The philadelphia, pennsylvania, general sales tax rate is 6%. Every 2021 combined rates mentioned above are the results of pennsylvania state rate (6%), the county rate (0% to.

Is Food Taxable In Pennsylvania – Taxjar

In the state of pennsylvania, any gratuities that are distributed to employees are not considered to be taxable.

Food sales tax in pa. Generally, the sale of food or beverages by a school or church is exempt from tax, if the sales are in the ordinary course of the activities of the school or church. To legally collect sales taxes, the food truck vendor must register to the state department of revenue. The pennsylvania sales tax rate is 6 percent.

Food delivery businesses and sales tax issues. The 6 percent state sales tax is to be collected on every separate taxable sale in accordance with the tax table on page 39. Some examples of items that exempt from pennsylvania sales tax are food (not ready to eat food), most types of clothing, textbooks, gum, candy, heating fuels intended for residential property, or pharmaceutical.

If a food truck in louisiana sells taxable products, they need to collect a sales tax of 9.52%. California (1%), utah (1.25%), and virginia (1%). Meals and prepared foods are generally taxable in pennsylvania.

All food and beverages, in any quantity, including both food and beverages prepared on the premises, and prepackaged food and beverages. Exact tax amount may vary for different items. An auditor will simply multiply the total number of bottles purchased by the expected revenue per bottle to reveal how much tax should have been paid.

Not long after the decision in wayfair gave states the ability to enact “economic nexus” laws, marketplace facilitator laws started to rise. Pennsylvania's sales tax can be very confusing. Code, chapter 46, food code, the rules and regulations of the pa department of agriculture, are issued under the retail food facility safety act (3 pa.

See chart on page 40. (3) tax rate may be adjusted annually according to a formula based on balances in the unappropriated general fund and the school foundation fund. The pennsylvania state sales tax rate is 6%, and the average pa sales tax after local surtaxes is 6.34%.

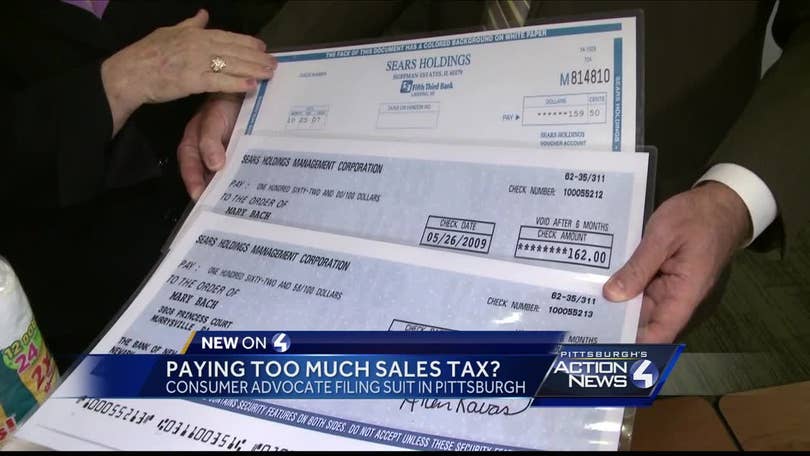

Allegheny county has local sales tax of 1% on top of the pa sales tax rate that totals 7%. The sale of food or beverage items by ‘‘d’’ from the restaurant is subject to tax. For example, if a bar has projected sales of $40,000 but only reported $25,000, it will be asked to pay tax on the discrepancy.

Philadelphia county has a local sales tax of 2% on top of the pa sales tax rate that totals 8%, which became effective october 8, 2009. Sales tax treatment of groceries, candy & soda, as of july january 1, 2019 (a) alaska, delaware, montana, new hampshire, and oregon do not levy taxes on groceries, candy, or soda. This includes pennsylvania's state sales tax rate of 6%, blair county’s sales tax rate of 0%, and mary’s local district tax rate of 0%.

