Our founder, linda liu, is a certified public accountant in arizona. The annual gift exclusion is available to each taxpayer.

Form 3520 What Is It And How To Report Foreign Gift Trust And Inheritance Transactions To Irs – Youtube

Citizen spouse increased to $100,000.

Foreign gift tax cpa. It is important to contact international tax experts that can help navigate murky waters of the irs. Ad study the cpa program with the level of support you need to succeed. The annual gift tax rate is $15,000, but it’s double if you’re married and filing jointly:

Under certain circumstances, nonresidents who are not u.s. Citizens legal permanent residents, and foreign nationals who meet the substantial presence test. To make the situation even worse, foreign nationals are often under the mistaken belief that by adding the names of their children to the title of the property, it will reduce the amount of u.s.

We don't do free consultations. Estate tax that could be due on death. For purported gifts from foreign corporations or foreign partnerships, you are required to report the receipt of such purported gifts only if the aggregate amount received from all entities exceeds $16,649 for 2020 (adjusted annually for inflation).

This exemption doesn’t apply to nonresident alien spouses. Cpa now april 1, 2020. The irs has been closely examining the accurate and timely reporting of foreign gifts and distributions to and from foreign trusts.

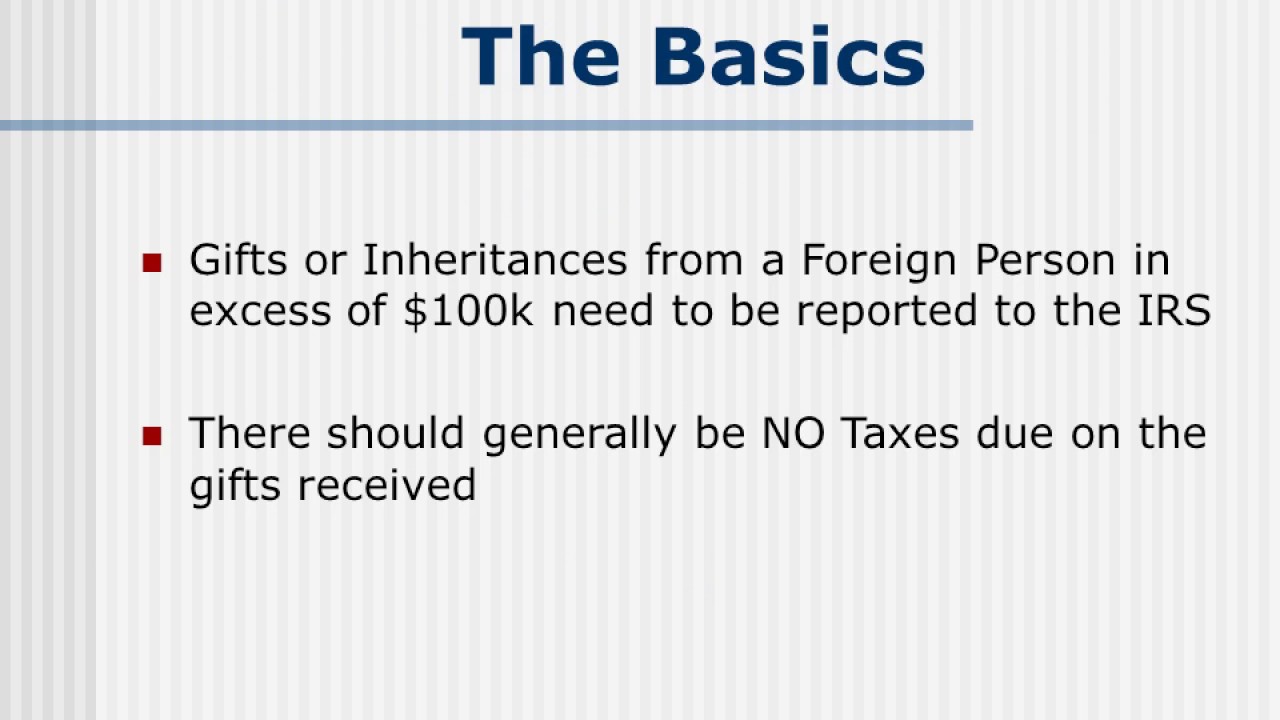

Person gives a gift that exceeds the annual exclusion amount, they typically must file a form 709, unless an exception or exclusion applies. Ad study the cpa program with the level of support you need to succeed. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than $100,000 during the tax year.

You must separately identify each gift and the identity of the donor. We are highly experienced in international taxation and our expert adviser is fluent in english and chinese. The penalty for failure to file a form 3520 reporting a foreign gift or bequest, or for filing an incorrect or incomplete form with respect to a gift or bequest, is 5% of the gift or bequest for each month during which the failure continues, up to a.

Specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts. For individuals, qualified international accountants can assist with tax filings, foreign tax credits, student taxes, asset compliance, gifts and inheritance, and more. Person ‘s first introduction to the world of international tax law and how the irs treats foreign income is when they receive a foreign inheritance.

Once the $100,000 threshold has been surpassed, the recipient must separately identify each gift/inheritance that is more than $5,000. If the gift was received from a foreign corporation or partnership, the threshold will be $16,815 in 2021 (up from $16,649 in 2020). The gift and inheritance tax laws of the country where the foreign person or entity making the gift or bequest resides aren't a u.s.

