The american rescue plan act expands the child tax credit for tax year 2021. For 2021 (and only 2021), the child tax credit was substantially improved.

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment – Cnet

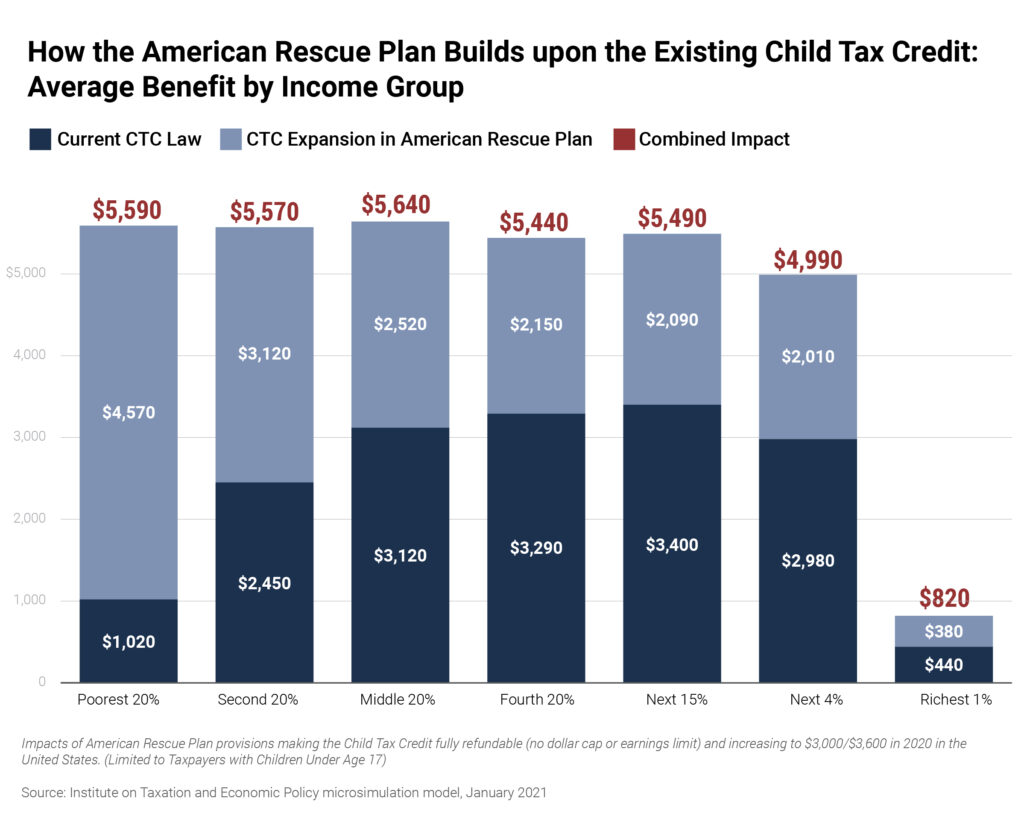

Parents can currently get a child tax credit of up to $3,000 per child under 18 years old, and $3,600 for kids under age 6.

Extended child tax credit 2021. To qualify for advance child tax credit payments, you — and your spouse, if you filed a joint return — must have: The child tax credit monthly payments began in july 2021 and will continue through december. Only one child tax credit payment remains in 2021, with the last payment set to roll out on december 15.

The child tax credits are worth $3,600 per child under six in 2021, $3,000 per child aged between six and 17, and $500 for college students aged up to 24. The monthly child tax credits worth up to $300 per child could be extended until 2024, according to reports. Parents would get up to $3,000 per child under age 18, and an extra $600 per child under age 6.

The credit provides up to $300 per month per child to most families. That value is poised to drop to $1,000 per kid after 2025. The benefit was increased to $3,000 from $2,000.

The credit amount jumped from $2,000 to $3,000 for children six to 17. Included in the bill is funding for the child tax credit (ctc) expansion for the next four years, with a price tag of $450 billion. You will claim the other half when you file your 2021 income tax return.

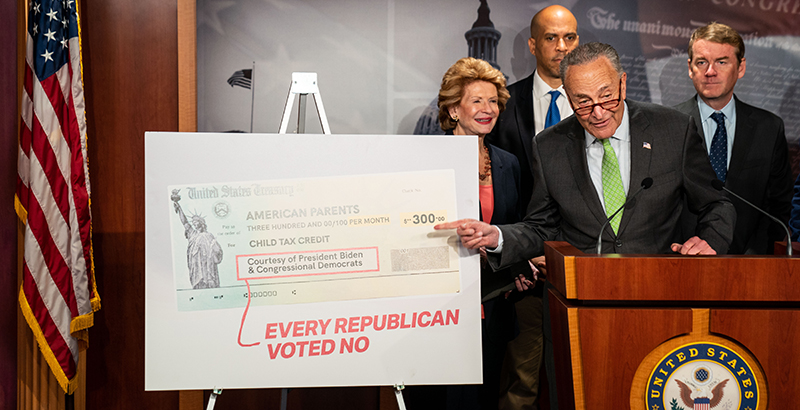

If you're eligible, you could receive part of the credit in 2021 through advance payments of up to: Since democrats are using budget reconciliation to pass the bill. Will the child tax credit be extended?

