No, florida does not have an inheritance tax (also called an “estate tax” or “death tax”). The national estate tax begins at a rate of 40%.

Exploring The Estate Tax Part 2 – Journal Of Accountancy

Does the state impose an inheritance tax?

Florida inheritance tax amount. The pro rata portion of the estate tax due florida is determined by the following formula: So if you live in a state that has an inheritance tax you may owe tax even though the assets were in the state of florida. This applies to the estates of any decedents who have passed away after december 31, 2004.

Inheritance tax, sometimes confused with estate tax, is a tax on the beneficiaries/receivers of an estate (e.g., your parents/families’ cash and assets). Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. Florida inheritance tax and gift tax.

Gross value of fl property 1 x federal. What is inheritance tax florida? (1) administer tax law for 36 taxes and fees, processing nearly $37.5 billion and more than 10 million tax filings annually;

That limit is tied to the gift tax exemption, and is now indexed to inflation. As of january 1, 2017, the federal estate tax applies to all estates worth more than $5.49 million. (2) enforce child support law on behalf of about 1,025,000 children with $1.26 billion collected in fy 06/07;

That’s right, there is no estate tax for the vast majority of us citizens. There is no inheritance tax in the state of florida but you could be assessed inheritance tax based on assets owned in other states. Other popular options used to help reduce your estate’s exposure to inheritance taxes include, but are not limited to, the following:

In pennsylvania, for instance, the inheritance tax may apply to you even if you live out of state, as long as the deceased lived in the state. However, depending on the size of your estate, you may be subject to the federal estate tax. For a married couple that means they can exempt a total of $10.9 million between them.

Other ways to avoid taxes. For example, if you live in florida and you inherit money from an uncle who lives in kentucky, which is one of the six states that does impose an inheritance tax, you may owe inheritance taxes to the state of kentucky. An inheritance tax is a tax on assets that an individual has inherited from someone who has died.

In 2021, federal estate tax generally applies to assets over $11.7 million, and the. Ad an inheritance tax expert will answer you now! The federal estate tax only applies if the value of the estate exceeds $11.4 million (2019), and the tax that’s incurred is paid out of the estate/trust rather than by the beneficiaries.

The “taxable estate” of a deceased refers to the possessions that are subject to taxation. This lack of inheritance tax, combined with the absence of florida income tax, makes florida attractive for wealthy individuals wanting to reduce their tax liability. There is no federal tax on inheritance tax and are only taxed in 6 us states.

For example, let's say a family member passes away in an area with a 5% estate tax and a 10% inheritance tax. The federal government, however, imposes an estate tax that applies to residents of all states. You’ll need to check the laws of the state where the person you are inheriting from lived.

The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold: Just because florida lacks an estate or inheritance tax doesn’t mean that there aren’t other tax filings that an estate. In 2019, the federal unified gift and estate tax exemption will increase from $11.18 million to $11.4 million per person.

There is no inheritance tax in florida, but other states’ inheritance taxes may apply to you. No estate tax or inheritance tax. If you have $5 million or less, congratulations:

As of 2020, only six states impose an inheritance tax on its residents, but florida is not one of them. An inheritance is not necessarily considered “income” to the recipient. Inheritance tax does not depend on the total amount of the estate;

Florida does not have a separate inheritance (“death”) tax. There are no inheritance taxes or estate taxes under florida law. What that means is that estates valued at less than that amount won’t be subject to the federal tax.

In kentucky, for instance, a. Additionally, some states offer exemptions on some amount of inheritance before taxes are due. If an individual’s death occurred prior to that time, then an estate tax return would need to be filed.

For 2016, the gift and estate tax lifetime exemption amount is set to be $5.45 million. The estate tax is a tax on a person's assets after death. Ad an inheritance tax expert will answer you now!

Florida does not have an estate tax. Florida residents are fortunate in that florida does not impose an estate tax or an inheritance tax. For the estate tax, a florida resident, or for that matter, any united states citizen or resident alien may leave an estate with a value of up to $5,340,000— free of us estate tax, or inheritance tax.

Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of florida. The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023.) The federal estate tax is only applicable if the total worth of the property reaches $11.7 million as of 2021, and also the tax is payable by that estate/trust, not the heirs.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Estate Tax – Rules On Estate Inheritance Taxes

Florida Inheritance And Estate Tax Definition Alper Law

New Yorks Death Tax The Case For Killing It – Empire Center For Public Policy

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Florida Inheritance And Estate Tax Definition Alper Law

How Is Tax Liability Calculated Common Tax Questions Answered

Legislation Introduced To Repeal Federal Estate Tax

Recent Changes To Estate Tax Law Whats New For 2019

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New Yorks Death Tax The Case For Killing It – Empire Center For Public Policy

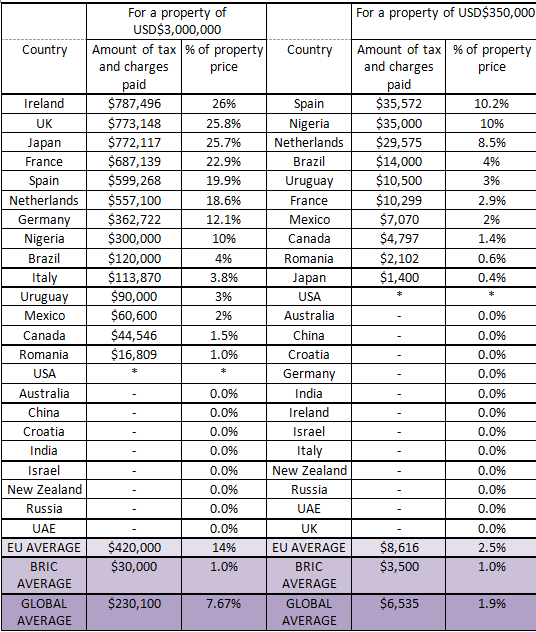

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies – Uhy Internationaluhy International

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2

Florida Attorney For Federal Estate Taxes Karp Law Firm

How Much Does Probate Court Cost And How Does It Work

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers