Your estate tax exemption is $4.56 million more than the value of your estate, so no tax is due. 196.075(2), f.s.) you should complete and file all required forms and

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023.)

Florida estate tax limit. Florida does not have a state income tax. As with other aspects of the tax code, the tax cuts and jobs act of 2017 significantly changed the way estate tax applies to americans. The first $25,000 applies to all property taxes.

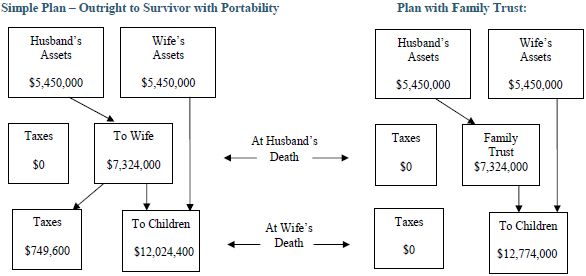

This exemption is not “portable” from one spouse to another. If the estate is worth less than $1,000,000, you don't need to. If the estate representative did not file an estate tax return within nine months after the decedent's date of death, or within fifteen months of the decedent's date of death (if a six month extension of time for filing the estate tax return had been obtained), the availability of an extension of time to elect portability of the dsue amount depends on whether the estate has a filing requirement,.

Every person who has legal or equitable title to real property in the state of florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. Since florida's estate tax was based solely on the federal credit, estate tax was no longer due on estates of decedents that died on or after january 1, 2005. For 2021, the threshold for federal estate taxes is $11.7 million, which is up slightly from $11.58 million in 2020.

Legislation was passed in 2019 to establish the current estate tax exemption of $5,490,000. The exemption increased after the new tax legislation was signed in 2017. Form 4768, application for extension of time to file a return and/or pay u.s.

An estate tax is calculated on the total value of a deceased's assets, and is to be paid before any distribution is made to the beneficiaries. By doing so, you can plan ahead to ensure that more of your. The executor is responsible for filing a single estate tax return and pays the tax out of the estate's funds.

Corporations that do business and earn income in florida must file a corporate income tax return (unless they are exempt). However, the personal representative of an estate may still need to complete certain forms to remove the automatic florida estate tax lien. The major change made by the new tax law is that the entire deduction is capped at $10,000 per return ($5,000 for married filing separately).

Taxes, whether inheritance or state, must be considered in estate planning. No estate tax or inheritance tax. Florida property tax is based on market value as of january 1st that year.

If a married couple has a $6 million estate and spouse 1 dies, everything passes tax free to spouse 2 by default. Even though florida doesn’t have an estate tax, you might still owe the federal estate tax, which kicks in at $11.18 million for 2018. If you're responsible for the estate of someone who died, you may need to file an estate tax return.

The federal estate tax exemption is portable for married couples. Florida sales tax rate is 6%. The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold:

State and local property taxes, including real estate taxes and taxes assessed on other personal property, such as automobiles. The additional $25,000 applies to any assessed Assuming you have not added any new construction to your homestead property, your assessed value cannot increase more than 1.4 percent in 2021.

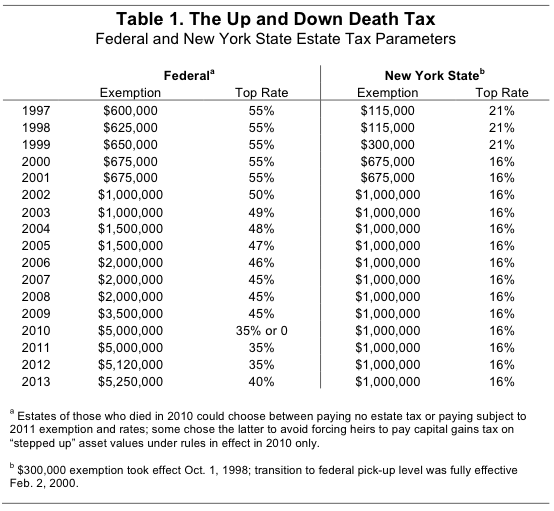

The maximum federal estate tax rate is 40 percent on the value of an estate above that amount. As of november 2020, there are no plans to increase the amount of the exemption in 2021. Constitutional amendments require 60% voter approval.

This year, the maximum increase on the assessed value of a homestead property in florida has been capped at 1.4 percent. The tax cuts and jobs act, signed into law in 2017, doubled the exemption for the federal estate tax and indexed that exemption to inflation. In september, the state also increased it’s progressive estate tax rate to as high as 20% for estates valued at more than $10 million.

This could include cash, real estate, retirement accounts or a range of other assets. The higher exemption will expire dec. Federal estate tax largely tamed.

State and local income taxes or state and local sales taxes. For married couples, this threshold is doubled, meaning they can protect up to $23.4 million in 2021. The florida state legislature cannot enact a florida estate tax or inheritance tax that conflicts with the state constitution— florida voters would have to amend the constitution for the legislature to impose income or inheritance taxes.

Any funds after that will be taxed as they pass on to heirs, at a rate that varies by the amount being passed on. The 2021 limit, after adjusting for inflation, is $11.7 million, up from $11.58 million in 2020. The florida constitution prohibits inheritance taxes.

2021 Florida Sales Tax Rates For Commercial Tenants – Winderweedle Haines Ward Woodman Pa

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Attorney For Federal Estate Taxes Karp Law Firm

Florida Inheritance And Estate Tax Definition Alper Law

New Yorks Death Tax The Case For Killing It – Empire Center For Public Policy

Florida Estate Tax – Rules On Estate Inheritance Taxes

A Guide To Estate Planning – Family And Matrimonial – United States

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New Yorks Death Tax The Case For Killing It – Empire Center For Public Policy

Florida Homestead Exemption How It Works Kin Insurance

Florida Inheritance And Estate Tax Definition Alper Law

New Yorks Death Tax The Case For Killing It – Empire Center For Public Policy

![]()

Florida Inheritance And Estate Tax Definition Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

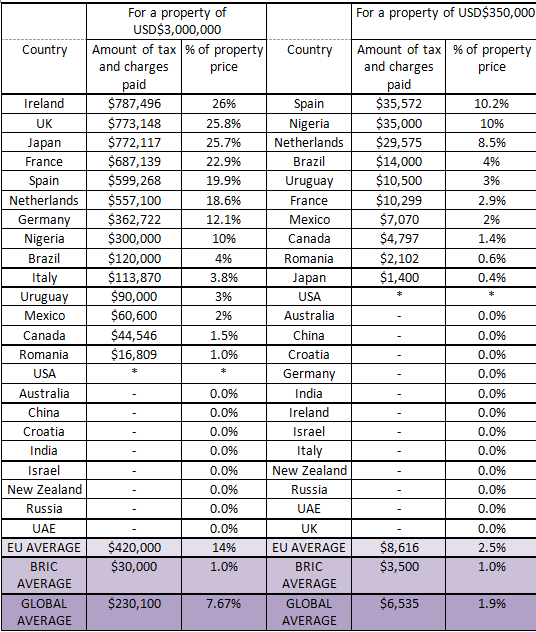

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies – Uhy Internationaluhy International

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Should I Put My Florida Homestead In A Living Trust

Florida Real Estate Taxes What You Need To Know

Florida Property Tax Hr Block