The december 2020 total local sales tax rate was also 7.500%. The ohio sales and use tax applies to the retail sale, lease, and rental of tangible personal property as well as the sale of selected services in ohio.

How To Charge Your Customers The Correct Sales Tax Rates

The sales and use tax rate for paulding county (63) will increase from 6.75 % to 7.25 % effective january 1, 2022.

Franklin county ohio sales tax rate 2020. Create your own online store and start selling today. The ohio sales tax rate is currently %. 2015 franklin county tax rates.

Ohio has state sales tax of 5.75% , and. The december 2020 total local sales tax rate was also 7.000%. To learn more about how franklin county generates the annual tax rate click here.

Create your own online store and start selling today. Please refer to the ohio website for more sales taxes information. Map of current sales tax rates.

2021 4th quarter rate change. There is no applicable city tax or special tax. Automating sales tax compliance can help your business keep compliant with.

The current total local sales tax rate in franklin county, oh is 7.500%. Try it now & grow your business! The next sexennial reappraisal will occur in.

January 2022 sales tax rates color.ai author: The sales tax rate is always 7% every 2021 combined rates mentioned above are the results of ohio state rate (5.75%), the county rate (1.25%). The county sales tax rate is %.

The minimum combined 2021 sales tax rate for franklin, ohio is. There is no applicable city tax. 2020 franklin county tax rates.

The franklin sales tax rate is %. The ohio state sales tax rate is currently %. The franklin county sales tax rate is %.

The franklin county, ohio sales tax is 7.50%, consisting of 5.75% ohio state sales tax and 1.75% franklin county local sales taxes.the local sales tax consists of a 1.25% county sales tax and a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc). 2018 franklin county tax rates. 2020 property tax rates for 2021 as provided by the franklin county auditor, expressed in dollars and cents on each one thousand dollars of assessed valuation.

The next announcement of the county's total value will come in november 2021. Has impacted many state nexus laws and sales tax collection requirements. There is no city sale tax for franklin.

In transactions where sales tax was due but not collected by the vendor or seller, a use tax of equal amount is due from the customer. The franklin's tax rate may change depending of the type of purchase. The following list of ohio post offices shows the total county and transit authority sales tax rates in most municipalities.

This is the total of state, county and city sales tax rates. This table shows the total sales tax rates for all cities and towns in franklin county, including all local taxes. The state sales and use tax rate is 5.75 percent.

2021 franklin county tax rates. 2016 franklin county tax rates. The 7.5% sales tax rate in columbus consists of 5.75% ohio state sales tax, 1.25% franklin county sales tax and 0.5% special tax.

Page 1 revised april 1, 2020. Franklin city rate(s) 7% is the. Try it now & grow your business!

2017 franklin county tax rates. There is no special rate for franklin. The sales tax jurisdiction name is columbus cota (delaware co) , which may refer to a local government division.

The 2018 united states supreme court decision in south dakota v. For tax year 2020, franklin county reached a record high of $142.4 billion in total real estate market value. 2022 1st quarter rate change.

If you need access to a database of all ohio local sales tax rates, visit the sales tax data page. 1117 rows average sales tax (with local): 2019 franklin county tax rates.

The 7% sales tax rate in franklin consists of 5.75% ohio state sales tax and 1.25% warren county sales tax. There is no applicable city tax. The sales and use tax rate for paulding county (63) will decrease from 7.25 % to 6.75 % effective october 1, 2021.

Ohio has a 5.75% sales tax and franklin county collects an additional 1.25%, so the minimum sales tax rate in franklin county is 7% (not including any city or special district taxes). The current total local sales tax rate in franklin, oh is 7.000%. This year’s number of $142.4 billion is an 18 percent increase on last year’s previous high ($120.1 billion).

