It says “franchise tax bd des:casttaxrfd”, which google slething tells me is a ca state tax refund. We just changed our entire website, so we likely moved what you’re looking for.

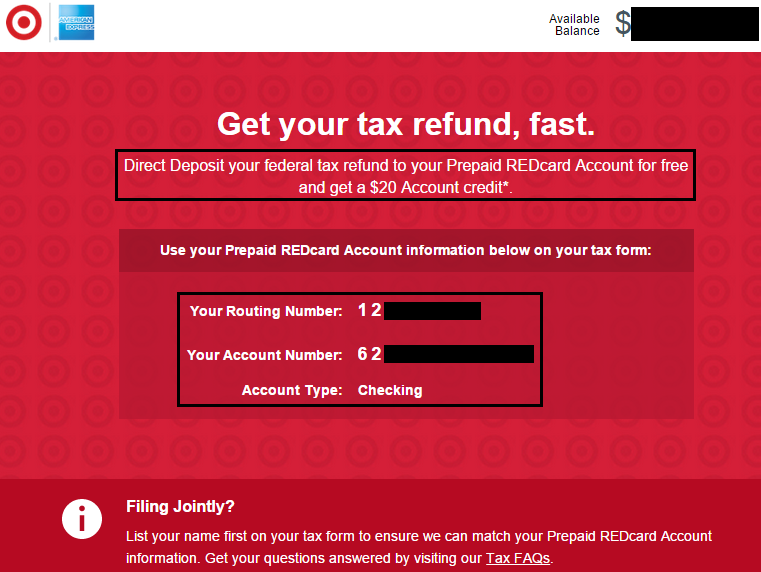

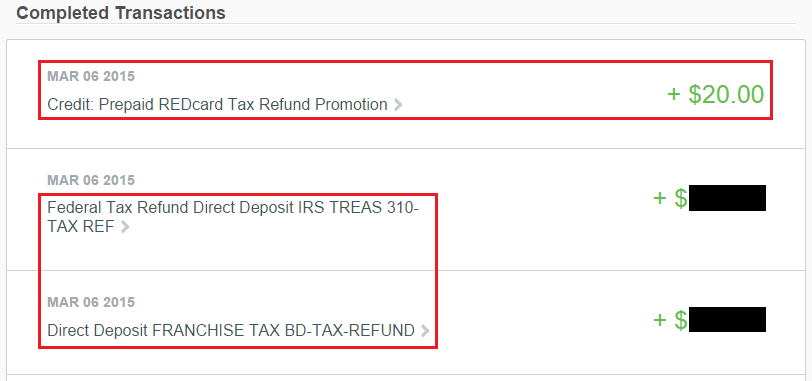

Redbird Statement Credit After Depositing Federal Tax Refund

State of california franchise tax board corporate logo.

Franchise tax bd refund. Fidelity paid the tax and filed a claim for a refund with the franchise tax board. There is a time limit to request a refund from the california franchise tax board. Handling and clearing state and local tax notices.

State income and sales tax nexus and taxabilty studies. Generally, you can file a refund claim until the latter of four years from the due date of your tax return, or one year from the date of overpayment. A state tax refund is taxable if you itemized deductions on that prior year's federal return and took a deduction for state income taxes instead of the sale tax.

The claim was deemed disallowed under section 19385 because the franchise tax board did not take action on it. It's your tax refund from the state. If you took the standard deduction it is.

The page or form you requested cannot be found. You got a deduction benefit for it so now you have to include it as income. One of the ftb’s most important functions is to review state income tax returns and, where appropriate, issue refunds to eligible california taxpayers.

No, they send it all at once. In these consolidated appeals, the california franchise tax board (ftb)challenges a judgment awarding respondent northwest energetic services, llc (northwest) a refund of amounts paid under revenue and taxation code section 17942 1 and an order awarding attorney fees. Franchise tax bd., 178 cal.app.4th 426, 100 cal.

For example, the board is authorized to seize and turn over california tax refunds or california lottery winnings to the appropriate agencies if the lottery winner or the entity that is due a tax refund is delinquent in paying that agency. Obtaining taxpayer account information is the privilege of individual taxpayers or their authorized representatives. In most cases, you may only request a refund when you have paid the full amount due.

Log in to your myftb account. Section 19382 of the revenue and taxation code of california provides that the taxpayer may bring an action for a claim for refund after full payment and denial by the ftb. The franchise tax board also helps other governmental agencies in california collect monies owed to them.

“if the franchise tax board fails to mail notice of action on any refund claim within six months after the claim was filed, the taxpayer may, prior to mailing of notice of. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed. The board is composed of the california state controller, the director of the california department of finance, and the chair of the california board of equalization.the chief administrative official is the executive.

Franchise tax [bd.], supra, 235 cal.app.3d at page 489, held that a taxpayer seeking a refund of franchise taxes paid under protest, and based on a challenge to the constitutionality of the tax assessment, was not excused from filing an administrative refund claim, and the failure to exhaust administrative remedies barred the action at law.] Section 19385 provides in relevant part: Past due taxes are charged interest beginning 61 days after the due date.

If the refund is less than what you're expecting from the state of ca, it may be due to some kind of past due state fees (parking tickets, dmv, courts, etc) and the state has adjusted the refund. Annual gross receipts tax and franchise tax filings such as washington b&o and delaware. Refund amount claimed on your 2020 california tax return:

Unlike state income taxes, franchise taxes are not based on a corporation’s profit. If you copied or typed in the web address, make sure it’s correct. That's the title they always use when they're direct depositing it into your account (at least that's what it is for me when i do taxes)

The california franchise tax board (ftb) collects state personal income tax and corporate income tax of california.it is part of the california government operations agency. The california franchise tax board (ftb) performs similar functions as the internal revenue service (irs). Refund amount whole dollars, no special characters.

Appellants waived the right to an oral hearing; In addition, the franchise tax board helps collect money from those. Franchise tax board (ftb) denying a claim for refund of $82,650 1 and applicable interest, for the 2016 tax year.

Accordingly, the franchise tax board assessed additional tax against fidelity. Follow the links to popular topics, online services. A business entity must file and pay the franchise tax regardless of.

File a return, make a payment, or check your refund. A $50 penalty is assessed on each report filed after the due date. California imposes a corporate franchise tax geared to income.

It employs the unitary business principle and formula apportionment in applying that tax to corporations doing business both inside and outside the state. Therefore, the matter is being decided based on the written record. I think in 2013 i did end up owing right around the amount that was.

If you haven’t filed your income taxes yet, visit estimated tax payments. They send a letter out in the weeks following the refund to. Managing current sales/use tax and income tax audits.

How To Redeem California Tax Income Return Warrants – Personal Finance Money Stack Exchange

What Happens If Your Bank Rejected Tax Refund Mybanktracker

Why Is My Refund Less Than Expected Gudorf Tax Group

More Victories 68

2

U-treasure Announces Beautiful Psyduck Necklace Otaquest In 2021 Psyduck Pokemon Necklace Japanese Jewelry

More Victories 67

2

Receipts – Seoul Tax Refund Tax Refund Seoul Refund

More Victories 67

Heres Your Estimated 2020 Tax Refund Schedule – Clark Howard

2

Amazing Informtargetcomcom

California Franchise Tax Board Taking Tax Refunds With No Notice Cbs Sacramento

Wheres My Tax Refund E-filecom

Redbird Statement Credit After Depositing Federal Tax Refund

Wheres My Refund California Hr Block

2020 Personal Income Tax Booklet California Forms Instructions 540 Ftbcagov

More Victories 68