The state of north carolina charges an excise tax on home sales of $2.00 per $1,000.00 of the sales price. Taxes are due on september 1 and delinquent on january 5th of the following year.

Fillable Online Nc Department Of Revenue Excise Tax Division Form Fax Email Print – Pdffiller

The excise tax division of the north carolina department of revenue is moving from our current address located on rock quarry road in raleigh north carolina to the following address:

Excise tax division raleigh nc. (8 days ago) state of north carolina privilege license tax issued by: Box 2331 raleigh, nc 27602. State of north carolina privilege license tax issued by:

Motor fuels and alternative fuels tax rate from july 1, 2016 through december 31, 2016. Customarily called excise tax, or revenue stamps. Enforced collections may begin immediately once the taxes are delinquent.

The excise tax is deposited in the black lung disability trust fund. This information includes changes to the legal name, trade name, physical address,. Irs field offices located in north carolina.

877.252.3052 corporate and franchise tax sales and use tax registration other taxes excise tax division: New 5 cents per milliliter (ml) on consumable vapor products effective june 1, 2015 this in respect to our wonderful politicians who believe in freedom( choking) and compared to indiana or ohio is not so bad. Easily calculate the north carolina title insurance rates and north carolina property transfer tax;

Raleigh, nc 27604 general information: Express mail (ups, fedex, etc.) north carolina department of revenue. North carolina taxes 30.2 3.

4701 atlantic ave ste 118 raleigh, nc 27604 is this your business? It is therefore our opinion the described instrument, conveying ownership of leasehold improvements owned by the lessee and conveyed by it to a purchaser, is not subject to the excise stamp tax on conveyances. North carolina department of revenue waives diesel fuel penalty due to hurricane florence

Banks special deputy attorney general Excise tax on coal internal revenue code 4121 imposes an excise tax on coal from mines located in the united states sold by the producer. Sheriffs’ education & training standards division;

Excise tax division tax administration north carolina department of revenue 1429 rock quarry road, suite 105 raleigh, north carolina 27610 a real estate broker or a real estate salesman, as. (vehicles are also subject to property taxes, which the n.c. Find 1 listings related to pay excise tax in raleigh on yp.com.

877.308.9103 corporation charter (corporation only) north carolina department of the secretary of state However, if a taxpayer receives a proposed assessment of a penalty covered by the relief granted in this notice, the. Sales and excise tax modernization subcommittee march 12, 2007 subcommittee members:

This agency is related to: North carolina department of revenue 501 n. The committee discussed principles for tax.

Claim your business to immediately update business information, respond to reviews, and more! Motor fuels and alternative fuels tax rate from january 1, 2016 through june 30, 2016. This title insurance calculator will also estimate the nc land transfer tax where applicable this calculator is designed to estimate the closing costs for one to four family residences and.

Excise tax is customarily paid by the seller, but payment is dictated by the sales Taxpayers do not need to request a penalty waiver to qualify for this relief. Excise tax division tax administration north carolina department of revenue 1429 rock quarry road, suite 105 raleigh, north carolina 27610 december 2019

Tax bills for real and personal property are usually mailed in july/august of each year. Greensboro/winston salem nc, kathy hout. North carolina law enforcement accreditation;

This webpage describes many of the excise taxes for which you may be liable. See reviews, photos, directions, phone numbers and more for pay excise tax locations in raleigh, nc. Small business self employed specialty division.

The relief from these late action penalties, administered by the north carolina excise tax division, applies to excise tax on alcoholic beverages. Motor fuels and alternative fuels tax rate from april 1, 2015 through december 31, 2015. In an effort to ensure taxpayer's contact information is valid and up to date, the department of revenue excise tax division is requesting that registered motor carriers submit their updated contact information.

2

Download Instructions For Form B-c-710 Malt Beverages Wholesaler And Importer And Resident Brewery Excise Tax Return Pdf Templateroller

Download Instructions For Form Gas-1242 Supplier 10 Day Notification Pdf Templateroller

North Carolina Alcohol Taxes – Liquor Wine And Beer Taxes For 2021

Ppt – Motor Carrier Registration Powerpoint Presentation Free Download – Id4414206

Completing An Ifta Tax Return Revised 1212 2 Overview Completing The Ifta Return Appropriate Rounding On The Ifta Return Surcharge Jurisdictions And – Ppt Download

Ppt – Motor Carrier Registration Powerpoint Presentation Free Download – Id4414206

Filesncgov

Motor Carrier Registration

North Carolina Department Of Revenue Excise Tax Division International Fuel Tax Agreement Compliance Manual – Pdf Free Download

2

2

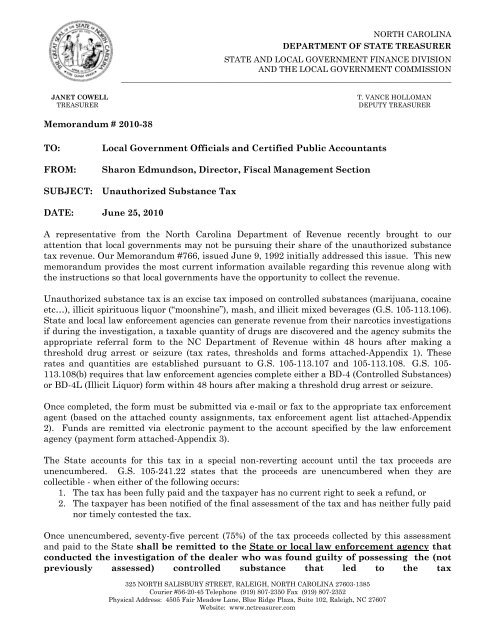

Memorandum 2010-38 To Local Government – State Treasurer

2

2

Fillable Online Dor State Nc Nc Department Of Revenue Excise Tax Division Address In Raleigh On Rock Quarry Rd Form Fax Email Print – Pdffiller

Download Instructions For Form Gas-1242 Supplier 10 Day Notification Pdf Templateroller

Motor Carrier Registration Excise Tax Division 1 July Ppt Download

Filesncgov