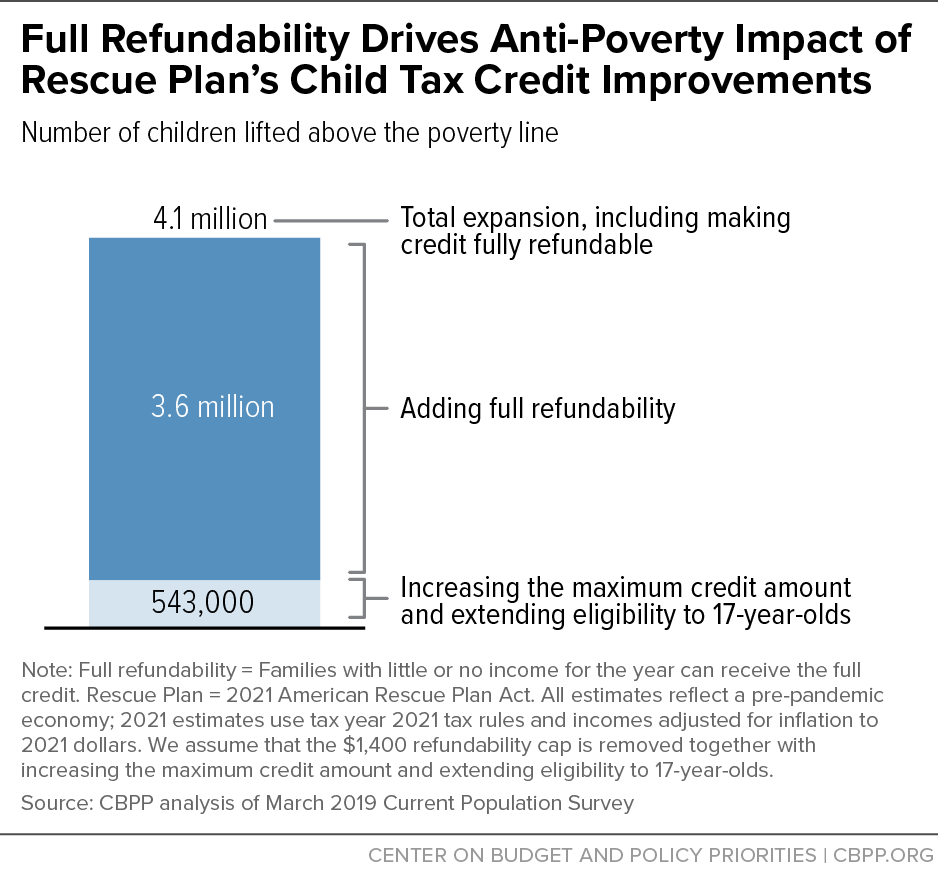

A recent study published by the urban institute shows that if the child tax credit is extended beyond 2021, it could substantially reduce child poverty in the vast majority of us states. Advocates hope it's a step toward making it permanent published mon, sep 13. The expanded tax credit delivers monthly payments of $300 for each eligible child under 6, and $250 for each child between 6 to 17 years old.

But, beginning in 2022, the credit will shrink in value, families will face restricted eligibility requirements, and the credit. This year, the existing child tax credit was expanded to include more children than ever before. Filed a 2019 or 2020 tax.

The current expanded ctc is a refundable credit, being partially paid in advance in 2021. Here's what to know about the fifth ctc check. House democrats propose extending expanded child tax credit through 2025.

In 2020, the credit was worth 2,000 dollars per child aged 16 or younger, according to household income with some variations. The enhanced value of the child tax credit would be extended for another year, through 2022. Calls are growing for the child tax credit benefits to be extended through 2022.

The child tax credit has been extended until the end of 2022 and further changes should help some of america's poorest families. These changes apply to tax year 2021 only. 22 november 2021 10:38 est

Under biden’s build back better spending plan the current expanded child tax credit will be extended for another year, bringing the total amount paid over 2 years to a maximum of $7,200. After the house ways and means committee on friday presented a draft of the 3.5 trillion budget bill that would mean that the child tax credit would be. The maximum credit amount has increased to $3,000 per qualifying child between ages 6 and 17 and $3,600 per qualifying child under age 6.

— mark albert (@malbertnews) december 2, 2021. The house ways and means committee released a proposal on friday extending the child tax credit through the end of 2025, and keeping it at current levels.

Child Tax Credit Update Could It Be Extended To 2025 Marca

Irs Child Tax Credit Payments Start July 15

Child Tax Credit 2022 Who Will Be Eligible For Ctc Extension Payments Marca

How The Expanded Child Tax Credit Could Cut Childhood Poverty In Half 1a Npr

Child Tax Credit 2022 Qualifications What Will Be Different Marca

House Bill Takes Major Steps Forward For Children Low-paid Workers Center On Budget And Policy Priorities

Child Tax Credit Payments A Shot In The Arm For Families But Some Argue Extending Them Should Depend On Results The 74

Child Tax Credit Enhancements Under The American Rescue Plan Itep

Child Tax Credit 2021 Payments How Much Dates And Opting Out – Cbs News

Ea_hqrg-etgyqm

Decembers Payment Could Be The Final Child Tax Credit Check What To Know – Cnet

Child Tax Credit 2022 Democrats Push Against Long-term Extension Marca

Will The Enhanced Child Tax Credit Continue In 2022 Heres Everything We Know – Cnet

2021 Child Tax Credit Heres Who Will Get Up To 1800 Per Child In Cash And Who Will Need To Opt Out – Cbs News

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Study Claims Parents Will Quit If Child Tax Credit Payments Are Extended Does Stimulus Hurt Labor – Fingerlakes1com

Child Tax Credit Expansion Us Senator Michael Bennet

Will The Enhanced Child Tax Credit Continue In 2022 Heres Everything We Know – Cnet

2021 Child Tax Credit Heres Who Will Get Up To 1800 Per Child In Cash And Who Will Need To Opt Out