Franchise tax bd., legal ruling no. Log in to your myftb account.

California Franchise Tax Board Bank Levy – How To Release And Resolve Tax Resolution Professionals A Nationwide Tax Law Firm 888 515-4829

Certiorari to the supreme court of nevada.

Franchise tax bd co. 149], the court considered whether california could include by apportionment income of woolworth, canada, a wholly owned subsidiary of the taxpayer. Franchise tax bd casttaxrfd 022117 xxxxx5 +$16.00 02/24/17 is this something from my tax return? 317 cal.2d 664, 111 p.2d 334 (1941), aff’d, 315 u.s.

530 cal.2d 472, 183 p.2d 16, 21 (1947). Pierce associates (1983) mcdonnell douglas corp. Castle, supra, 36 cal.app.4th 1794, 1807, internal quotations omitted.

The deposit stands for franchise tax board california state tax refund. I received a deposit from franchise tax board not matching what my tax return said, do i receive my tax return in amounts? (chase brass & copper co.

Received a direct deposit in my checking account from 'franchise tax bd'.have no idea where/what it is from, should i be worried? Thus, in 1993, the board launched an audit to determine whether hyatt underpaid his 1991 and 1992 state income taxes by misrepresenting his residency. Follow the links to popular topics, online services.

Roberts pilar mata carley a. Sabine and dan kaufmann, assistant attorneys general, and frank m. The california franchise tax board (ftb) collects state personal income tax and corporate income tax of california.it is part of the california government operations agency.

The case now before us is act ii of the dispute between firestone tire rubber company (firestone) and the franchise tax board. Franchise tax bd., supra, 10 cal.app.3d at pp. Franchise tax board of california.

, 60 cal.2d 406 [l. Franchise tax board, defendant and appellant. You would need to follow the directions here to contact the irs to discuss why the refund was lowered.

That would be your california refund only. Term 2018) slip opinion | scotusblog. Defendant franchise tax board (board) appeals from a judgment in the sum of $1,324,591.96 plus interest in favor of the pacific telephone and telegraph company (pacific) in this action for a refund of a portion of the franchise taxes paid to the state of california for the year 1960.

Counsel stanley mosk, attorney general, james e. There are 7222 searches per month from people that come from terms like franchise tax bo or similar. The board is composed of the california state controller, the director of the california department of finance, and the chair of the california board of equalization.the chief administrative official is the.

(2000) 85 cal.app.4th 875 [ 102 cal.rptr.2d 611 ] ( ceridian ), the first district held that a corporate tax deduction, for dividends paid to the corporation from the corporation's insurance company subsidiaries, violated the commerce clause because the deduction was limited to dividends paid from income. Chase brass and copper co. Franchise tax (2001) district of columbia v.

The state calculates its franchise tax based on a company’s margin which is computed in one of four ways: Franchise tax bd., 463 u.s. Argued january 9, 2019—decided may 13, 2019.

Franchise tax bd., 463 u. I noticed a $256.65 direct deposit in my account this morning. Total revenue multiplied by 70%.

Keesling for defendant and appellant. Respondent hyatt sued petitioner franchise tax board of california (board) in nevada state court for alleged torts committed during a tax audit. 29, 1963.] superior oil company, plaintiff and respondent, v.

(1984) 160 cal.app.3d 1154 [ 207 cal.rptr. Petitioner franchise tax board of california (board), the state agency responsible for assessing personal income tax, suspected that hyatt’s move was a sham. The nevada supreme court rejected the board’s argument

Each company maintains separate advertising, accounting, legal, research and development, and personnel departments. File a return, make a payment, or check your refund.

State Of California Real Estate Withholding Viva Escrow

How Many Years Does The California Franchise Tax Board Have To Collect A Debt From A Disability Recipient

California Ftb Rjs Law Tax Attorney San Diego

Getting A Phone Call From The Ftb – Lsl Cpas

2

2

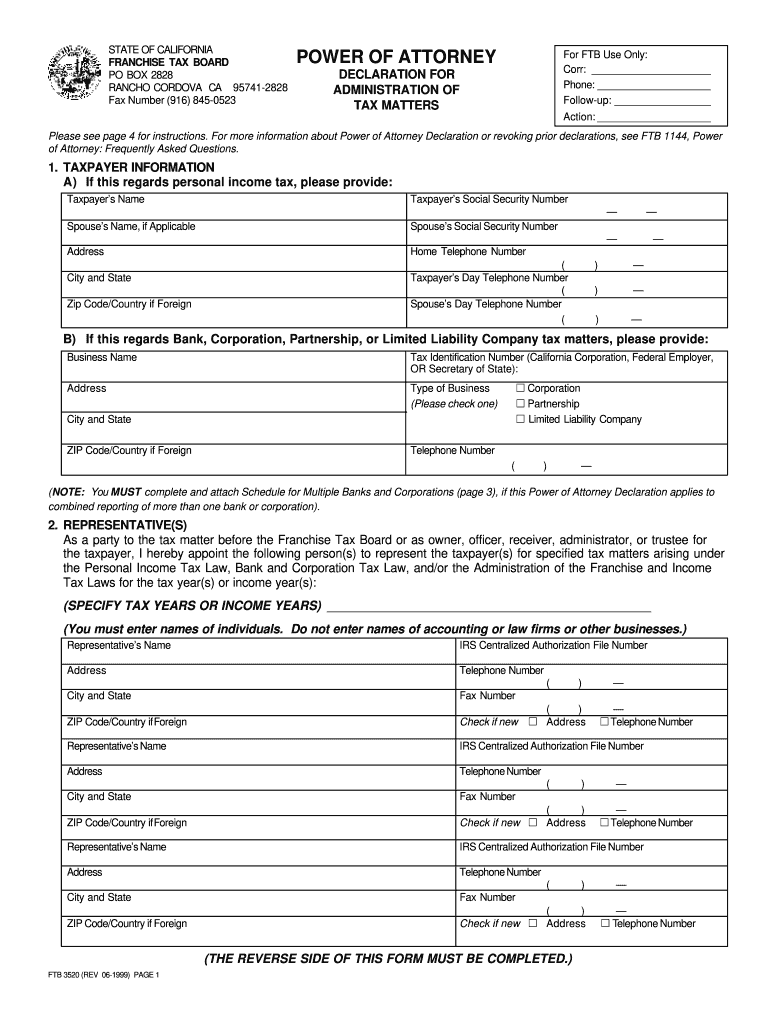

Franchise Tax Board – Fill Online Printable Fillable Blank Pdffiller

Whats The Deadline To File Tax Return With The Franchise Tax Board And Claim A Gss Payment – Ascom

2

How To Speak With An Actual Representative At The Franchise Tax Board Of California Ca Ftb – Quora

What Does Legal Order Debit Franchise Tax Board Mean – Larson Tax Relief

Franchise Tax Board Homepage Tax Franchising California State

2

Stop Wage Garnishments From The California Franchise Tax Board Tax Resolution Professionals A Nationwide Tax Law Firm 888 515-4829

![]()

Ca Franchise Tax Board Sf Business Portal

2

2

2

The Limits Of Nudging Why Cant California Get People To Take Free Money Planet Money Npr