Regular gambling withholding for certain games. Canada tax treaty, canadians can offset their gambling losses against their gambling winnings.

Pin By Krystal Pusser On Money Retirement Portfolio Retirement Retirement Planning

However, for the following sources listed below, gambling winnings over $5,000 will be subject to income tax withholding :

Gambling winnings tax calculator florida. The sports gambling tax calculator in colorado shows that you will pay 24 percent federal income tax if your taxable gambling winnings from lotteries, wagering pools, and sweepstakes are over $5,000. Any lottery, sweepstakes, or betting pool. You should consult a tax professional to avoid any mistakes in.

Luckily, due to the u.s. Gambling winnings are subject to a 24% withholding for federal tax, though the actual amount you owe on your gambling win will depend on your total income. However, for the activities listed below, winnings over $5,000 will be subject to income tax withholding:

The second rule is that you can’t subtract the cost of gambling from your winnings. For example, if you win $620 from a horse race but it cost you $20 to bet, your taxable winnings are $620, not $600 (after subtracting your $20 wager). Federal tax rates range from 10% to 37%, and gambling winnings can bump a person into a higher tax bracket.

Every state has its own rules regarding nonresident returns. However, if you fail to give your tax id number to the payer, 28% of the winnings will be withheld instead of the usual 25%. For florida residents who don't have a social security number, the lottery is required to withhold 24 percent on winnings of more than $600.

19.5% tax on all winnings: That tax is automatically withheld on winnings that reach a specific threshold (see below for exact amounts). If a payment is already subject to regular gambling withholding, it isn't subject to backup withholding.

25% tax + a flat ron61,187.50 tax. The state passed a law that states that all winnings received after 2017 and that are more than $5,000 have a 24 percent federal gambling tax rate. Taxes on gambling winnings in florida, blue heron casino shuttle, complete texas holdem rules, black jack black pink

Even taxes gambling winnings florida more deposit bonus spins follow on your second, third and fourth deposits! I am unemployed and my only income is derived from regular gambling. Generally, yes, but it depends on the state.

If you’re unsure about a specific tax issue, it’s best to consult a tax professional before filing to avoid any potential mistakes. (a) regular gambling withholding at 24% (31.58% for certain noncash payments) and (b) backup withholding which is also at 24%. Sign up to lv bet and claim up to £200 + up to 200 lv spins on your first deposit.

Any sweepstakes, lottery, or wagering pool (this can include payments made to. All the withdrawals made on this platform are processed within an hour. For information on withholding on gambling winnings, refer to publication 505, tax withholding and estimated tax.

Gambling winnings are subject to 24% federal tax, which is automatically withheld on winnings that exceed a specific threshold (see next section for exact amounts). State and local tax rates vary by location. 10% tax on all winnings:

Even if that threshold wasn’t met, include the winnings on your federal and ny income tax returns. 1% on winnings up to ron66,750; Do i have to file out of state taxes on gambling winnings?

Those of you familiar with taxes will immediately see the slew of extra costs this creates. Some states don’t impose an income tax while others withhold over 15 percent. Nonresident aliens will see 30 percent withheld on winnings of any amount.

In some cases, the tax ( 25%) is already deducted by the casino before you are paid your winning. Your gambling winnings are generally subject to a flat 24% tax. You may deduct gambling losses only if you itemize your deductions on schedule a (form 1040) and kept a record of your winnings and losses.

You may be required to withhold 24% of gambling winnings for federal. All taxed at a rate of 30%. So it doesn’t matter if you earn $2,000 or $400,000 because betting taxes are not progressive.

Report your total gambling winnings as “other income’’ on form 1040, schedule 1, line 8. There are two types of withholding on gambling winnings: Virginia’s state tax rates range from 2% to 5.75%.

The following answers general questions on how gambling winnings are taxed in pa. You will pay the same casino tax if your winnings are 300 times your stake. When you have gambling winnings, you may be required to pay an estimated tax on that additional income.

However, the specific amount of time it florida state tax on gambling winnings will take for the money to get to your account will depend on the payment method you choose. 100% bonus up to £200 + up to 200 lv spins on first deposit. Any other bet if the proceeds are equal to or greater than 300 times the wager amount.

You have to report your gambling winnings as income and then deduct your loses as an itemized deduction. Cash is not the only kind of winnings you need to report. But it doesn’t take much — an annual income of more than $17,000 — for the highest percentage to kick in.

Players should report winnings that are below $5,000 and state their sources. Winners of $5,000 or less aren't required to deduct federal withholding taxes from any monies they receive. Gambling winnings are typically subject to a flat 24% tax.

