Any sweepstakes, lottery, or wagering pool (this can include payments made to the winner(s) of poker tournaments). Depending on the number of your winnings, your federal tax rate could be as high as 37 percent as per the lottery tax calculation.

Wagering And Betting Tax

However, if you fail to give your tax id number to the payer, 28% of the winnings will be withheld instead of the usual 25%.

Gambling winnings tax calculator nj. Section 620(a) provides that “a resident shall be allowed a credit against the tax otherwise due under this article for any. 5% for lottery payouts between $10,001 and $500,000; Your gambling winnings are generally subject to a flat 24% tax.

1(c), effective july 1, 2016, the withholding rates for gambling winnings paid by the new jersey lottery are as follows: With all sports betting, casino, poker, daily fantasy, and state lotteries, is the government entitled to a fair share?the most accurate answer is, you can bet on it. New jersey income tax is withheld at an amount equal to three percent (3%) of the payout for both new jersey residents and nonresidents ( n.j.s.a.

In new york, state tax ranges from a low of 4% to a high of 8.82%. For example, if you win $620 from a horse race but it cost you $20 to bet, your taxable winnings are $620, not $600 (after subtracting your $20 wager). The rate is determined by the amount of the payout.

Sometimes in a positive way, but sometimes in a negative way. Taxes on gambling winnings nj to all our taxes on gambling winnings nj visitors. 100% up to £500 + 20 free spins.

Gambling winnings are subject to a 24% federal tax rate. New jersey income subject to tax: Withholding rate from gambling winnings.

31, 2019, taxes on gambling income in illinois are owed regardless of what state you live in. Tax law section 620 allows residents a tax credit for taxes paid to another state. Taxes on nj state lottery winnings.

The percentages withheld from the state lottery payouts of more than $10,000 are as follows. The second rule is that you can’t subtract the cost of gambling from your winnings. As of the 2021 tax year, you would have to have an individual income above $164,925 (including your winnings) to owe more taxes on your winnings.

Yes, gambling winnings fall under personal income taxed at the flat illinois rate of 4.95. Military pension or survivor’s benefit payments adjustment There is reason behind our shortlist and australian online casino reviews, so read on to find out why these are the best casino sites accepting aussie players.

In some cases, the tax ( 25%) is already deducted by the casino before you are paid your winning. Any other bet if the proceeds are equal to. However, for the following sources listed below, gambling winnings over $5,000 will be subject to income tax withholding :

However, for the activities listed below, winnings over $5,000 will be subject to income tax withholding: Withholding rate from lottery winnings. Net gambling winnings are the total winning minus the losses.

The tax brackets are progressive, which means portions of your winnings are taxed at different rates. What happens if i don’t report gambling winnings? While that fair share might cause you to grumble under your breath, the fact is gambling winnings are taxed.

The state tax rate in new jersey is 3%, which is the rate your gambling winnings are taxed. Be prepared to show the losses used to reduce the winnings claimed on the return. However, effective january 2009, new jersey lottery winnings in excess of $10,000 became subject to the state gross income tax.

Gambling winnings are typically subject to a flat 24% tax. If your total income was under $86,376, you may. Any lottery, sweepstakes, or betting pool.

Prior to 2009, nj state lottery winnings were not taxable. The state income tax rate in arizona ranges from 2.59% to 4.50%, which is the rate your gambling winnings are taxed. The higher your taxable income, the higher your state tax rate.

Gambling winnings are considered taxable income by the irs. Pennsylvania taxes gambling income of residents regardless of where the gambling income was won as well. One small consolation is pa’s 3.07% state tax on lottery winnings is less than half than neighboring states such as new york (8.82%), new jersey (8.0%) and west virginia (6.5%).

There’s no doubting that the tax on gambling winnings nj laws tax on gambling winnings nj of the land affect your relationship with online tax on gambling winnings nj casinos: A breakdown of tax rates for single new yorkers: Gambling winnings subject to tax?

Amounts less than $0 cannot be entered. New jersey taxes winnings of $10,000 or more. Are gambling winnings taxable in arizona all online gambling winnings, whether placed online or in person at casinos, are taxable.

Whether they’re winnings from a slot machine, horse track, poker table or sportsbook, they all count as income and are subject to state taxes. See the residents in the following pdf document: If you didn’t give the payer your tax id number, the withholding rate is also 24%.