Ohio Sales Tax – Small Business Guide Truic

Sales Taxes In The United States – Wikiwand

What Is Georgias Sales Tax – Discover The Georgia Sales Tax Rate For 159 Counties

Tennessee Sales Tax – Taxjar

Sales Taxes In The United States – Wikiwand

The Benton County Washington Local Sales Tax Rate Is A Minimum Of 65

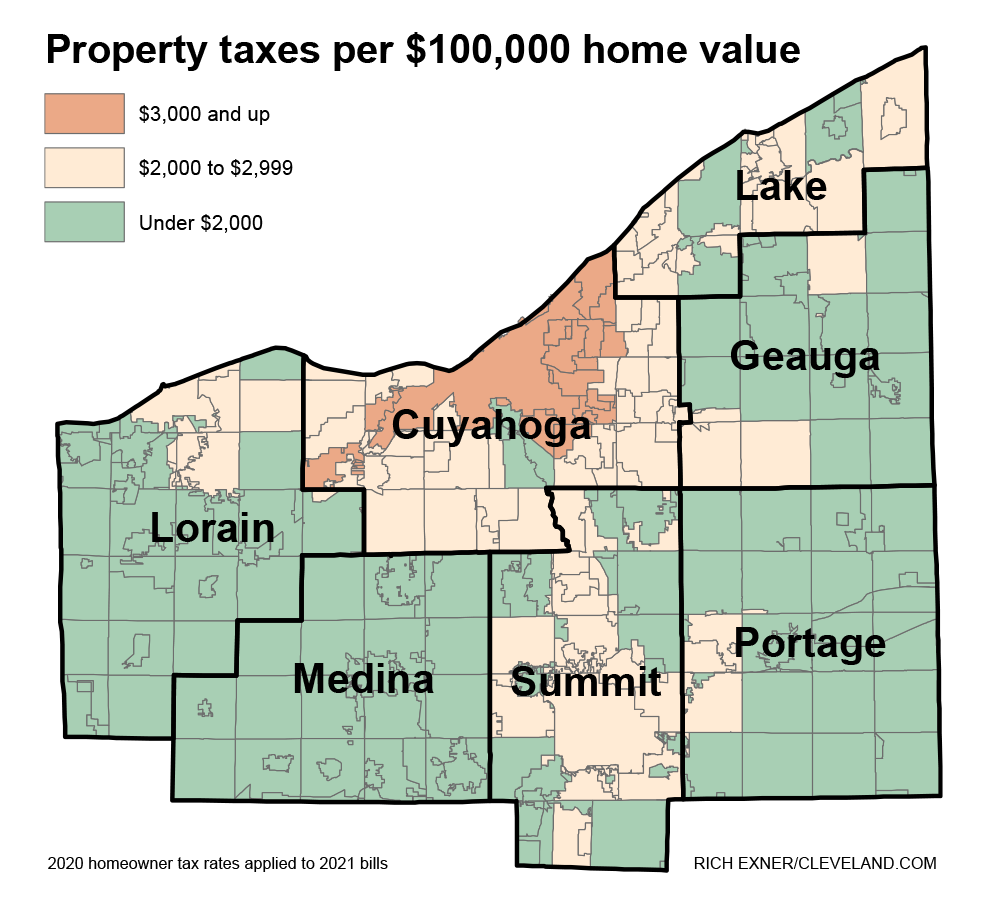

These Cuyahoga County Places Have Ohios 6 Highest Property Tax Rates Thats Rich Recap – Clevelandcom

Ebay Sales Tax Everything You Need To Know Guide – A2x For Amazon And Shopify – Accounting Automated And Reconciled

Ohio Sales Tax Rates By City County 2021

Sales Taxes In The United States – Wikiwand

City Of Powell Ohio Taxes

Florida Sales Tax Rates By City County 2021

Ohio Sales Tax – Taxjar

Solving Sales Tax Applications Prealgebra

Kansas Sales Tax Rates By City County 2021

Solving Sales Tax Applications Prealgebra

State Local Property Tax Collections Per Capita Tax Foundation

Sales Taxes In The United States – Wikiwand

How To Charge Your Customers The Correct Sales Tax Rates