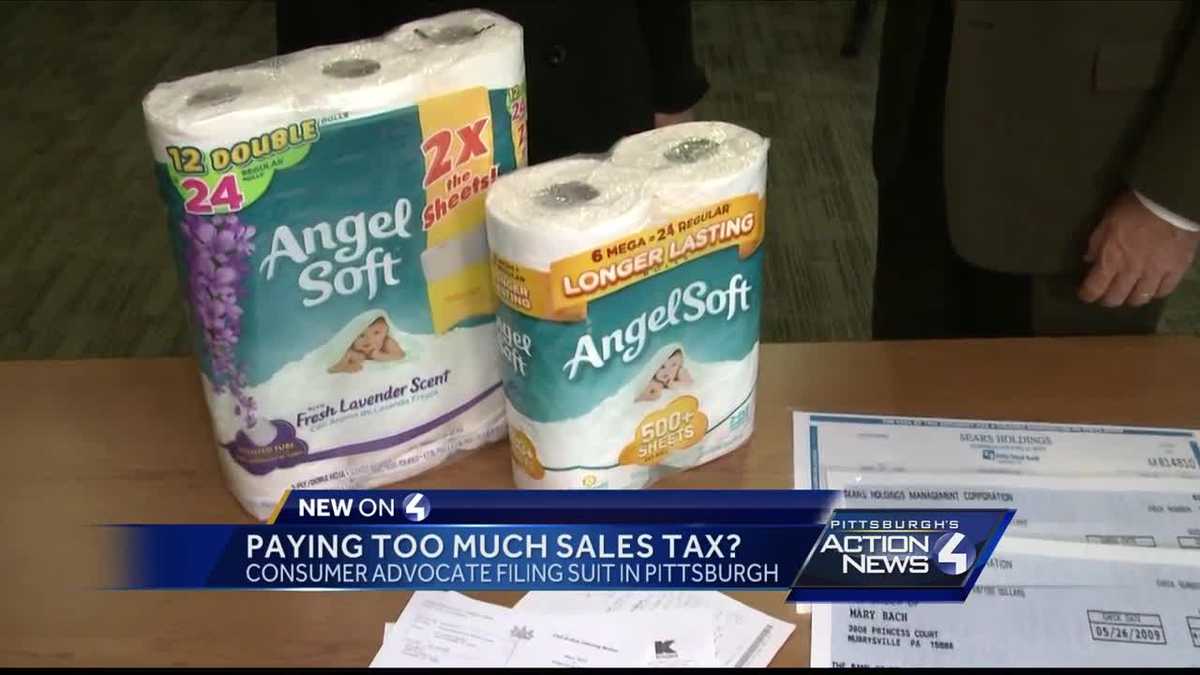

Most people know the rules about food and clothing generally being exempt, but state law details hundreds of categories and identifies those items. Tax is paid at time of purchase from a liquor control board store or licensed malt beverage distributor. See faq 3354 for more information.

In the state of pennsylvania, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. Food, most clothing, and footwear are among the items most frequently exempted. For example, if a food truck in washington sells taxable products, the vendor needs to collect a 9.21% sales tax from their customers.

In the state of pennsylvania, whether food items are taxed or exempt depends upon the type of food in question, and the location from which the food is sold. On taxable sales originating in a city or county that has imposed a local tax, a separate 1 or 2 percent local sales and use tax is imposed. State sales tax rates and food & drug exemptions (as of january 1, 2021) (5) includes a statewide 1.25% tax levied by local governments in utah.

By law, a 1 percent local tax is added to purchases made in allegheny county, and 2 percent local tax is added to purchases made in philadelphia. 31 rows the latest sales tax rates for cities in pennsylvania (pa) state. (4) food sales subject to local taxes.

Rates for public transportation assistance fund taxes due (6) sale of food and beverages at or from a school or church. Depending on the zipcode, the sales tax rate of philadelphia may vary from 6% to 8%.

Tax Management Strategy Httpsflevycombrowseflevyprodoc-3165 The Tax Function Should Be Our Companys Strategic Pa Management Business Presentation Tax

Pin On Business Brainstorm

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Pennsylvania Sales Tax Which Items Are Taxable And Whats Exempt

Key Issues Tax Expenditures Types Of Taxes Infographic Tax

Sales Tax On Grocery Items – Taxjar

Pin On Announcements

Everything You Dont Pay Sales Tax On In Pennsylvania From Books To Utilities – On Top Of Philly News

Offer In Compromise Elizabethtown Pa 17022 Mmfinancialorg Payroll Taxes State Tax Income Tax

Pennsylvania Sales Tax Which Items Are Taxable And Whats Exempt

Daily Design Challenge 004 – Tax Calculator Design Challenges Calculator Design Design

Fromm For Cats Holistic Dog Food Dog Food Recipes Acana Dog Food

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Paych Infographic Finance Investing Sales Tax

Understanding Sales Tax With Printify Printify Sales Tax Understanding Tax Exemption

The Tampon Tax Explained Tampon Tax Tampons State Tax

Pa Unemployment Base Year Chart Sales Taxes In The United States 350-275 Of Best Of Pa Unempl Tax Chart Sales Tax

In Which States Are Groceries Tax Exempt Sales Tax Grocery Items Amazon Sale

Pennsylvania Sales Tax – Small Business Guide Truic

Lifeone Formula Is A Advanced Immune Defense Lifeone Plus Natural Immune Defense Herbalism Immunity Booster