So it doesn’t matter if you earn $2,000 or $400,000 because betting taxes are not progressive. When gambling winnings are combined with your annual income, it could move you into a higher tax bracket, so it’s important to be aware of gambling income before starting tax preparation.

Tax Involvement For Players In New Jersey

Lottery Tax Calculator Updated 2021 – Lottery N Go

Lottery Tax Calculator – How Lottery Winnings Are Taxed Taxact

Gambling Winnings Tax Hr Block

Lottery Tax Calculator All You Should Know – Gamblegusto

:max_bytes(150000):strip_icc()/dotdash-TheBalance-best-and-worst-states-for-property-taxes-3193328-final3-4972494b00d447d58e8943ad5b82913e.jpg)

State Taxes

How To Pay Taxes On Sports Betting Winnings Bookiescom

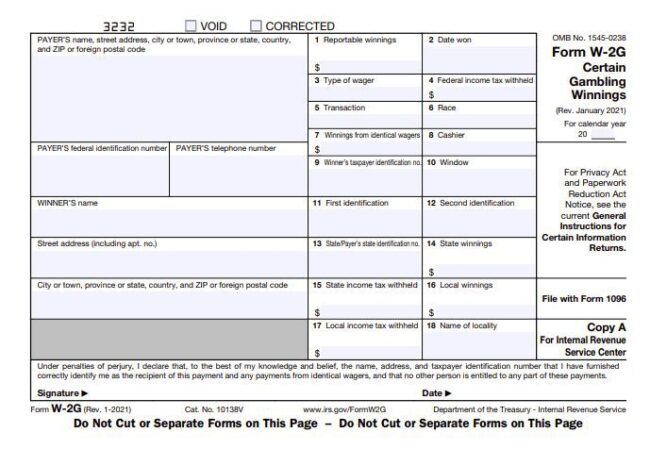

Filing Out Of State W-2g Form Hr Block

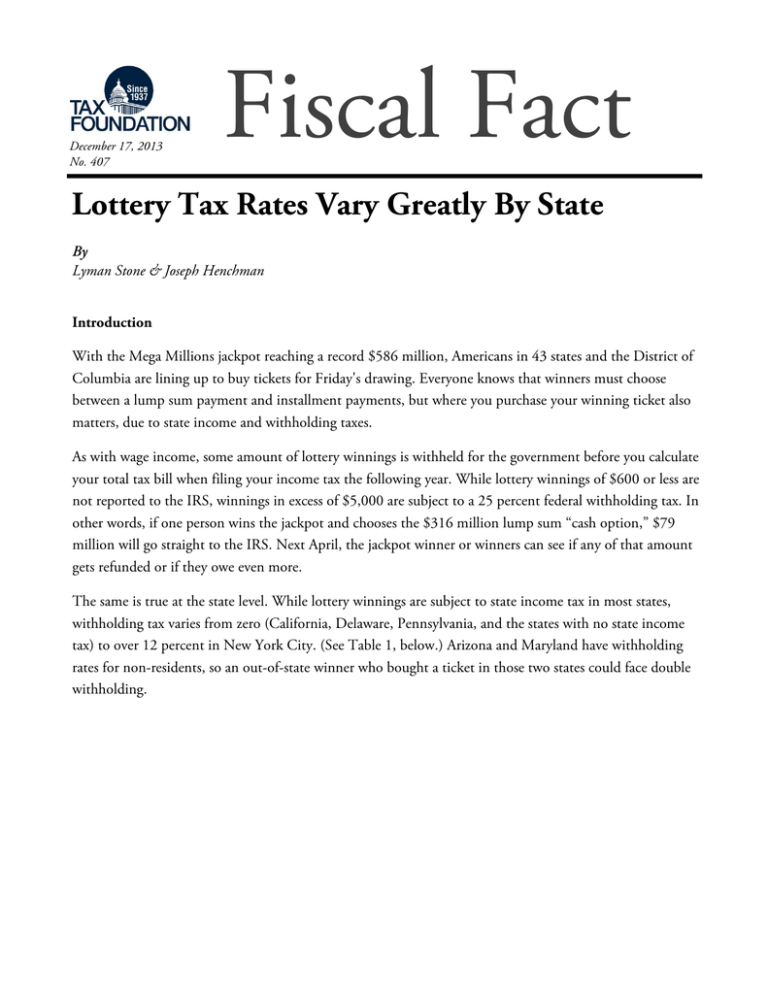

Lottery Tax Rates Vary Greatly By State

Nj Gambling Winnings Tax Calculator

How Much Tax Do You Pay On A 10000 Lottery Ticket Lotto Library

Maryland Gambling Winnings Tax Calculator Marylandbetscom

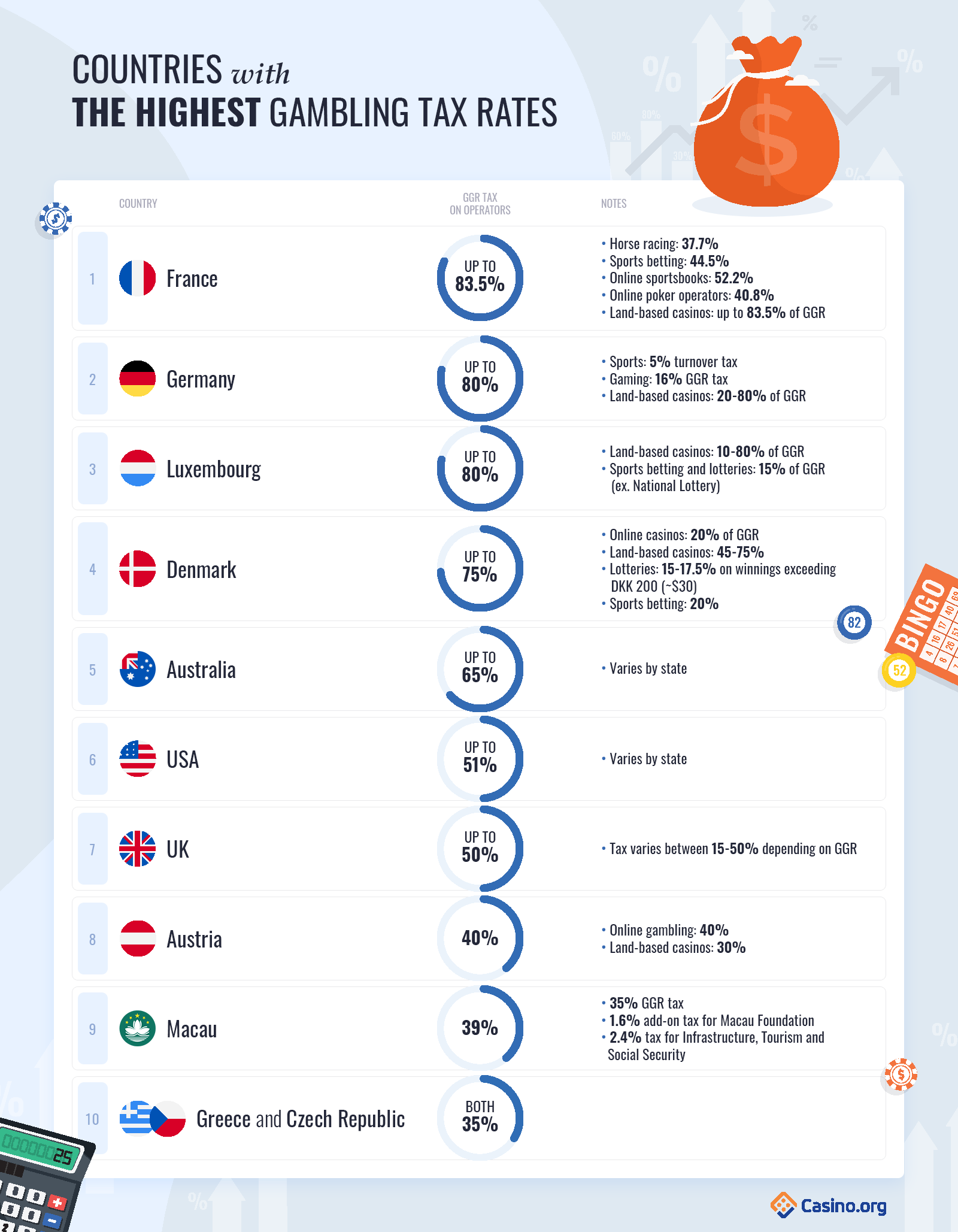

Gambling And Taxes

Tax Calculator Gambling Winnings Free To Use All States

The Buzz On How Are Gambling Winnings Are Taxed Diginerds

Free Gambling Winnings Tax Calculator All 50 Us States

Tax Calculator Gambling Winnings Free To Use All States

Alabama State Tax On Gambling Winnings – Massagegood

4 Rules To Know About New York Gambling Taxes – Music Raiser