World tax llc is a cpa firm providing international tax services for global businesses, american expatriates and foreign nationals. Foreign gift tax & the irs: Person receives a gift from a foreign person.

The gift tax rates start at 18% and increase to a maximum rate of 40%. The annual gift tax exclusion applies to each gift, so if you have multiple children, you can give them each a gift up to the limit. If an individual has average.

Citizen spouse, then you must file a form 709 gift tax return for that year, and the gift uses some of your lifetime exemption amount. You may make unlimited gifts to a. See sections 2501(a) and 2511(b).

188 grand st #244, new york, ny 10013 tel: Study the cpa program with the level of support you need to succeed. If you are a nonresident not a citizen of the united states who made a gift subject to u.s.

The foreign person or entity must consult with tax experts in their own country to. Gift tax would be due on gifts exceeding the $15,000 exclusion amount. Leon nazarian is a certified public accountant offering bookkeeping, accounting, tax and business management cpa services in los angeles.

Form 3520 is due the fourth month following the end of the person's tax year, typically april 15. The rules are different when the u.s. Citizens are also subject to gift (and gst) taxes for gifts of intangible property.

American expatriates are advised to contact an expat tax cpa if they have questions about gifts tax reporting, foreign gifts tax, foreign trust, foreign partnership, foreign controlled corporations and other overseas tax issues. +1 212 316 9944 email: When they sell the shares, they’ll pay a lower tax rate than you would if they’re in a lower tax bracket.

Since 2002, this annual exclusion has increased each year and in 2021 the exclusion is $159,000. In 2021, the amount you can give to one person without gift tax implications is $15,000 per recipient. Study the cpa program with the level of support you need to succeed.

1509 wilcox ave, unit 302 los angeles, ca 90028 united states

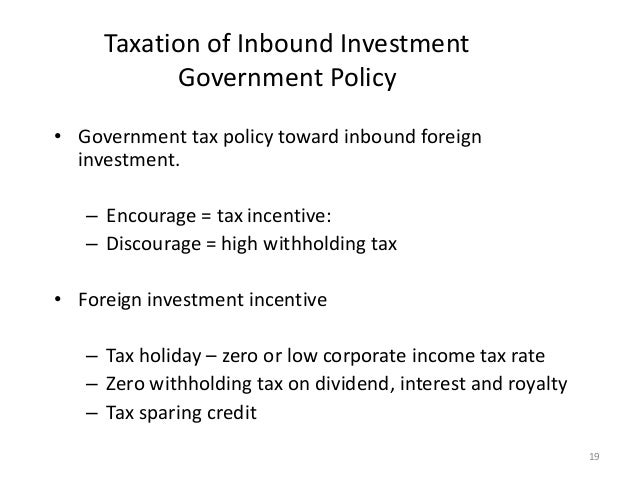

Tax Concerns For Foreign Investors And Us Citizens Investing Abroad By Thomas C Roberge Company Certified Public Accountants Us International Tax – Ppt Download

Accounting 45705570 N Chapter 16 – International Taxation Issues – Ppt Download

Receiving A Foreign Gift You May Need To Tell The Irs – The Wolf Group

Gift Tax Corporate Income Tax Course Cpa Exam Far – Youtube

Do I Need To Report Foreign Gifts To The Irs

Pre-immigration Tax Planning Asset Protection Us Cpa Firm

Chaston Tax Accounting – Home Facebook

International Taxation

Foreign Tax Credits Overall Foreign Tax Credits Limitation International Taxation Course – Youtube

Fa La La Falling Afoul Of Foreign Gift Rules – Ryan Wetmore Pc

Taxes Reporting A Foreign Gift Or Bequest – Strategic Finance

International Tax Compliance Ppt Video Online Download

How To Report A Foreign Gift Or Inheritance Of More Than 100k – Youtube

International Tax Compliance Ppt Video Online Download

Gifts From Foreign Persons Marcum Llp Accountants And Advisors

Edible Cpa Gift Ideas For Tax Preparer Accounting Clients Totally Chocolate

Foreign Gift Reporting Requirements – Henryhorne

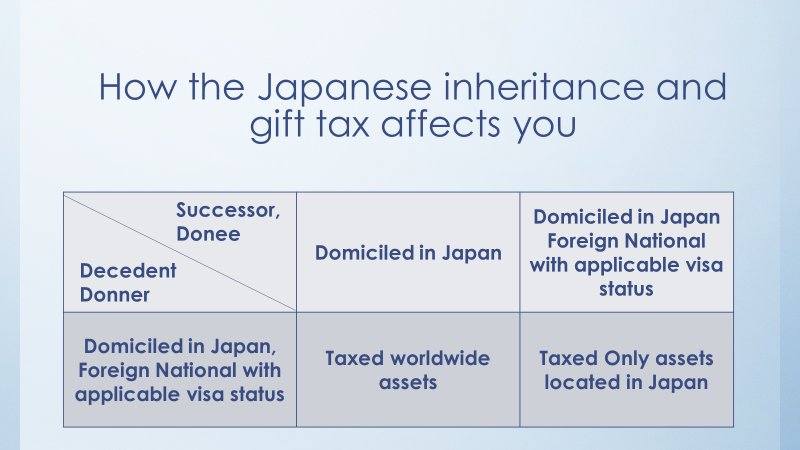

How Do The New Change Of The Japanese Inheritance And Gift Tax Help You – Cdh

Services Fraker Cpa