended through 2023. The recently signed federal budget and stimulus bill includes an extension of the federal geothermal heat pump (ghp) tax credits through 2023.

While the bill mainly targets homeowners, small business and commercial owners may be eligible for a 10% tax credit for their geothermal heat pump investment. The new law extends the credits for ghp installations through 2023.

Pdf Tax Incentive Policy For Geothermal Development A Comparative Analysis In Asean

Pdf Tax Incentive Policy For Geothermal Development A Comparative Analysis In Asean

The Federal Geothermal Tax Credit Your Questions Answered

The Extended 26 Solar Tax Credit Critical Factors To Know

What Federal Tax Incentives Are There For Geothermal Heat Pumps

Geothermal Heat Pump Tax Credits Approved By Congress – Geothermal Heating And Cooling Chesapeake Geosystems

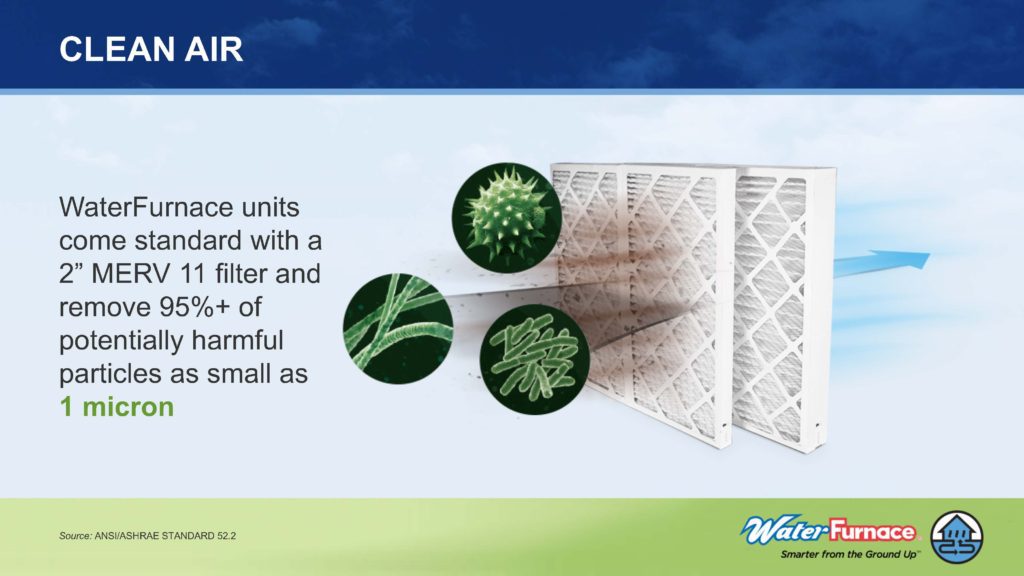

Tax Credits And Other Incentives For Geothermal Systems Waterfurnace

Oklahomas Geothermal Tax Credit Extension Explained Dehart Ok

What Is The 2021 Geothermal Tax Credit – Climatemaster Geothermal Hvac

Geothermal Tax Credits Extended Smart Choices

Geothermal Rebates Extended – Corken Steel Products

Congress Gets Renewable Tax Credit Extension Right – Renewable Energy World

House-passed 17 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

Congress Gets Renewable Tax Credit Extension Right – Renewable Energy World

Geothermal Investment Tax Credit Extended Through 2023

What Is The 2021 Geothermal Tax Credit – Climatemaster Geothermal Hvac

Pdf Tax Incentive Policy For Geothermal Development A Comparative Analysis In Asean

Newsletter

What Federal Tax Incentives Are There For Geothermal Heat Pumps