Depending on the number of your winnings, your federal tax rate could be as high as 37 percent as per the lottery tax calculation. Now, for tax purposes you cannot just subtract losses from winnings and report your net as additional income. 16% tax + a flat ron667.50 on taxes from ron66,750 to ron445,000;

20% on winnings over €40,000: The internal revenue service (irs) treats casino winnings and winnings from other forms of gambling activity as taxable income. Thus, a full or partial irs tax refund can be obtained.

The state’s 3.23 percent personal income tax rate applies to.

Builder Floor In Uttam Nagar House Styles Dream House Flooring

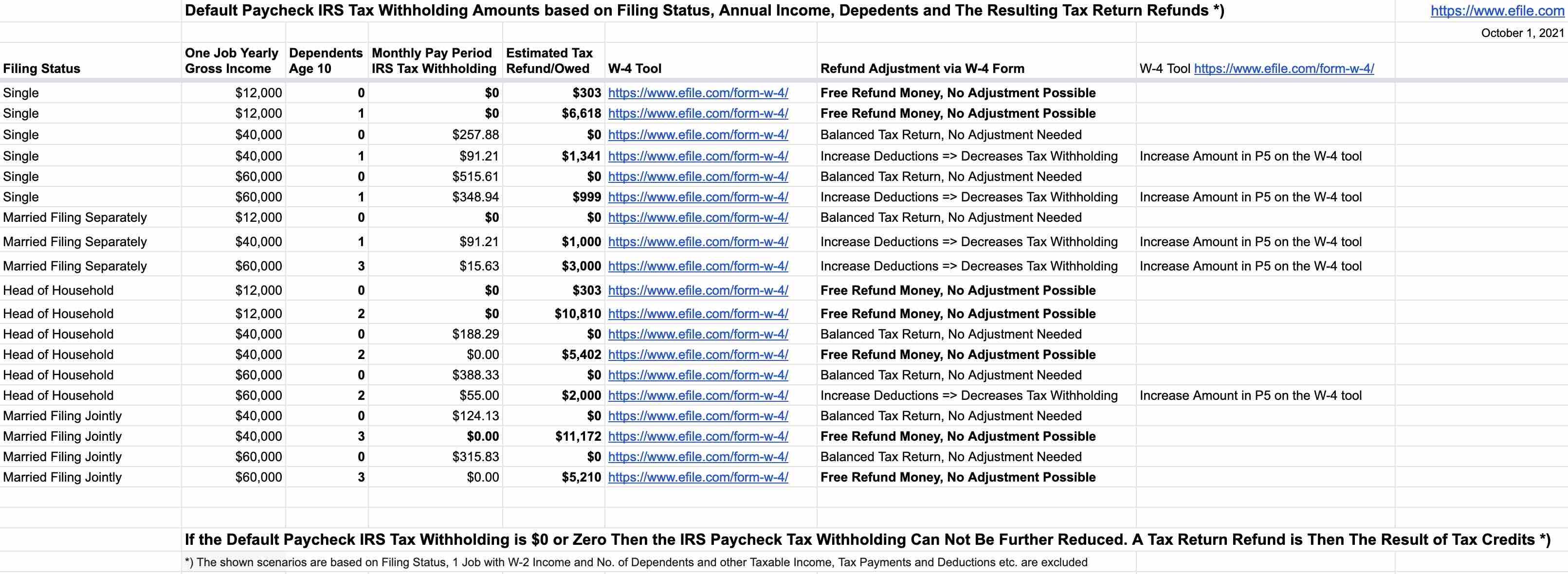

How To File Out A W-4 Form Or W4 Tax Withholding 2021

Free Tax Calculator For Gambling Winnings All States

Prior Year Tax Return Software File Previous Year Taxes With Freetaxusa

Sweepstakes Taxes Heres The Lowdown Freebie Babble Sweepstakes Money Sweepstakes Online Sweepstakes

How To File Out A W-4 Form Or W4 Tax Withholding 2021

Gambling Winnings Tax How Much You Will Pay For Winning The Turbotax Blog

Did You Know Lottery 1040taxstore Filing Taxes Accounting Services Lottery

The Starter Guide To Tracking Your With An Excel Spreadsheet Excel Spreadsheets Spreadsheet Template Excel

Sales Tax Fundamentals – Taxjar

What Nonprofits Need To Know About Sales Tax – Taxjar

Aflacs Real Cost Calculator Saves Money And Headaches Aflac Emergency Medical Household Expenses

8 Tips To Improve Your Money Mindset Life In A Break Down Money Mindset Mindset Investing Infographic

Traditional Ira Vs Roth Ira Whats The Difference Traditional Ira Roth Ira Ira

Dont Count On A Lucky Break Book Making Rivalry Sports Betting

Sales Tax Fundamentals – Taxjar

Retirement Planning Calculator Day Trading Investing Risk Aversion

How To File Out A W-4 Form Or W4 Tax Withholding 2021

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income