Fidelity new jersey municipal income fund: Learn about the fund's agencies rating and risk rating, transparent information about the fund's management personal, policies of invested allocation and diversification, past.

How Much Fidelity Bond Coverage Are We Required To Have

The investment seeks to provide, consistent with prudent portfolio management, the highest level of income exempt from federal and maryland state and local income taxes by.

Fidelity maryland tax-free bond fund. We don't track any funds with an extremely high correlation to maryland municipal income fund. As of august 18, 2021, the fund has assets totaling almost $4.74 billion invested in 1,368 different holdings. Fidelity maryland municipal income fund:

Here are the best muni single state long funds. Quantitative rating as of oct 31, 2021. Nuveen wisconsin municipal bond fund

Fidelity arizona municipal income fund: Nuveen missouri municipal bond fund; Investment, market cap and category.

Fidelity connecticut municipal income fund: If interest rates rise significantly from current levels, total returns will decline and may even turn negative in the short term. Invests at least 80% of net assets in maryland municipal bonds.

This information may help you prepare your state income tax return. Learn more about mutual funds at fidelity.com. Updated in february 2021, to include strategic advisers funds.

Weighted average maturity is expected to exceed 10 years. If you owned shares of any of the fidelity funds listed in the table on the following pages of this letter during 2020, a portion of the The maryland municipal income fund fund, symbol smdmx, is an exchange traded fund (etf) within the fidelity family.

Nuveen la municipal bond fund; Information for state tax reporting. Must also trades at a 0.5% premium to net asset value, which means investors pay a tiny premium to the.

Find basic information about the fidelity® maryland municipal income fund mutual fund such as total assets, risk rating, min.

Smdmx – Fidelity Maryland Municipal Income Fund Fidelity Investments

Smdmx – Fidelity Maryland Municipal Income Fund Fidelity Investments

Which Funds Are Right For You Fidelity Vs Vanguard Investment Guide

Smdmx – Fidelity Maryland Municipal Income Fund Fidelity Investments

How Do I Determine The Exempt-interest Dividends F

How Tax Free Mutual Funds Work Howstuffworks

/Municipal-bonds-investing-for-income-benefits-35598aefcf37427cad5d206750833699.png)

Benefits Of Investing In Municipal Bonds For Income

Smdmx – Fidelity Maryland Municipal Income Fund Fidelity Investments

Fidelity Money Market Funds – How To Choose The Best One

2

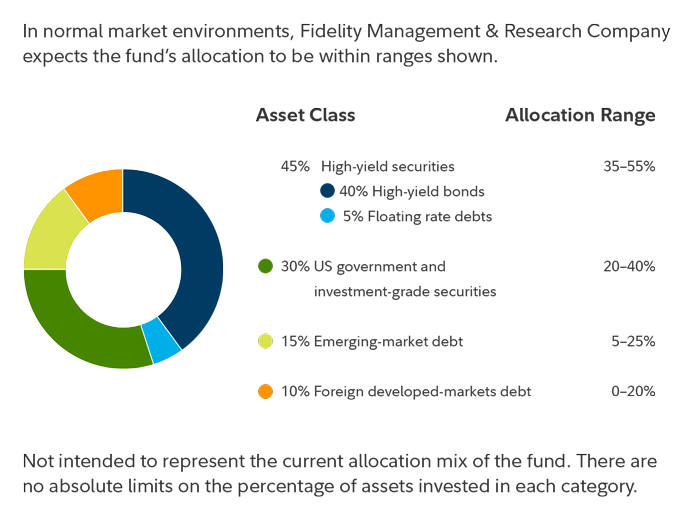

Strategic Income Fund

2

Smdmx – Fidelity Maryland Municipal Income Fund Fidelity Investments

N-csr 1 Filing836htm Primary Document United States Securities And Exchange Commission Washington Dc 20549 Form N-csr Certified Shareholder Report Of Registered Management Investment Companies

2

Do Municipal Bonds Pay Dividends

Fidelity Funds – Mutual Funds From Fidelity Investments

Fidelitycom

2